Credit Score To Apply For Discover Card

The pursuit of financial stability often begins with accessing credit, and for many, a Discover card represents a key stepping stone. However, navigating the credit score requirements for approval can be a daunting task, leaving potential applicants uncertain about their chances. Understanding these requirements is crucial for both building credit and avoiding application rejections that can further damage your credit standing.

This article delves into the credit score landscape for Discover cards, providing a comprehensive overview of what's typically needed to qualify. It will explore the different card options available, the factors Discover considers beyond credit scores, and strategies for improving your chances of approval. We will also examine insights from credit experts and recent data to offer a clear picture of the current approval climate.

Understanding the Credit Score Spectrum

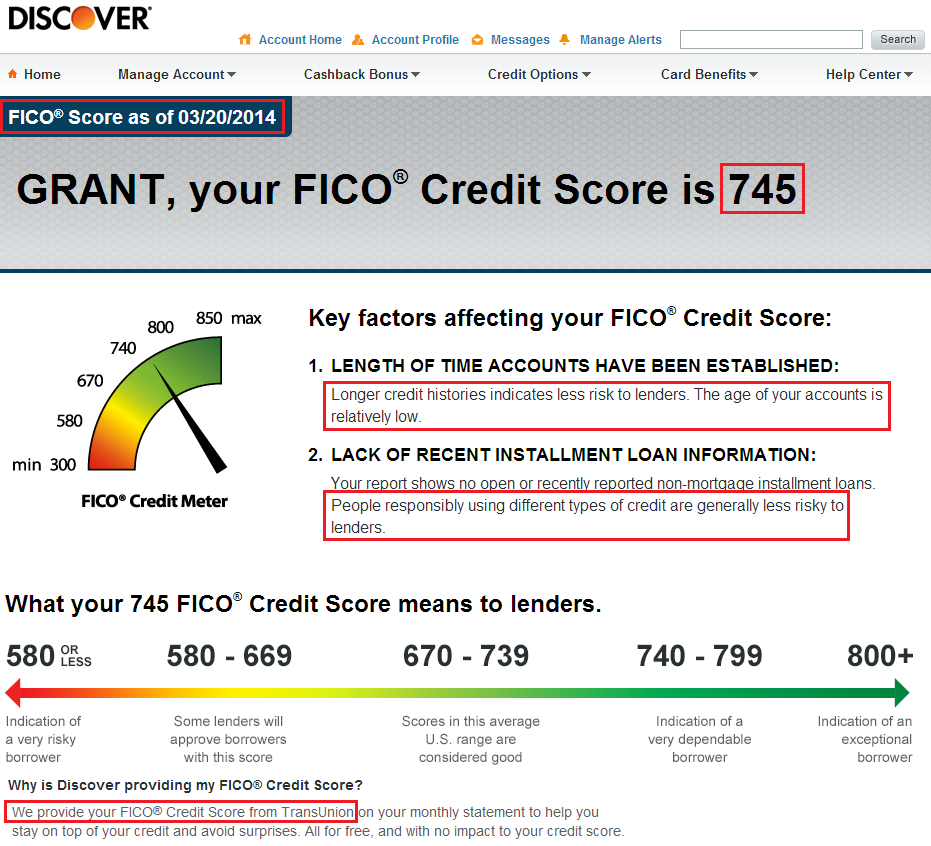

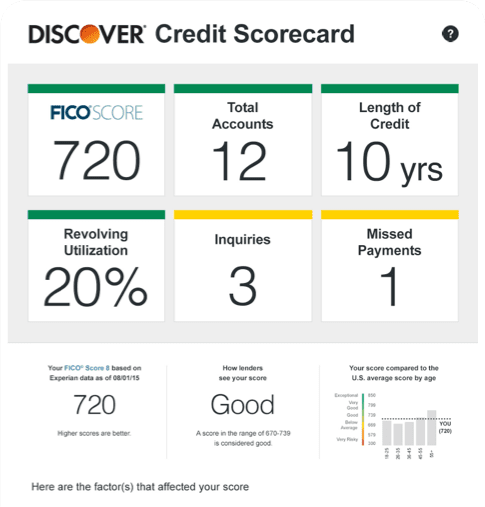

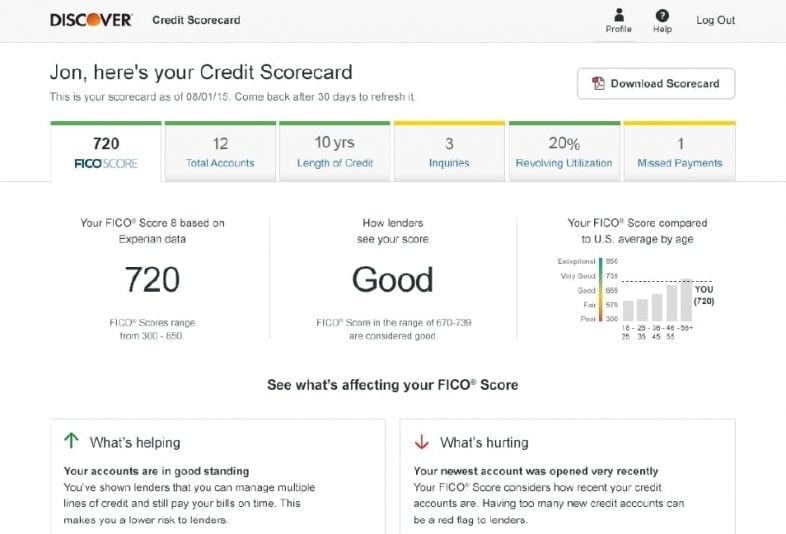

Credit scores, typically represented by FICO or VantageScore models, range from 300 to 850. Discover, like most credit card issuers, categorizes applicants based on their creditworthiness using these scores. These ranges generally fall into the following categories: Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), and Excellent (800-850).

While Discover doesn't explicitly publish minimum credit score requirements for each of its cards, data analysis and anecdotal evidence suggest general guidelines. Different Discover cards cater to different credit profiles, meaning the required credit score can vary widely.

Discover's Card Portfolio and Credit Score Requirements

Discover offers a variety of credit cards, each designed with specific rewards and benefits aimed at different customer segments. The Discover it® Secured Credit Card is generally considered the most accessible option for individuals with limited or no credit history. Because it's a secured card, it requires a security deposit, which acts as collateral and reduces the risk for Discover.

Applicants with fair credit (580-669) might consider the Discover it® Chrome Gas & Restaurant Rewards card. This card offers rewards on gas and restaurant purchases and is generally available to those who are actively working on improving their credit score.

Individuals with good to excellent credit (670+) have access to a broader range of Discover cards, including the Discover it® Cash Back card. This card typically requires a good to excellent credit score and offers rotating quarterly bonus categories that earn higher cash back rewards.

Beyond the Credit Score: Other Factors Discover Evaluates

