Which Of The Following Statements Regarding Liabilities Is Not True

The deceptively simple question, "Which of the following statements regarding liabilities is not true?" has become a surprisingly common stumbling block for individuals pursuing financial literacy and even some business students. Its prominence in online quizzes, practice exams, and certification tests underscores a persistent gap in understanding fundamental accounting principles.

This article aims to dissect the nuances of liabilities, clarify common misconceptions, and provide a comprehensive understanding of what constitutes a liability. This analysis will help anyone facing this frequently asked question, ensuring they are well-equipped to identify incorrect statements and grasp the broader implications of financial obligations.

Understanding Liabilities: The Core Principles

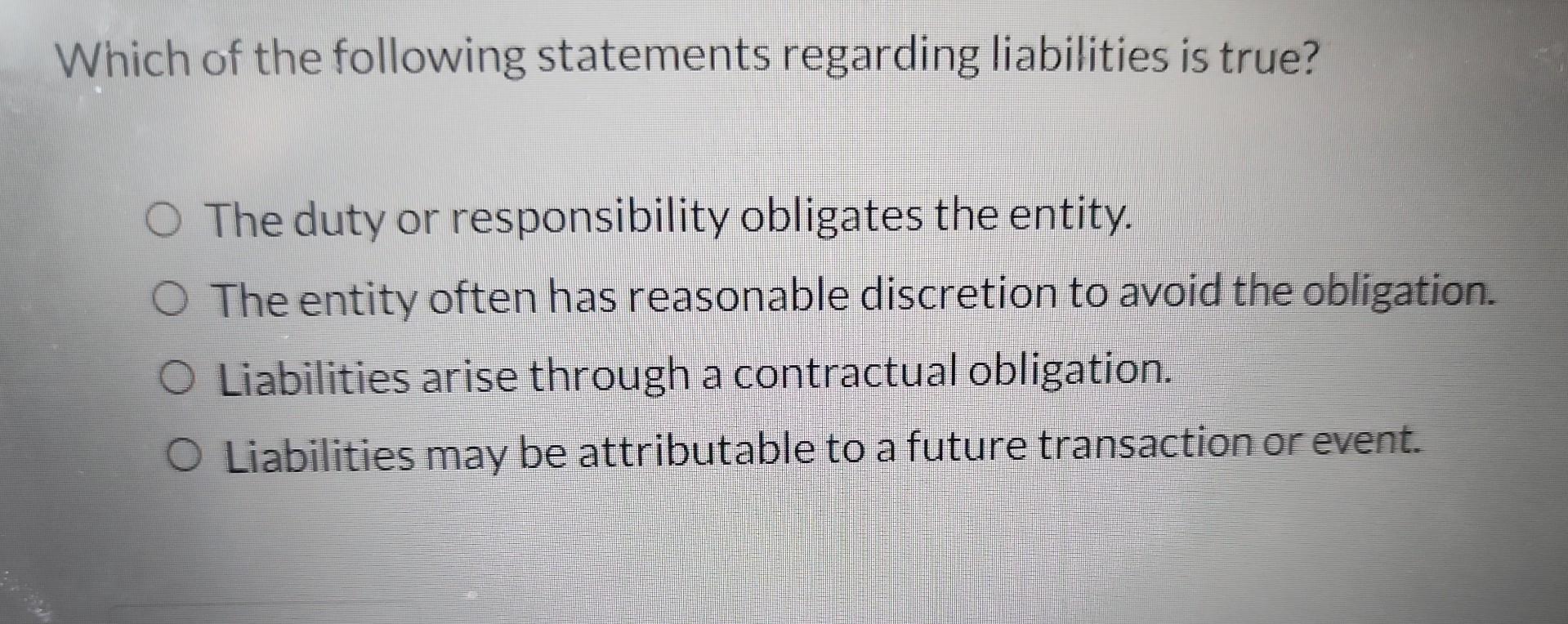

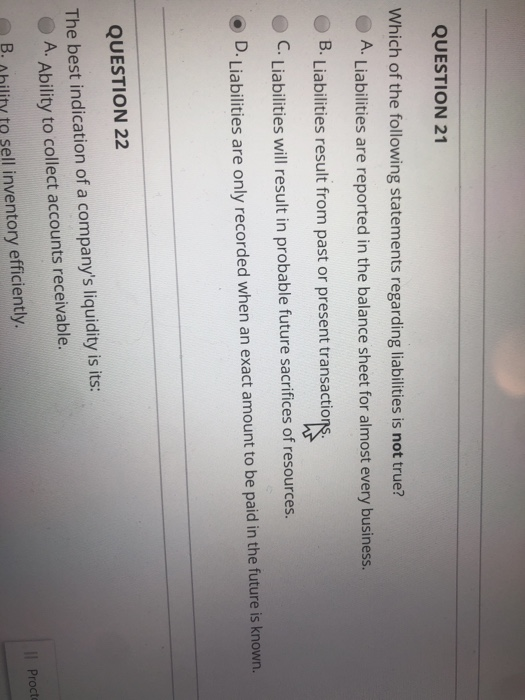

At its core, a liability represents a present obligation of an entity to transfer an economic resource as a result of past events. It is crucial to differentiate it from other financial concepts such as equity or assets. The defining characteristics involve a present duty, a clear obligation, and a future outflow of resources.

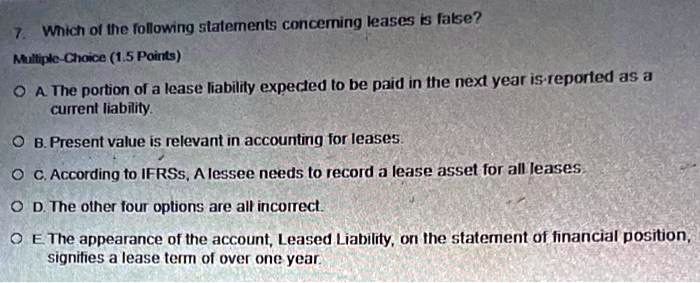

Liabilities are generally classified as either current or non-current. Current liabilities are those expected to be settled within one year or the entity's operating cycle. Non-current liabilities extend beyond this timeframe.

