Consolidated Statement Of Operations Vs Income Statement

Imagine you're sitting down with a cup of coffee, sifting through a stack of financial reports. Sunlight streams through the window, illuminating rows of numbers and complex terminology. The air is thick with the promise of insights, but also the potential for confusion.

The seemingly interchangeable terms "Consolidated Statement of Operations" and "Income Statement" can often feel like just another hurdle in understanding a company's financial health. But fear not! This article clarifies the subtle, yet significant, difference between these financial reports, offering a clear understanding for anyone seeking to decipher the financial landscape.

Decoding Financial Reports: The Basics

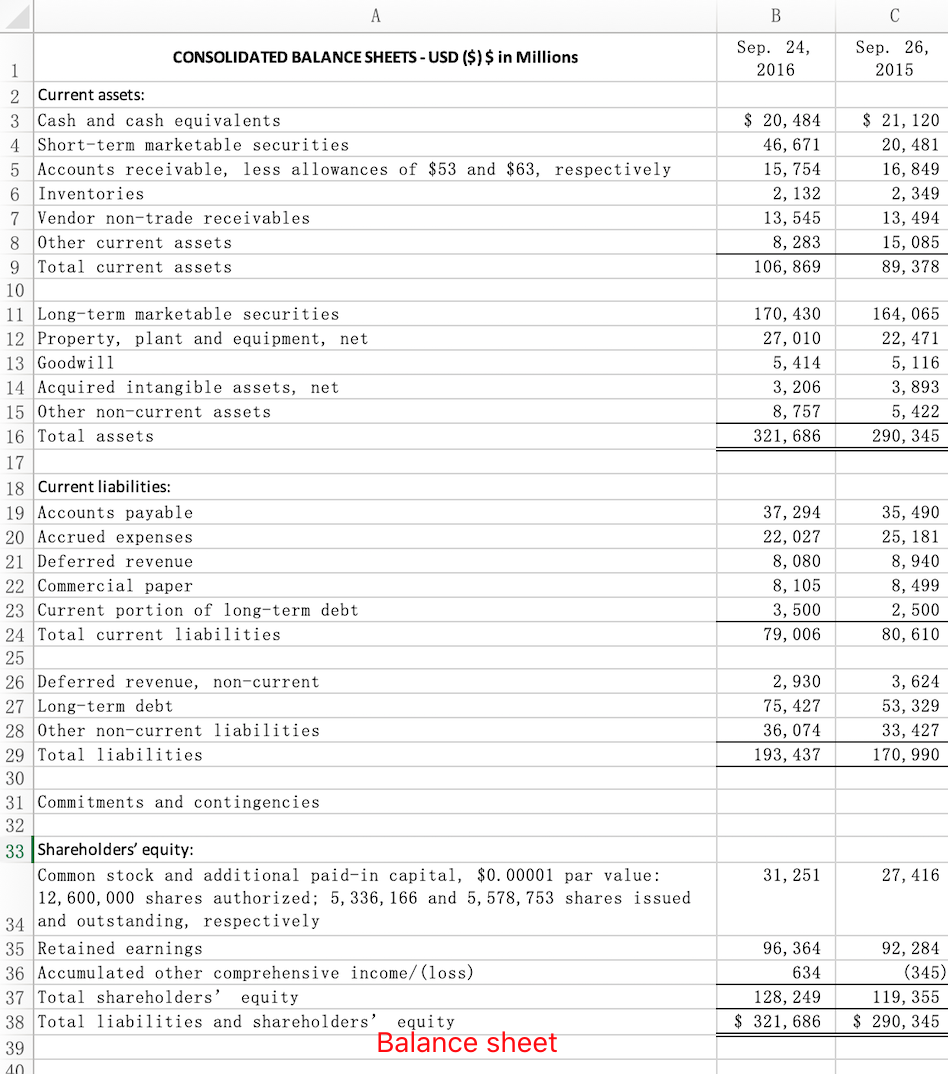

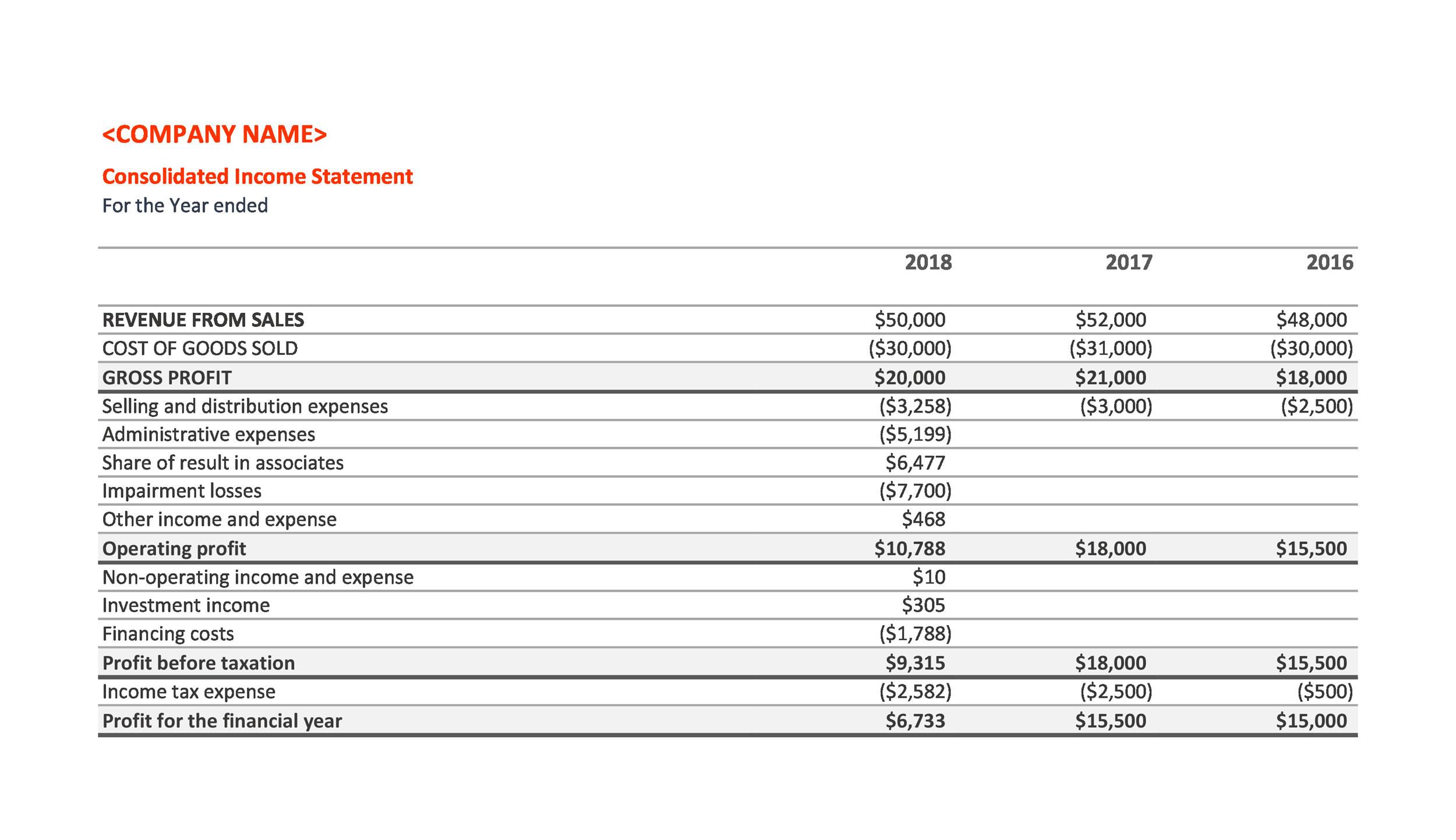

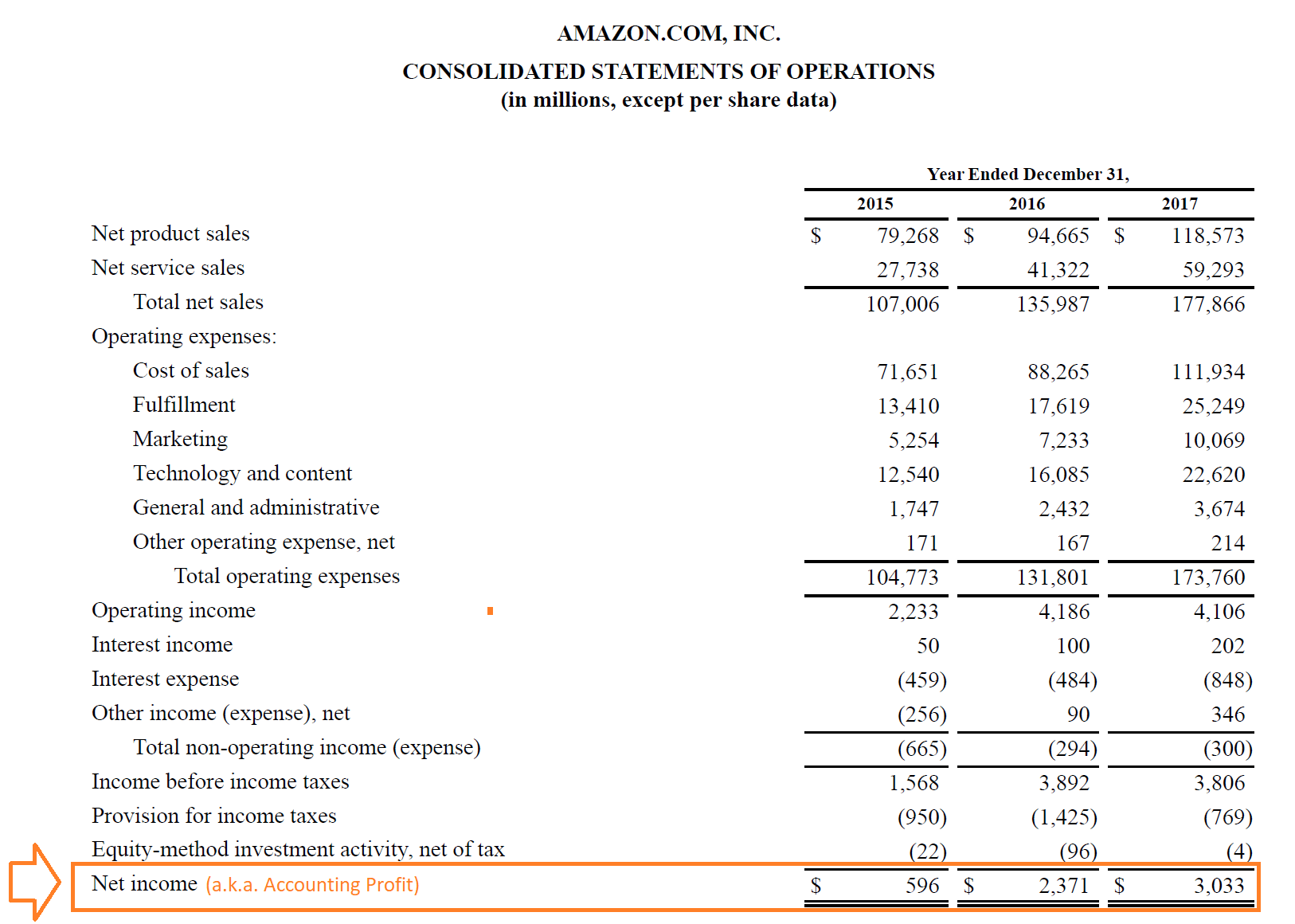

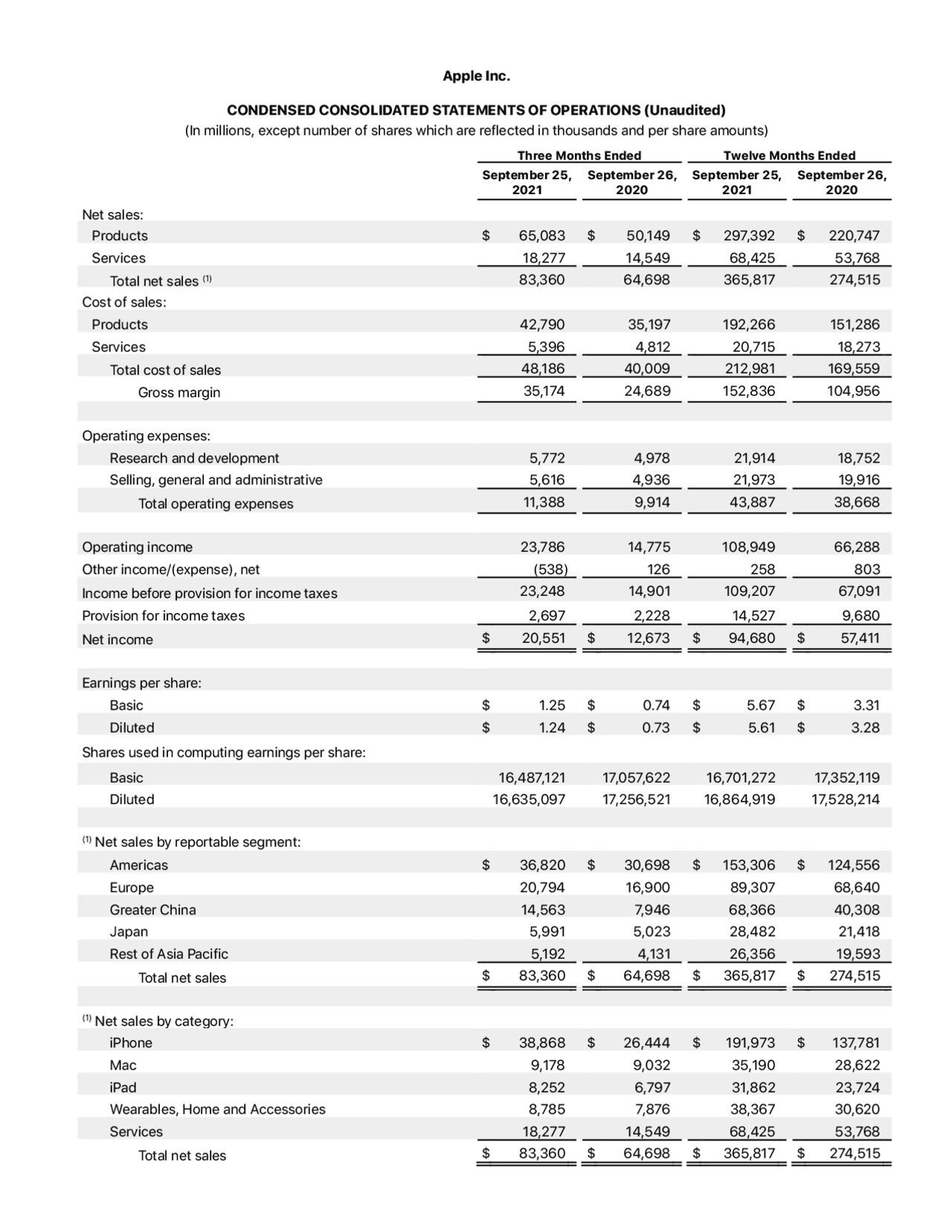

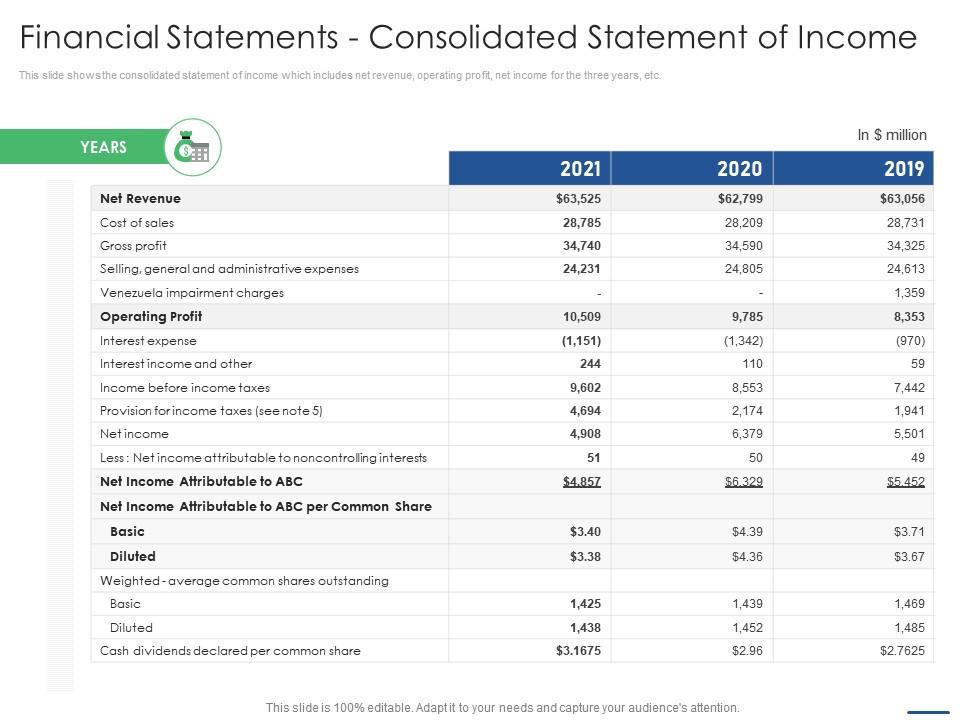

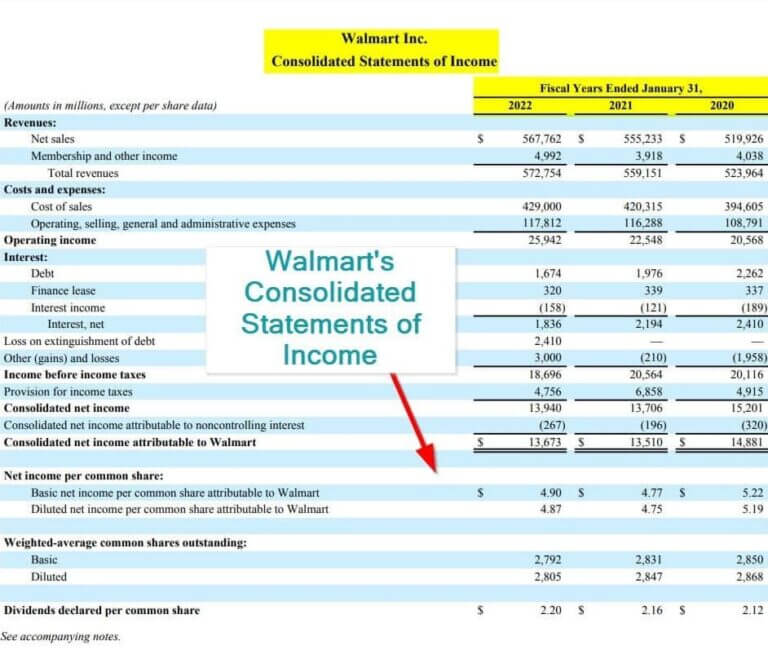

Let's start with the fundamentals. Both the Consolidated Statement of Operations and the Income Statement serve the crucial purpose of showcasing a company's financial performance over a specific period. This period could be a quarter, a year, or any other defined timeframe.

