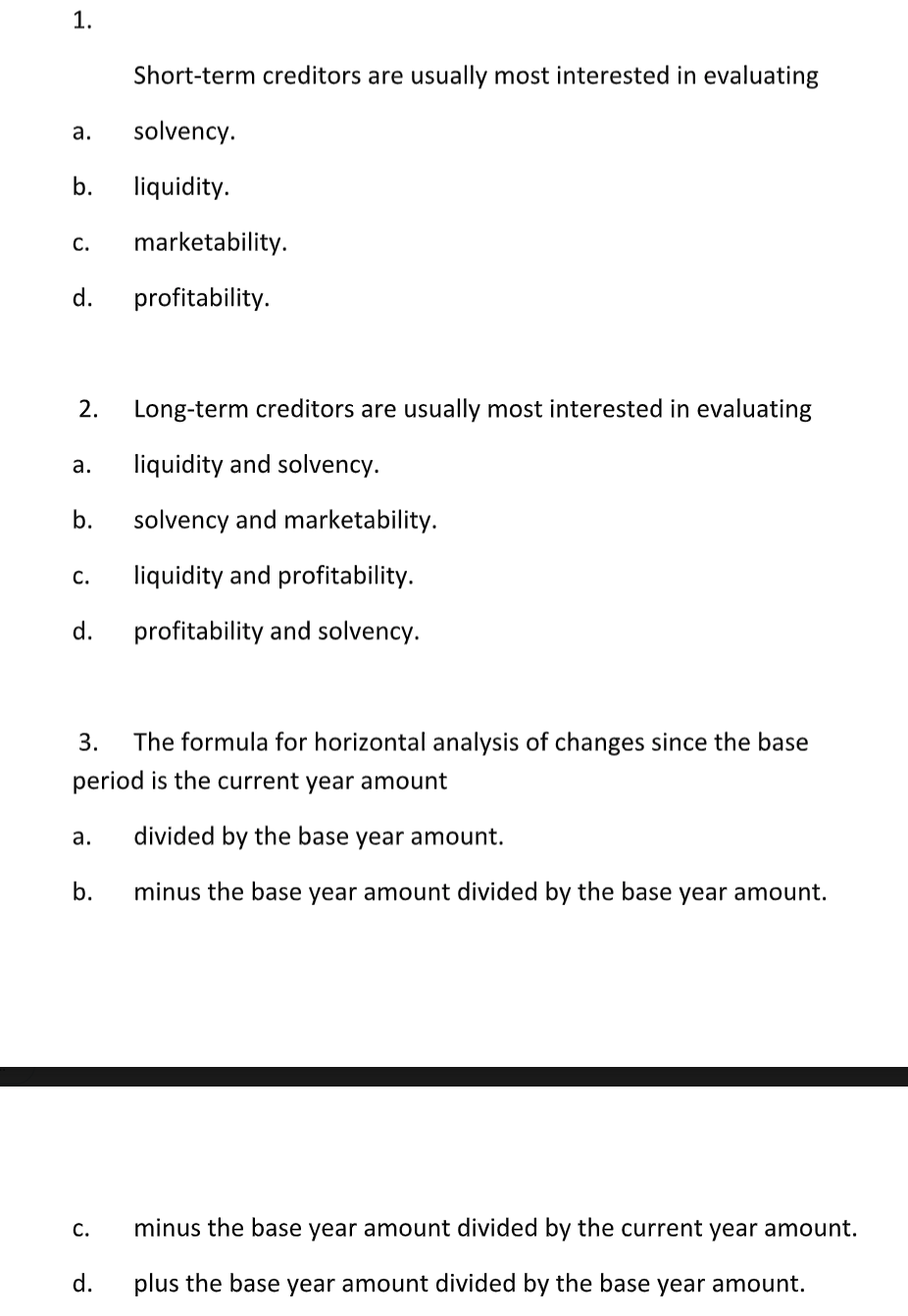

Short Term Creditors Are Usually Most Interested In Assessing

Immediate action is crucial as understanding short-term creditor priorities dictates critical financial decisions for businesses facing liquidity pressures. Failure to recognize their assessment focus could result in detrimental financial consequences, impacting solvency and future funding opportunities.

