Simple Business Accounting Software

The financial health of small and medium-sized enterprises (SMEs) hinges on accurate and efficient accounting. Complex accounting systems, often designed for larger corporations, can overwhelm smaller businesses, leading to errors, missed opportunities, and even financial instability.

Fortunately, a growing market of simple business accounting software is emerging to address these specific challenges, offering user-friendly interfaces and streamlined functionalities. But are these simplified solutions truly effective, and what factors should business owners consider when making a choice?

The Rise of Simplified Accounting Solutions

For many SMEs, the prospect of tackling complex accounting software like SAP or Oracle NetSuite can be daunting. According to a 2023 report by the Small Business Administration (SBA), a significant portion of small businesses cite bookkeeping as a major operational hurdle.

The rise of simple business accounting software aims to level the playing field, providing intuitive platforms that automate key tasks and minimize the learning curve.

The core value proposition revolves around ease of use, affordability, and accessibility, allowing business owners to focus on their core competencies rather than struggling with intricate financial systems.

Key Features and Benefits

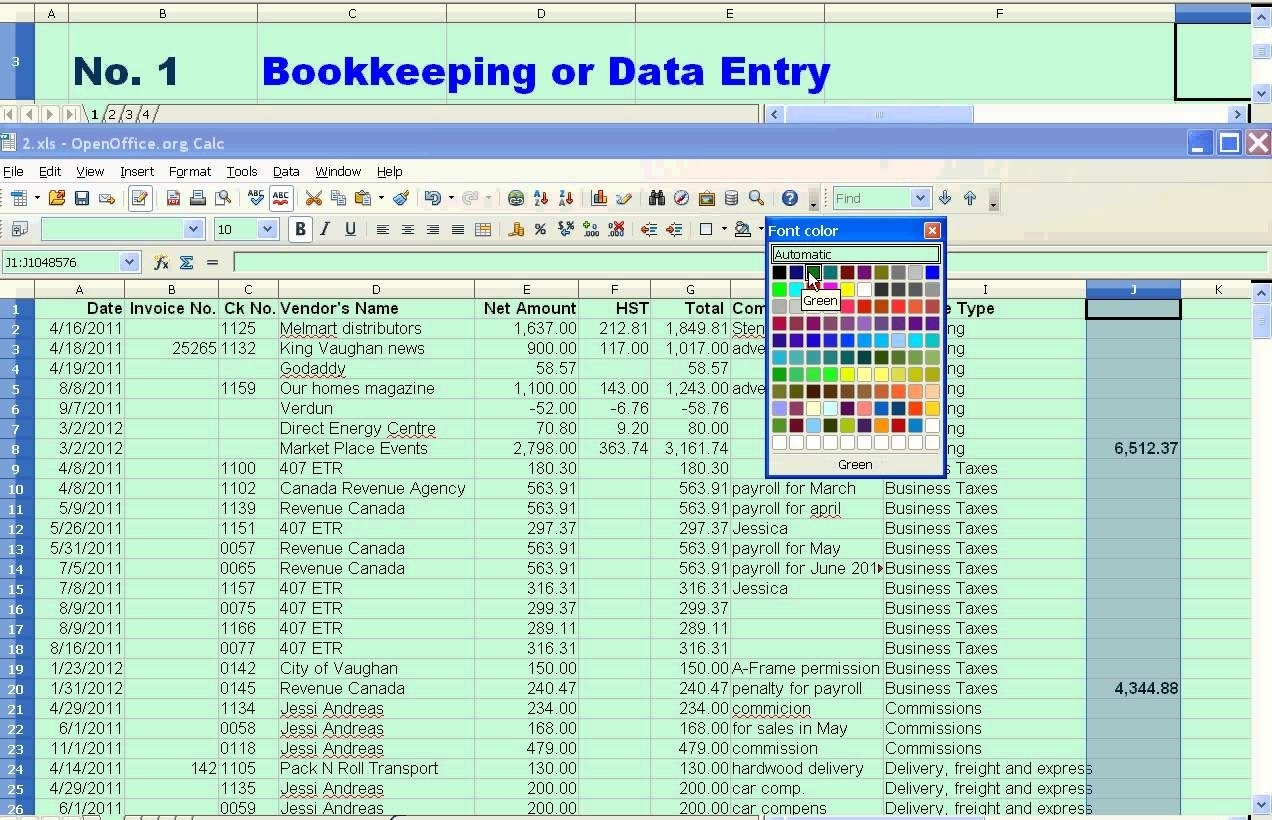

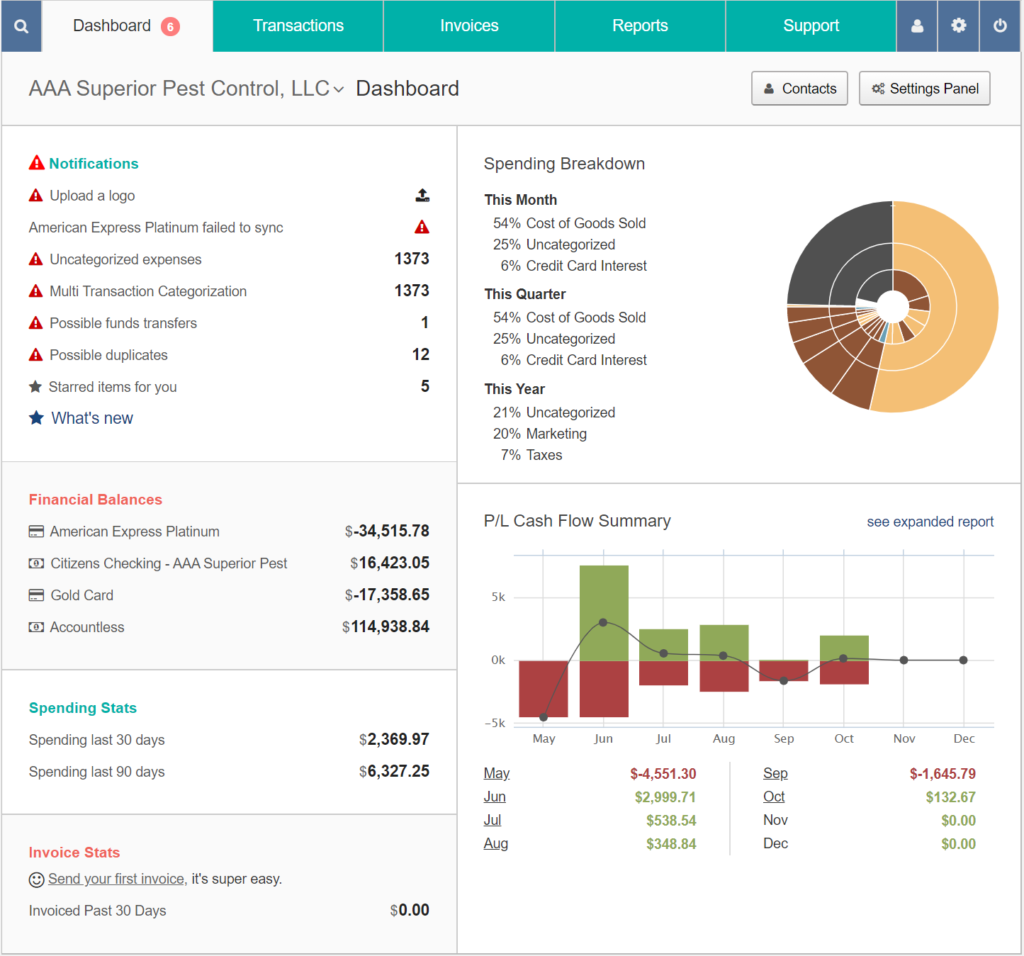

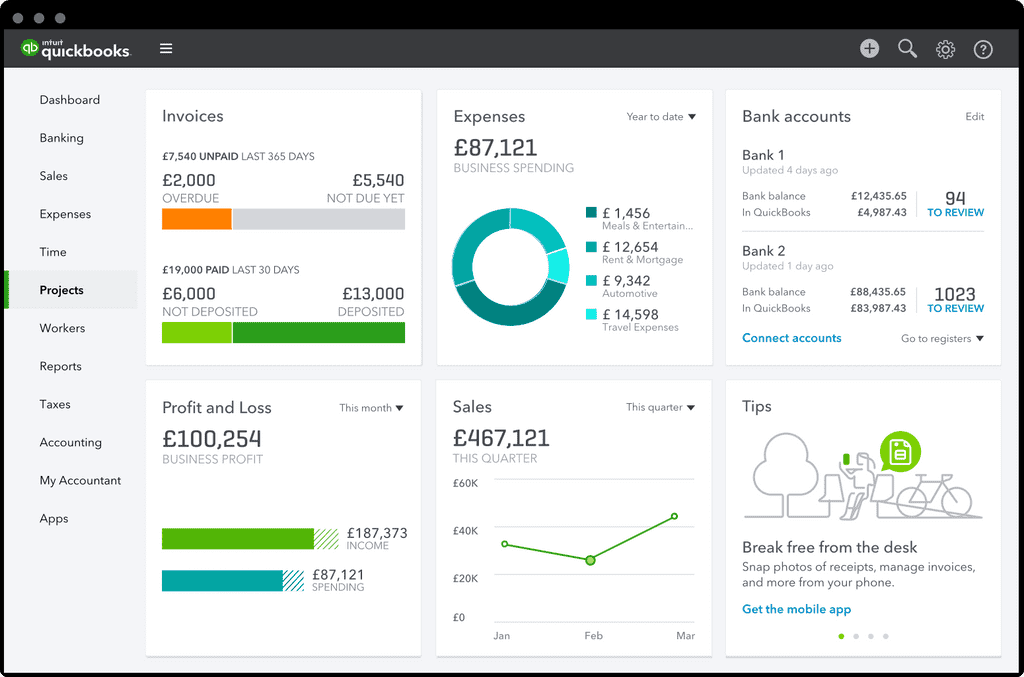

Simple business accounting software typically focuses on core accounting functions. These often include invoice generation, expense tracking, bank reconciliation, and basic financial reporting.

