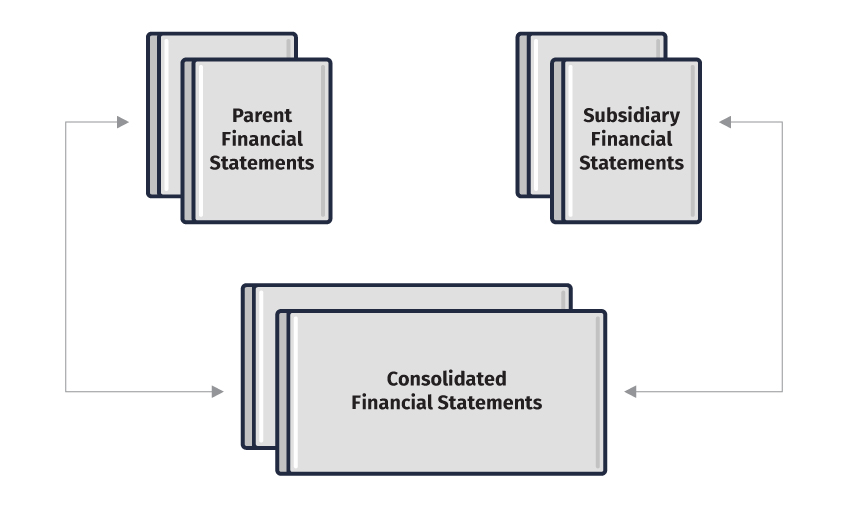

Consolidated Financial Statements Are Typically Prepared When One Company Has

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)

Financial watchdogs are urging increased scrutiny of corporate reporting as concerns mount over the consistent application of consolidated financial statement principles. Experts are raising alarms about potential misrepresentation of a company’s true financial health.

The issue centers on the conditions under which a parent company must consolidate the financials of its subsidiary entities. This article breaks down the essentials of consolidated financial statements and why they matter.

Understanding Consolidated Financial Statements

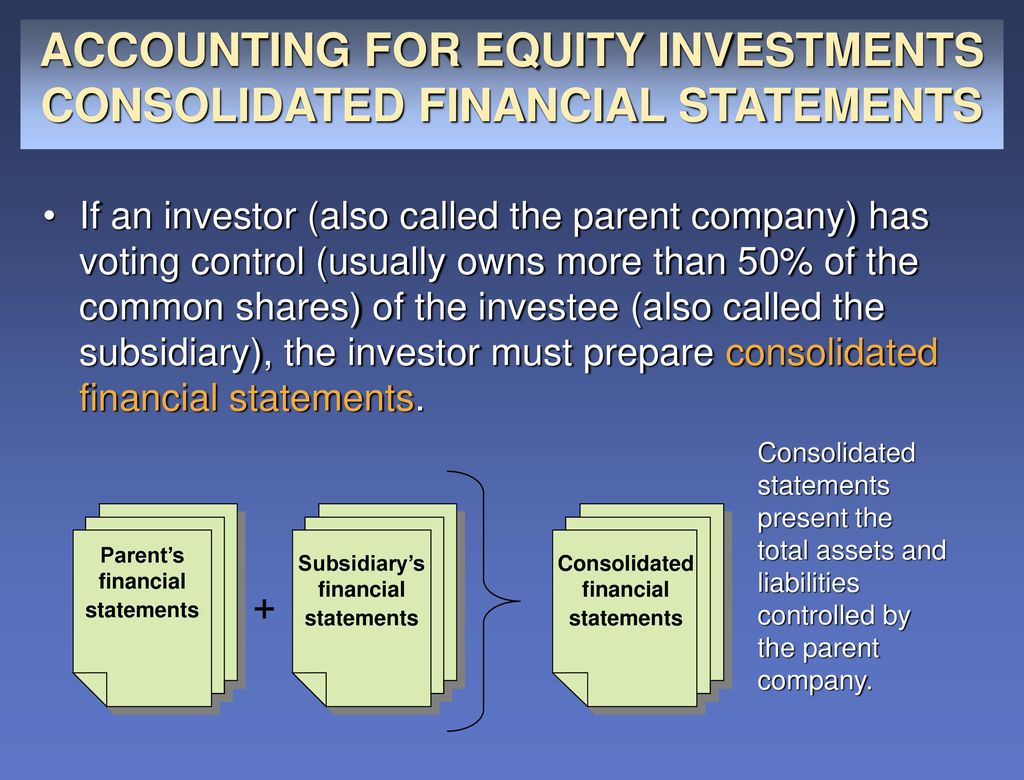

Consolidated financial statements combine the financial results of a parent company and its subsidiaries into a single report. This report presents a unified view of the group’s financial position and performance.

This process eliminates intercompany transactions, preventing artificial inflation of financial metrics.

Key Condition: Control

The fundamental trigger for preparing consolidated financial statements is control. Generally, this means one company has the power to direct the activities of another entity.

Accounting standards, like IFRS 10 and ASC 810, provide detailed guidance on determining control.

Typically, control is established through majority ownership of voting rights. Specifically, holding more than 50% of the voting shares grants a company the power to dictate the subsidiary’s decisions.

Beyond Majority Ownership

Control can exist even with less than 50% ownership. This occurs when a company possesses contractual rights or other arrangements granting it the power to govern the subsidiary's financial and operating policies.

Potential indicators of control include the ability to appoint or remove key management personnel, or the right to cast the majority of votes at board meetings.

Implications of Non-Consolidation

Failure to consolidate when control exists can severely distort a company's reported performance. It can hide debt, inflate profits, and create a misleading picture for investors.

In 2018, the SEC fined a company for failing to consolidate a variable interest entity it controlled, resulting in a material misstatement of its financial condition.

"Transparency is paramount, and consolidated financial statements are crucial for accurate financial reporting," warned accounting professor, Dr. Anya Sharma, from the University of Financial Compliance.

Currently, the SEC is investigating multiple companies for potential improper accounting practices, including questionable consolidation decisions. The probes are across industries, including tech and real estate.

The Role of the Auditor

Independent auditors play a critical role in verifying the appropriateness of consolidation decisions. They must thoroughly assess the relationships between entities to confirm whether control exists.

Auditors are expected to perform rigorous due diligence to identify potential indicators of control that may not be immediately obvious.

Enhanced auditor oversight and stronger enforcement of accounting standards are crucial for preventing fraudulent or misleading financial reporting.

Recent Developments and Future Actions

The Financial Accounting Standards Board (FASB) is actively reviewing existing consolidation guidance to address emerging issues and complexities. The FASB is expected to issue an exposure draft with proposed changes in the coming months.

Investors and stakeholders are urged to closely monitor regulatory developments and scrutinize company filings for any signs of inappropriate consolidation practices.

Companies must prioritize compliance with accounting standards and ensure that their consolidation decisions are based on a thorough and objective assessment of control.

![Consolidated Financial Statements Are Typically Prepared When One Company Has [Solved] 1) Prepare the consolidated statement of | SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2020/09/5f5c69ebcbd0e_1599891941594.jpg)