Credit Score Needed For Capital One

In the realm of credit cards, accessibility hinges significantly on one's credit score. Capital One, a major player in the credit card industry, offers a diverse portfolio of cards tailored to different credit profiles. Understanding the credit score requirements for various Capital One cards is crucial for consumers seeking to build or improve their credit and access the benefits these cards offer.

This article delves into the credit score landscape surrounding Capital One credit cards, providing a comprehensive overview of the scores typically needed for approval. We will explore different card categories and the corresponding credit ranges, offering valuable insights for individuals looking to apply for a Capital One card. Navigating the credit card application process requires a clear understanding of these requirements, and this article aims to provide that clarity.

Understanding Credit Score Ranges for Capital One Cards

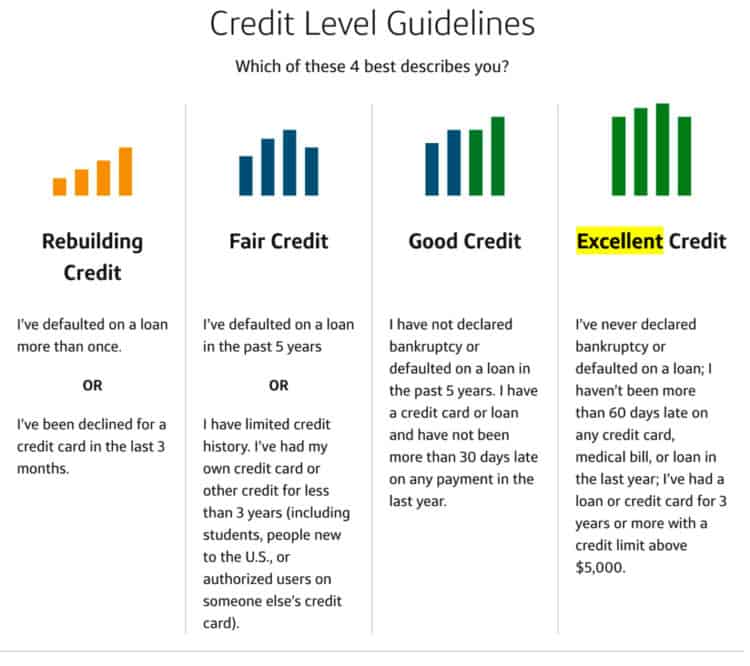

Capital One, like most credit card issuers, categorizes its cards based on the creditworthiness of the applicant. These categories generally align with standard credit score ranges, although internal factors may also influence approval decisions. Here's a breakdown of typical credit score ranges and the types of Capital One cards associated with them:

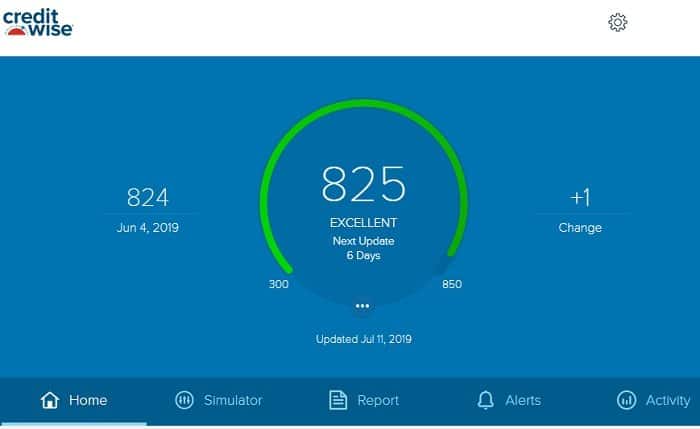

Excellent Credit (720-850)

