Creating A Budget Plan For Business

In today’s dynamic economic landscape, a well-structured budget plan is no longer a mere suggestion for businesses, but a critical necessity. From startups navigating initial funding to established corporations managing complex portfolios, effective budgeting provides a roadmap for financial stability and sustainable growth.

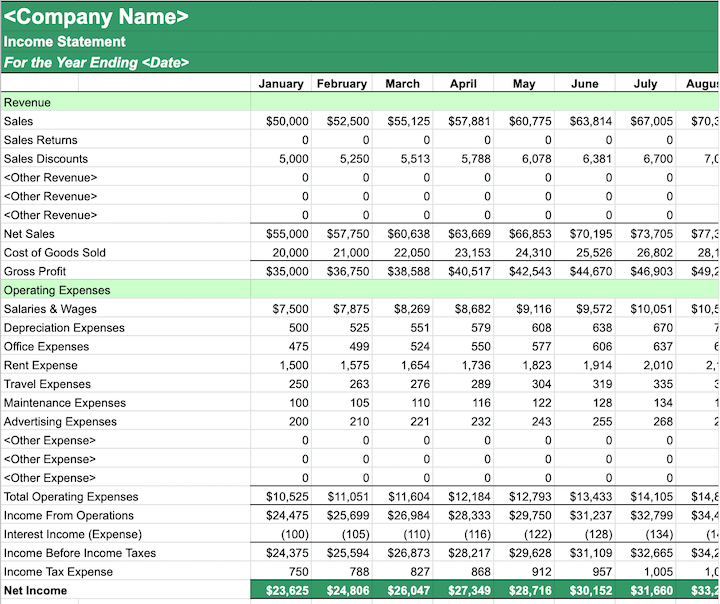

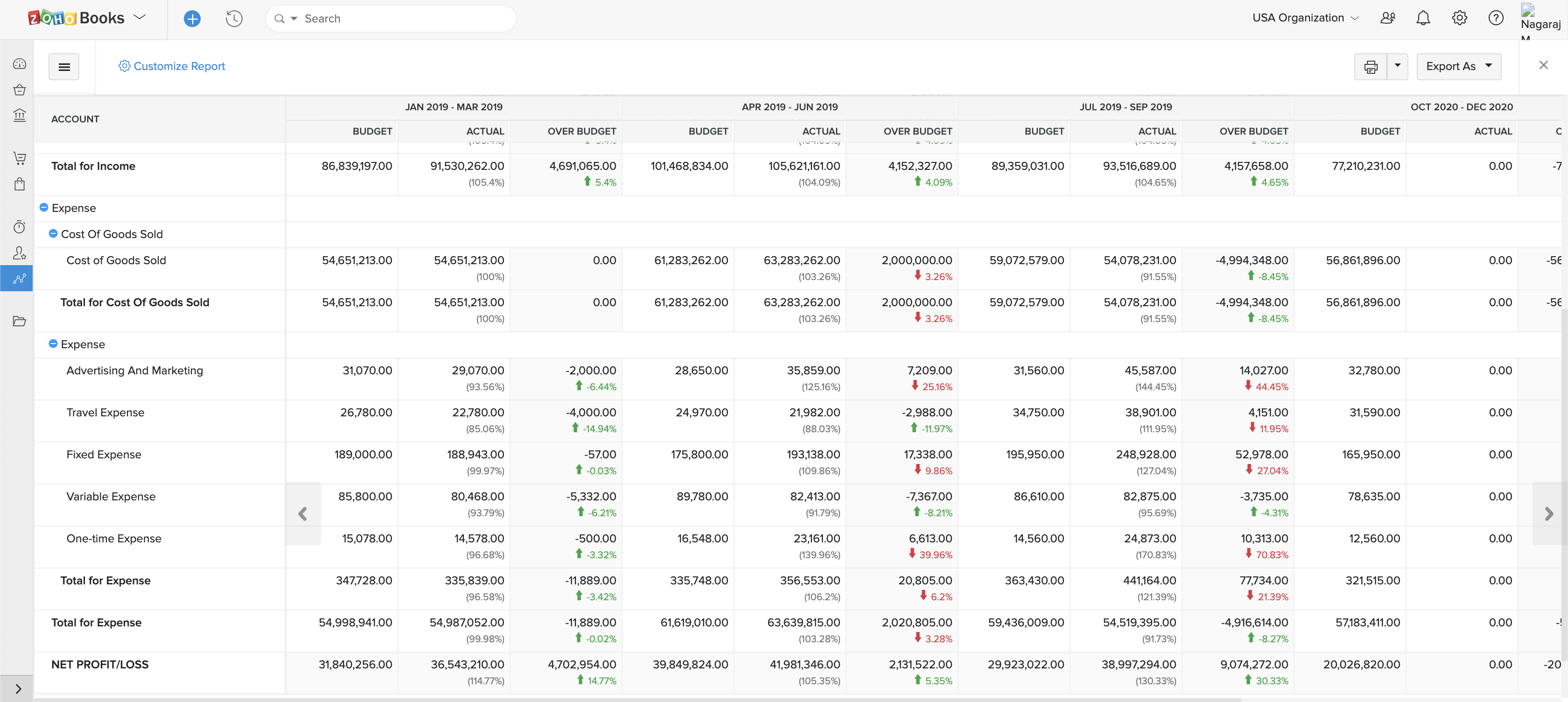

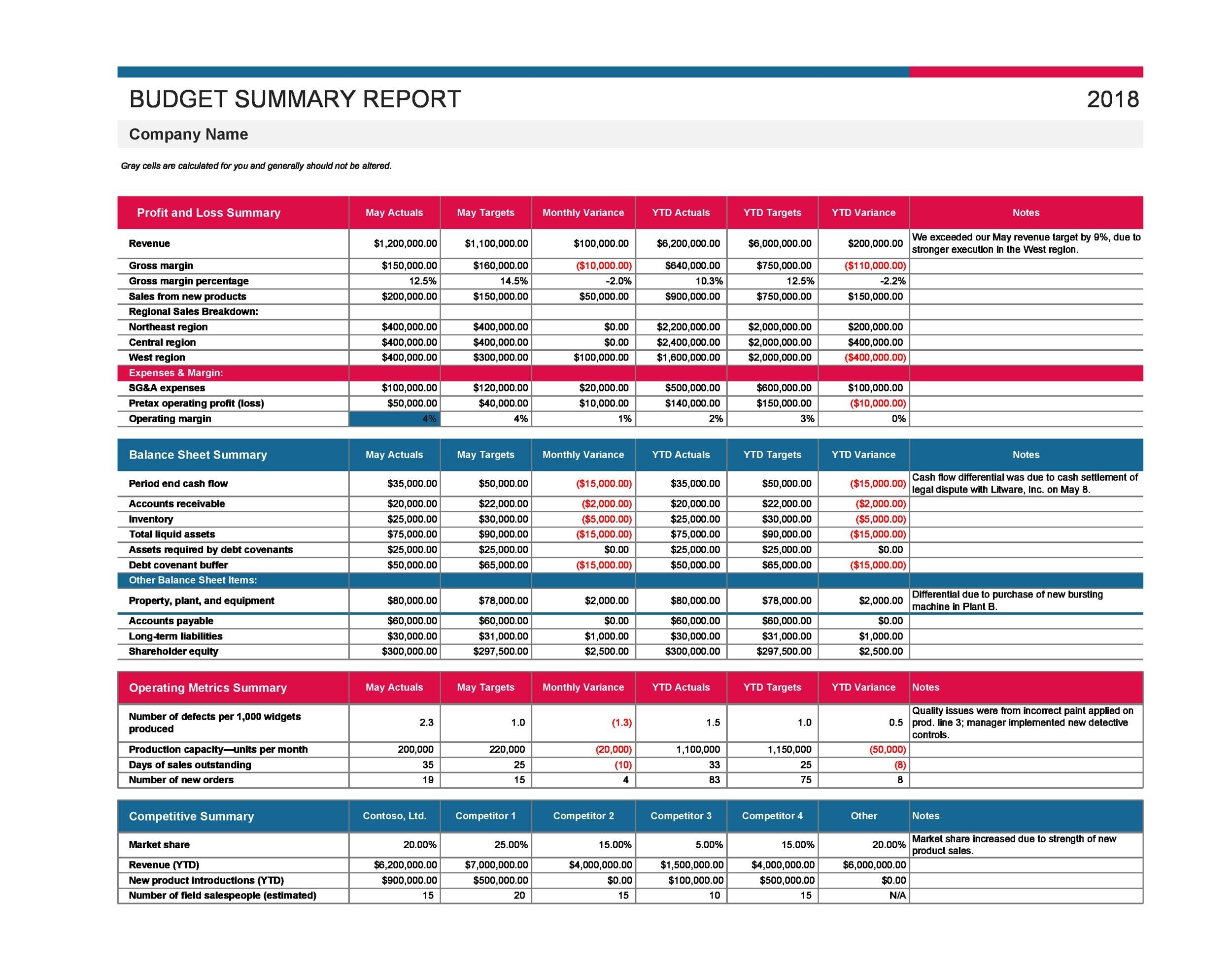

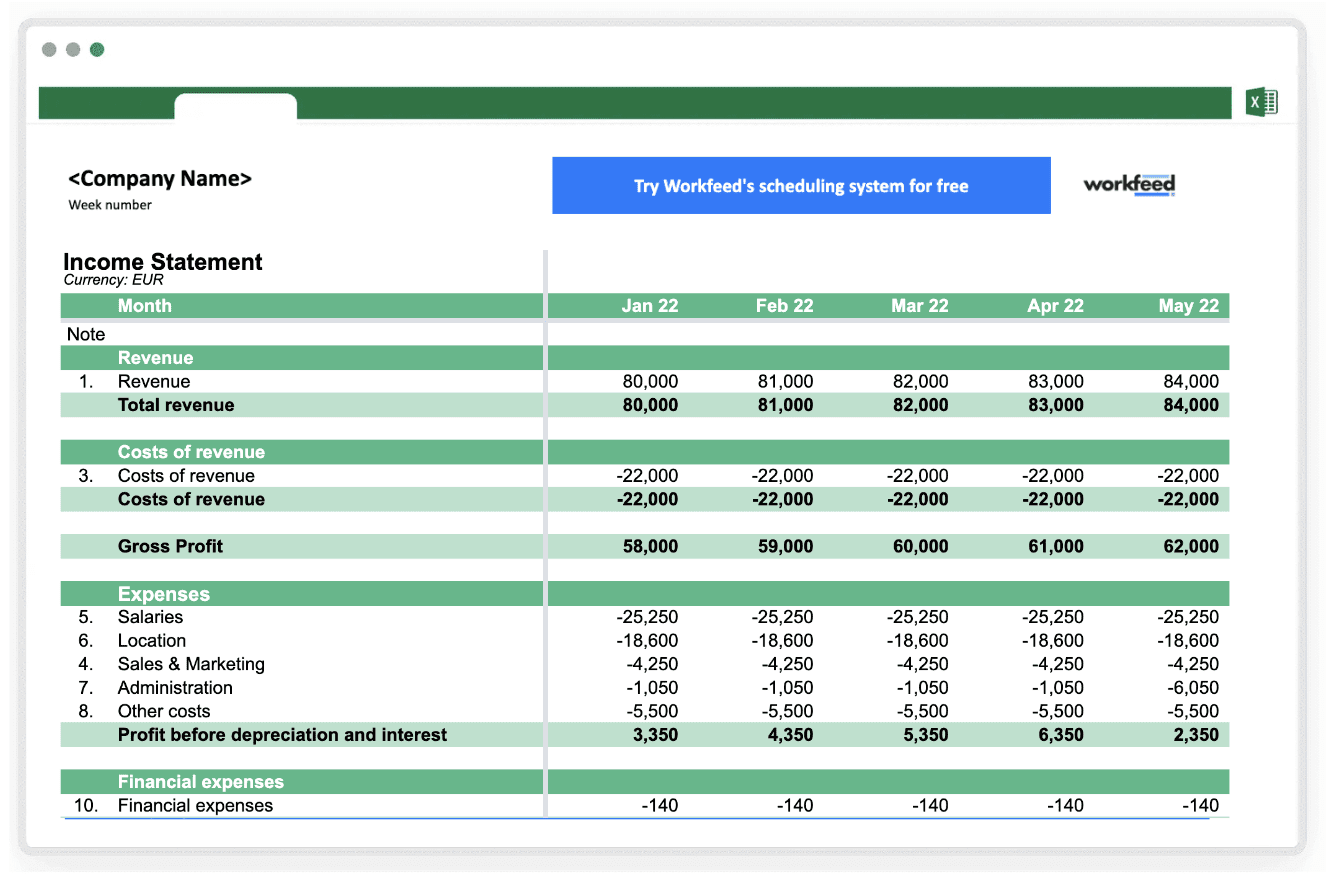

A business budget is a comprehensive financial plan that outlines expected revenues, expenses, and profit targets over a specific period, typically a month, quarter, or year. It serves as a benchmark against which actual financial performance can be measured, highlighting areas of success and areas requiring adjustments. The Small Business Administration (SBA) emphasizes its importance in managing cash flow and securing funding.

