Chase Freedom Unlimited Credit Card Pre Approval

Time is running out! Check if you're pre-approved for the Chase Freedom Unlimited card now, offering a streamlined path to potential rewards and benefits. Discover if you're eligible and avoid missing out.

This article provides a concise overview of the Chase Freedom Unlimited credit card pre-approval process, detailing how to check your eligibility and what it means for your chances of approval.

Pre-Approval: What It Means

Pre-approval indicates a higher likelihood of approval for the Chase Freedom Unlimited card. It is based on a soft credit inquiry, which doesn't affect your credit score.

However, pre-approval is not a guarantee of approval. A full credit review will still be conducted upon application.

How to Check for Pre-Approval

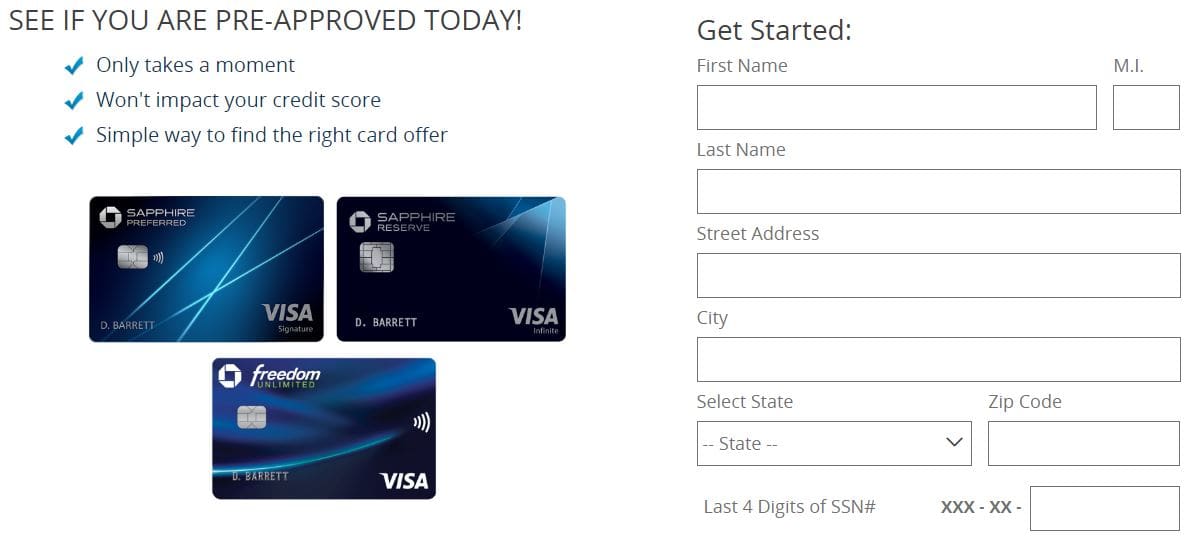

Visit the Chase website and navigate to the Chase Freedom Unlimited card page. Look for a section or button specifically labeled "Check for Pre-Approval" or similar wording.

You'll typically need to provide your name, address, date of birth, and the last four digits of your Social Security number. Ensure the information you provide is accurate.

The system will then perform a soft credit inquiry to determine your pre-approval status. This process usually takes only a few seconds.

Benefits of the Chase Freedom Unlimited Card

The Chase Freedom Unlimited card offers a competitive rewards program. Cardholders typically earn a percentage back on all purchases, with bonus rewards in select categories.

The card also often comes with an introductory APR period for purchases or balance transfers. This can be a valuable benefit for managing debt.

Other potential benefits may include travel and purchase protections. Review the card's terms and conditions for full details.

