Common Shareholders Usually Have All Of The Following Rights Except

The world of corporate finance can seem like a labyrinth, especially when navigating the rights and responsibilities tied to owning stock. While common shareholders are granted several fundamental rights, a persistent misconception exists about the extent of their power. One area often misunderstood is the extent of control they wield over the daily operations and strategic decision-making within a company.

Understanding the nuances of shareholder rights is vital for both seasoned investors and those just entering the market. This article clarifies a common misconception: common shareholders generally possess a wide array of rights, but direct involvement in the corporation's management is typically not among them. We will examine what rights they *do* have, and why the absence of direct management control is a crucial feature of corporate governance.

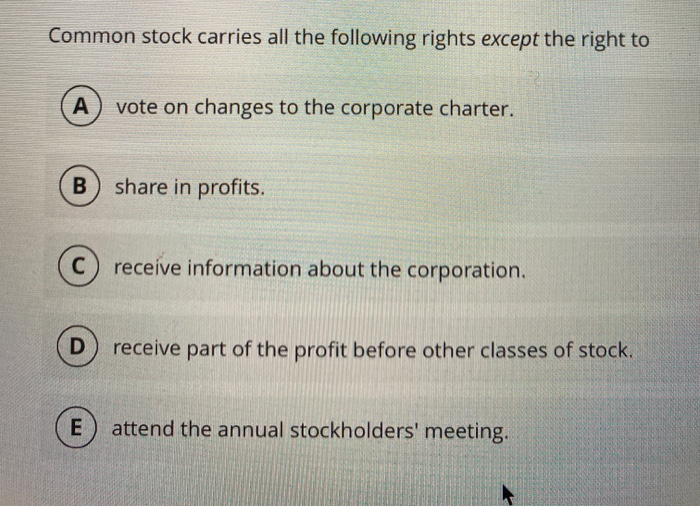

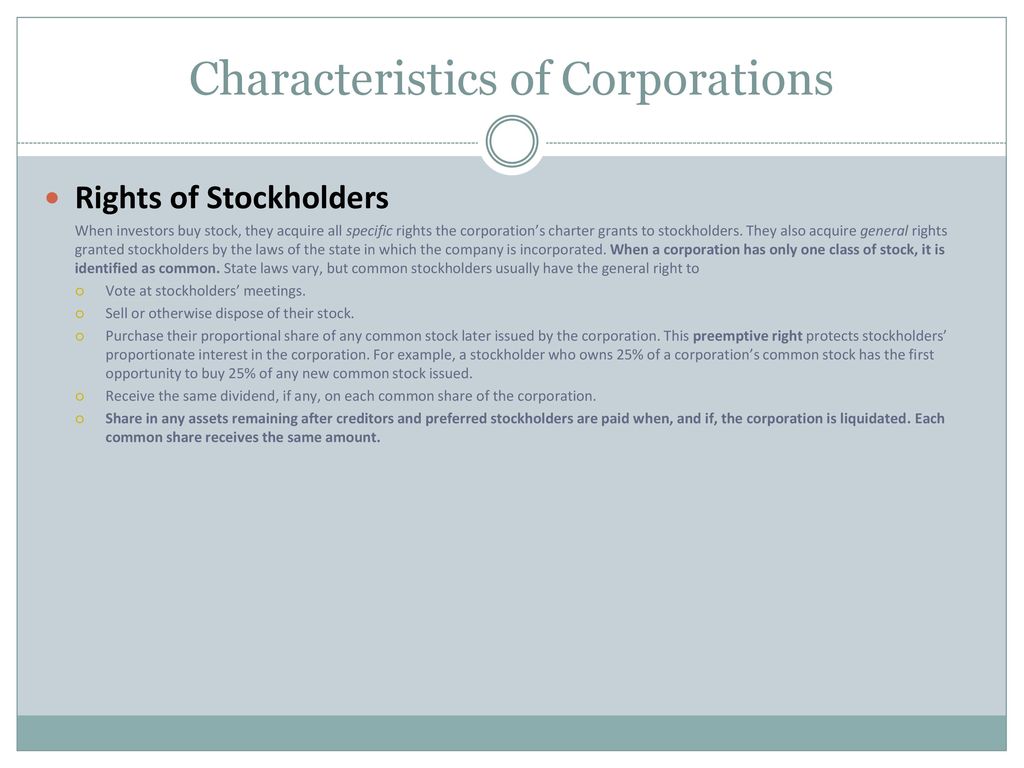

Key Rights of Common Shareholders

Common shareholders own a piece of the company. Their ownership grants them various rights intended to protect their investment and ensure a degree of influence over the corporation's direction.

