Comparison Of Different Forms Of Business Organizations

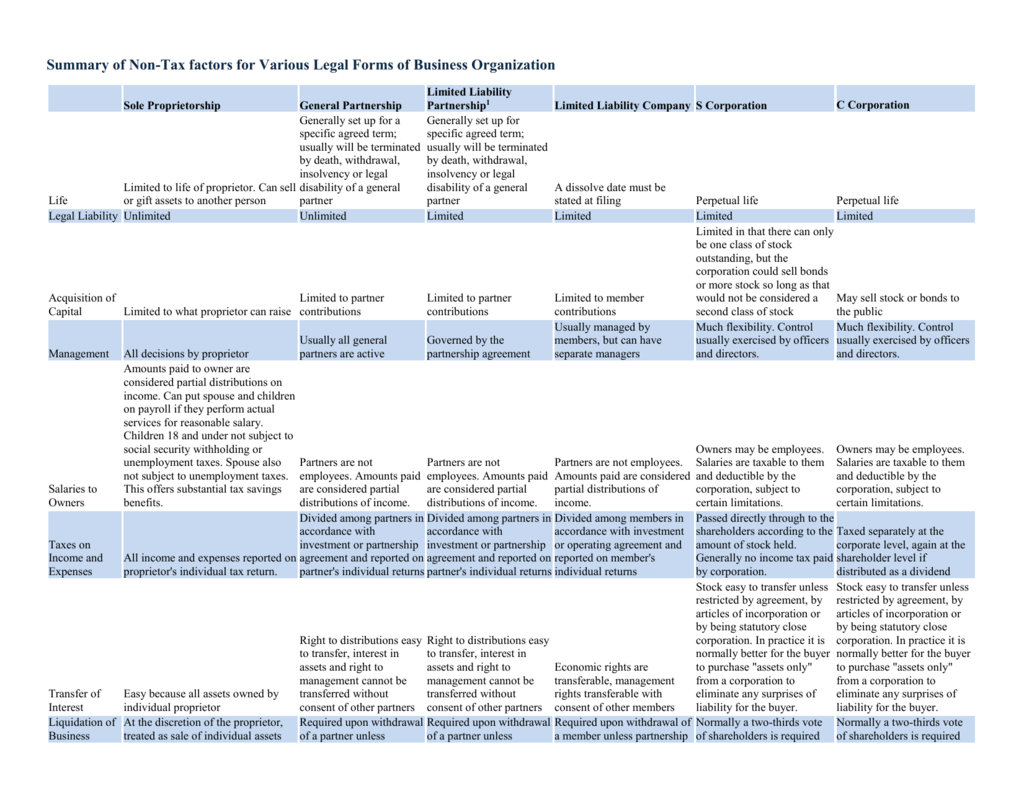

Choosing the right business structure is a foundational decision that can significantly impact a company's legal liabilities, tax obligations, fundraising capabilities, and operational flexibility. The landscape of business organization is diverse, ranging from the simplicity of a sole proprietorship to the complexities of a corporation. Understanding these nuances is paramount for entrepreneurs and business owners aiming for sustainable growth and long-term success.

