Class 8 Truck Sales Forecast 2025

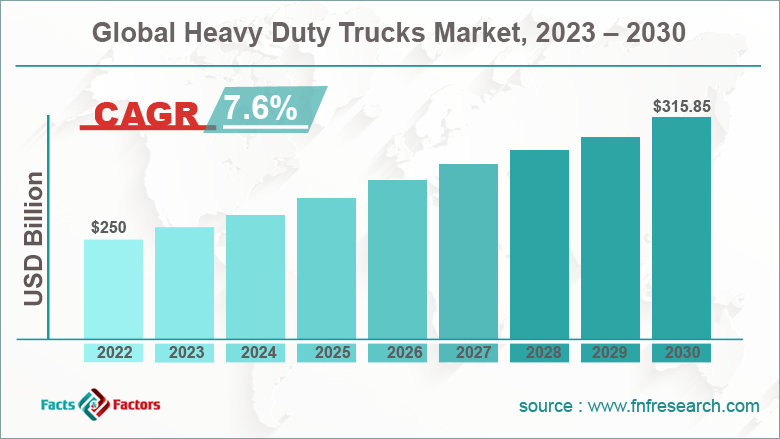

Navigating a landscape of shifting economic currents, evolving regulations, and technological advancements, the heavy-duty truck market faces a pivotal year ahead. Predictions for 2025 Class 8 truck sales are painting a complex picture, with analysts and industry leaders offering varied perspectives on the factors that will drive demand and shape the future of freight transportation.

The upcoming year's performance hinges on several key influencers: freight demand, interest rates, inflation, and the penetration of alternative fuel technologies. Understanding these dynamics is crucial for manufacturers, suppliers, fleet operators, and policymakers alike, as they navigate investment decisions and strategic planning in this critical sector of the economy.

Forecasting the Road Ahead: Divergent Views

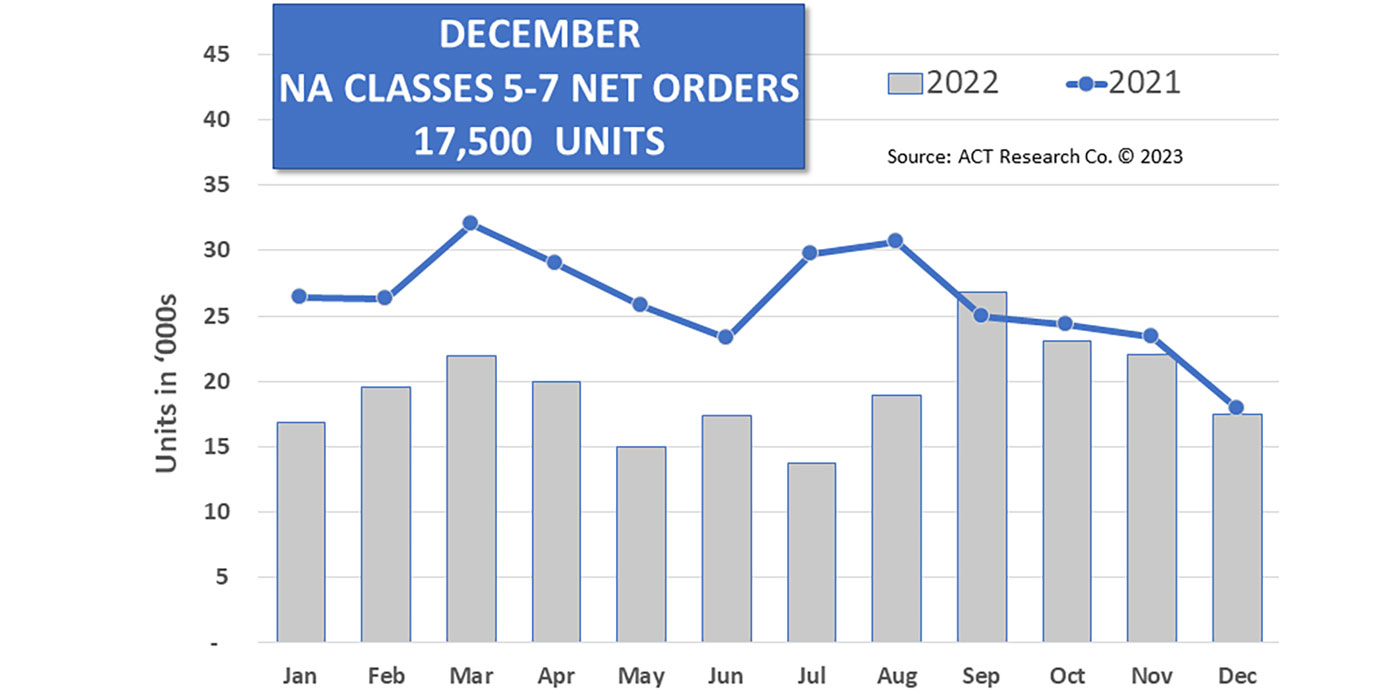

Several leading organizations have released their 2025 Class 8 truck sales forecasts, revealing a range of potential outcomes. ACT Research, a prominent commercial vehicle market research firm, anticipates a moderate year, while other analysts point to potentially stronger or weaker results, depending on economic conditions and other variables.

