Credit Card Payment Processing Time

In today's fast-paced digital economy, consumers expect near-instantaneous transactions. However, the often-invisible process of credit card payment processing can introduce frustrating delays, impacting both merchants and consumers. These delays can range from a few seconds to several business days, raising questions about efficiency and transparency in the payment ecosystem.

The processing time for credit card payments, while seemingly straightforward, involves a complex web of actors and technologies. Understanding these intricacies is crucial for businesses aiming to optimize their cash flow and enhance customer satisfaction. This article delves into the factors affecting credit card payment processing times, examines potential challenges, and explores evolving solutions aimed at speeding up these transactions.

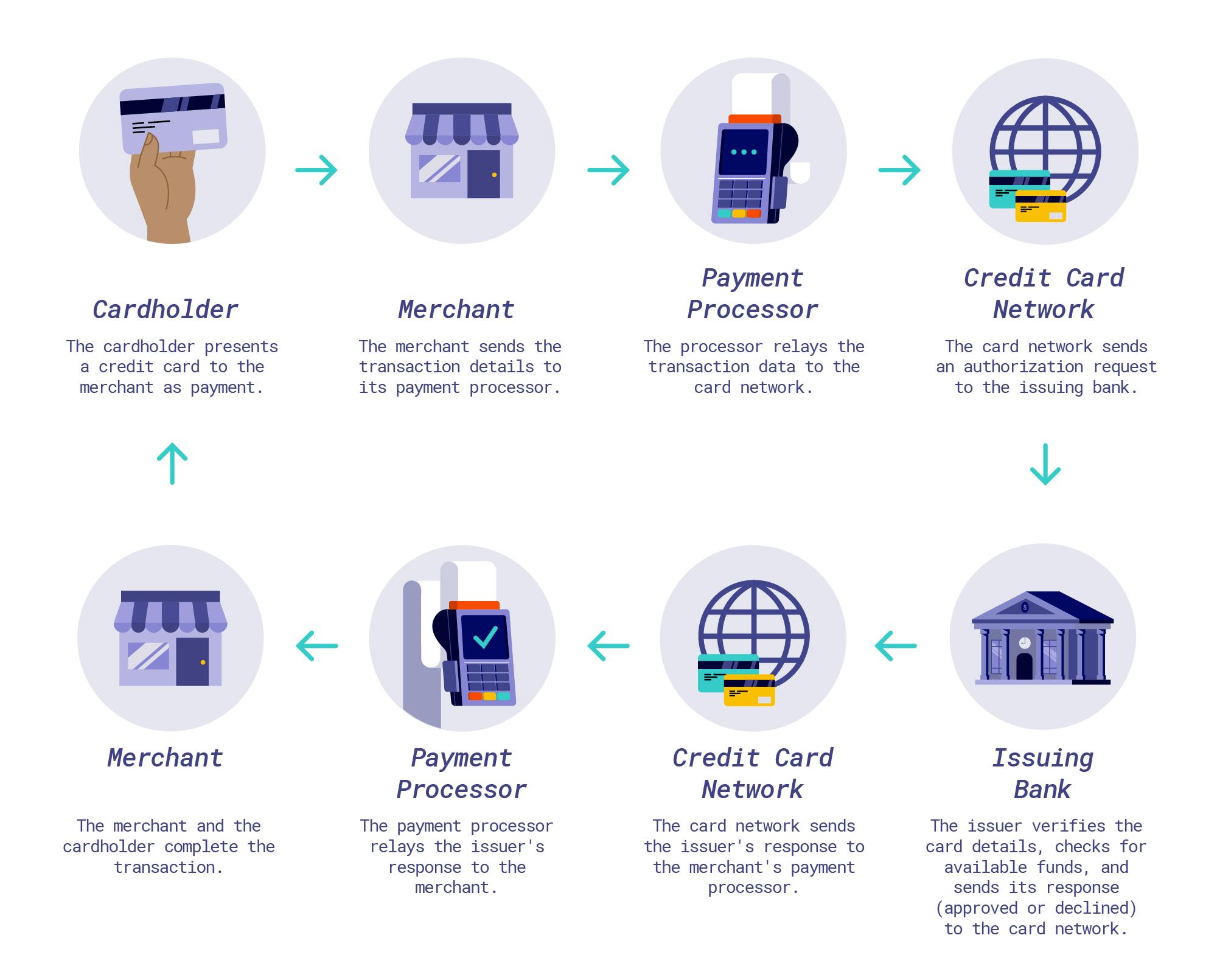

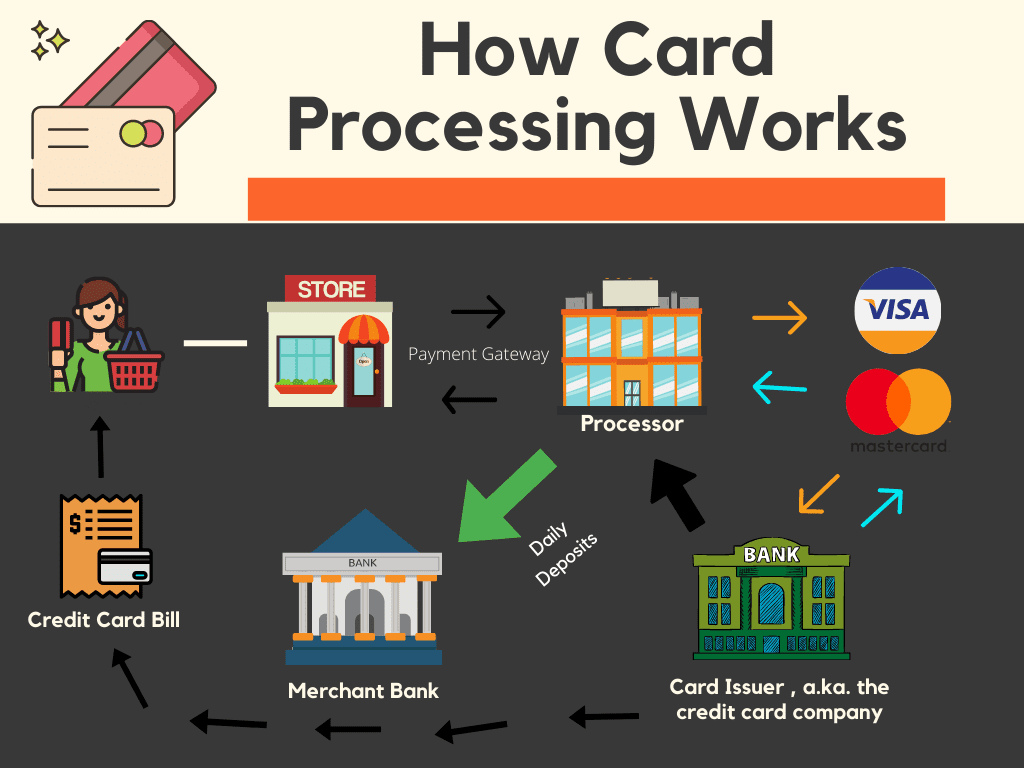

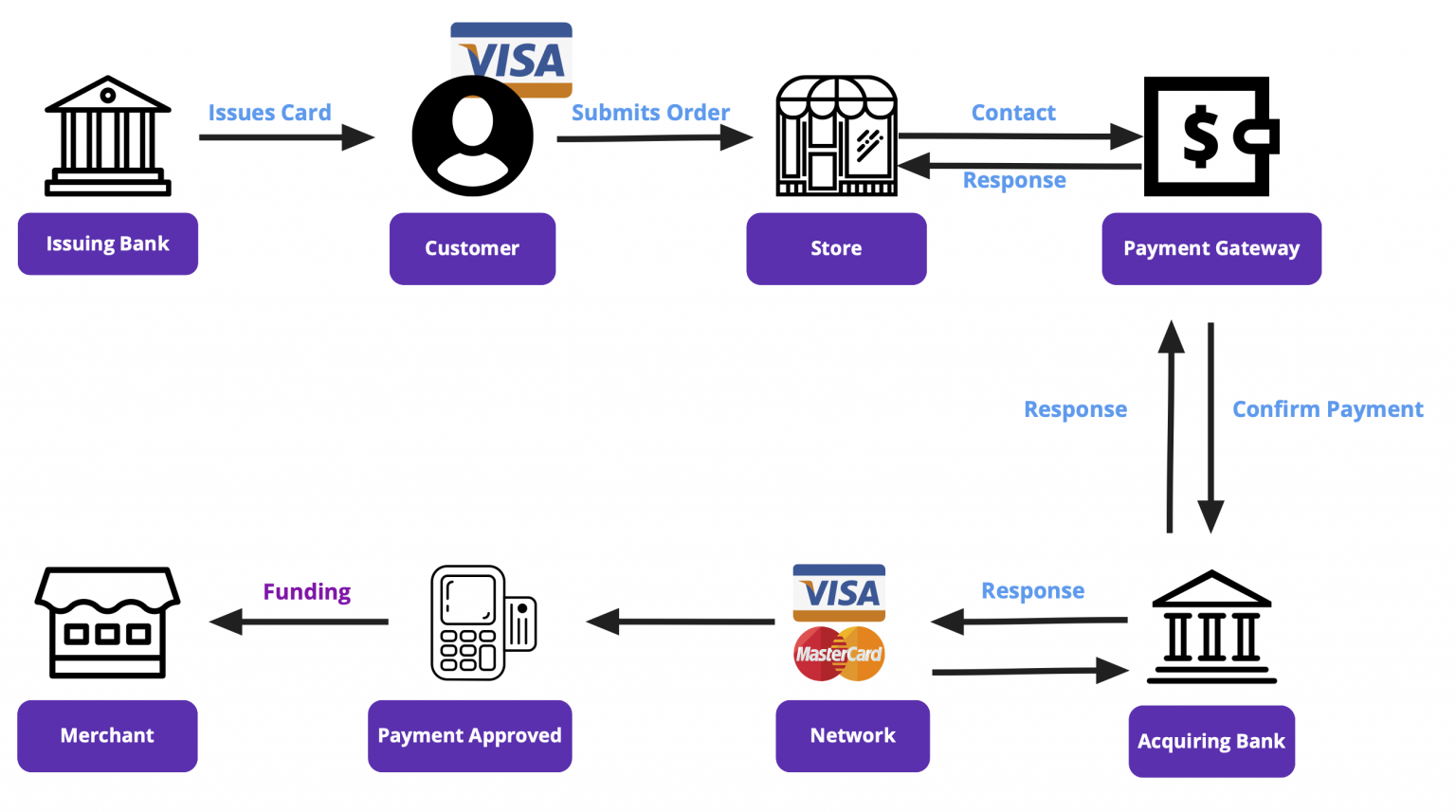