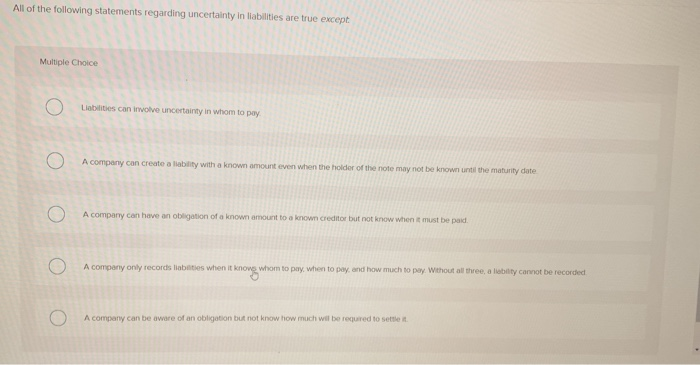

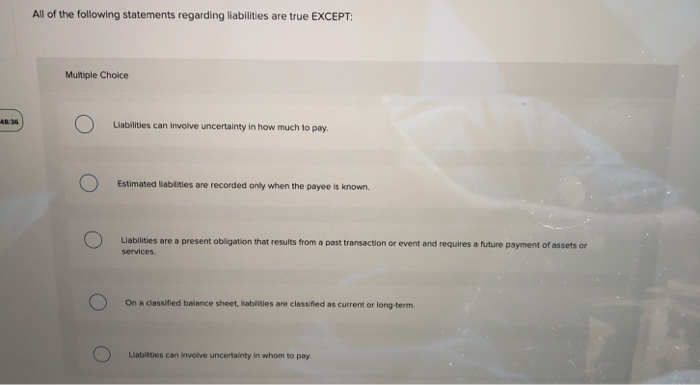

Common Misconceptions About Liabilities

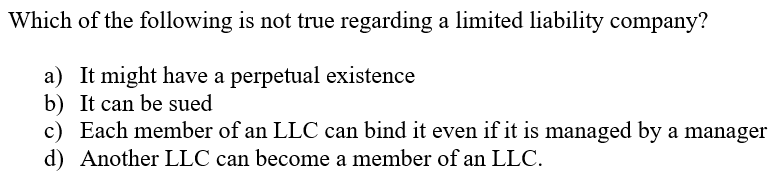

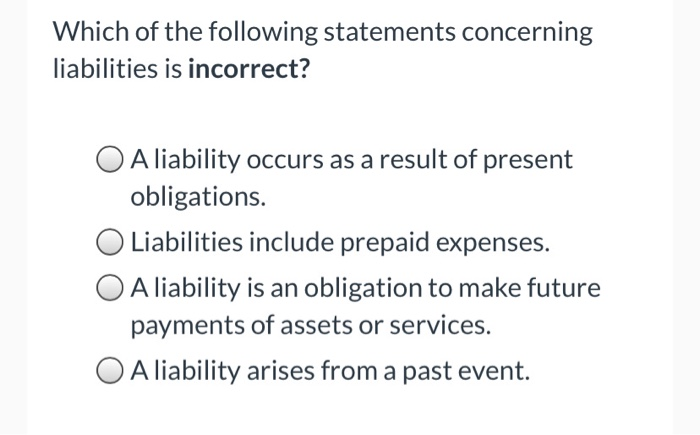

Many incorrect statements surrounding liabilities stem from a misunderstanding of their precise definition and scope. A common error involves confusing liabilities with contingent liabilities. Contingent liabilities are potential liabilities that depend on the outcome of a future event.

Another frequent misconception lies in the timing of recognition. An obligation does not necessarily have to be legally enforceable to