Comprehensive Proposal Xrp As A Strategic

Imagine a world where cross-border payments are as seamless as sending an email, transactions settle in seconds, and financial inclusion reaches the farthest corners of the globe. This vision, long a dream of innovators and global citizens, is now edging closer to reality, fueled by advancements in digital asset technology and a renewed focus on strategic solutions like XRP.

At the heart of this transformation lies a comprehensive proposal positioning XRP as a strategic asset for revolutionizing global finance. This proposal outlines how XRP can solve inefficiencies in cross-border payments, enhance liquidity for financial institutions, and ultimately foster greater financial inclusion for underserved communities worldwide.

XRP, the digital asset native to the XRP Ledger, has been the subject of much discussion and debate since its inception. Understanding its origins and evolution is crucial to appreciating the current comprehensive proposal and its potential impact.

The Genesis of XRP and the XRP Ledger

The XRP Ledger, a decentralized cryptographic ledger, was created in 2012 by Jed McCaleb, Arthur Britto, and David Schwartz. Their vision was to create a faster, cheaper, and more efficient payment system than traditional methods.

Unlike Bitcoin, the XRP Ledger uses a unique consensus mechanism called the XRP Ledger Consensus Protocol, which allows for incredibly fast transaction settlement times – typically 3-5 seconds.

This speed, coupled with low transaction fees, makes XRP a compelling alternative to traditional cross-border payment systems like SWIFT, which can be slow and expensive.

Addressing the Pain Points of Traditional Finance

Traditional cross-border payments often involve multiple intermediaries, each adding fees and delays to the process. These inefficiencies disproportionately affect individuals and businesses in developing countries, hindering economic growth and financial inclusion.

The comprehensive proposal highlights how XRP can bypass these intermediaries, enabling direct and near-instantaneous transfers between financial institutions. This reduces costs, increases transparency, and speeds up the entire payment process.

This is particularly beneficial for remittances, where migrant workers send money back to their families in their home countries. The current remittance system can be exorbitant, with fees often exceeding 10% of the transfer amount. XRP offers a significantly cheaper and faster alternative, allowing more money to reach those who need it most.

XRP as a Liquidity Solution

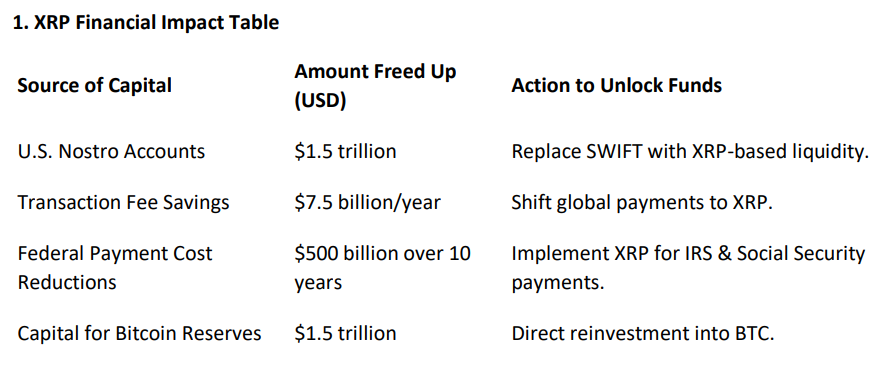

Another key aspect of the comprehensive proposal focuses on XRP's role as a liquidity solution for financial institutions. Many banks and payment providers hold pre-funded accounts in different currencies to facilitate cross-border transactions. This ties up significant capital that could be used for other purposes.

The proposal suggests using XRP as a bridge currency to eliminate the need for these pre-funded accounts. Financial institutions can convert their local currency to XRP, transfer it across borders, and then convert it back to the destination currency.

This "on-demand liquidity" model frees up capital, reduces operational costs, and allows financial institutions to offer more competitive exchange rates to their customers. Ripple, the company behind XRP, has been actively developing and promoting this use case through its On-Demand Liquidity (ODL) solution.

Real-World Implementations and Partnerships

Ripple has partnered with numerous financial institutions and payment providers around the world to implement ODL and explore other XRP-based solutions. These partnerships demonstrate the growing interest in and adoption of XRP as a strategic asset.

For example, MoneyGram, a leading money transfer company, has previously utilized ODL to facilitate faster and cheaper remittances. While the partnership evolved, the initial success showcased the potential of XRP in real-world applications.

Other companies like SBI Remit in Japan and Azimo in Europe have also integrated XRP into their payment systems, highlighting the global reach and versatility of the technology.

Addressing Concerns and Navigating Regulatory Landscapes

Despite its potential, XRP has faced regulatory scrutiny, particularly in the United States. A lawsuit filed by the Securities and Exchange Commission (SEC) in 2020 alleged that Ripple sold XRP as an unregistered security.

This legal battle has created uncertainty around XRP's regulatory status and impacted its adoption in some markets. However, recent court rulings have provided some clarity, with a judge ruling that XRP is not necessarily a security when sold to the general public. However, the situation remains fluid and subject to further legal developments.

The comprehensive proposal acknowledges these regulatory challenges and emphasizes the importance of compliance and collaboration with regulatory bodies. It advocates for clear and consistent regulations that foster innovation while protecting consumers and maintaining the integrity of the financial system.

The Future of XRP: A Strategic Vision

The future of XRP as a strategic asset hinges on several factors, including regulatory clarity, technological advancements, and continued adoption by financial institutions. The comprehensive proposal outlines a roadmap for achieving widespread adoption and realizing the full potential of XRP.

This roadmap includes initiatives to enhance the scalability and security of the XRP Ledger, develop new use cases for XRP, and foster a vibrant ecosystem of developers and businesses building on the platform.

Ultimately, the vision is to create a more inclusive and efficient global financial system that benefits everyone, regardless of their location or socioeconomic status. The comprehensive proposal paints a compelling picture of how XRP can play a crucial role in achieving this vision.

Beyond the Technology: A Vision for Financial Inclusion

While the technological aspects of XRP are impressive, the underlying goal is to promote greater financial inclusion and empower individuals and communities around the world. Access to affordable and efficient financial services is essential for economic development and poverty reduction.

By reducing the costs and delays associated with cross-border payments, XRP can help to unlock new opportunities for businesses and individuals in developing countries. It can also facilitate access to credit, savings, and other essential financial services.

The comprehensive proposal recognizes the social impact of XRP and emphasizes the importance of using the technology to create a more equitable and just world. It calls for collaboration between governments, businesses, and civil society organizations to ensure that the benefits of digital assets are shared by all.

The journey of XRP has been marked by both challenges and opportunities. The comprehensive proposal represents a bold step towards realizing its full potential as a strategic asset for global finance.

Whether XRP will ultimately fulfill this vision remains to be seen. However, the proposal offers a compelling glimpse into a future where cross-border payments are seamless, financial inclusion is widespread, and the global economy is more connected and efficient.

The conversation surrounding XRP, its role, and its potential is far from over. As technology continues to evolve and regulatory landscapes adapt, one thing remains clear: the quest for a more efficient and inclusive global financial system is a driving force, and solutions like XRP will continue to be at the forefront of this transformative journey.