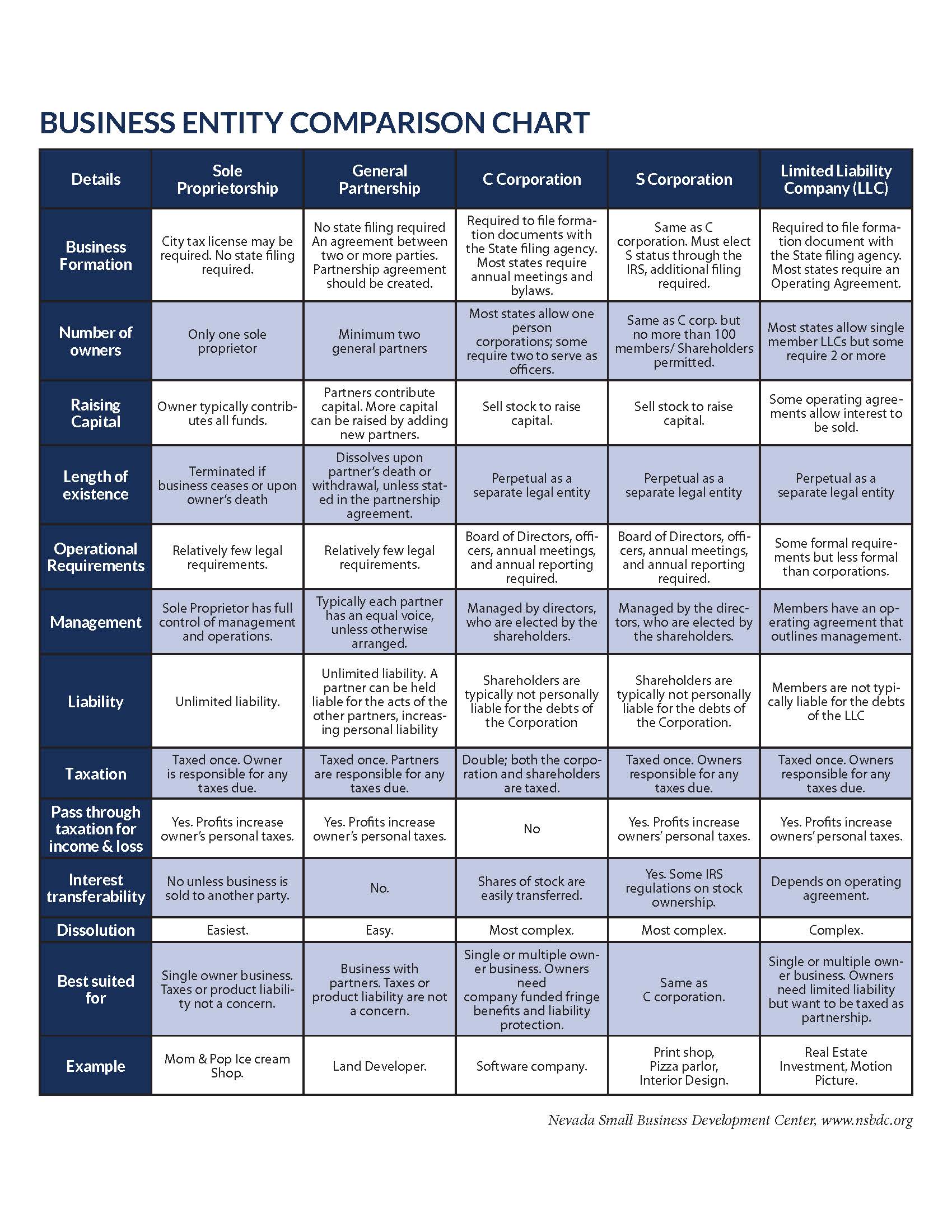

This article provides a comprehensive comparison of various business structures, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. It outlines the key characteristics, advantages, and disadvantages of each model, drawing on data from the U.S. Small Business Administration (SBA) and legal perspectives. It also sheds light on the factors entrepreneurs should consider when making this critical choice, ensuring they align their business structure with their specific goals and risk tolerance.