The Building Blocks of a Business Budget

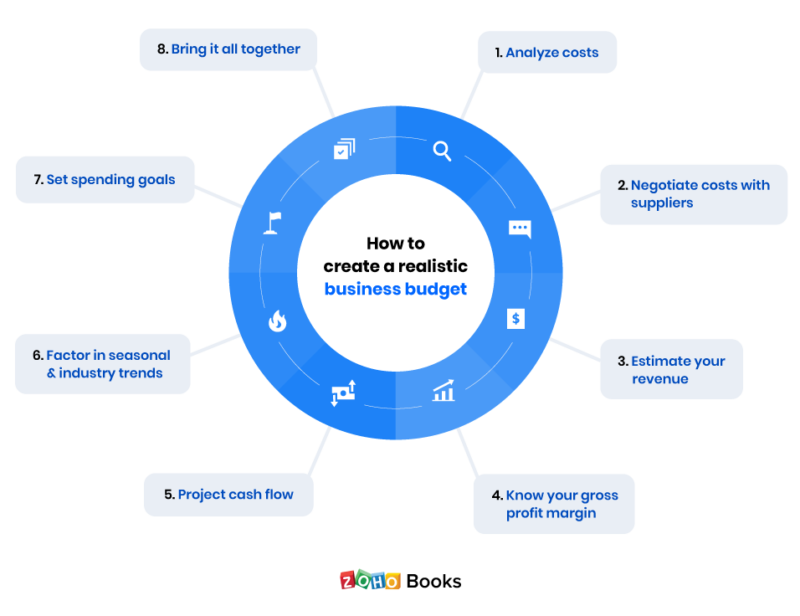

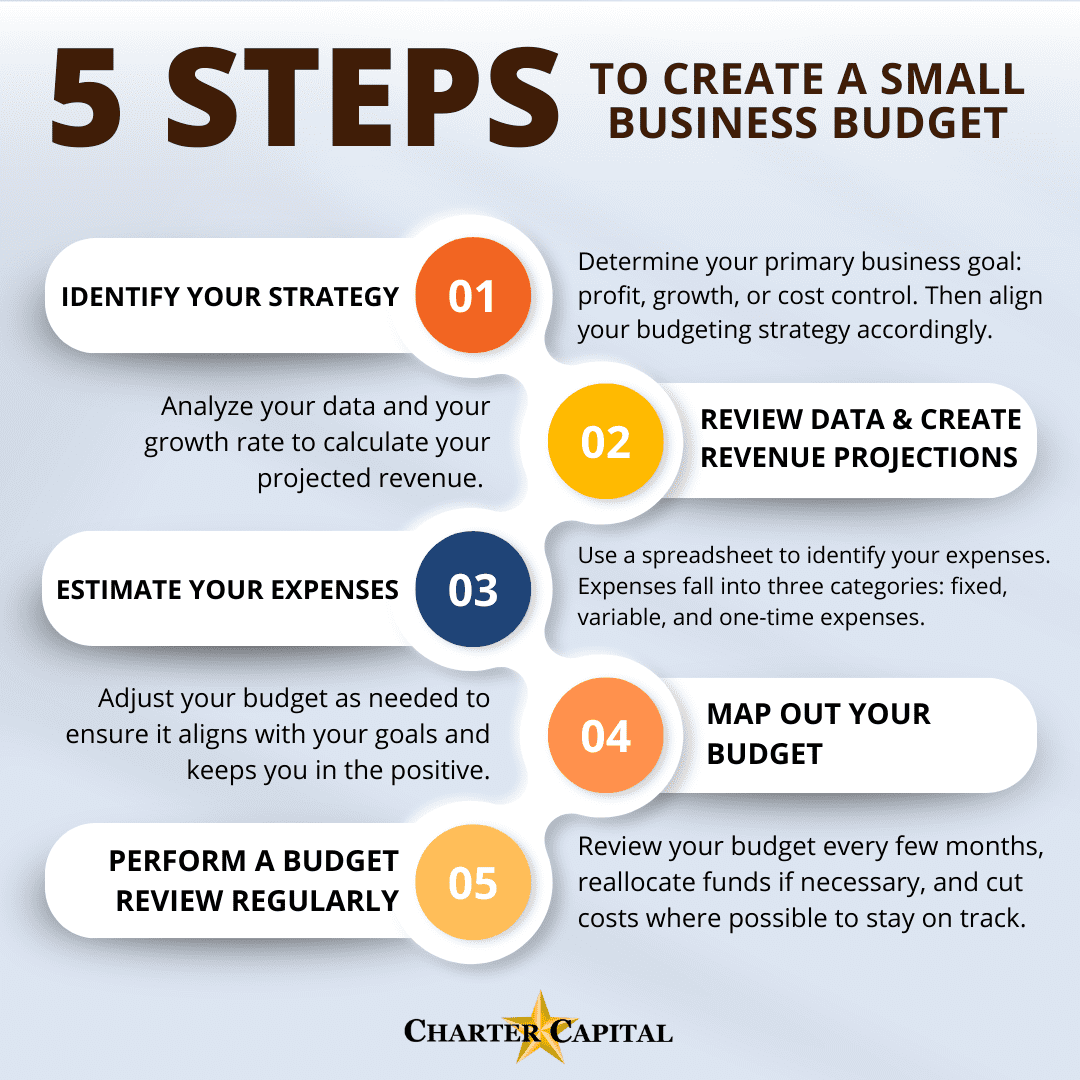

Creating a robust budget involves several key steps. First, businesses need to accurately forecast their revenue. This requires analyzing past sales data, market trends, and anticipated changes in demand.

