List Of Accounting Services For Small Business

The lifeblood of the American economy, small businesses, often face a daunting challenge alongside innovation and growth: navigating the complexities of accounting. From tracking revenue to managing expenses and ensuring compliance, these tasks can quickly become overwhelming. A solid grasp of available accounting services is no longer a luxury, but a necessity for survival and sustained success.

This article delves into a comprehensive list of essential accounting services tailored for small businesses, outlining the key functions, benefits, and considerations for each. We aim to provide clarity for small business owners, empowering them to make informed decisions about their accounting needs and ultimately, secure their financial future.

Essential Accounting Services for Small Businesses

Small businesses require a suite of accounting services that go beyond simple bookkeeping. These services help to ensure financial stability, compliance, and informed decision-making.

Bookkeeping Services

At its core, bookkeeping is the systematic recording of all financial transactions. This includes tracking income, expenses, sales, purchases, and other financial activities. Accurate and up-to-date bookkeeping provides a clear picture of a business's financial health.

It forms the foundation for all other accounting functions. Many small businesses choose to outsource this function to specialized firms.

Tax Preparation and Planning

Tax compliance is a critical aspect of running a small business. This service involves preparing and filing federal, state, and local taxes accurately and on time.

Effective tax planning can also help minimize tax liabilities and maximize profitability. This includes strategies for deductions, credits, and other tax-saving opportunities.

Payroll Services

Managing payroll can be time-consuming and complex, especially with changing regulations. Payroll services handle tasks such as calculating employee wages, withholding taxes, and issuing paychecks.

They also manage payroll tax filings and ensure compliance with labor laws. Outsourcing payroll reduces the risk of errors and penalties.

Financial Statement Preparation

Financial statements provide a snapshot of a business's financial performance and position. These statements typically include a balance sheet, income statement, and cash flow statement.

Preparing these statements requires expertise in accounting principles. They are essential for securing loans, attracting investors, and making informed business decisions.

Management Accounting

Management accounting provides insights into a company's performance and profitability. This involves analyzing financial data to identify trends, opportunities, and areas for improvement.

Services include budgeting, forecasting, and cost accounting. It helps businesses make strategic decisions to optimize operations and achieve their financial goals.

Audit and Assurance Services

An audit involves an independent examination of a company's financial records. This provides assurance to stakeholders that the financial statements are accurate and reliable.

While not always required for small businesses, audits can be beneficial for attracting investors or securing large loans. Assurance services can also help identify weaknesses in internal controls.

Forensic Accounting

Forensic accounting involves investigating financial fraud or irregularities. This service is crucial for businesses that suspect embezzlement or other financial crimes.

Forensic accountants can help uncover evidence, quantify losses, and provide expert testimony in legal proceedings. This service protects the assets of the business.

Choosing the Right Accounting Service

Selecting the right accounting service is crucial for a small business's success. Several factors should be considered when making this decision.

Assess Your Needs

Determine the specific accounting needs of your business. Consider the complexity of your operations, the size of your business, and your growth plans.

A startup with minimal transactions will have different needs than a growing company with multiple revenue streams. Understanding your needs will help you identify the right service.

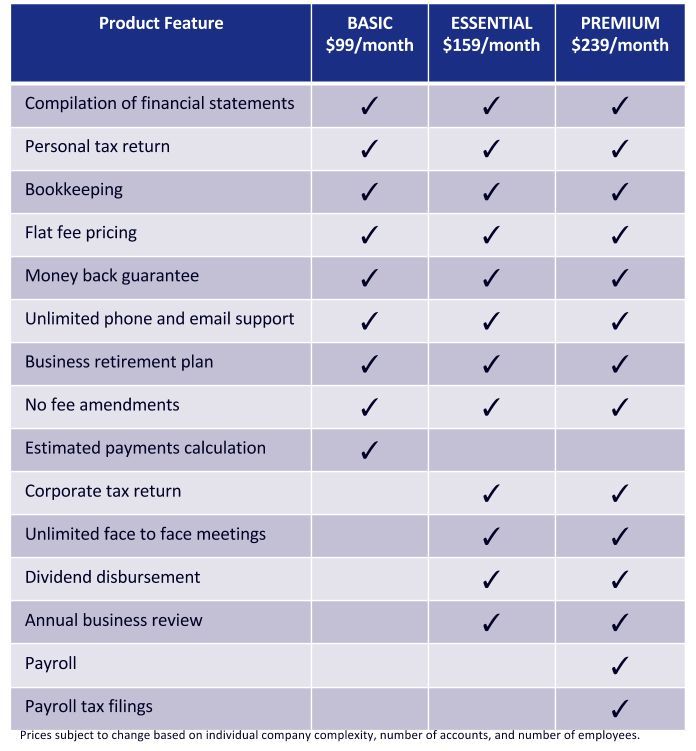

Consider Your Budget

Accounting services can vary in price, so it's important to establish a budget. Compare the costs of different service providers and choose one that fits your financial constraints.

Keep in mind that investing in quality accounting services can save you money in the long run by preventing costly errors and maximizing tax savings.

Evaluate Experience and Expertise

Look for accounting professionals with experience working with small businesses. Ensure they have the expertise to handle your specific industry and accounting needs.

Check their credentials and certifications. Look for Certified Public Accountants (CPAs) or Certified Management Accountants (CMAs).

Check References and Reviews

Before hiring an accounting service, check references and read online reviews. This will give you insights into their reputation and the quality of their services.

Contact former clients to ask about their experience. A reputable accounting service will have positive references and reviews.

Consider Technology Integration

Choose an accounting service that utilizes modern technology and integrates with your existing systems. This can streamline your accounting processes and improve efficiency.

Look for services that offer online portals, cloud-based accounting, and mobile accessibility. Technology integration can save time and reduce errors.

The Future of Accounting for Small Businesses

The accounting landscape is constantly evolving, driven by technological advancements and changing regulations. Small businesses need to stay informed about these trends to remain competitive.

According to a report by the Small Business Administration (SBA), "the adoption of digital accounting tools is increasingly crucial for small businesses to manage their finances effectively and efficiently." This includes cloud-based accounting software, automation, and data analytics.

The rise of Artificial Intelligence (AI) and Machine Learning (ML) is also transforming the accounting industry. These technologies can automate routine tasks, improve accuracy, and provide valuable insights.

In conclusion, small businesses should invest in the right accounting services and embrace technological advancements to ensure financial stability, compliance, and sustainable growth. By choosing wisely, small business owners can unlock the full potential of their businesses and achieve long-term success. Understanding the array of services available and proactively selecting the right fit will empower entrepreneurs to navigate the complexities of finance and thrive in today's competitive landscape.

![List Of Accounting Services For Small Business How to Package Your Bookkeeping Services [Guide] - Future Firm](https://futurefirm.co/wp-content/uploads/2022/09/Plans-U-nique-Accounting-Services-1.png)