Costco Citi Card Business Vs Personal

Costco members face a crucial decision when choosing a rewards credit card: Should they opt for the Citi Costco Business card or the Citi Costco Anywhere Visa Card for personal use? Both cards offer compelling benefits, but understanding the nuances of each is essential to maximizing rewards and minimizing potential drawbacks. This article delves into the key differences between these two cards, helping Costco members make informed choices based on their spending habits and business needs.

The choice between the Citi Costco Business card and the Citi Costco Anywhere Visa Card hinges on several factors, including eligibility requirements, reward structures, and spending patterns. While both offer rewards on Costco purchases and at gas stations, understanding the fine print can significantly impact the value a cardholder receives. This article examines these differences, providing a comprehensive comparison to guide your decision.

Eligibility and Application

The primary difference lies in eligibility. The Citi Costco Business card, as the name suggests, is available only to Costco business members. Individuals without a Costco business membership are ineligible to apply, making the personal card the only option.

Applying for either card is typically done online or in-store at Costco warehouses. Applicants will be subject to a credit check, and approval depends on their creditworthiness.

Reward Structures: A Side-by-Side Comparison

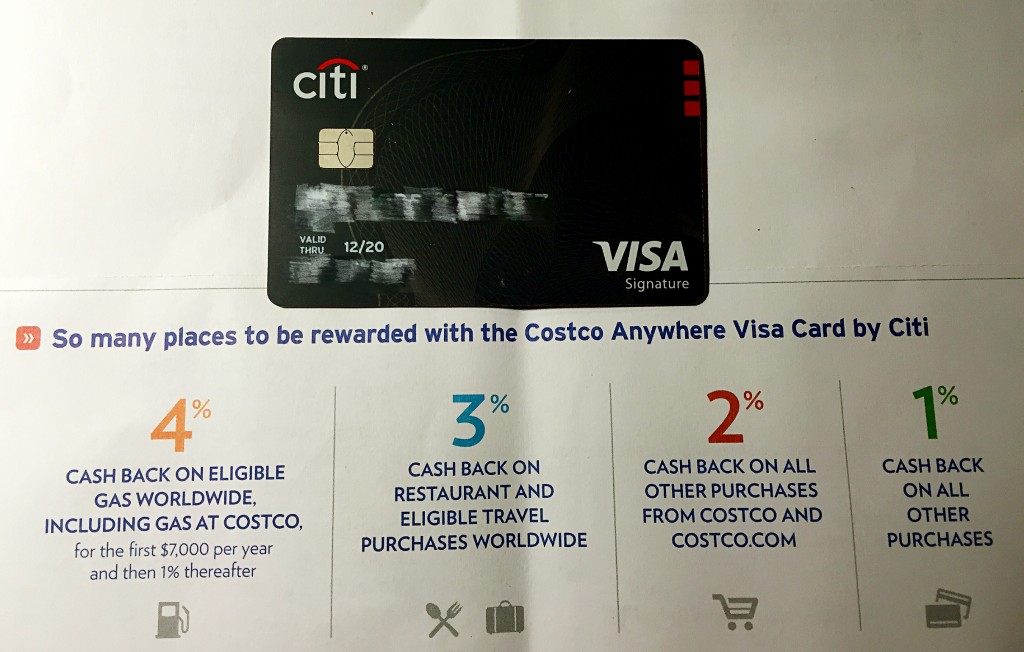

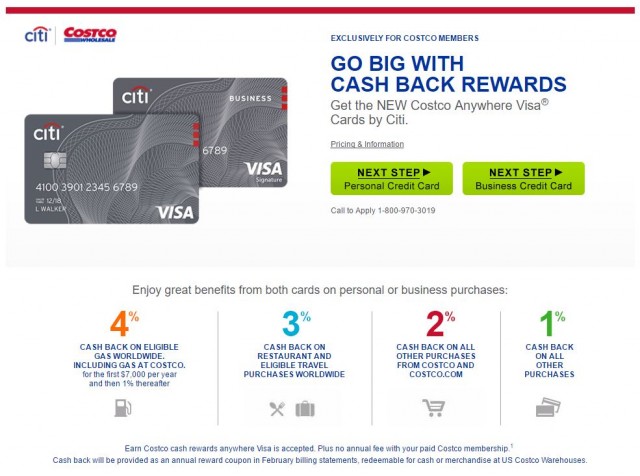

Both cards offer a tiered rewards system, but the specific percentages and categories vary. The Citi Costco Anywhere Visa Card for personal use provides 4% cash back on eligible gas purchases (on the first $7,000 per year, then 1%), 3% on restaurants and eligible travel, 2% on Costco and Costco.com purchases, and 1% on all other purchases. These rates apply to purchases worldwide.

The Citi Costco Business card offers similar rewards, but with some key differences. It also provides 4% cash back on eligible gas purchases (on the first $7,000 per year, then 1%), 3% on restaurants and eligible travel, 2% on Costco and Costco.com purchases, and 1% on all other purchases. The main difference is that some business expenses, such as advertising, might yield higher returns depending on the vendor's categorization.