Sole Proprietorship: Simplicity and Direct Control

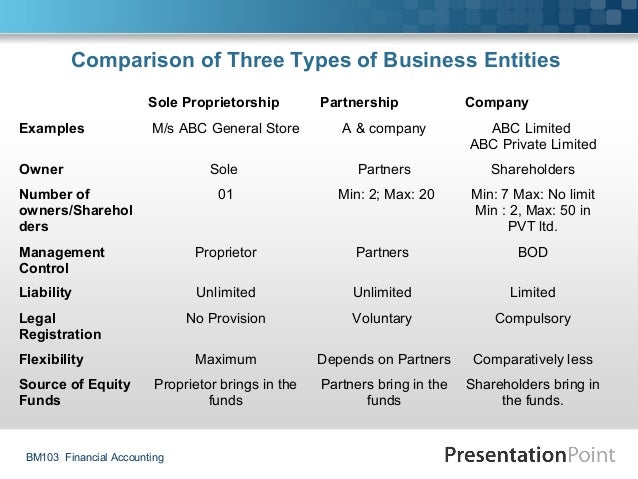

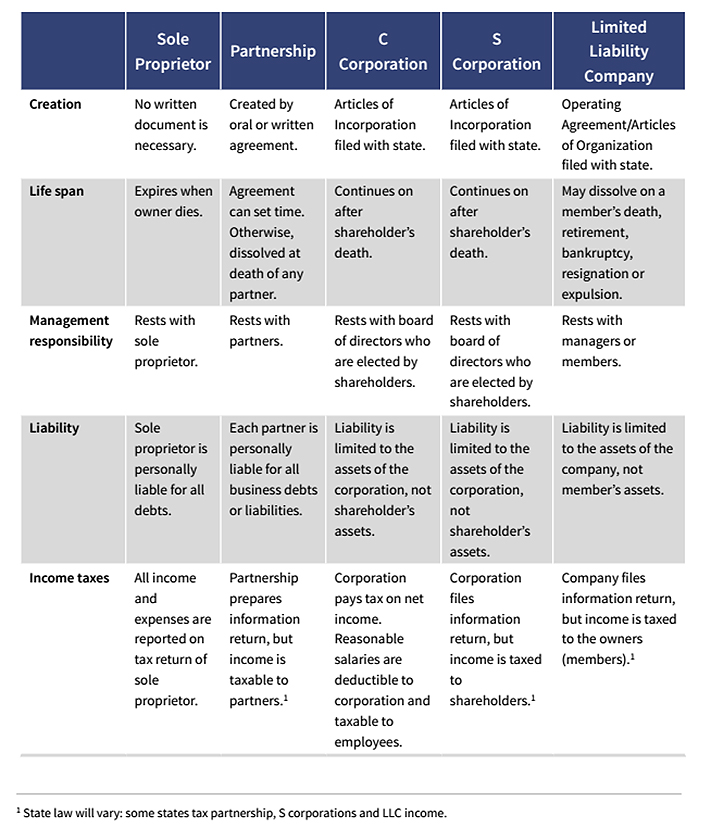

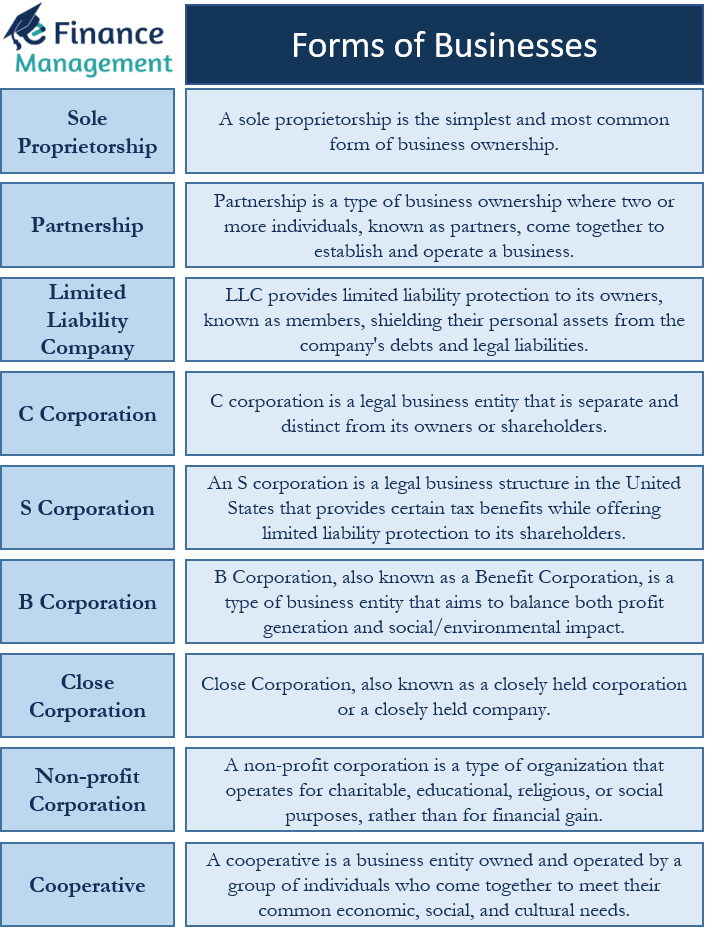

A sole proprietorship is the simplest form of business organization, owned and run by one person. The owner directly receives all profits but is also personally liable for all business debts and obligations. This direct exposure to risk is a significant disadvantage.

According to the SBA, this structure is easy to set up and requires minimal paperwork. However, raising capital can be challenging, as the business's creditworthiness is tied to the owner's personal credit. This can limit growth potential and expansion opportunities.

