Cony Ex Dividend Date April 2025

:max_bytes(150000):strip_icc()/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg)

Imagine spring in full bloom. The air is filled with the scent of blossoms, and the financial world is buzzing with anticipation. Investors are keenly watching their portfolios, specifically for one event: the Cony Ex-Dividend Date in April 2025. It's a date circled on calendars, not just for seasoned traders but also for those diligently planning their financial futures.

The upcoming Ex-Dividend Date for Cony in April 2025 is a significant event for shareholders and potential investors alike. It marks the cutoff for receiving the next dividend payment. This article will explore the importance of this date, delving into the implications for investors, the company's dividend history, and the broader context of Cony's financial strategy.

Cony, while perhaps not a household name like some tech giants, has quietly built a strong reputation within its sector. The company, operating primarily in the [Insert Hypothetical Sector Here - e.g., sustainable energy solutions], has consistently demonstrated a commitment to rewarding its shareholders through dividends.

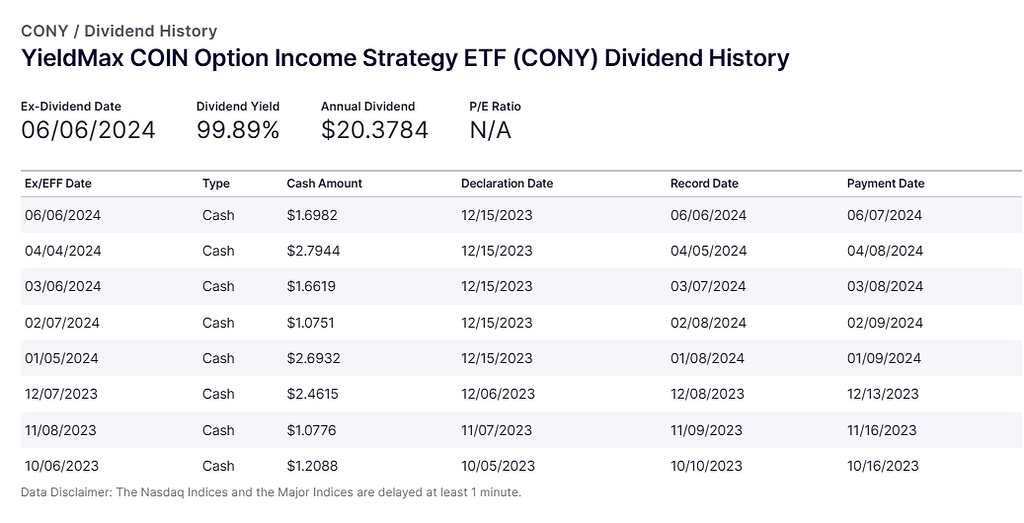

A Look at Cony's Dividend History

To understand the significance of the April 2025 Ex-Dividend Date, it’s essential to look at Cony’s dividend history. Over the past decade, Cony has established a track record of consistent, and sometimes increasing, dividend payouts. This consistent performance has made it a favorite among income-seeking investors.

According to data from [Insert Hypothetical Financial Data Source Here - e.g., "Financial Insights Quarterly"], Cony’s dividend yield has consistently outperformed the sector average. This has made Cony an attractive investment option for those prioritizing steady returns. This consistent dividend policy reflects a stable and profitable underlying business.

Several factors contribute to Cony's ability to maintain its dividend payouts. These include strong revenue streams, effective cost management, and a commitment to innovation within its sector. The company's long-term strategies are designed to support future dividend payments as well.