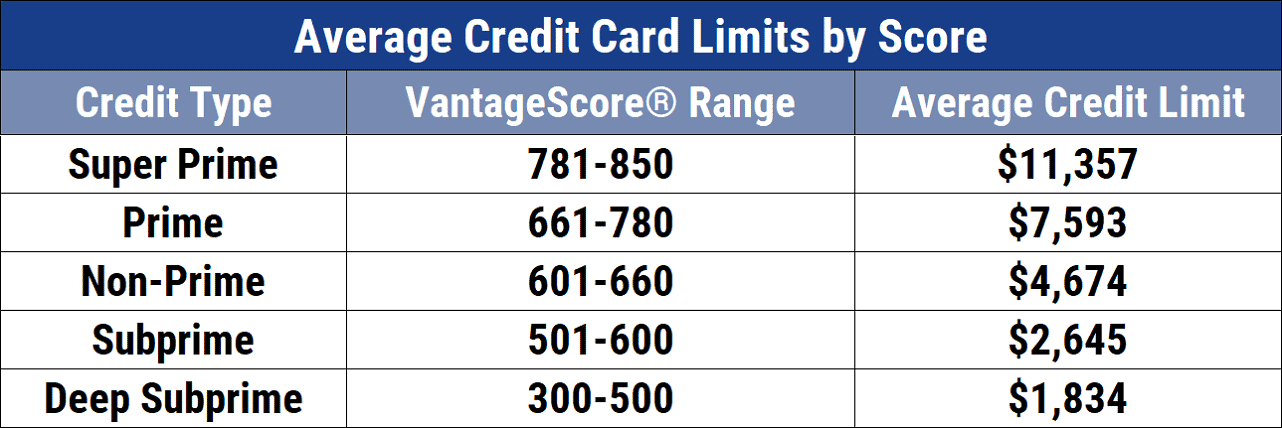

Individuals with excellent credit scores typically have the widest range of options available to them. Capital One offers premium rewards cards like the Capital One Venture X Rewards Credit Card and the Capital One Venture Rewards Credit Card to those with excellent credit. These cards often feature generous rewards programs, travel benefits, and higher credit limits.

Good/Fair Credit (630-719)

This range caters to individuals who have demonstrated responsible credit management but might have a limited credit history or a few minor blemishes. Cards designed for this range often help users build or rebuild their credit. The Capital One QuicksilverOne Cash Rewards Credit Card and the Capital One Platinum Credit Card are frequently targeted towards this segment.

Limited/No Credit History

For those new to credit or with very limited credit history, Capital One provides secured credit card options. The Capital One Secured Mastercard requires a security deposit, which acts as collateral and helps build credit. These cards are an excellent starting point for establishing a positive credit track record.

Beyond Credit Score: Other Factors Considered

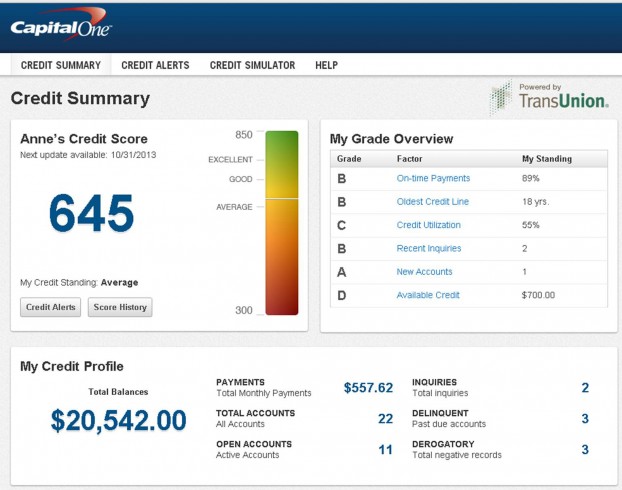

While credit score is a primary factor, Capital One also considers other elements when evaluating applications. These include income, employment history, and existing debt obligations. A stable income and low debt-to-income ratio can significantly improve approval chances, even with a borderline credit score.

Capital One, like other lenders, assesses the applicant's overall creditworthiness to determine the risk involved in extending credit. They review applicants credit reports to understand their previous credit behaviour. Responsible credit usage, such as on-time payments and low credit utilization, can increase the chances of approval.

Tips for Improving Your Approval Odds

If your credit score falls below the required range for your desired Capital One card, there are steps you can take to improve your approval odds. Checking your credit report for errors and disputing any inaccuracies can help boost your score. Furthermore, focusing on making timely payments on all existing debts and keeping credit utilization low are crucial.

Consider becoming an authorized user on a responsible friend or family member's credit card. This can help you establish a positive credit history more quickly. If your credit history is limited, a secured credit card can be a stepping stone to accessing unsecured cards.

Looking Ahead: Capital One's Evolving Landscape

The credit card landscape is constantly evolving, and Capital One regularly updates its card offerings and eligibility requirements. Staying informed about these changes is crucial for consumers seeking to maximize their chances of approval. Monitoring your credit score and maintaining responsible credit habits are essential ongoing practices.

While specific approval criteria might shift, the underlying principle remains constant: responsible credit management is key to accessing the best credit card products. Understanding the credit score requirements for Capital One cards empowers consumers to make informed decisions and pursue the credit card that aligns with their financial goals.