This article breaks down the core assessment interests of short-term creditors, highlighting the key metrics and financial indicators they scrutinize to determine creditworthiness and minimize risk. Businesses must proactively address these concerns to maintain healthy financial relationships and secure essential short-term financing.

Key Focus: Liquidity and Solvency

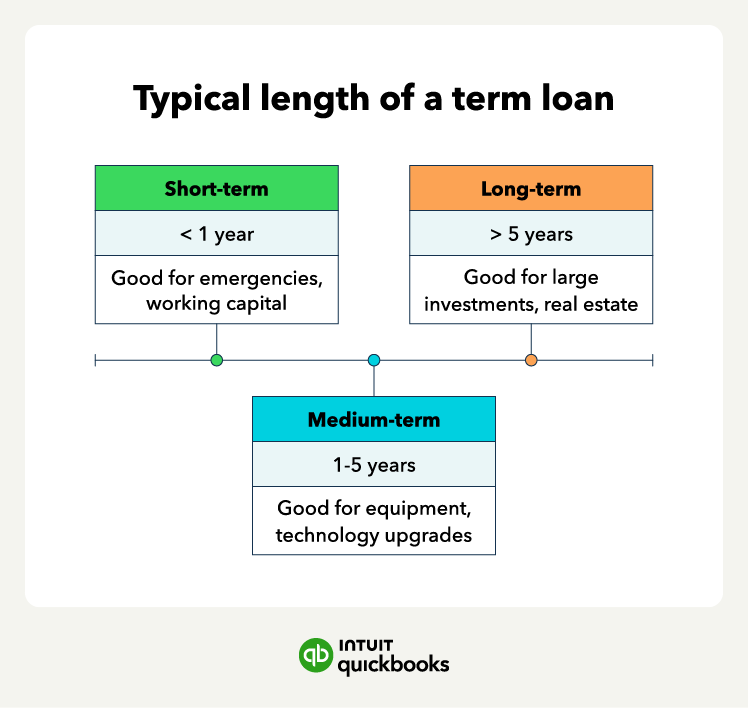

Short-term creditors, such as banks offering lines of credit and suppliers providing trade credit, are primarily concerned with a borrower's immediate ability to repay obligations.

Their assessment hinges on liquidity, the ease with which assets can be converted to cash, and solvency, the ability to meet financial obligations as they come due. The emphasis is on the *short-term* horizon, typically within one year.

