Compute The Debt-to-equity Ratio For Each Of The Above Companies

Did you know that too much debt can sink even the most promising business? Understanding your debt-to-equity ratio is like having a financial health check-up. It can reveal potential risks and opportunities.

This article will show you how to calculate the debt-to-equity ratio.

Understanding the Debt-to-Equity Ratio

The debt-to-equity (D/E) ratio compares a company’s total liabilities to its shareholder equity. It essentially reveals how much of a company’s financing comes from debt versus equity. A high ratio signals more reliance on debt, which could indicate higher risk.

Conversely, a low ratio suggests the company relies more on equity financing.

Why is it Important?

The D/E ratio is crucial for several reasons. It helps investors, lenders, and management understand a company's financial risk profile. A high ratio can signal a company may struggle to repay debts during an economic downturn.

It also highlights how much ownership the company's lenders have vs. the shareholders.

Calculating the Debt-to-Equity Ratio: A Step-by-Step Guide

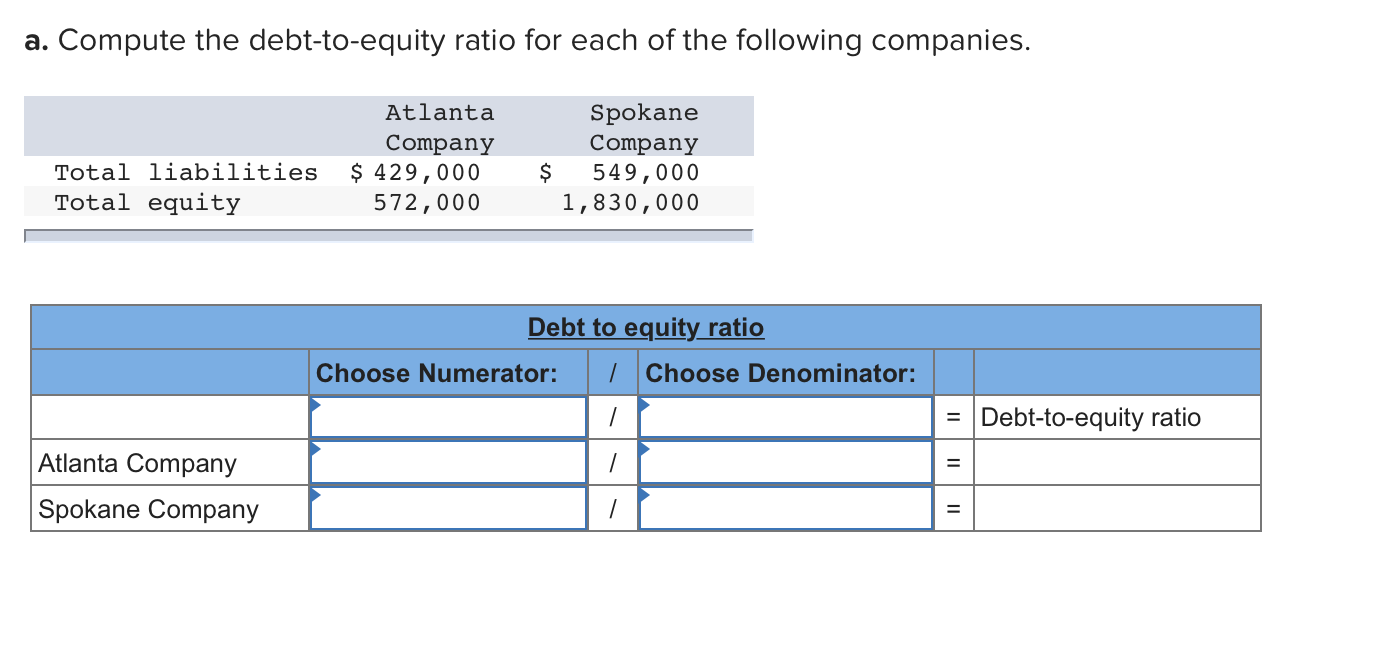

The formula is straightforward: Debt-to-Equity Ratio = Total Liabilities / Shareholder Equity. Let’s break down each component.

First, you need to locate the company's total liabilities.

Step 1: Finding Total Liabilities

Total liabilities are all the company’s obligations to external parties. These are things the company owes to others. They include accounts payable, salaries payable, deferred revenue, and long-term debt.