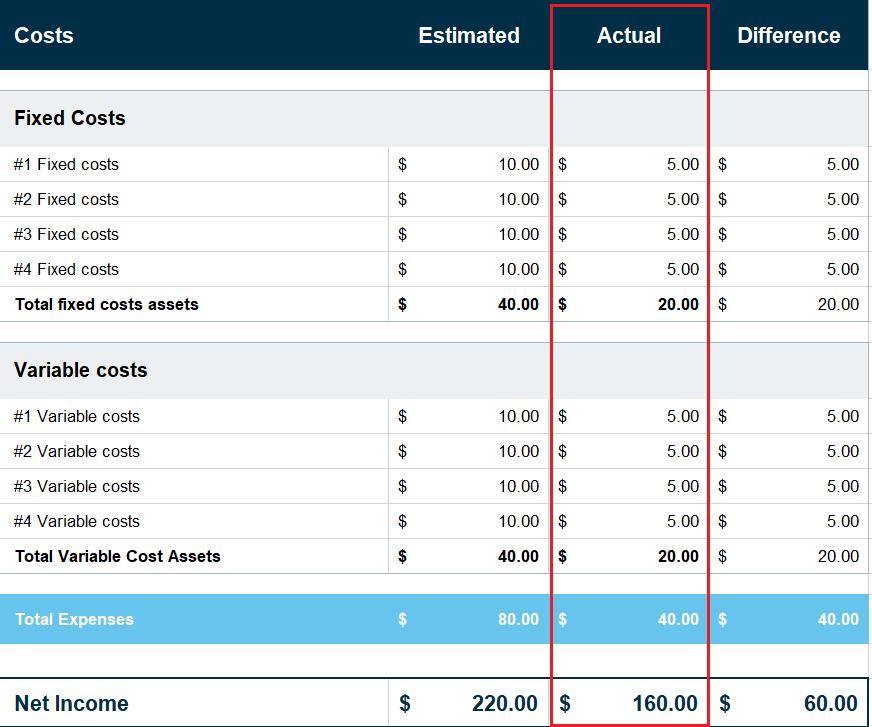

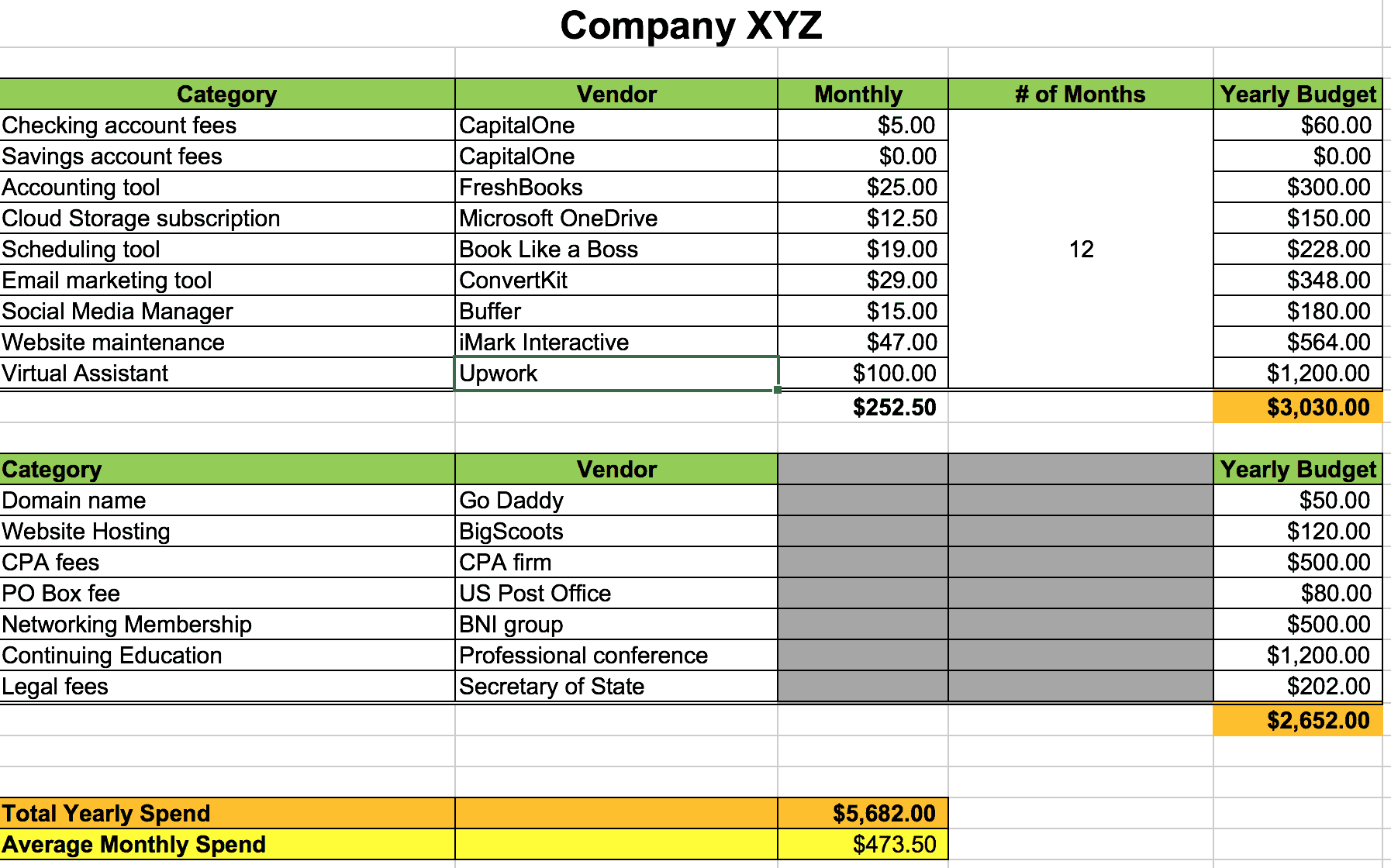

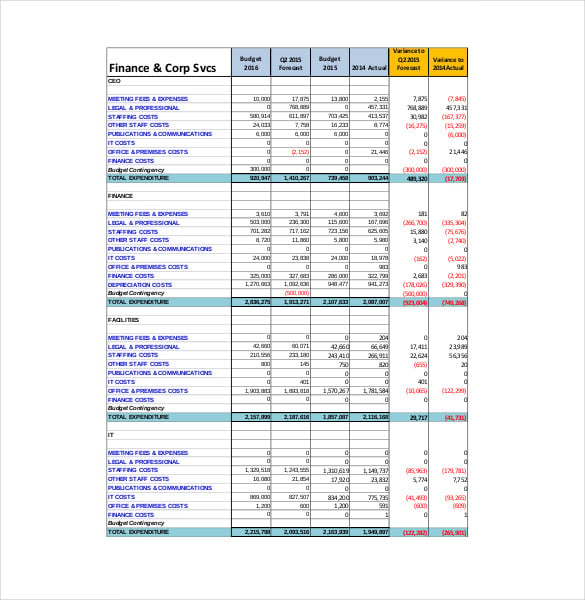

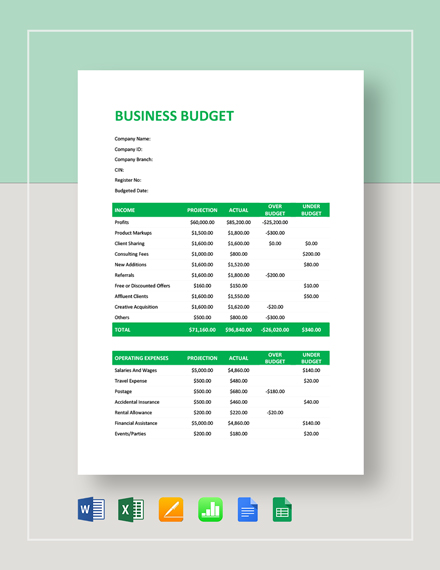

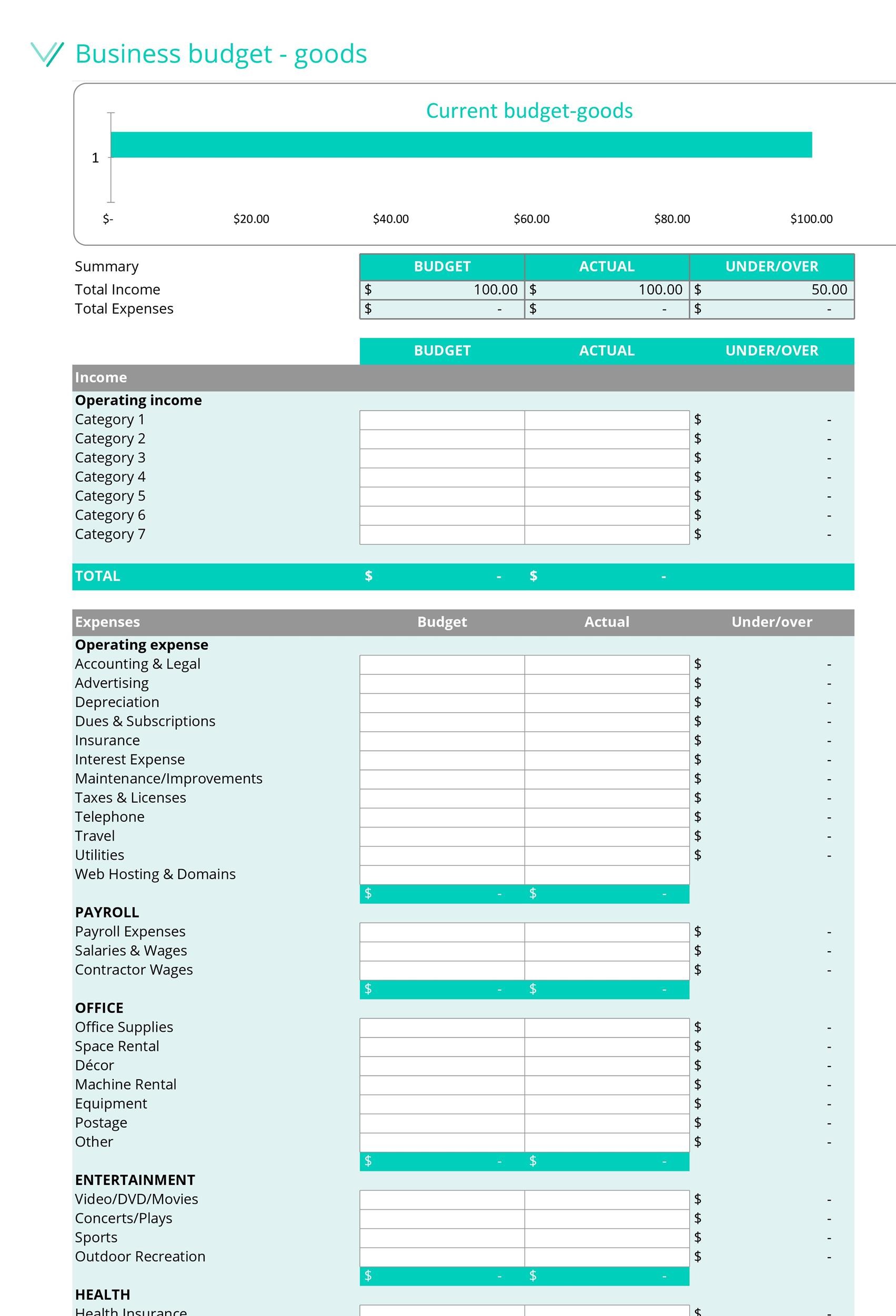

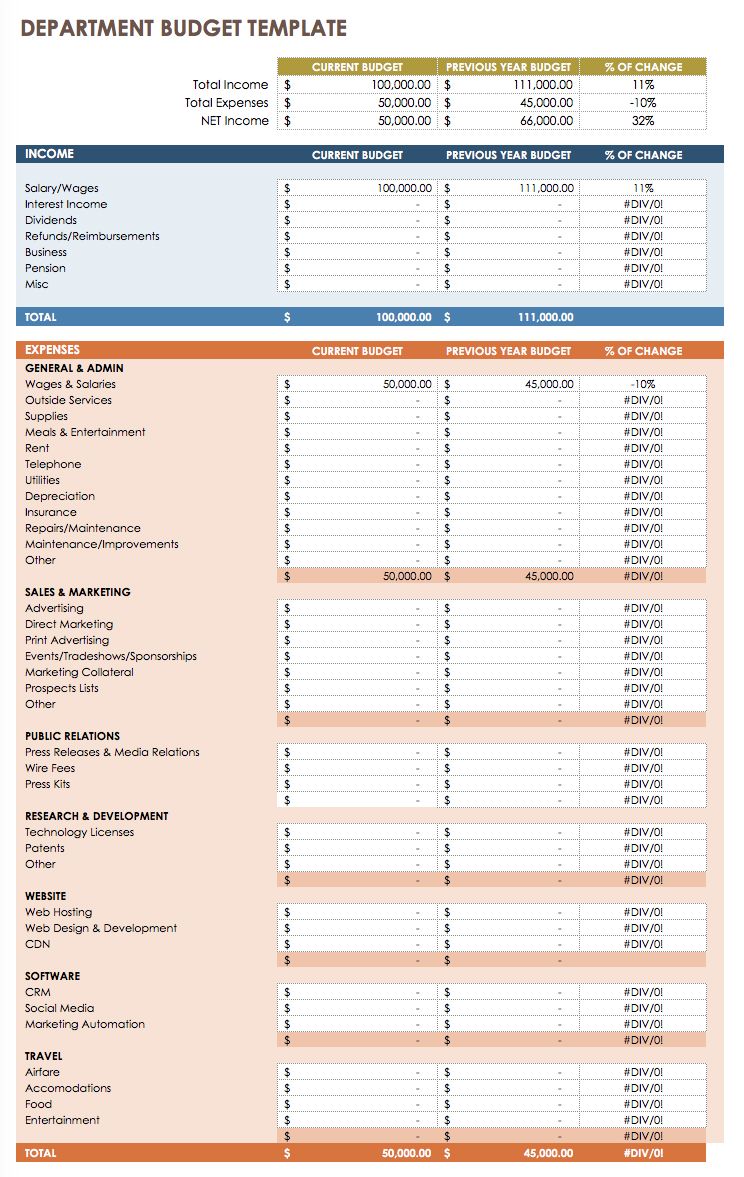

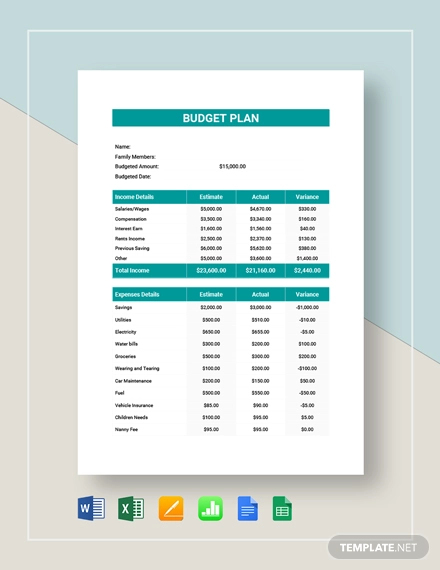

Next, businesses must meticulously list all anticipated expenses. These expenses often fall into two primary categories: fixed costs and variable costs. Fixed costs are those that remain relatively constant regardless of production levels, such as rent, insurance premiums, and salaries.

Variable costs, on the other hand, fluctuate with production volume, including raw materials, direct labor, and shipping expenses. Accurately projecting these costs requires careful consideration of production plans and market prices.

Once revenue and expenses are projected, the business can calculate its anticipated profit or loss. This difference between income and expenses provides a clear indication of the business's financial health and its ability to achieve its goals.