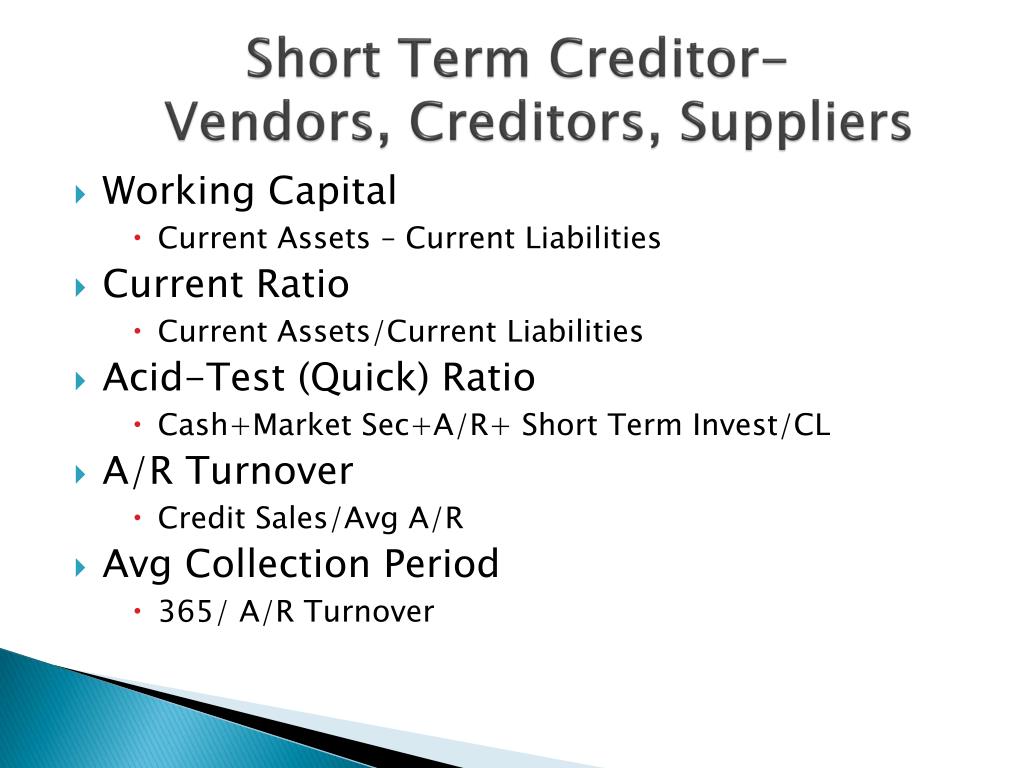

Critical Financial Ratios

Several key financial ratios are meticulously examined to gauge a company's short-term financial health.

The current ratio, calculated by dividing current assets by current liabilities, is a primary indicator. A current ratio of 2:1 or higher is generally considered healthy, suggesting the company has sufficient liquid assets to cover its short-term debts.

The quick ratio (also known as the acid-test ratio) offers a more conservative assessment, excluding inventory from current assets. This ratio, calculated as (Current Assets - Inventory) / Current Liabilities, assesses the ability to meet obligations without relying on the sale of inventory.

Cash Flow Analysis

Beyond ratios, short-term creditors scrutinize cash flow statements to understand the actual movement of cash within the business.

They focus on operating cash flow, assessing whether the company generates sufficient cash from its core operations to cover its immediate obligations.

Negative operating cash flow is a significant red flag, indicating a potential struggle to repay debts.