FTR Transportation Intelligence, another respected forecasting entity, projects a specific unit volume for Class 8 truck orders. However, they emphasize that this projection is subject to change based on the evolving macroeconomic environment and its impact on freight activity.

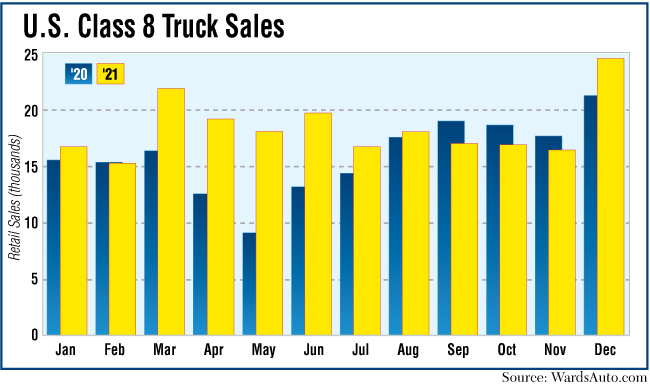

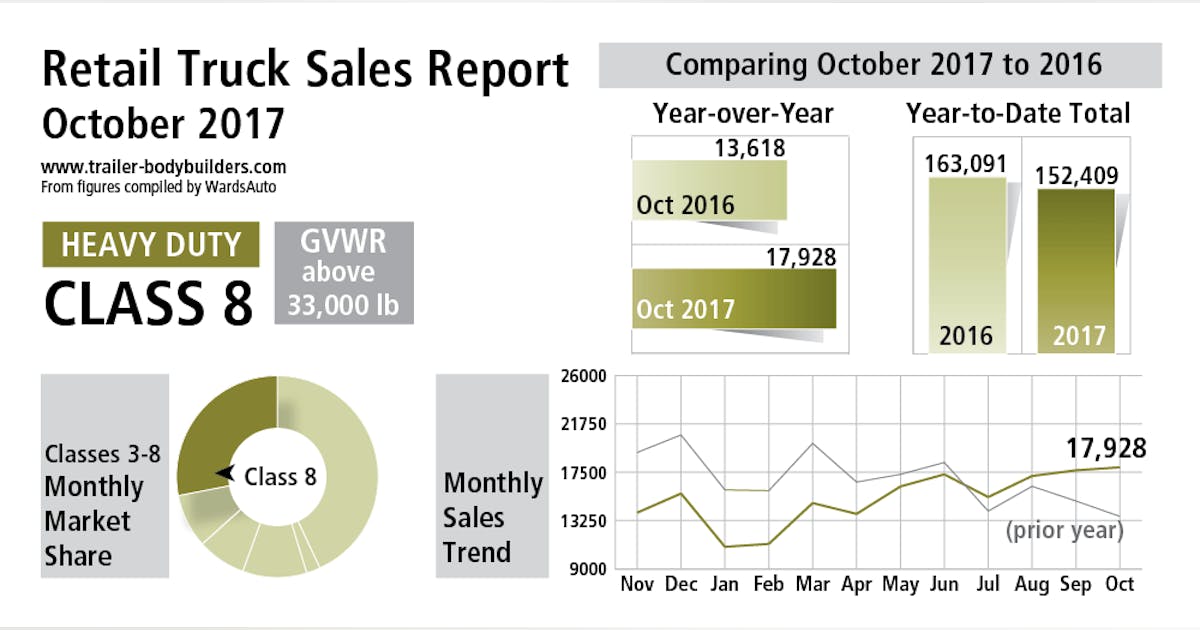

These forecasts are derived from sophisticated models that consider a multitude of data points, including historical sales trends, economic indicators, and regulatory changes. The variability in these forecasts reflects the inherent uncertainty of the market and the diverse range of potential future scenarios.

Key Factors Influencing Demand

Freight demand remains a primary driver of Class 8 truck sales. A robust economy typically translates to higher freight volumes, leading to increased demand for trucks. Conversely, an economic slowdown can depress freight activity, impacting truck sales negatively.

Interest rates play a significant role in the affordability of new trucks. Higher interest rates increase the cost of financing, potentially deterring fleet operators from making new purchases. The Federal Reserve's monetary policy decisions will, therefore, be closely watched by industry stakeholders.

Inflation also impacts the cost of trucks and operations. Rising material and labor costs can push up truck prices, while higher fuel and maintenance expenses can affect fleet profitability. These inflationary pressures can influence the timing and magnitude of fleet investment decisions.

