Credit Score Needed For Brandsmart Credit Card

Are you eyeing that new appliance at BrandsMart U.S.A. but unsure if your credit score makes the cut for their store credit card? The answer could impact your purchasing power sooner than you think.

This report cuts straight to the chase, providing the credit score information you need to determine your eligibility for the BrandsMart U.S.A. credit card, empowering you to make informed decisions about your next big purchase.

What Credit Score Do You Need?

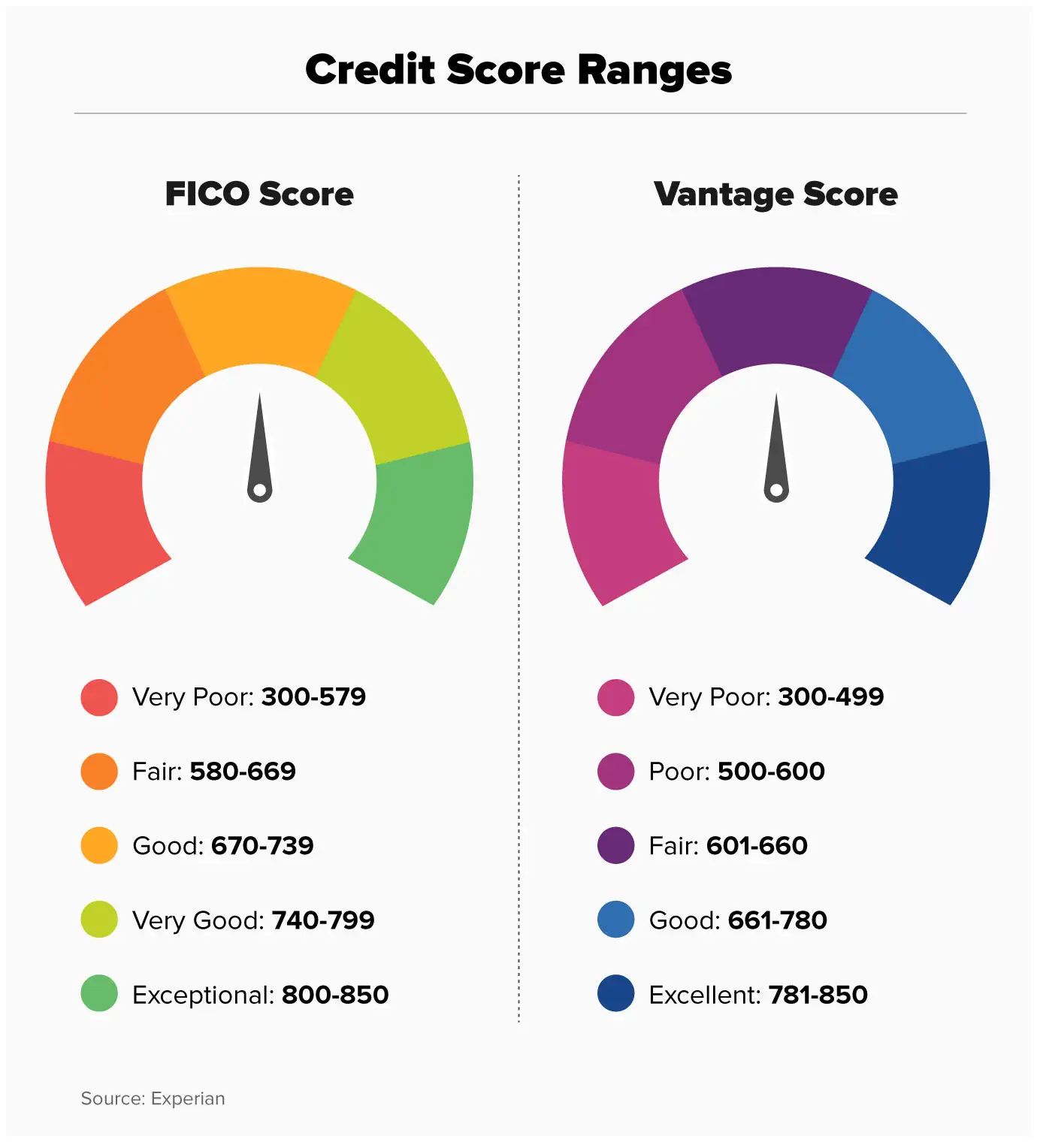

BrandsMart U.S.A. partners with Synchrony Bank to offer their store credit card. While Synchrony Bank doesn't publicly disclose the exact minimum credit score required, data points suggest that a fair to good credit score is generally needed.

This typically translates to a FICO score of 620 or higher to increase your chances of approval. Some customers have reported approvals with scores slightly below this threshold, but it's not a guarantee.

Factors Beyond Your Credit Score

Keep in mind that your credit score is only one piece of the puzzle. Synchrony Bank will also assess your overall creditworthiness, including your credit history, debt-to-income ratio, and payment history.

A longer credit history with responsible borrowing habits will strengthen your application. Conversely, multiple recent applications for credit or high outstanding debt could decrease your approval odds.