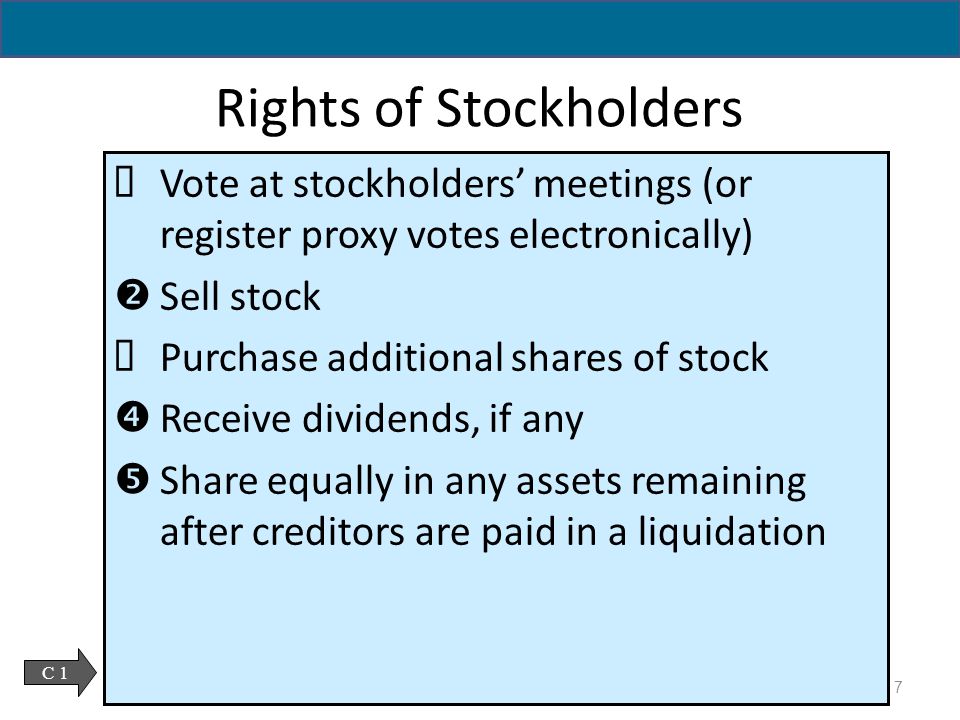

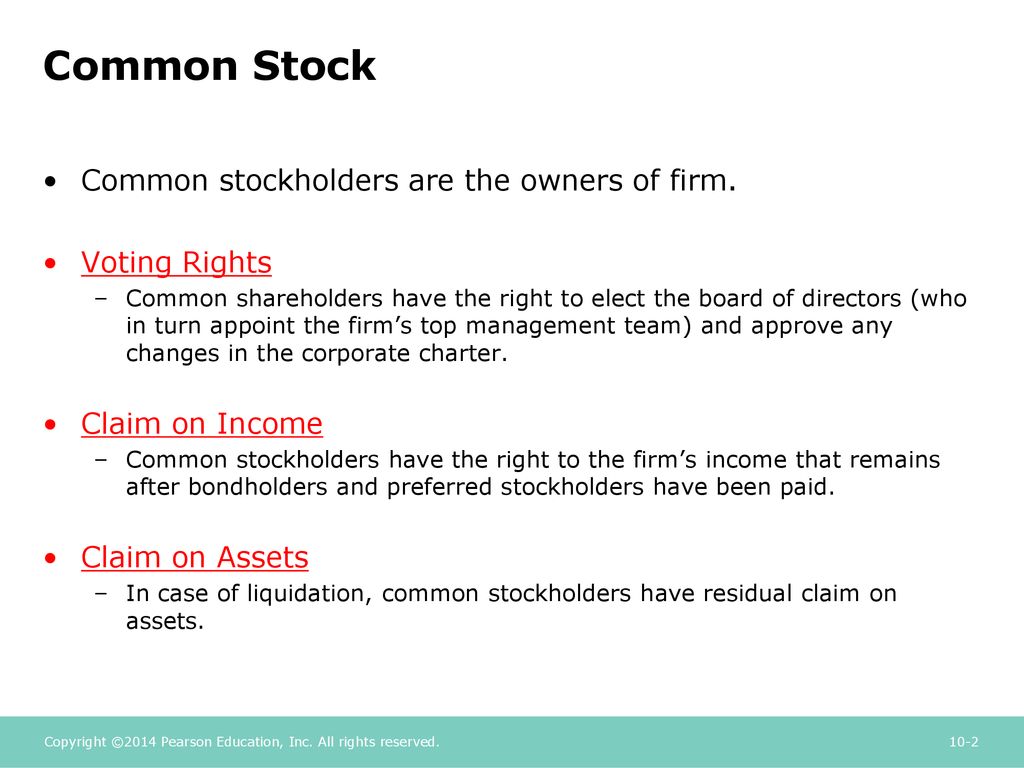

One of the most fundamental rights is the right to vote. This allows shareholders to participate in electing the board of directors, who are responsible for overseeing the company's management and setting strategic policies. The number of votes a shareholder has is usually proportional to the number of shares they own.

