Charter Communications Exceeds Wall Street Expectations In Q4 Earnings Report

Charter Communications just released its Q4 earnings, and the numbers are in: they've blown past Wall Street predictions, signaling a strong finish to the year.

This unexpected surge in profitability and subscriber growth marks a significant win for the telecommunications giant, immediately impacting investor confidence and industry outlook.

Q4 Earnings: The Headline Numbers

Charter reported $13.68 billion in revenue for the fourth quarter, exceeding analysts' estimates of $13.64 billion.

Earnings per share (EPS) landed at $9.78, a considerable jump over the anticipated $8.22.

These figures demonstrate a resilient performance despite ongoing market pressures and increased competition.

Subscriber Growth: Beating the Odds

While the cable industry faces cord-cutting challenges, Charter added 61,000 residential internet customers in Q4.

This positive net addition contrasts sharply with competitor struggles and indicates effective customer retention and acquisition strategies.

Mobile lines also saw substantial growth, with Spectrum Mobile adding 393,000 lines, further diversifying revenue streams.

Key Performance Indicators: Diving Deeper

Capital expenditures decreased to $2.2 billion in Q4, reflecting improved efficiency in network buildout and upgrades.

This cost management contributed significantly to the increased profitability.

Charter's blended average revenue per residential internet customer increased by 2.8%, demonstrating successful pricing strategies and value-added service adoption.

Management Commentary: Immediate Reaction

"Our focus on delivering superior products and services is clearly resonating with customers," stated Christopher Winfrey, CEO of Charter Communications, in the earnings release.

He emphasized the company's commitment to network investments and customer experience enhancements.

Winfrey highlighted the positive impact of Spectrum Mobile's growth on overall financial performance.

Financial Outlook: Looking Ahead

Charter anticipates continued growth in 2024, driven by broadband and mobile services.

The company projects capital expenditures to remain relatively stable as they continue to upgrade their network.

Specific guidance on revenue and earnings growth will be detailed in the upcoming investor call.

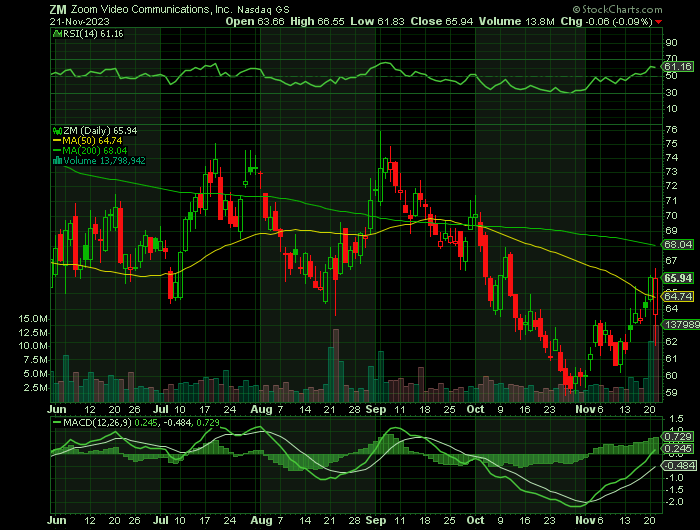

Stock Market Impact: Immediate Surge

Following the earnings release, Charter's stock (CHTR) experienced an immediate surge in pre-market trading.

Analysts predict a positive opening bell and continued upward momentum throughout the trading day.

This market reaction underscores investor confidence in Charter's strategic direction and financial health.

Analyst Perspectives: Rapid Assessment

Early analyst reports indicate a positive outlook on Charter's performance.

Several firms have already upgraded their price targets for CHTR, citing strong subscriber growth and cost management.

The consensus view is that Charter is well-positioned to navigate the evolving telecommunications landscape.