This information is found on the company’s balance sheet. Look for the line item "Total Liabilities".

Step 2: Finding Shareholder Equity

Shareholder equity (also called stockholders' equity) represents the owners’ stake in the company. It is the difference between a company's assets and its liabilities.

Find shareholder equity on the balance sheet. Look for line items like "Total Equity" or "Shareholders' Equity."

Step 3: Performing the Calculation

Once you have both figures, simply divide total liabilities by shareholder equity. The result is the debt-to-equity ratio. This gives you a clear picture of the company's leverage.

Let's look at an example of the Debt-to-Equity ratio, from the Tesla's balance sheet for the Quarter Ending March 31, 2024: $38.85B / $56.63B = 0.69. Tesla's debt/equity ratio for the quarter ending March 31, 2024 was 0.69 (macrotrends.net).

Interpreting the Results

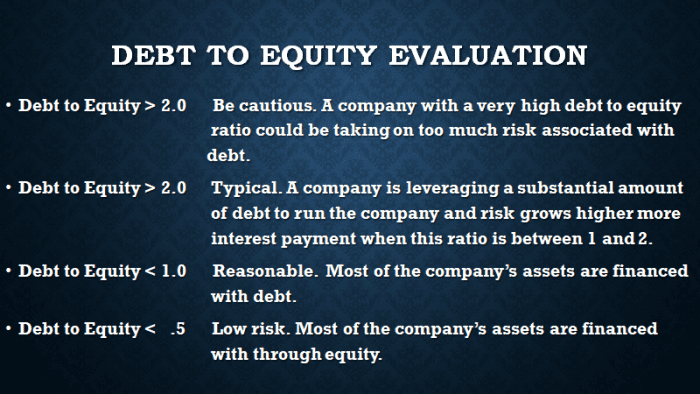

What does the ratio actually mean? There is no one-size-fits-all "good" ratio. It varies depending on the industry, economic conditions, and company-specific factors.

Consider industry benchmarks and peer comparisons when analyzing this ratio.

General Guidelines

A ratio below 1 generally indicates that a company relies more on equity than debt. A ratio of 1 means the company is funded equally by debt and equity. A ratio above 1 indicates more reliance on debt.

However, a very low ratio could also mean the company isn't taking advantage of potential leverage.

Industry Context Matters

Capital-intensive industries, like manufacturing or utilities, often have higher debt-to-equity ratios. This is because they require significant upfront investments in equipment and infrastructure. Tech companies may have lower ratios because they need less physical assets.

Consider industry norms before making any judgements.

Using the Debt-to-Equity Ratio in Decision-Making

The D/E ratio can be a valuable tool for various business decisions. Management uses it to optimize capital structure. Investors use it to assess risk and return. Lenders use it to evaluate creditworthiness.

Here are some examples of how to use the D/E Ratio in decision-making.

Investment Decisions

Investors can use the D/E ratio to assess the risk associated with investing in a company. A high ratio may deter risk-averse investors. A low ratio might be attractive to those seeking stability.

However, always consider other financial metrics before making investment decisions.

Lending Decisions

Lenders use the D/E ratio to determine a company’s ability to repay loans. A high ratio could lead to higher interest rates or stricter loan terms. A low ratio might increase the chances of loan approval.

Lenders also evaluate a company's cash flow and asset base.

Capital Structure Decisions

Companies use the D/E ratio to make decisions about how to finance their operations. They can adjust their capital structure by issuing more stock or taking on more debt. The optimal ratio depends on the company’s specific circumstances and goals.

Keep an eye on market conditions to make the best decision for your business.

Conclusion

Calculating and interpreting the debt-to-equity ratio is a crucial skill for any business owner or manager. It provides valuable insights into a company’s financial health and risk profile. By understanding this ratio, you can make more informed decisions about investing, lending, and capital structure.

Don't underestimate the power of financial ratios. They can unlock valuable knowledge.

Further Resources: Check out Investopedia's definition of Debt to Equity Ratio at investopedia.com/terms/d/debtequityratio.asp for additional information and examples.

:max_bytes(150000):strip_icc()/debtequityratio_final-86f5e125b5a3459db4c19855481f4fc6.png)