Many platforms also offer integration with other business tools, such as point-of-sale (POS) systems and e-commerce platforms. This integration helps to streamline data flow and reduce manual data entry.

The benefits are multifaceted: reduced risk of human error, improved cash flow management, and enhanced financial transparency. Furthermore, the cloud-based nature of many solutions enables real-time access to financial data from anywhere, facilitating informed decision-making.

Considerations and Limitations

While simple business accounting software offers numerous advantages, it's essential to acknowledge potential limitations. One common concern is scalability.

As businesses grow and their accounting needs become more complex, the simplified solutions may lack the advanced features required to handle sophisticated financial transactions. According to a survey by Gartner, a technology research firm, nearly 30% of SMEs using basic accounting software eventually outgrow its capabilities within three years.

Another consideration is the level of customization available. Some solutions offer limited customization options, which may not be ideal for businesses with unique accounting requirements.

"Businesses should carefully assess their long-term needs before selecting a solution," states Maria Rodriguez, a CPA specializing in small business accounting.

Choosing the Right Software

Selecting the right simple business accounting software requires a careful assessment of a business's specific needs and resources. Key factors to consider include the size and complexity of the business, the level of accounting expertise available in-house, and the budget.

Businesses should also consider the software's integration capabilities, customer support options, and data security measures.

Free trials are often a valuable tool for evaluating different options and ensuring a good fit.

Expert Perspectives

Accountants and financial advisors offer valuable insights into the effectiveness of simple business accounting software. Many acknowledge the benefits for small businesses with straightforward financial operations.

However, they also caution against relying solely on simplified solutions without professional guidance.

"While these tools can be helpful, they are not a substitute for sound accounting principles and professional advice," warns David Lee, a financial advisor at a leading firm.

They encourage businesses to consult with a qualified accountant to ensure proper setup, accurate data entry, and compliance with tax regulations.

The Future of Simple Accounting

The market for simple business accounting software is expected to continue growing in the coming years, driven by the increasing adoption of cloud-based solutions and the growing number of SMEs globally. Advancements in artificial intelligence (AI) and machine learning (ML) are likely to further enhance the capabilities of these platforms.

We can expect to see more automation of tasks such as invoice processing and bank reconciliation, as well as more sophisticated financial reporting and analytics.

Ultimately, simple business accounting software empowers SMEs to take control of their finances, but a balanced approach, combining technological tools with expert guidance, is crucial for long-term financial success.