Creating Different Streams Of Income

The traditional notion of relying solely on a single paycheck is increasingly being challenged as individuals seek financial stability and independence through the creation of diverse income streams.

This growing trend, fueled by economic uncertainties and the rise of the gig economy, is empowering individuals to take control of their financial futures.

The Rise of the Multi-Income Earner

The concept of diversifying income is not new, but its adoption has accelerated in recent years. The Bureau of Labor Statistics reports a significant increase in self-employment and freelance work, indicating a shift toward individuals managing multiple income sources.

This shift is partly driven by technological advancements that have made it easier to start and manage online businesses, offer freelance services, and invest in various assets.

“The internet has democratized access to income-generating opportunities,” says Dr. Anya Sharma, an economist specializing in labor market trends. “People can now leverage their skills and passions to create revenue streams that supplement their primary income.”

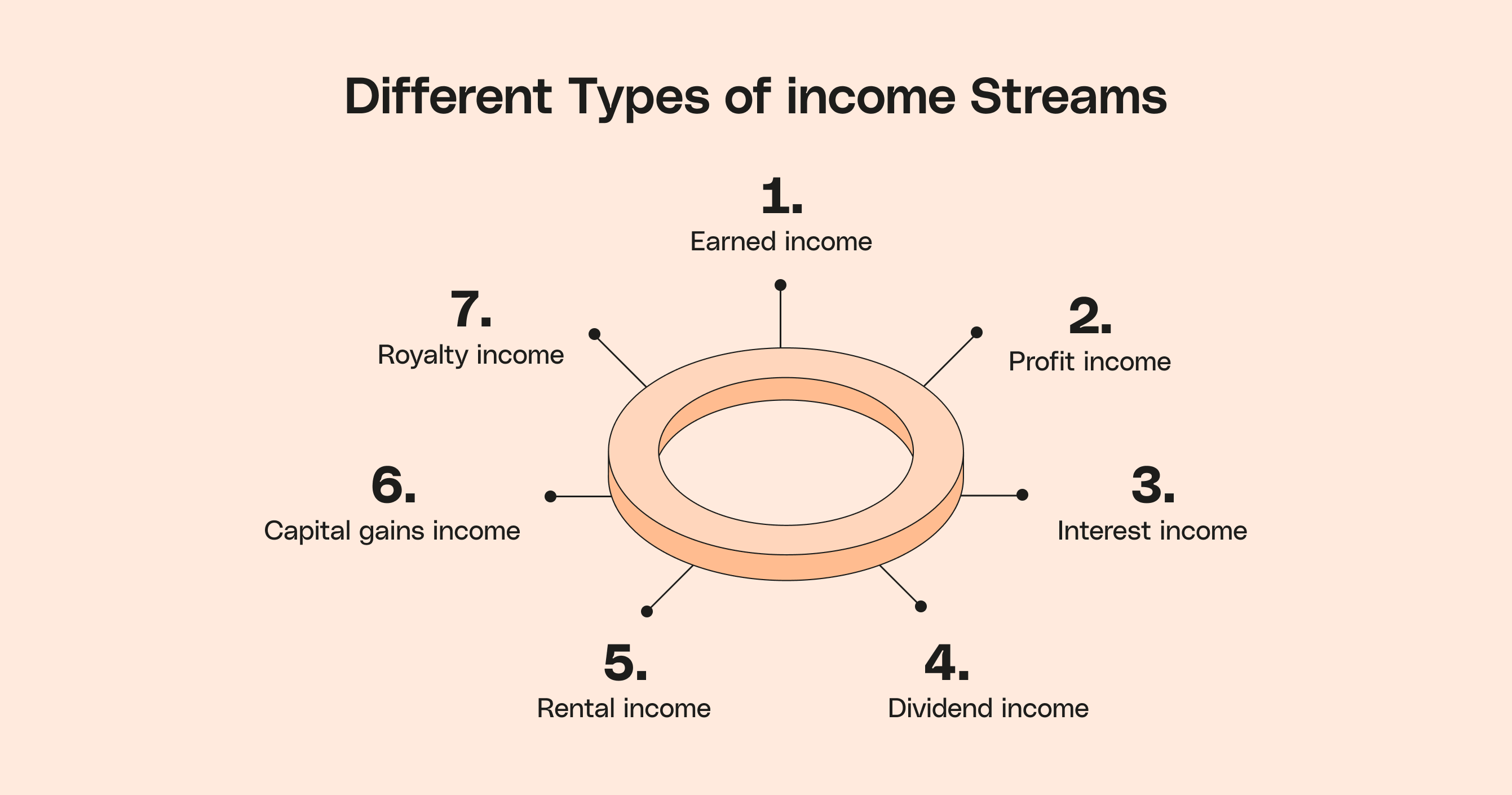

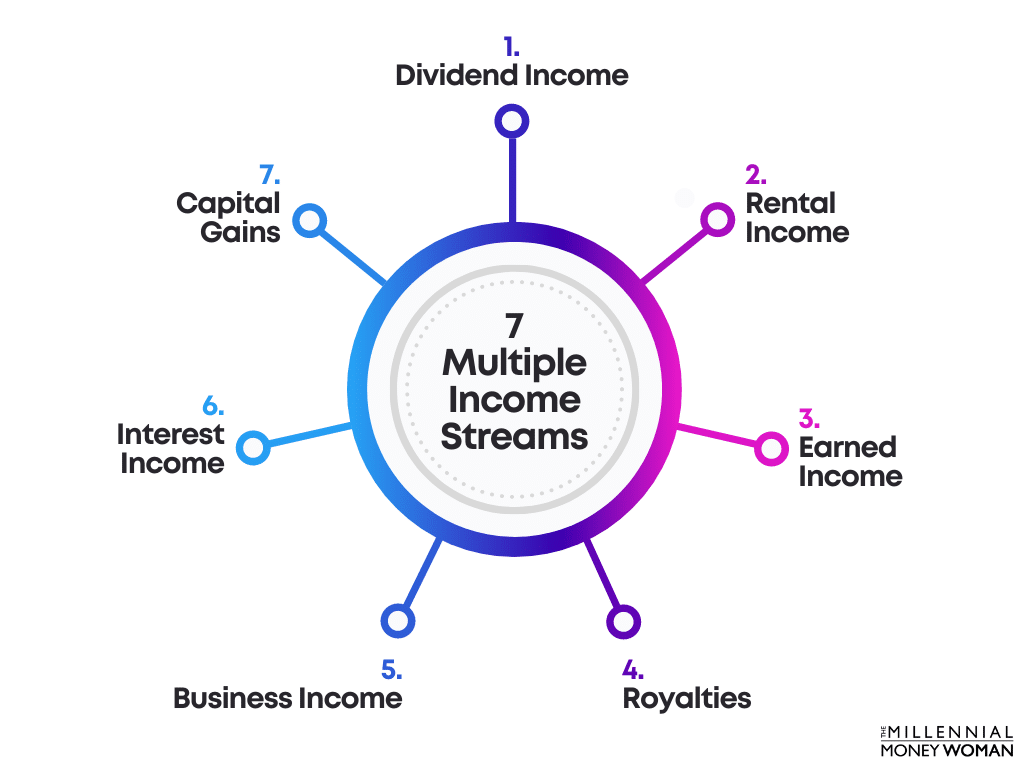

Exploring Different Income Streams

The strategies for creating additional income streams are diverse and cater to various skill sets and interests. Some popular options include freelancing, offering services in areas like writing, design, or web development.

Investing in stocks, bonds, or real estate remains a common approach. Creating and selling online courses or digital products is also gaining traction.

Sarah Chen, a marketing professional, started a blog and an online store selling handmade crafts. "My primary job provides security, but these side ventures give me creative freedom and financial flexibility," she explains.

"It’s about building a safety net and exploring new passions," Chen adds.