Taxation is straightforward, with profits taxed as personal income. However, this also means the owner is subject to self-employment taxes on top of income taxes. This might be a burden when compared to other business structures.

Partnerships: Collaboration and Shared Responsibility

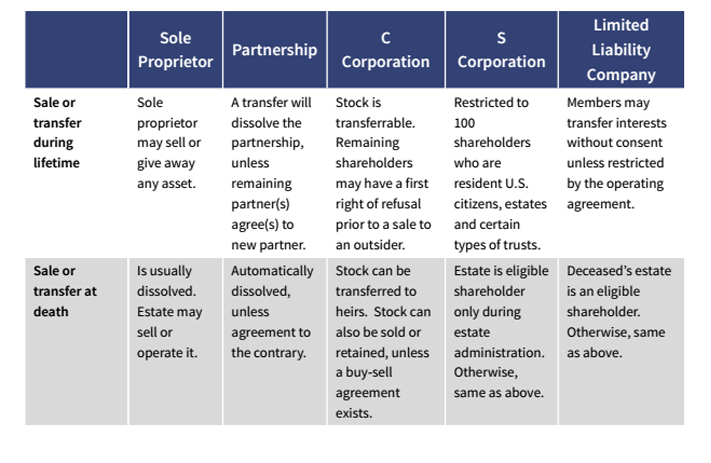

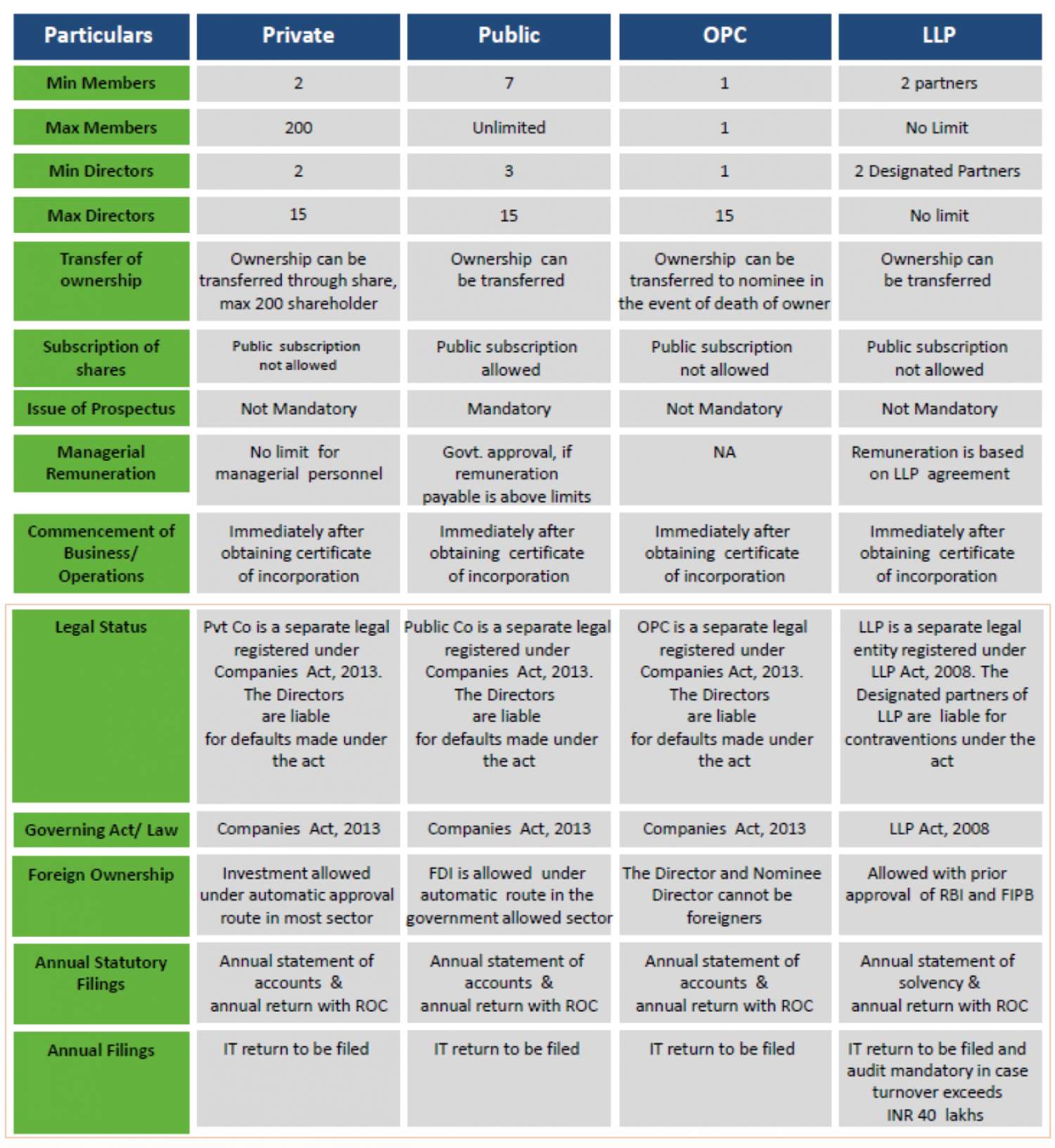

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Partnerships can take various forms, including general partnerships, limited partnerships (LPs), and limited liability partnerships (LLPs). Each form has distinct implications for liability and management responsibility.

In a general partnership, all partners share in the management and are jointly and severally liable for the business's debts. LPs, on the other hand, have general partners with full liability and limited partners with limited liability and limited management roles. LLPs offer limited liability to all partners, protecting them from the negligence or misconduct of other partners.

While partnerships offer the advantage of pooling resources and expertise, they can also lead to disagreements and conflicts among partners. A well-defined partnership agreement is crucial for outlining roles, responsibilities, and procedures for resolving disputes. According to legal experts, this can mitigate potential issues.

Limited Liability Companies (LLCs): Balancing Liability and Flexibility

An LLC offers a hybrid structure that combines the limited liability of a corporation with the flexibility and simplicity of a partnership. Members of an LLC are not personally liable for the business's debts, shielding their personal assets from business creditors. This is one of the main attractions of an LLC.

LLCs offer flexibility in terms of management structure and taxation. Members can choose to be taxed as a sole proprietorship, partnership, or corporation. This flexibility allows businesses to tailor their tax strategy to optimize their financial outcomes.

According to state laws, the formation of an LLC requires filing articles of organization with the state. While this process is relatively straightforward, it is essential to comply with all legal requirements to maintain the limited liability protection. Furthermore, LLCs can face complexity with taxation in some states.

Corporations: Formal Structure and Capital Raising

A corporation is a legal entity separate and distinct from its owners, offering the strongest form of liability protection. Corporations can raise capital more easily through the issuance of stock. This makes them attractive to investors.

