Class Action Lawsuit Against Lincoln Financial

Imagine receiving a letter that throws your retirement plans into disarray. For many American retirees and those diligently saving for their golden years, this nightmare scenario has become a reality. A cloud of uncertainty now hangs over their financial futures as a significant class action lawsuit has been filed against Lincoln Financial Group, one of the nation's largest providers of retirement and insurance solutions.

At the heart of the legal challenge is the allegation that Lincoln Financial breached its fiduciary duty, unfairly profiting at the expense of its clients. The lawsuit claims the company charged excessive fees and made imprudent investment decisions within its variable annuity products, diminishing the returns for countless individuals and families relying on these funds for their long-term security.

Background of Lincoln Financial Group

Lincoln Financial Group, a name synonymous with financial security for over a century, holds a prominent position in the American financial landscape. They offer a wide array of services, including life insurance, annuities, retirement plan services, and investment management. Millions of Americans trust Lincoln Financial to safeguard their financial futures, making them a pivotal player in the nation's retirement system.

Variable annuities, a cornerstone of Lincoln Financial's offerings, are complex financial products. They combine insurance features with investment options, allowing individuals to invest in a variety of market-linked accounts. The appeal lies in the potential for growth coupled with guarantees, offering a blend of risk and security for retirement savings.

The Allegations Against Lincoln Financial

The lawsuit alleges that Lincoln Financial prioritized its own profits over the best interests of its clients. The plaintiffs contend that the company levied excessive and often undisclosed fees on its variable annuity products. These fees, they argue, significantly eroded the value of the investments, reducing the potential returns for policyholders.

Furthermore, the lawsuit scrutinizes Lincoln Financial's investment choices within these annuities. It's claimed the company directed investments towards proprietary funds that generated higher fees for Lincoln Financial but offered inferior performance compared to other available options. This alleged conflict of interest forms a critical part of the legal challenge.

“We believe Lincoln Financial put its own financial gains ahead of the well-being of its customers,” stated a lead attorney from the law firm representing the plaintiffs. “Our goal is to hold them accountable and recover the losses suffered by these hardworking individuals and families.”

The Impact on Policyholders

The potential impact of this lawsuit on Lincoln Financial policyholders is substantial. Many individuals invested their life savings into these variable annuities, trusting Lincoln Financial to act as a responsible steward of their retirement funds. The alleged mismanagement and excessive fees could have significant consequences, potentially delaying retirement or forcing individuals to make difficult financial choices.

For some, the impact may be measured in thousands of dollars lost in potential returns. For others, it could translate to a delayed retirement or a diminished quality of life in their later years. The lawsuit seeks to compensate policyholders for these losses and to prevent similar actions from occurring in the future.

One plaintiff, a retired teacher named Sarah Miller, expressed her frustration: “I trusted Lincoln Financial to help me secure my retirement. Now, I'm facing the possibility of having to drastically cut back on my expenses because of their alleged mismanagement. It’s incredibly disheartening.”

Legal and Regulatory Scrutiny

This class action lawsuit comes at a time of increased scrutiny of the financial services industry. Regulators are paying closer attention to fees and investment practices, particularly within retirement products. The outcome of this case could have far-reaching implications for how financial institutions manage and administer retirement savings.

The lawsuit highlights the importance of transparency and fiduciary responsibility in the financial industry. It underscores the need for companies to prioritize the interests of their clients above their own profits. The case could also lead to changes in regulations governing variable annuities, ensuring greater protection for investors.

According to a statement from the U.S. Securities and Exchange Commission (SEC), “Protecting investors, especially those saving for retirement, is a top priority for the SEC. We are committed to holding financial institutions accountable for any misconduct that harms investors.”

The Road Ahead

The class action lawsuit against Lincoln Financial is still in its early stages. The legal process is expected to be lengthy and complex, involving extensive discovery, expert testimony, and potentially a trial. The outcome of the case will depend on the evidence presented and the legal arguments made by both sides.

Lincoln Financial has stated that it intends to vigorously defend itself against the allegations. In a press release, the company said, “We believe the claims are without merit and we will vigorously defend ourselves. We are committed to acting in the best interests of our customers and adhering to the highest ethical standards.”

Regardless of the outcome, this lawsuit serves as a crucial reminder to investors to carefully review their financial products and fees. It also highlights the importance of seeking independent financial advice and understanding the potential risks and rewards of different investment options.

What Policyholders Should Do

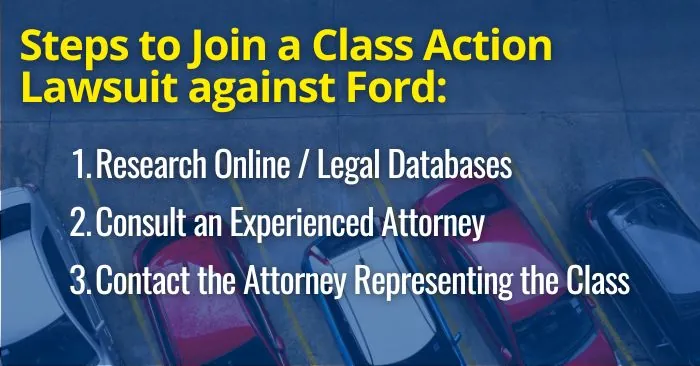

For those who are currently invested in Lincoln Financial variable annuities, it is essential to stay informed about the lawsuit and its potential impact. Policyholders should carefully review their account statements and fee disclosures to understand the costs associated with their investments. Consulting with a qualified financial advisor can also provide valuable guidance.

Information regarding the class action lawsuit, including how to join the class or opt out, is typically available on the website of the law firm representing the plaintiffs. It’s crucial for policyholders to understand their rights and options during this process.

The case also emphasizes the need for ongoing monitoring of investments. Even after initial due diligence, it is important to periodically review performance and fees to ensure that investments are aligned with financial goals and risk tolerance.

A Broader Perspective on Retirement Security

The Lincoln Financial lawsuit also raises broader questions about retirement security in America. With the decline of traditional pensions and the increasing reliance on individual savings, it is crucial that financial institutions act responsibly and ethically. Transparency, fair fees, and prudent investment management are essential for ensuring that Americans can retire with dignity and financial security.

The case also highlights the need for financial literacy and education. Individuals need to be equipped with the knowledge and skills to make informed decisions about their retirement savings. This includes understanding the complexities of financial products, the importance of diversification, and the impact of fees on long-term returns.

As we move forward, it is imperative that we create a financial system that prioritizes the well-being of individuals and families, ensuring that everyone has the opportunity to achieve a secure and comfortable retirement.

The outcome of this lawsuit will undoubtedly have significant ramifications, not only for Lincoln Financial and its policyholders, but also for the broader financial industry. It serves as a powerful reminder of the importance of fiduciary duty and the need for transparency and accountability in managing retirement savings. The financial future of countless individuals hangs in the balance, waiting to see how this story unfolds.