Another essential right is the right to receive dividends. If the company decides to distribute profits to its shareholders, common shareholders are entitled to their share of those dividends. The amount of dividends received depends on the number of shares owned and the dividend policy of the company.

Common shareholders also possess the right to information. This means they are entitled to access the company's financial statements, annual reports, and other relevant information about its performance and operations. This transparency allows shareholders to make informed decisions about their investment and to hold management accountable.

Preemptive Rights and Asset Claims

The preemptive right allows existing shareholders to maintain their percentage ownership in the company if it issues new shares. This prevents their ownership stake from being diluted by new stock offerings.

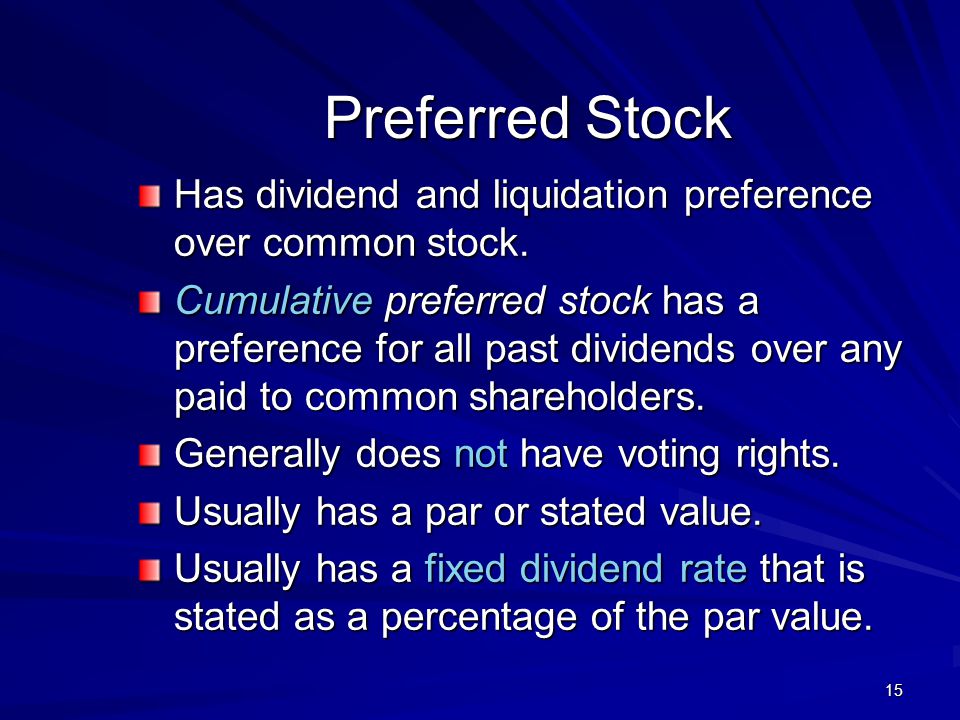

In the event of liquidation, common shareholders have a claim on the company's assets after all creditors and preferred shareholders have been paid. This is known as the right to assets upon liquidation. However, it's important to note that this right is often of limited value, as there may be little or nothing left for common shareholders after all other claims have been settled.

The Missing Piece: Direct Management Control

Despite the comprehensive rights afforded to common shareholders, they typically do *not* have the right to directly manage the company. This responsibility lies with the board of directors and the executive management team appointed by the board.

The separation of ownership and control is a cornerstone of modern corporate governance. This model is designed to ensure that the company is managed by individuals with the expertise and experience necessary to make sound business decisions.

Imagine a scenario where every common shareholder had the power to directly influence daily operations. The result would be utter chaos and a complete lack of strategic direction. Decisions would be made based on individual preferences rather than sound business principles.

The Role of the Board of Directors

The board of directors acts as a crucial intermediary between shareholders and management. The board is elected by the shareholders and is responsible for overseeing the management team, setting strategic goals, and ensuring that the company is operating in the best interests of its shareholders.

Shareholders hold the board accountable through their voting rights. If shareholders are dissatisfied with the performance of the board, they can vote to elect new directors who they believe will better represent their interests.

This system provides a balance between shareholder influence and effective management. Shareholders have the power to hold management accountable through the board, but they do not have the right to interfere directly in the day-to-day operations of the company.

Impact and Significance

The distinction between shareholder rights and management control is essential for understanding corporate governance and investor responsibilities. It highlights the importance of informed decision-making and the role of the board of directors in representing shareholder interests.

This understanding is particularly crucial for new investors who may mistakenly believe that owning stock grants them direct control over the company. It's important to recognize that shareholder influence is exercised through voting rights and the ability to hold the board accountable, not through direct management intervention.

Ultimately, the system is designed to foster sustainable growth and profitability for the company while protecting the interests of its shareholders. The delineation of responsibilities ensures efficiency and accountability in the corporate world.