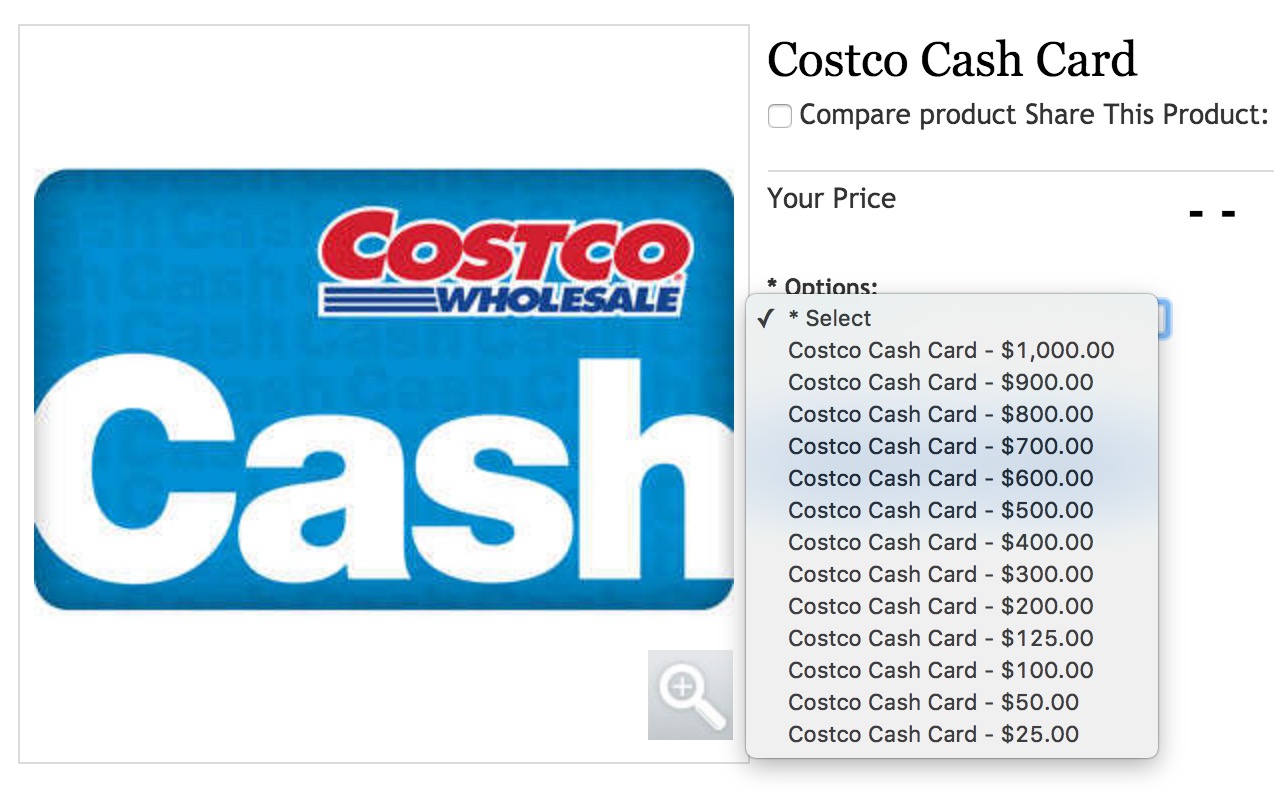

Reward payouts are typically issued once a year as a credit card reward certificate, redeemable for cash or merchandise at Costco warehouses.

Annual Fees and Other Considerations

Neither card has an annual fee, *provided* you maintain a paid Costco membership (either Business or Gold Star). The annual Costco membership fee applies separately.

Both cards function as your Costco membership card, streamlining the checkout process. There are no foreign transaction fees associated with either card, making them useful for international travel and purchases.

Impact on Credit Score

Applying for either card will result in a hard inquiry on your credit report, which can temporarily lower your credit score. Responsible use of either card, including paying balances on time and keeping credit utilization low, can positively impact your credit score over time.

Opening multiple credit cards in a short period can negatively impact your credit score. It's important to consider your credit history and financial situation before applying for either card.

A Human Element: Choosing What's Right for You

Consider the experience of Maria Rodriguez, a small business owner who uses the Citi Costco Business card to track her business expenses. "The rewards on gas and travel really add up for my business," she says. "Plus, it helps me keep my personal and business spending separate."

Conversely, David Chen, a frequent Costco shopper, prefers the Citi Costco Anywhere Visa Card for personal use. "I use it for everything – gas, groceries, restaurants," he explains. "The cash back helps offset the cost of my Costco membership."

Conclusion: Making an Informed Decision

Ultimately, the choice between the Citi Costco Business card and the Citi Costco Anywhere Visa Card depends on individual circumstances and spending habits. Business owners with significant business-related expenses may find the Citi Costco Business card more advantageous. Individuals seeking rewards on everyday purchases may prefer the Citi Costco Anywhere Visa Card for personal use.

Carefully assess your spending patterns, consider your eligibility, and weigh the rewards structures to make the best choice for your needs. By understanding the nuances of each card, you can maximize your rewards and get the most value from your Costco membership.

/costco-anywhere-visa-business-card_blue-96abd8e63fc4452d9e2c00f10e314718.jpg)