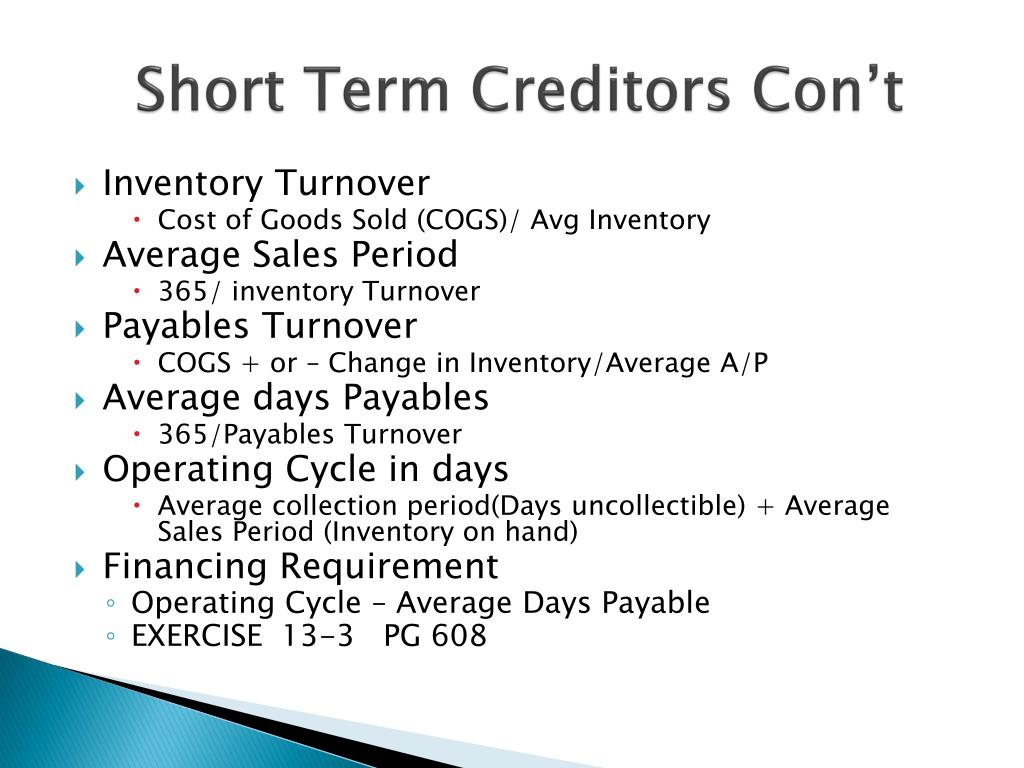

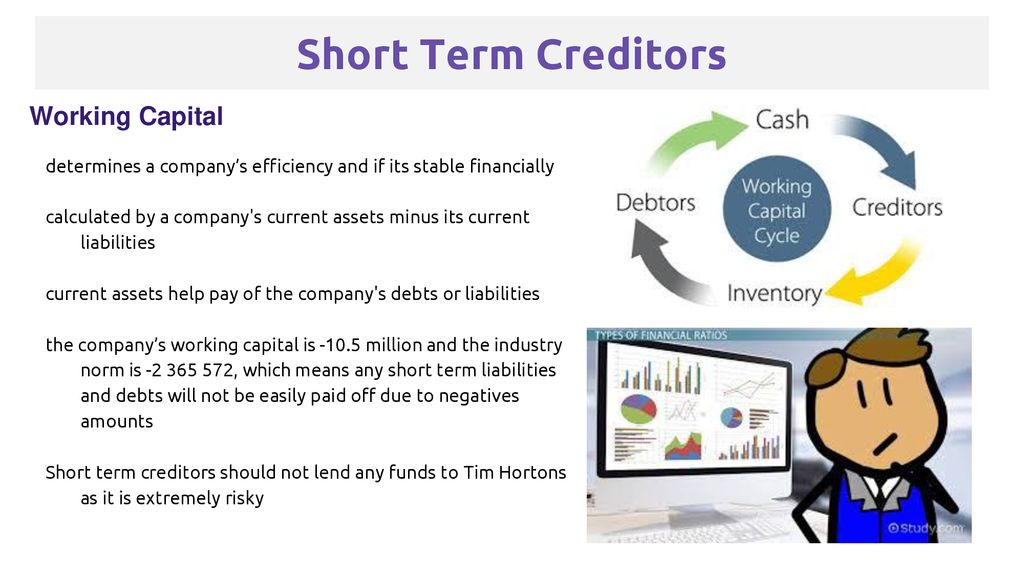

Working Capital Management

Efficient working capital management is vital for maintaining adequate liquidity.

Creditors analyze metrics like accounts receivable turnover, inventory turnover, and accounts payable turnover to assess how effectively the company manages its short-term assets and liabilities. Slow receivables collection or excessive inventory levels can strain cash flow.

Understanding the Credit Agreement

The specific terms of the credit agreement, including interest rates, repayment schedules, and any restrictive covenants, are carefully considered.

Covenants might include maintaining a minimum current ratio or debt-to-equity ratio. Failure to comply with these covenants can trigger default, giving the creditor the right to demand immediate repayment.

The *Wall Street Journal* recently reported a surge in covenant breaches among small businesses due to rising interest rates and inflation, highlighting the increased risk for short-term lenders.

Industry Benchmarks and Economic Conditions

A company's financial performance is evaluated relative to industry benchmarks and the broader economic environment.

A business operating in a volatile sector or facing challenging economic conditions may be perceived as higher risk, even with seemingly adequate financial ratios. The Federal Reserve's Beige Book provides valuable insights into regional economic conditions impacting various industries.

For example, a restaurant facing declining consumer spending due to a recession may be deemed riskier than a tech company experiencing rapid growth.

Supplier Relationships and Trade Credit

Suppliers offering trade credit are particularly interested in a company's payment history and relationship with other vendors.

Consistent late payments or disputes with suppliers can signal financial distress. Trade credit agencies, like *Dun & Bradstreet*, provide reports on a company's payment history, influencing suppliers' willingness to extend credit.

Collateral and Guarantees

While often associated with longer-term loans, short-term creditors may also require collateral or personal guarantees to mitigate risk, especially for new or financially weaker borrowers.

Acceptable collateral might include inventory, accounts receivable, or equipment. Personal guarantees shift the risk to the individual owners of the business.

Next Steps and Ongoing Monitoring

Businesses should proactively monitor their liquidity ratios and cash flow, addressing any potential weaknesses before seeking short-term financing.

Transparency and open communication with creditors are crucial for building trust and maintaining healthy financial relationships. Consulting with a financial advisor can help businesses navigate complex financing options and optimize their working capital management.

The situation is evolving. Expect updates as economic conditions shift and new data emerges from the *Bureau of Economic Analysis*.