Tools and Techniques

Numerous tools and techniques can aid businesses in crafting their budgets. Spreadsheet software, such as Microsoft Excel or Google Sheets, remains a popular choice for its versatility and data analysis capabilities.

However, specialized accounting software like QuickBooks or Xero offers more advanced features, including automated reporting, real-time financial tracking, and integration with other business systems.

Furthermore, scenario planning can be useful to prepare the budgets. This involves developing multiple budgets based on different assumptions about future economic conditions or market changes, allowing businesses to prepare for a range of potential outcomes.

"A budget is telling your money where to go instead of wondering where it went." - Dave Ramsey, Financial Author and Radio Host.

The Impact on Small Businesses

For small businesses, a well-managed budget can be particularly transformative. It provides a clear picture of their financial standing, allowing them to make informed decisions about investments, hiring, and pricing strategies.

Moreover, a solid budget can significantly improve their chances of securing financing from lenders or investors. Financial institutions typically require detailed budget projections as part of the loan application process, demonstrating the business's ability to repay its debt.

Consider the story of Sarah's Bakery, a small bakery that struggled with inconsistent profits. After implementing a detailed budget plan, Sarah was able to identify areas where she could reduce waste, negotiate better prices with suppliers, and adjust her pricing to improve profitability.

Adapting to Change

A budget is not a static document; it should be regularly reviewed and adjusted to reflect changing circumstances. Unexpected events, such as economic downturns, supply chain disruptions, or shifts in consumer preferences, can significantly impact a business's financial performance.

Businesses should monitor their actual performance against their budget on a regular basis and make adjustments as needed. This requires a flexible approach and a willingness to adapt to changing conditions.

This adaptability requires frequent monitoring. The frequency of monitoring should depend on the business. Some businesses need to monitor monthly, others may monitor weekly.

In conclusion, creating a budget plan for business is an essential practice that provides financial direction, enhances decision-making, and promotes sustainable growth. By carefully planning, monitoring, and adapting their budgets, businesses can navigate the complexities of the modern economy and increase their chances of success.

![Creating A Budget Plan For Business How To Make/Create a Budget Plan [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2018/01/How-To-MakeCreate-a-Budget-Plan.jpg)