While your credit score is a critical factor, Discover considers other aspects of your financial profile during the application process. These include your income, employment history, debt-to-income ratio (DTI), and overall credit history.

A steady income demonstrates your ability to repay your debts, and a stable employment history indicates financial reliability. A low DTI signals that you aren't overburdened with existing debt, increasing your chances of approval.

Furthermore, Discover examines your credit report for negative marks, such as bankruptcies, late payments, or collections accounts. The presence of these issues can significantly impact your approval odds, regardless of your credit score.

Strategies for Improving Your Approval Odds

If you're concerned about your credit score, there are several steps you can take to improve your chances of approval. Start by checking your credit report for errors and disputing any inaccuracies you find.

Paying your bills on time is paramount for building a positive credit history. You should also aim to keep your credit utilization ratio (the amount of credit you're using compared to your total available credit) low – ideally below 30%.

Consider becoming an authorized user on someone else's credit card account, provided they have a good credit history. This can help you build credit quickly, but ensure the primary cardholder uses the card responsibly.

Expert Perspectives on Credit Card Approval

According to Ted Rossman, a senior industry analyst at CreditCards.com, "Discover is known for being relatively accessible to those with fair credit, particularly their secured card offering." He cautions, however, that even with a fair credit score, a history of late payments or high debt could lead to rejection.

Lyle Daly, a credit card expert at The Ascent, suggests that "applicants should research the specific requirements for each Discover card they're interested in and focus on improving the factors that are most relevant." He emphasizes the importance of addressing any negative marks on your credit report before applying.

Looking Ahead: Credit Card Approval Trends

The credit card approval landscape is constantly evolving, influenced by economic conditions and issuer policies. Experts predict that as interest rates rise and economic uncertainty persists, lenders may become more cautious in their lending practices.

It's essential to monitor your credit score regularly and stay informed about the latest credit card trends. By understanding the credit score requirements and other factors Discover considers, you can increase your chances of being approved for the card that best suits your needs and financial goals.

:max_bytes(150000):strip_icc()/discover-business-card_FINAL-62720016f74d497d90e0dc0896ca0be4.png)