They essentially tell the story of how much revenue a company generated and what costs it incurred in the process. The ultimate goal? To arrive at the company's net income, often referred to as the "bottom line."

Think of it as a detailed narrative, revealing whether a company is profitable and, more importantly, how it achieved that profitability.

The Income Statement: A Singular View

The Income Statement, at its core, presents the financial performance of a single, individual company. It details revenue, expenses, and ultimately, the net income or loss for that specific entity.

It offers a straightforward picture of the company's operational effectiveness during the reporting period. This makes it a key tool for investors and stakeholders analyzing the performance of a particular business.

It answers fundamental questions: Did the company sell more goods or services than it spent on producing and delivering them? Was it a financially sound period?

The Consolidated Statement of Operations: A Broader Perspective

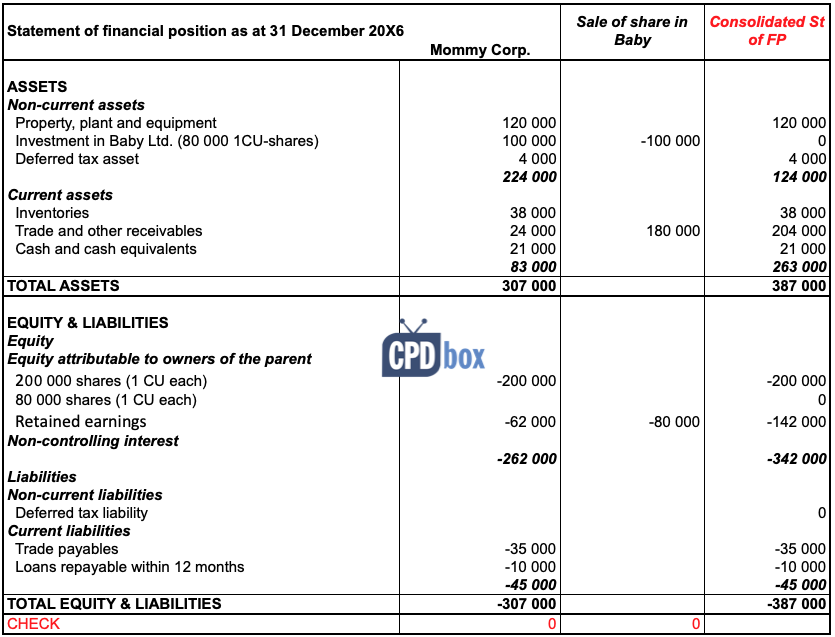

Now, let's introduce the Consolidated Statement of Operations. This report takes a wider view. It combines the financial results of a parent company and all its subsidiaries into a single, comprehensive statement.

This means that the revenues, expenses, assets, and liabilities of all entities under the parent company's control are aggregated and presented as if they were a single economic unit.

This approach is especially crucial for understanding the overall financial health of larger organizations with complex corporate structures. The Consolidated Statement of Operations, therefore, provides a bird's-eye view.

The Importance of Consolidation: Controlling Interest

The concept of "control" is central to understanding consolidation. A parent company typically consolidates the financial results of a subsidiary when it owns a majority voting interest (usually more than 50%).

This signifies that the parent company has the power to direct the subsidiary's operations. When such control exists, consolidating the financial statements provides a more accurate reflection of the group's overall financial position and performance.

It presents a truer picture of the resources the group controls and the profits it generates.

Key Differences: A Side-by-Side Comparison

So, what are the key differences that set these reports apart? The Income Statement focuses on a single entity, while the Consolidated Statement of Operations presents the combined results of a parent company and its subsidiaries.

Think of it this way: An Income Statement is like looking at an individual tree, while a Consolidated Statement of Operations is like looking at the entire forest. It shows the overall health of the entire group.