be considered a liability. A constructive obligation, arising from past practices or statements, can also meet the criteria.

Furthermore, some incorrectly assume that a liability must always involve a transfer of cash. Liabilities can also be settled through the provision of goods or services.

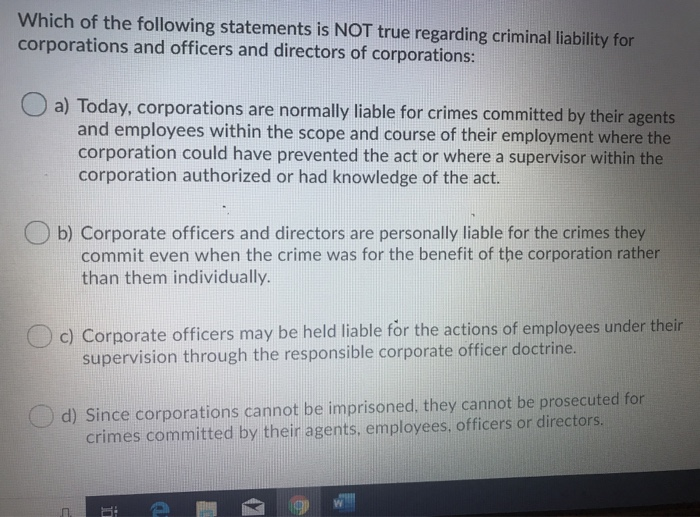

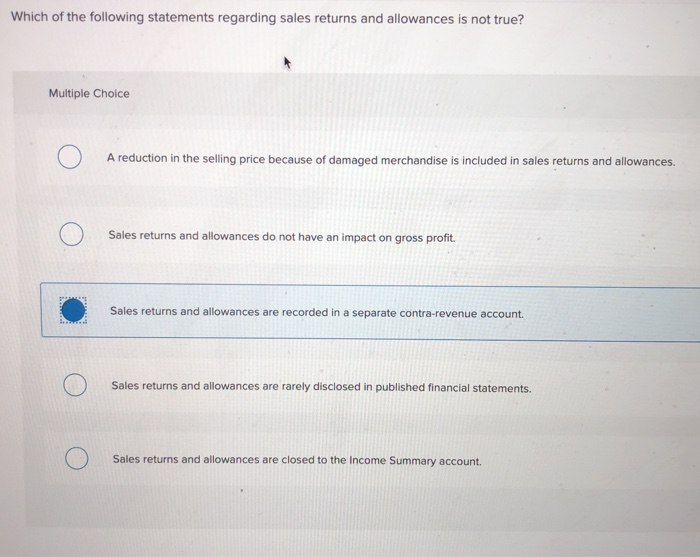

Analyzing Potential False Statements

Let's examine potential statements one might encounter in the "Which of the following statements regarding liabilities is not true?" question:

"A liability represents a present obligation arising from past events."

