Compare Charles Schwab And Fidelity

In the ever-evolving landscape of personal finance, choosing the right brokerage firm can be a pivotal decision, impacting investment growth, access to resources, and overall financial well-being. Two giants consistently stand out in this arena: Charles Schwab and Fidelity Investments.

Both firms boast decades of experience, massive asset bases, and millions of clients, making them go-to options for investors of all levels. But beneath the surface similarities lie key differences that can significantly influence an investor's experience and outcomes.

This article provides a comprehensive comparison of Charles Schwab and Fidelity, delving into their offerings, pricing structures, platform features, and customer service to help investors determine which brokerage best aligns with their individual needs and goals.

A Deep Dive into Offerings

Both Schwab and Fidelity offer a wide array of investment products. This includes stocks, bonds, mutual funds, ETFs, and options.

Fidelity generally boasts a slightly larger selection of no-transaction-fee (NTF) mutual funds, particularly those managed in-house. However, Schwab's OneSource platform provides a vast selection of NTF funds as well, making it a competitive option.

For those interested in more complex investments, both firms offer access to futures and forex trading, though the platforms and tools available may vary. Active traders should compare the specific tools and margin rates offered by each.

Pricing and Fees: A Battle of the Brokers

The brokerage industry has largely moved towards commission-free trading for stocks, ETFs, and options. Both Charles Schwab and Fidelity were early adopters of this model.

This makes them highly competitive when it comes to basic trading. However, it's crucial to consider other fees, such as those associated with wire transfers, account maintenance (though these are generally waived), and margin rates.

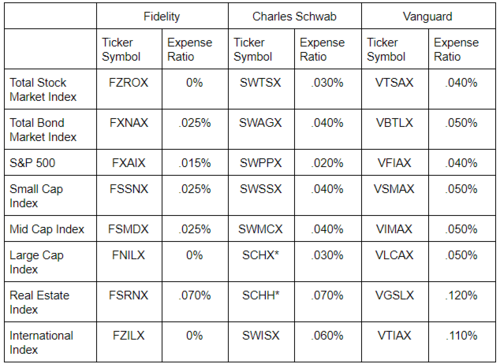

Fidelity is often lauded for its low expense ratios on its index funds, making it a compelling choice for cost-conscious investors. Schwab also offers competitive expense ratios on its own index funds. Therefore, comparison based on specific fund choices is essential.

Platform Features and User Experience

Both Schwab and Fidelity offer robust online platforms and mobile apps. These provide investors with tools for research, trading, and account management.

Schwab's platform is often praised for its user-friendly interface, making it accessible to both beginners and experienced traders. The StreetSmart Edge platform caters to active traders with advanced charting and analysis capabilities.

Fidelity's platform provides a comprehensive suite of tools, including research reports from reputable sources and a customizable dashboard. The firm's Active Trader Pro platform is a powerful option for those who require advanced trading features.

Customer Service and Support

Exceptional customer service is a hallmark of both Schwab and Fidelity. Both firms offer 24/7 phone support and online chat.

Schwab consistently receives high ratings for its customer service, often attributed to its proactive approach and knowledgeable representatives. Fidelity also provides excellent customer support, with dedicated teams to assist clients with various needs.

The availability of branch locations is another differentiating factor. Schwab has a larger network of brick-and-mortar branches. This offers in-person assistance for clients who prefer face-to-face interactions.

Looking Ahead: The Future of Investing

The competition between Charles Schwab and Fidelity continues to drive innovation and benefit investors. Both firms are constantly evolving their platforms, expanding their offerings, and enhancing their customer service to stay ahead of the curve.

The rise of robo-advisors and automated investment tools is another area where both firms are actively competing. Schwab's Intelligent Portfolios and Fidelity's Go are examples of these offerings, providing hands-off investment management solutions for investors who prefer a more passive approach.

Ultimately, the best choice between Charles Schwab and Fidelity depends on individual circumstances and priorities. Investors should carefully consider their investment goals, preferred platform features, and desired level of customer support before making a decision.