There are two main types of corporations: S corporations and C corporations. C corporations are subject to double taxation, where profits are taxed at the corporate level and again when distributed to shareholders as dividends. S corporations, on the other hand, allow profits and losses to be passed through directly to the owners' personal income without being subject to corporate tax rates.

Corporations require more complex regulatory compliance and corporate governance procedures. They are subject to strict rules regarding meetings, record-keeping, and financial reporting. The cost and complexity of these requirements are deterrents to small business owners.

Choosing the Right Structure: Key Considerations

The choice of business structure depends on various factors, including the business's size, risk profile, capital needs, and long-term goals. Entrepreneurs should carefully evaluate these factors and seek legal and financial advice to make an informed decision. Considering the potential growth trajectory of the business is vital.

Tax implications play a significant role in determining the optimal structure. Businesses should analyze the tax advantages and disadvantages of each option to minimize their tax burden. They must also consider the level of personal liability they are willing to assume.

Ultimately, the right business structure is one that supports the business's strategic objectives and provides a solid foundation for future success. Regular review of the chosen structure may be necessary as the business evolves. Therefore, adaptability is important.

Looking Ahead: Adaptability and Future Trends

The business landscape is constantly evolving, and business owners must adapt their organizational structures to remain competitive. Emerging trends, such as remote work and increased globalization, are influencing how businesses operate and organize. This can change the needs of a business.

As more businesses embrace digital technologies and adopt flexible work arrangements, the traditional distinctions between business structures may become blurred. Entrepreneurs may need to explore innovative organizational models that leverage technology and promote collaboration. This may create new kinds of business.

By staying informed about the latest developments and adapting their business structures accordingly, entrepreneurs can position themselves for long-term growth and success. They can also take advantage of the unique opportunities that arise in today's dynamic business environment. Continuous learning and strategic planning are crucial.