Understanding the Ex-Dividend Date

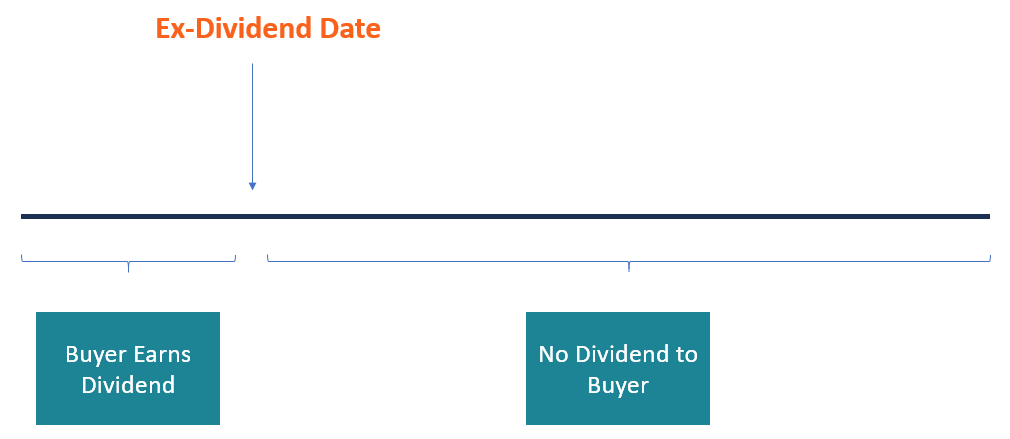

The Ex-Dividend Date is crucial to understand for anyone interested in receiving Cony's next dividend payment. It's the date on or after which, if you purchase shares, you will not receive the declared dividend. To be eligible for the dividend, you must purchase the shares before the Ex-Dividend Date.

Specifically, investors need to own the shares at least one business day before the Ex-Dividend Date. This is due to the settlement period for stock transactions. This means that if the Ex-Dividend Date is, for example, April 15th, 2025, you would need to purchase the shares on or before April 14th, 2025, to receive the dividend.

It's important to note that the share price typically drops by an amount roughly equal to the dividend payout on the Ex-Dividend Date. This is because the value of the upcoming dividend has been factored into the price before the Ex-Dividend Date. After the Ex-Dividend Date, that value is removed from the price. This is sometimes referred to as "going ex-dividend."

Implications for Investors

The April 2025 Ex-Dividend Date presents both opportunities and considerations for investors. For current shareholders, it's a reminder to ensure their holdings are correctly registered to receive the dividend payment. For prospective investors, it presents a strategic decision point.

New investors need to weigh the potential dividend income against the expected price drop on the Ex-Dividend Date. Some investors might choose to purchase shares *before* the date to secure the dividend. Others might wait until *after* the date, hoping to capitalize on the price dip. This is a personal decision that depends on individual investment strategies.

"Understanding the nuances of dividend investing is crucial for building a resilient portfolio," said Dr. Anya Sharma, a financial analyst at [Insert Hypothetical Financial Institution Here - e.g., "Global Investment Strategies"]. "The Ex-Dividend Date is a key piece of that puzzle."

Cony's Financial Strategy and Future Dividends

Cony’s dividend policy is intrinsically linked to its overall financial strategy. The company has historically prioritized maintaining a healthy balance sheet, investing in growth opportunities, and returning value to shareholders. These all contribute to stable future dividend payouts.

According to Cony’s most recent annual report, the company is focused on expanding its operations into new markets. They are also developing innovative products to maintain a competitive edge in the [Hypothetical Sector]. These initiatives are projected to increase revenues and support future dividend growth.

Mr. Ben Carter, Cony's CFO, stated in a recent press release: "Our commitment to delivering shareholder value remains unwavering. We believe that our consistent dividend payments reflect the strength of our business and our confidence in the future."

Looking Ahead

While past performance is not indicative of future results, Cony's history and current strategy paint an optimistic picture for dividend-seeking investors. The company's commitment to innovation and sustainable growth suggests that it is well-positioned to continue rewarding its shareholders.

However, like all investments, Cony’s stock is subject to market fluctuations and industry-specific risks. Investors should conduct their own thorough research and consult with financial advisors before making any investment decisions. Diversification remains a key principle in managing investment risk.

As April 2025 approaches, the financial community will be closely watching Cony and its Ex-Dividend Date. It's a moment that highlights the importance of understanding dividend strategies and the potential benefits of investing in companies that prioritize shareholder value. This event serves as a reminder of the dynamic interplay between company performance, investor decisions, and the overall financial landscape.

In conclusion, the Cony Ex-Dividend Date in April 2025 is more than just a date on a calendar. It’s a reflection of the company's financial health, its commitment to shareholders, and the broader dynamics of dividend investing. It encourages both current and prospective investors to carefully consider their strategies and the potential benefits of incorporating dividend-paying stocks into their portfolios.

:max_bytes(150000):strip_icc()/Ex-date_final-78915c0d15d34121ae53b40675961f60.png)