This broader scope means the Consolidated Statement of Operations offers a more holistic understanding of a company's performance when that company has multiple subsidiaries.

Practical Implications: Why It Matters

Understanding the distinction between these two reports has significant implications for investors, analysts, and stakeholders. A Consolidated Statement of Operations reveals the true economic performance of a corporate group, shielding against potential distortions from individual subsidiary performance.

It uncovers hidden strengths or weaknesses that might not be apparent when looking at each subsidiary in isolation. This provides a more realistic assessment of the parent company's financial position.

The U.S. Securities and Exchange Commission (SEC) mandates that publicly traded companies with subsidiaries provide consolidated financial statements. This underscores their importance in ensuring transparency and accountability in financial reporting.

Real-World Examples: Putting it into Practice

Consider a hypothetical example: TechGiant Inc. is a parent company with several subsidiaries specializing in different areas of technology, like software development, hardware manufacturing, and cloud services. TechGiant Inc. would publish both an individual Income Statement and a Consolidated Statement of Operations.

The Income Statement would show only TechGiant Inc.'s direct revenues and expenses. On the other hand, the Consolidated Statement of Operations would combine the financial performance of TechGiant Inc. with all its subsidiaries, offering a complete picture of the entire technology ecosystem.

Analyzing the consolidated statement would reveal how each subsidiary contributes to the overall financial health of the group.

Navigating Complexity: The Role of Accounting Standards

The preparation of both Income Statements and Consolidated Statements of Operations adheres to specific accounting standards, primarily Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS) globally.

These standards dictate how revenue and expenses are recognized, measured, and presented in financial statements. In the case of consolidated statements, specific rules govern how the financial data of subsidiaries are combined.

These stringent guidelines ensure consistency and comparability across different companies' financial reports, enabling informed decision-making.

Beyond the Numbers: Qualitative Insights

While both reports provide valuable quantitative data, it's essential to remember that they represent only one piece of the puzzle. Qualitative factors, such as management's discussion and analysis (MD&A), also play a critical role in understanding a company's financial performance.

The MD&A provides context and insights into the trends and factors that have impacted the financial results. This narrative explanation offers a more nuanced understanding of the numbers.

It is important to look beyond the numbers to form a holistic view of the company's situation.

The Future of Financial Reporting: Embracing Technology

The future of financial reporting is rapidly evolving with the integration of technology. Automation, artificial intelligence, and data analytics are transforming how financial information is collected, processed, and analyzed.

These technologies are enabling companies to produce more accurate, timely, and insightful financial reports. They also allow stakeholders to gain a deeper understanding of financial performance.

This will undoubtedly lead to greater transparency and efficiency in the financial world.

In Conclusion: Unlocking Financial Clarity

Understanding the difference between a Consolidated Statement of Operations and an Income Statement is crucial for anyone navigating the complex world of finance. While both reports provide insights into a company's financial performance, they offer distinct perspectives.

The Income Statement focuses on a single entity, while the Consolidated Statement of Operations presents a broader, more comprehensive view of a parent company and its subsidiaries.

By mastering these concepts, you'll be better equipped to analyze financial statements, make informed decisions, and unlock the story hidden within the numbers. Just like understanding the difference between a tree and a forest, it's the combined understanding that paints a complete picture.

![Consolidated Statement Of Operations Vs Income Statement [Solved] The following pages contain the consolida | SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1542/7/3/2/0025bf438e215cdb1542714526622.jpg)

![Consolidated Statement Of Operations Vs Income Statement [SOLVED] Following are the consolidated statement of | Course Eagle](https://www.courseeagle.com/images/following-are-the-consolidated-statement-of-operations-balance-sheet-and-223042-1.jpg)

![Consolidated Statement Of Operations Vs Income Statement [Solved] Following are the consolidated statement | SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1604/2/9/2/2045f9f8e6c3cebd1604292203385.jpg)