This statement accurately reflects the fundamental definition of a liability.

"All liabilities require a transfer of cash."

This statement is false. As previously mentioned, liabilities can be settled through various means, including providing goods or services.

"Contingent liabilities are always recorded on the balance sheet."

This is another false statement. Contingent liabilities are only disclosed in the notes to the financial statements if the probability of an outflow of resources is probable and the amount can be reliably estimated.

"Current liabilities are always due within one year."

This statement is generally true, although the wording can be slightly misleading. Current liabilities are due within one year or the entity's operating cycle, whichever is longer.

Examples of Tricky Scenarios

Consider the case of a warranty provided on a product. The company has an obligation to repair or replace the product if it malfunctions within the warranty period. This creates a liability, even though the exact amount and timing of the future outflow of resources are uncertain.

Another example is unearned revenue. If a company receives payment for goods or services that have not yet been delivered, it has a liability to provide those goods or services in the future.

Best Practices for Identifying False Statements

To effectively answer "Which of the following statements regarding liabilities is not true?" consider the following tips: First, carefully analyze each statement and dissect its component parts. Second, apply the core definition of a liability to each statement. Third, consider potential scenarios or examples that could disprove the statement.

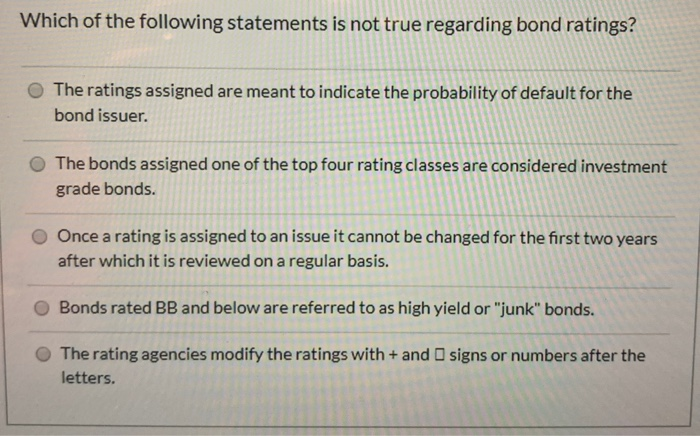

It is also crucial to understand the difference between different types of liabilities, such as accounts payable, notes payable, and deferred revenue. Distinguishing these differences will improve your ability to analyze statements critically.

Consulting authoritative accounting standards, such as those issued by the Financial Accounting Standards Board (FASB) in the United States or the International Accounting Standards Board (IASB), can also be invaluable. These standards provide detailed guidance on the recognition and measurement of liabilities.

The Broader Implications of Understanding Liabilities

A strong understanding of liabilities is critical for various reasons. It enables informed financial decision-making by individuals and businesses. It also promotes transparency and accountability in financial reporting.

Furthermore, it allows investors and creditors to assess the financial health and risk of an organization accurately. Accurately presented liabilities give a clear picture of a company’s solvency.

Conclusion

The question "Which of the following statements regarding liabilities is not true?" serves as a powerful reminder of the importance of mastering fundamental accounting concepts. By understanding the core principles of liabilities, recognizing common misconceptions, and adopting best practices for analysis, anyone can confidently answer this question and navigate the complexities of financial reporting.

Moving forward, the emphasis on financial literacy and education must be continuously strengthened. This includes promoting a deeper understanding of liabilities and their implications for individuals, businesses, and the broader economy.