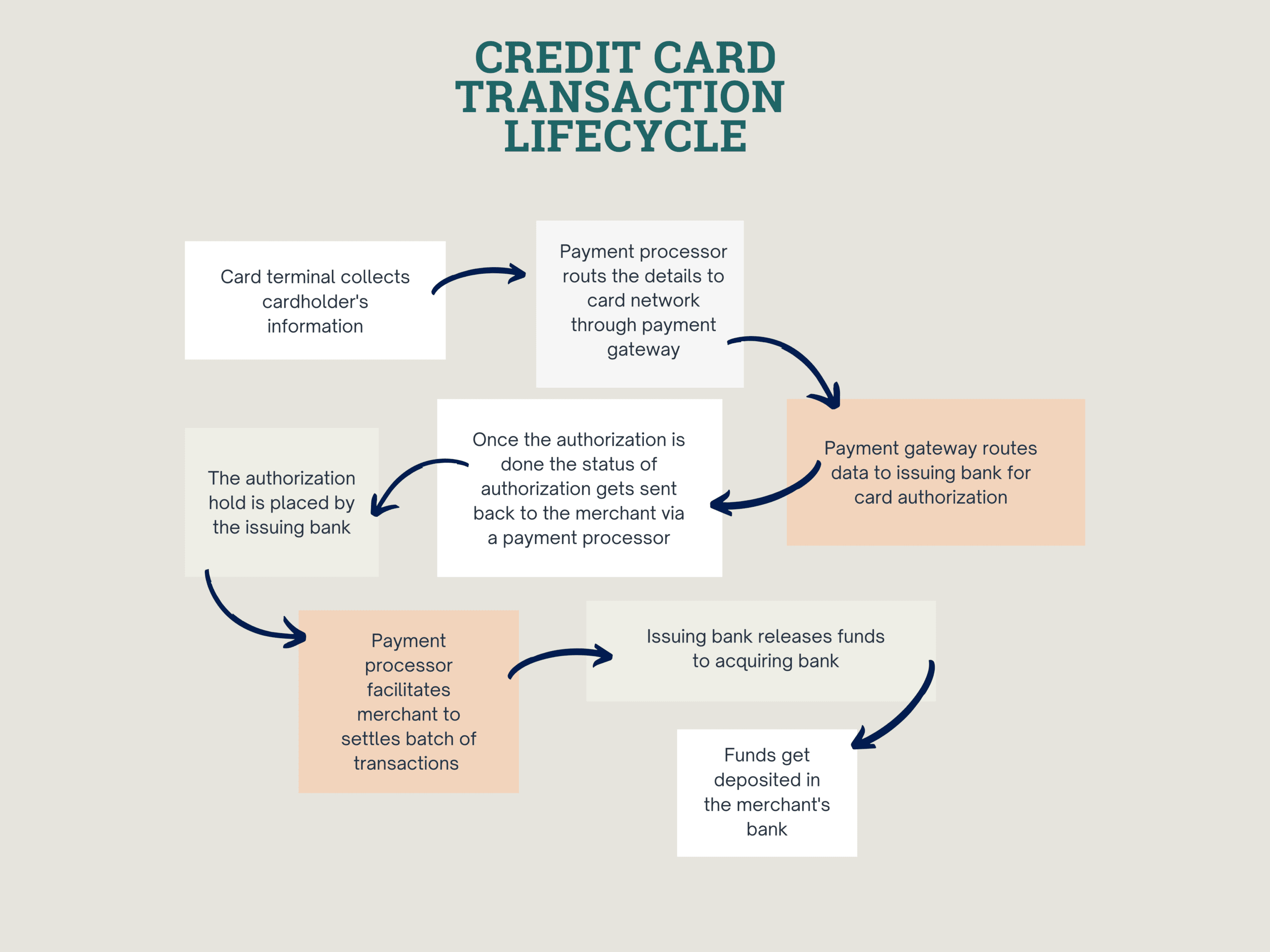

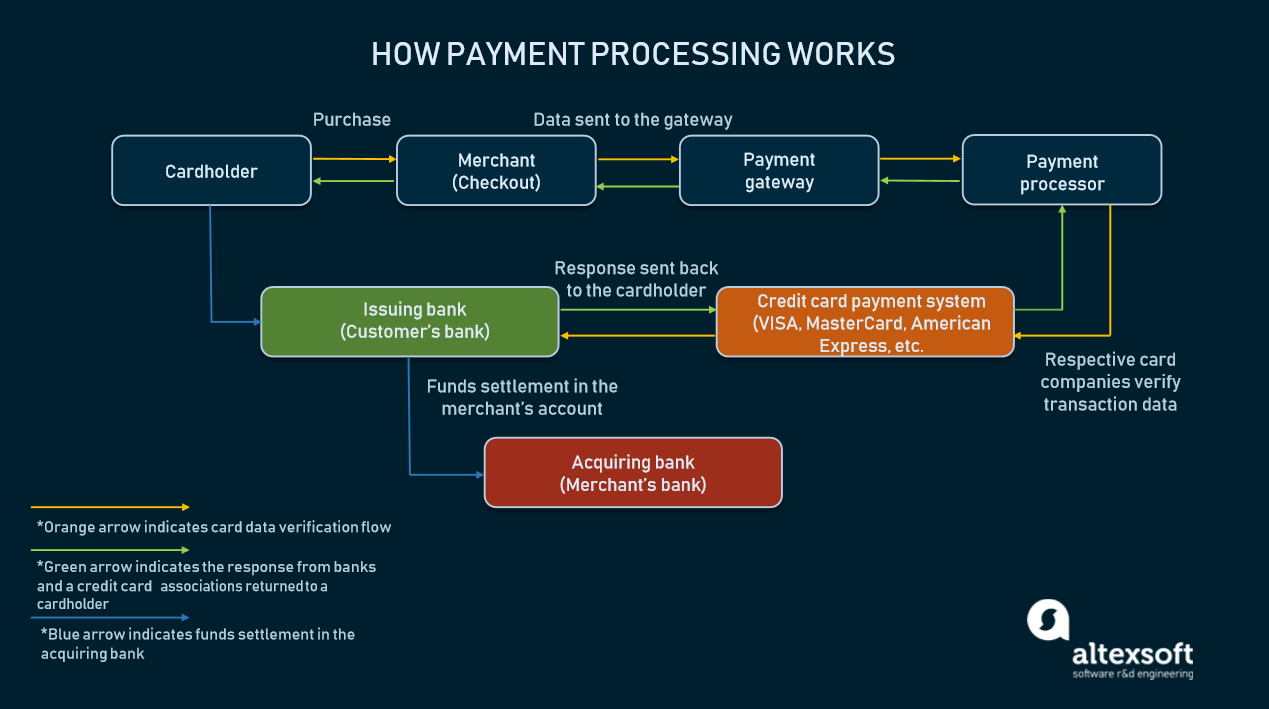

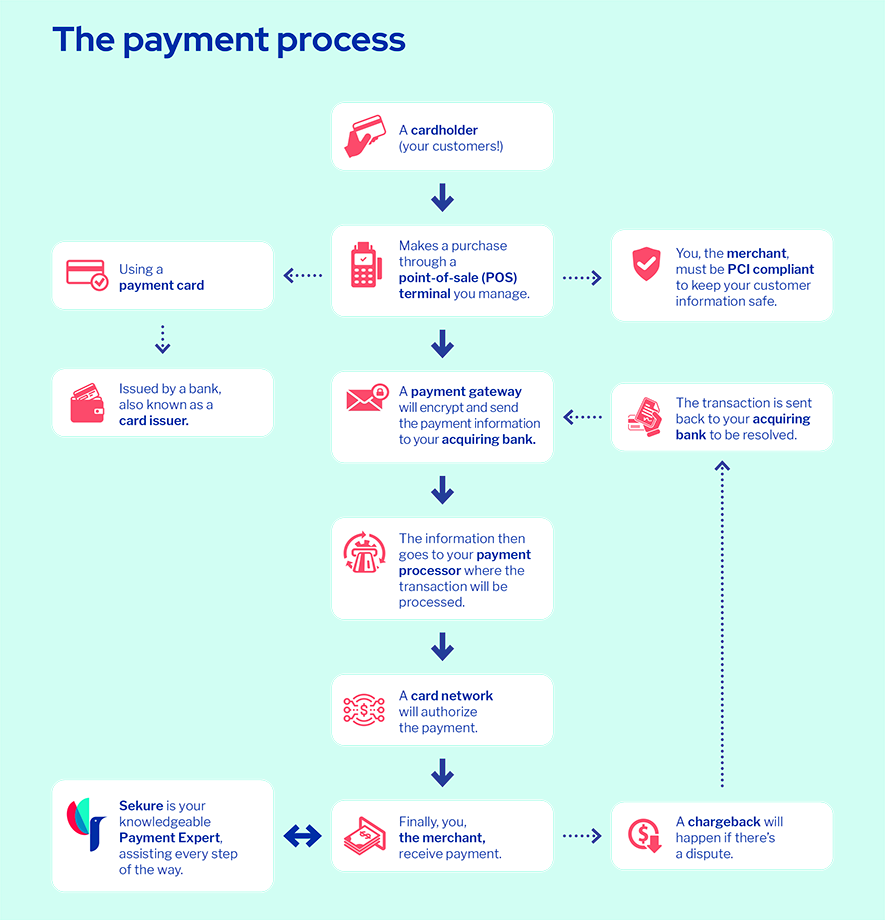

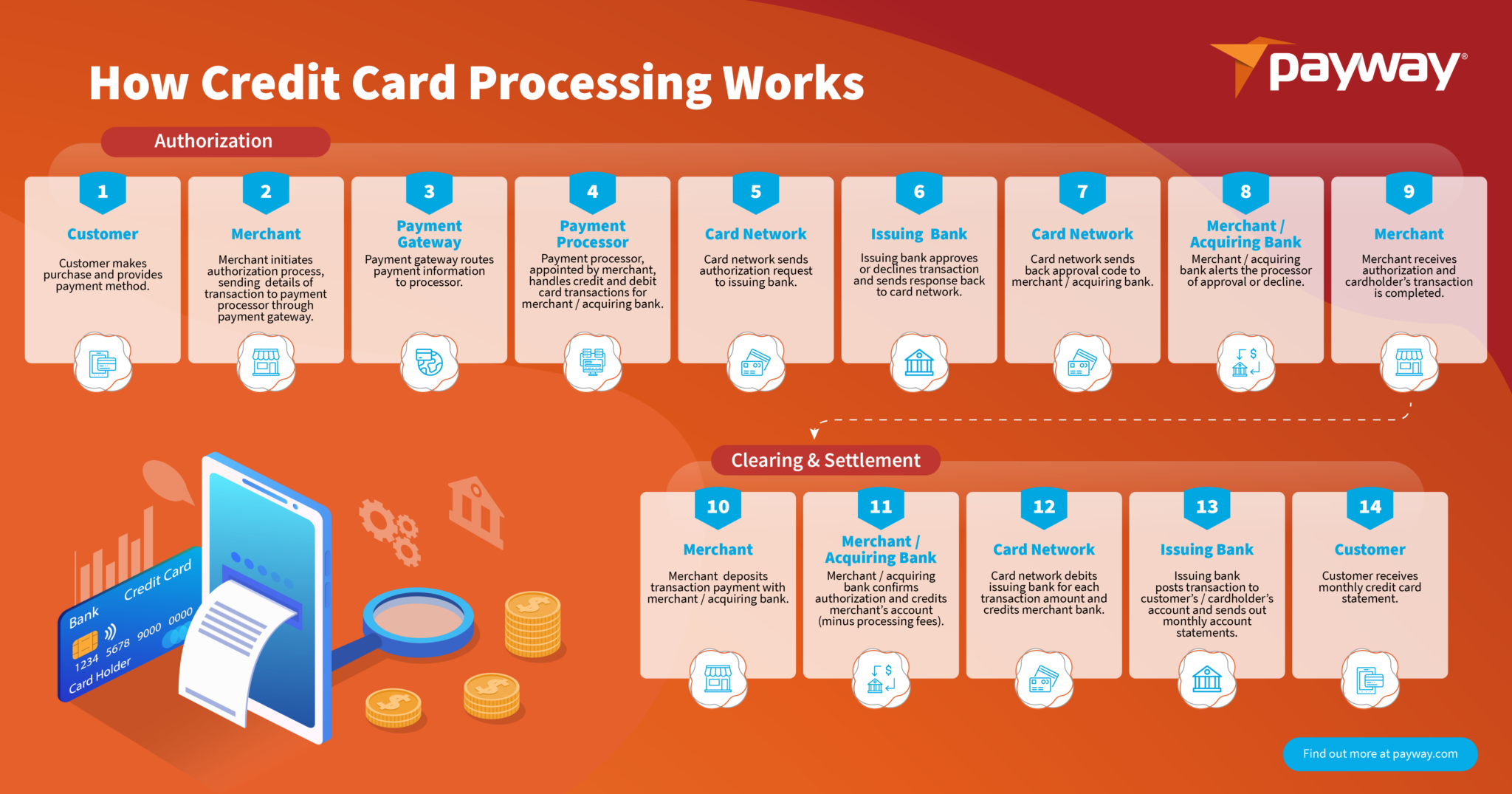

Understanding the Payment Processing Ecosystem

The journey of a credit card payment involves several key players. These include the merchant, the customer's issuing bank, the merchant's acquiring bank, and the payment processor. Each entity plays a vital role in verifying the transaction and transferring funds.