Potential Benefits and Challenges

The benefits of creating multiple income streams are numerous. Increased financial security, reduced dependence on a single employer, and the potential for faster wealth accumulation are among the key advantages.

It also provides an avenue for individuals to pursue their passions and develop new skills. However, managing multiple income streams can also present challenges.

Time management, potential tax complexities, and the need for self-discipline are crucial considerations. "It’s important to realistically assess your capacity and prioritize effectively," advises David Lee, a financial advisor.

“Don’t spread yourself too thin. Focus on building a few strong income streams rather than many weak ones.”

Impact on Society and the Economy

The growing trend of multi-income earning has broader implications for the economy and society. It could lead to a more resilient workforce less susceptible to economic downturns.

It also fosters entrepreneurship and innovation as individuals experiment with new business models and revenue-generating strategies. However, some economists caution about the potential for increased income inequality if certain groups lack access to the resources and skills needed to diversify their income.

Ensuring equal access to education, training, and resources will be critical to maximizing the benefits of this trend.

Conclusion

The shift toward creating multiple income streams represents a significant change in how individuals approach financial security and career development. By embracing this trend responsibly and strategically, individuals can build a more stable and fulfilling financial future.

Whether it's through freelancing, investing, or starting a side business, the possibilities for diversification are vast. The key is to identify opportunities that align with your skills, passions, and financial goals.