The Rise of Alternative Fuels

The transition to alternative fuels, such as electric and hydrogen, is gradually gaining momentum in the heavy-duty truck market. While diesel-powered trucks still dominate, the increasing availability of zero-emission vehicles (ZEVs) and government incentives are encouraging adoption. California's Advanced Clean Fleets rule, for example, mandates a gradual transition to ZEVs for many truck fleets operating in the state.

The pace of this transition will depend on factors such as battery technology advancements, charging infrastructure availability, and the total cost of ownership of alternative fuel vehicles. The degree to which alternative fuel vehicles penetrate the market in 2025 will significantly influence overall Class 8 truck sales figures, considering the higher price point of these technologies initially.

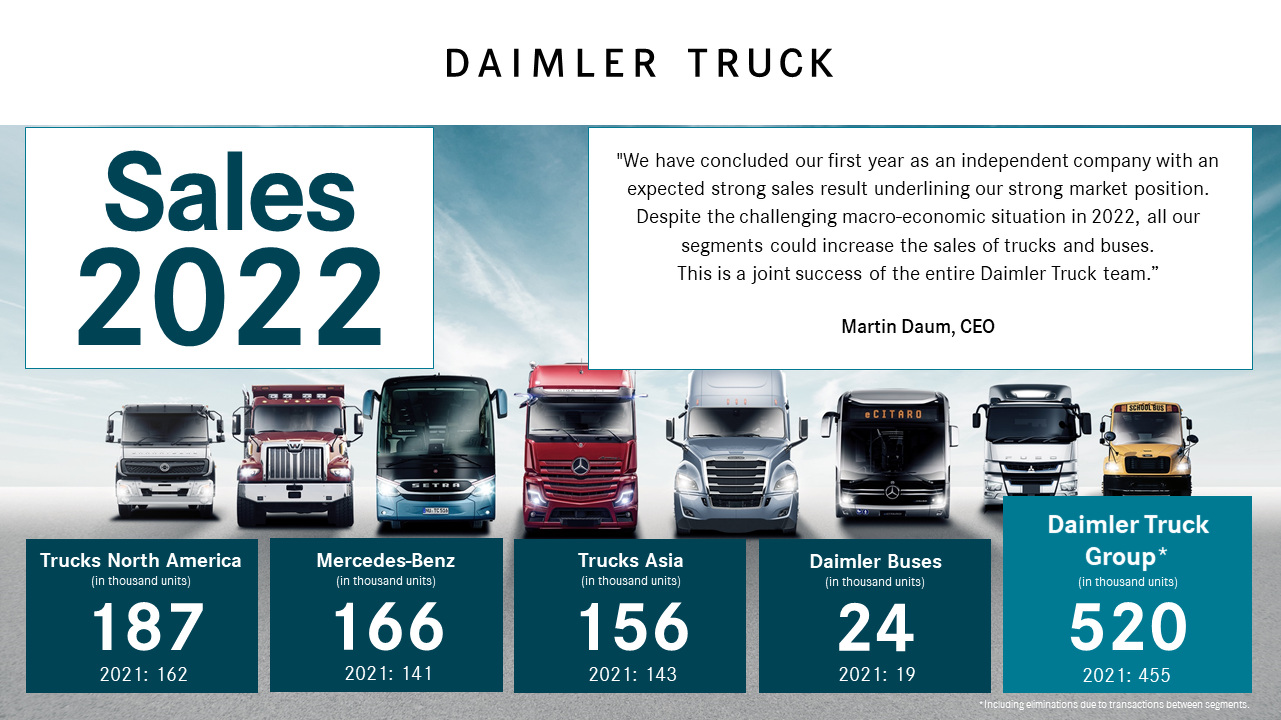

Daimler Truck and Volvo Group, two leading truck manufacturers, are heavily investing in electric truck technology and infrastructure. Their success in scaling up production and lowering costs will be crucial to accelerating the adoption of ZEVs in the Class 8 segment.

Impact on the Industry and Beyond

The performance of the Class 8 truck market has far-reaching implications. It affects not only truck manufacturers and their suppliers but also the broader logistics and transportation sectors, which are essential to the functioning of the global economy.

Truck sales also provide insights into the overall health of the economy. Strong truck sales typically indicate a healthy economy, while weak sales can signal an impending slowdown.

The shift toward cleaner transportation technologies has environmental implications. Widespread adoption of ZEVs can reduce greenhouse gas emissions and improve air quality, contributing to a more sustainable future.

Navigating the Uncertainties

The 2025 Class 8 truck market forecast remains uncertain, with various factors potentially influencing outcomes. Fleet managers should analyze these factors and create robust operational plans. Monitoring economic data, regulatory developments, and technological advancements will be crucial for making informed decisions in this dynamic market.

Government policies, such as tax credits and infrastructure investments, can play a vital role in supporting the transition to cleaner transportation. Collaboration between government, industry, and other stakeholders is essential to navigate the challenges and opportunities ahead.

By embracing innovation, adapting to changing market conditions, and prioritizing sustainability, the heavy-duty truck industry can continue to play a vital role in powering the economy and shaping a cleaner future.