Competitive Landscape: Immediate Implications

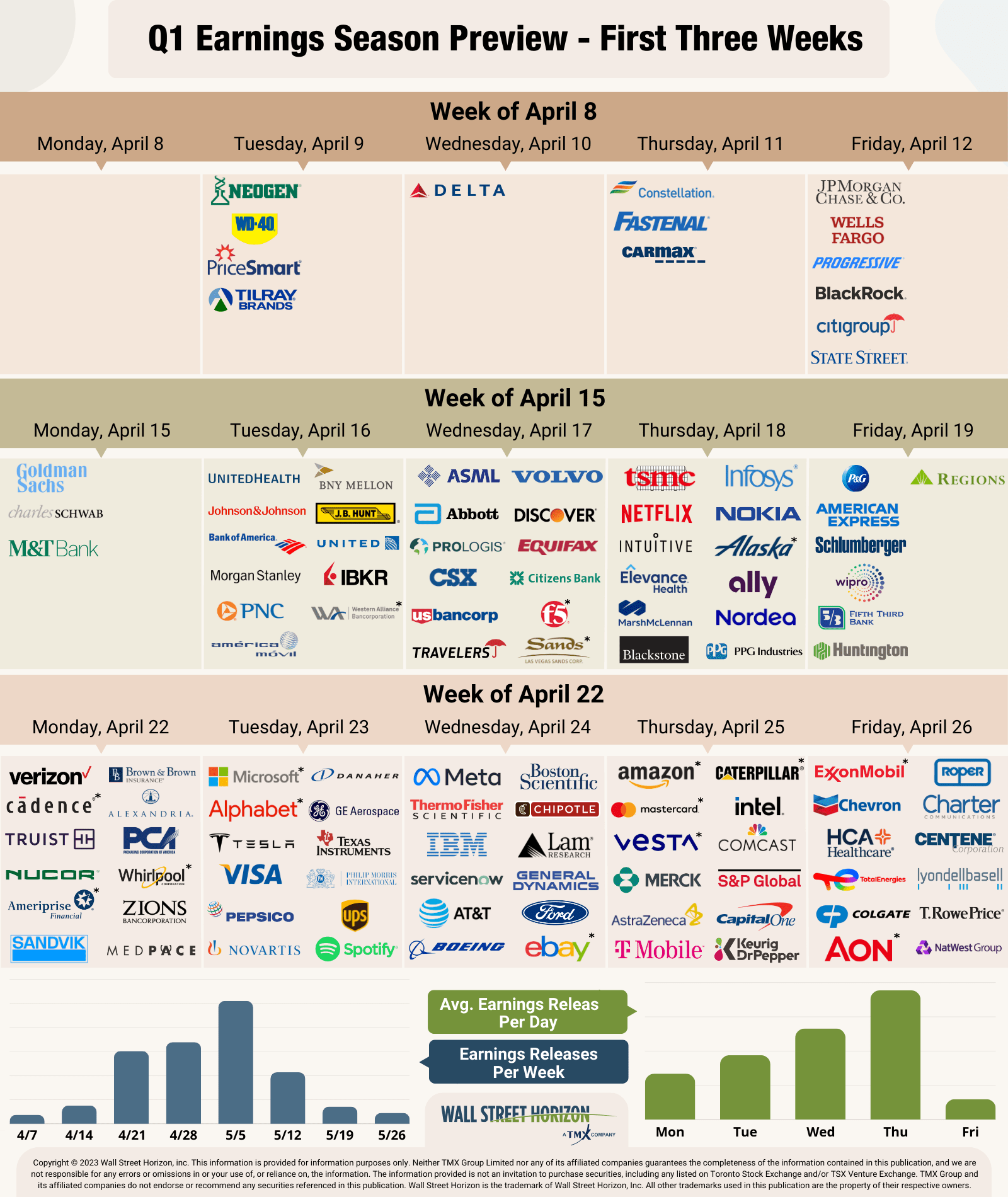

Charter's strong Q4 performance puts pressure on competitors to demonstrate similar growth and profitability.

Companies like Comcast and Verizon will be closely scrutinized for their own subscriber numbers and financial results.

The competitive landscape is expected to intensify as providers vie for market share in broadband and mobile services.

Key Takeaways: Urgent Summary

Charter Communications' Q4 earnings report significantly surpassed Wall Street expectations, showcasing resilience and strategic success.

Strong subscriber growth in both internet and mobile services, coupled with effective cost management, drove the positive results.

The market reaction has been immediate and positive, reflecting investor confidence in Charter's future prospects.

Next Steps: Ongoing Developments

Investors and analysts will closely monitor Charter's upcoming investor call for detailed guidance on 2024 performance.

The company's continued investments in network upgrades and customer experience will be critical to sustaining growth.

Further developments in the competitive landscape and regulatory environment will also shape Charter's future trajectory.