Key Application Considerations

A stable income is crucial for demonstrating your ability to repay any debt incurred. Be prepared to provide proof of income, such as pay stubs or bank statements, during the application process.

Ensure your application information is accurate and complete to avoid delays or denials. Double-check your address, Social Security number, and employment details.

Benefits of the BrandsMart U.S.A. Credit Card

The BrandsMart U.S.A. credit card, issued by Synchrony Bank, offers exclusive benefits, including special financing options. These options, typically available for a limited time, can range from deferred interest periods to reduced APRs.

Cardholders also receive access to exclusive promotions and discounts throughout the year. This can translate to significant savings on your purchases.

How to Apply

You can apply for the BrandsMart U.S.A. credit card online or in-store at any BrandsMart U.S.A. location. The application process typically takes just a few minutes.

You'll receive a decision almost immediately upon submitting your application, allowing you to take advantage of the card's benefits right away, if approved.

What If You're Denied?

If your application is denied, Synchrony Bank will send you a letter explaining the reasons for the denial. This letter will also provide information on how to obtain a free copy of your credit report.

Take the time to review your credit report for any errors or inaccuracies that may be negatively impacting your score. You can dispute any errors with the credit bureaus.

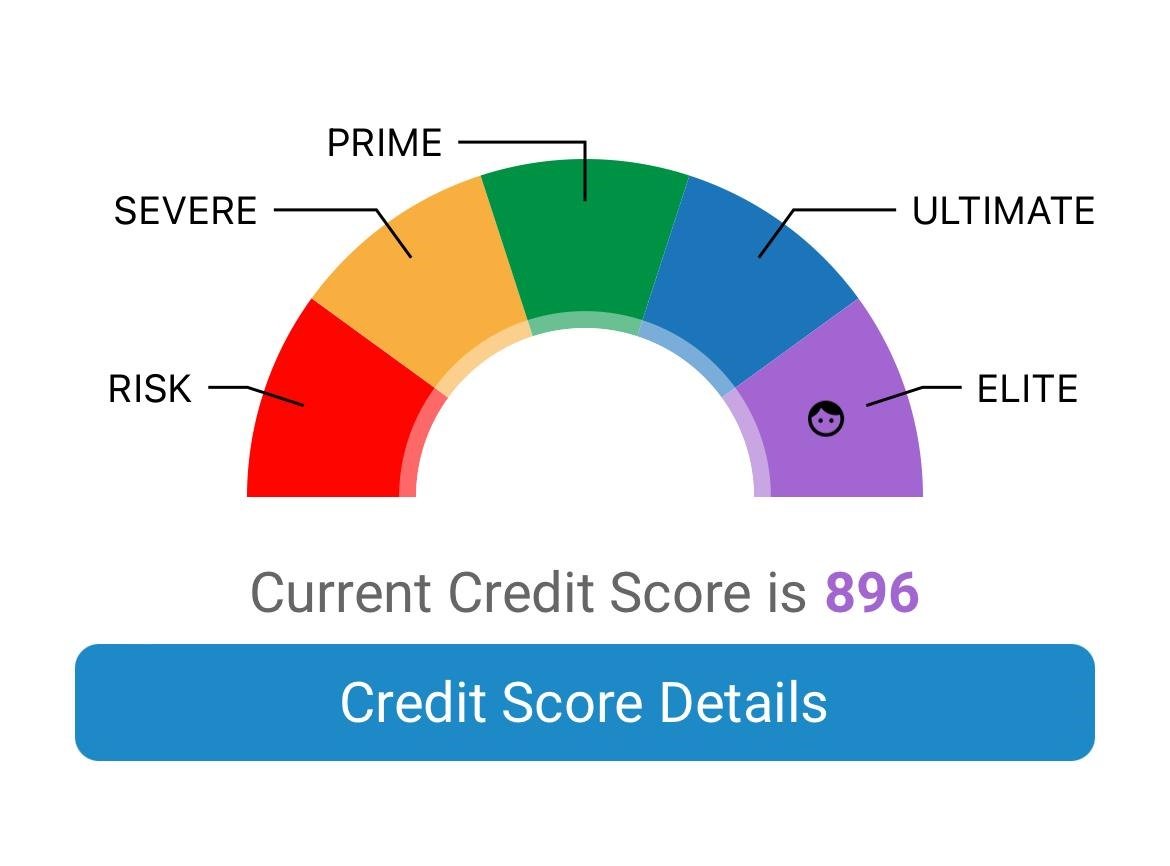

Consider focusing on improving your credit score by paying down debt, making on-time payments, and avoiding new credit applications. Reapply in a few months after you've made progress in these areas.

Moving Forward

Keep an eye on your credit score and focus on responsible credit management. By maintaining a healthy credit profile, you'll improve your chances of approval for the BrandsMart U.S.A. credit card and other financial products in the future.

Monitor your credit reports regularly for any suspicious activity. You are entitled to a free credit report from each of the three major credit bureaus annually: Equifax, Experian, and TransUnion.