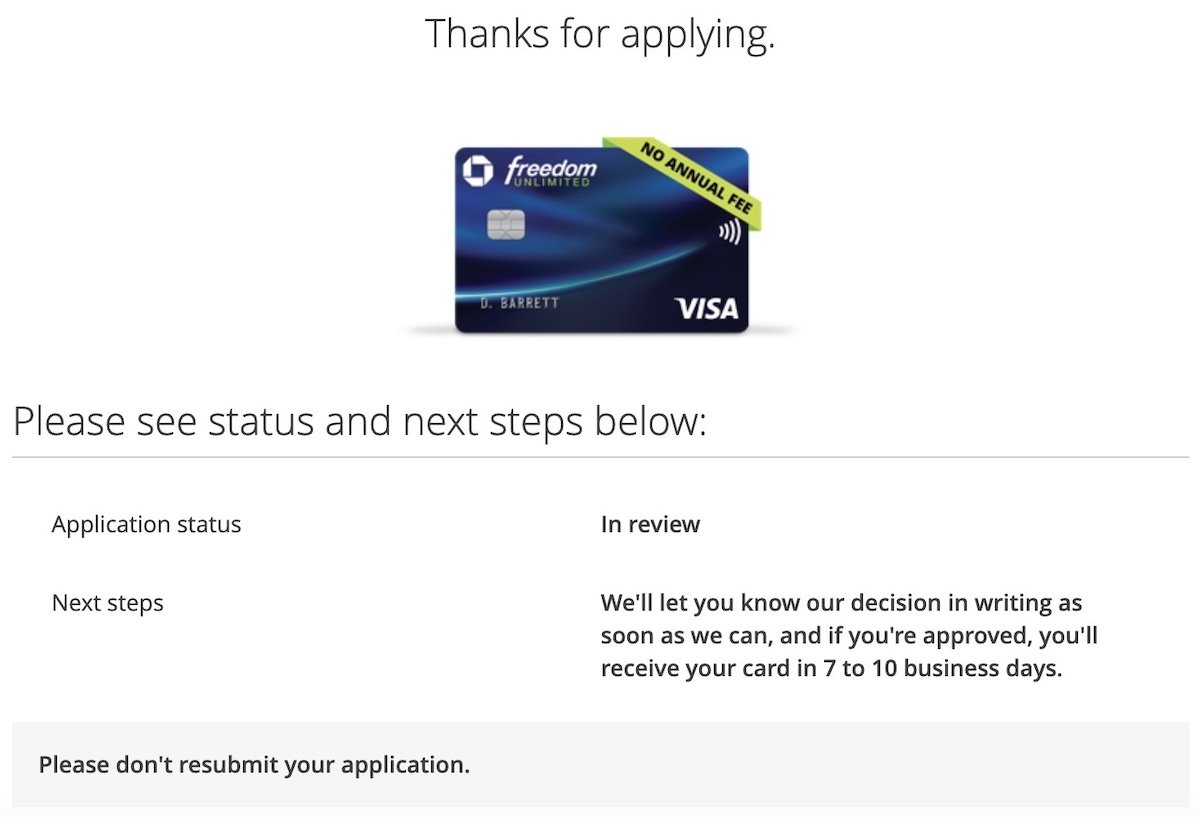

What Happens After Pre-Approval?

If you're pre-approved, you'll likely see an offer to apply for the card. Consider the terms and conditions carefully.

Even with pre-approval, ensure you meet the card's eligibility requirements before applying. These requirements often include a minimum credit score and income.

Submitting a formal application triggers a hard credit inquiry. This could slightly impact your credit score.

Important Considerations

Pre-approved offers can expire, so act quickly if you're interested. Check the offer's expiration date to avoid missing out.

Always compare offers from different credit card issuers. This will help you find the card that best suits your needs.

Understand the card's fees, interest rates, and rewards program before applying. Fully understand your responsibilities as a cardholder.

Staying Informed

Visit the official Chase website for the most up-to-date information on the Chase Freedom Unlimited card and its pre-approval process.

Keep an eye on financial news and credit card reviews for expert insights and comparisons. Stay informed about changes to the card's terms and benefits.

Don't delay; explore your pre-approval options today to potentially unlock valuable rewards and benefits with the Chase Freedom Unlimited card!

![Chase Freedom Unlimited Credit Card Pre Approval Chase Credit Card Pre-Approval: (How to get offers) [2020] - UponArriving](https://www.uponarriving.com/wp-content/uploads/2018/04/Chase-Credit-Card-Pre-Approval.png)

:max_bytes(150000):strip_icc()/chase-freedom-unlimited_blue-90aa9a715e0641a692dc08bb21d71f8b.jpg)