Payment processors act as intermediaries, routing transaction data between the merchant and the banks. The speed at which they operate directly impacts the overall processing time. This involves authentication and authorization of the transaction, as well as transfer of funds.

Factors Influencing Processing Time

Numerous factors can affect how long it takes for a credit card payment to process. Some of these factors are inherent to the system, while others are specific to the merchant or the transaction itself.

Bank Processing Times

Banks have their own internal procedures for verifying and settling transactions. These procedures can vary based on the bank, the time of day, and the day of the week. Weekends and holidays often lead to longer processing times due to reduced staffing.

Payment Processor Efficiency

Different payment processors employ varying technologies and protocols. Some processors utilize faster networks and more streamlined verification processes, resulting in quicker transaction times. Choosing the right payment processor can significantly impact the speed of settlement.

Transaction Type and Risk

Certain types of transactions, such as international payments or high-value purchases, may require additional verification steps. These additional steps inevitably increase the processing time. Increased security measures are required to prevent fraud and ensure secure transactions.

The geographic location of the buyer and seller can also impact processing times. Cross-border transactions may necessitate currency conversion and additional regulatory compliance checks, leading to longer delays. Such transactions may incur international transaction fees.

Merchant Account Setup and History

New merchants may experience longer processing times initially, as banks and processors assess their risk profile. Establishing a positive transaction history can help expedite future payments. A good credit score is critical.

Fraud Prevention Measures

Security measures, while crucial for protecting against fraud, can sometimes introduce delays. Address Verification System (AVS) checks and CVV verification add extra steps to the process. These measures are in place to protect both the merchant and the customer.

The Impact of Delays

Slow credit card payment processing can have several negative consequences for businesses. These include delayed access to funds, cash flow issues, and potential customer dissatisfaction.

For small businesses, delayed access to funds can be particularly problematic. It can hamper their ability to cover operating expenses or invest in growth opportunities. Efficient cash flow is essential for survival and growth.

Customers may become frustrated if they experience delays in receiving confirmations or refunds. This can lead to negative reviews and damage the merchant's reputation. Transparent communication about potential processing times is crucial.

Emerging Solutions and Technologies

The payment industry is constantly evolving, with new technologies and solutions emerging to address the issue of slow processing times. These innovations aim to streamline the process and provide faster access to funds.

Instant payment systems are gaining popularity, offering near-instantaneous transaction settlements. These systems utilize real-time payment networks and advanced fraud detection mechanisms.

Blockchain technology has the potential to revolutionize payment processing by providing a secure and transparent platform for transactions. However, its widespread adoption still faces regulatory and scalability challenges.

Faster payment processors and banking APIs are enabling more streamlined and efficient data transfer. This results in reduced processing times and quicker access to funds. Technological advancements are continuously improving the speed and security of payment processing.

Looking Ahead

The future of credit card payment processing is likely to be characterized by increased speed, efficiency, and transparency. As technology continues to advance, we can expect to see further innovations that reduce processing times and enhance the overall payment experience. Banks are modernizing infrastructure for 24/7 real-time capabilities, according to a recent statement from the Federal Reserve.

Merchants should prioritize choosing payment processors that offer fast settlement times and robust security measures. Staying informed about emerging payment technologies can help businesses optimize their payment processes and improve customer satisfaction.

Industry analysts predict that instant payment systems will become increasingly prevalent in the coming years.

![Credit Card Payment Processing Time Credit Card Processing Guide: Everything You Need to Know [in 2022]](https://www.gettrx.com/wp-content/uploads/2021/11/stages-of-payment-processing.png)