Cross Price Elasticity Of Demand Positive Or Negative

The price of gasoline surged last month, leading to a noticeable increase in public transportation ridership in several major metropolitan areas. This seemingly simple observation touches on a fundamental economic concept: the cross price elasticity of demand, a measure of how the quantity demanded of one good responds to a change in the price of another.

At its core, understanding whether cross price elasticity is positive or negative provides insights into the relationship between goods, revealing whether they are substitutes or complements. This information is crucial for businesses making pricing and production decisions, as well as for policymakers assessing the impact of taxes or subsidies.

Understanding Cross Price Elasticity

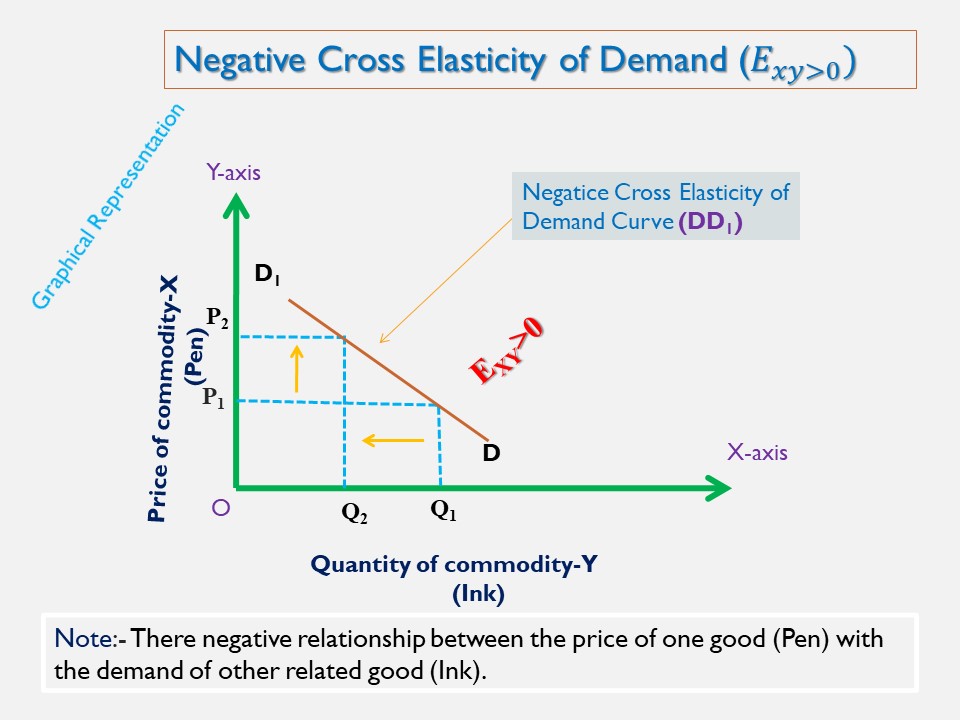

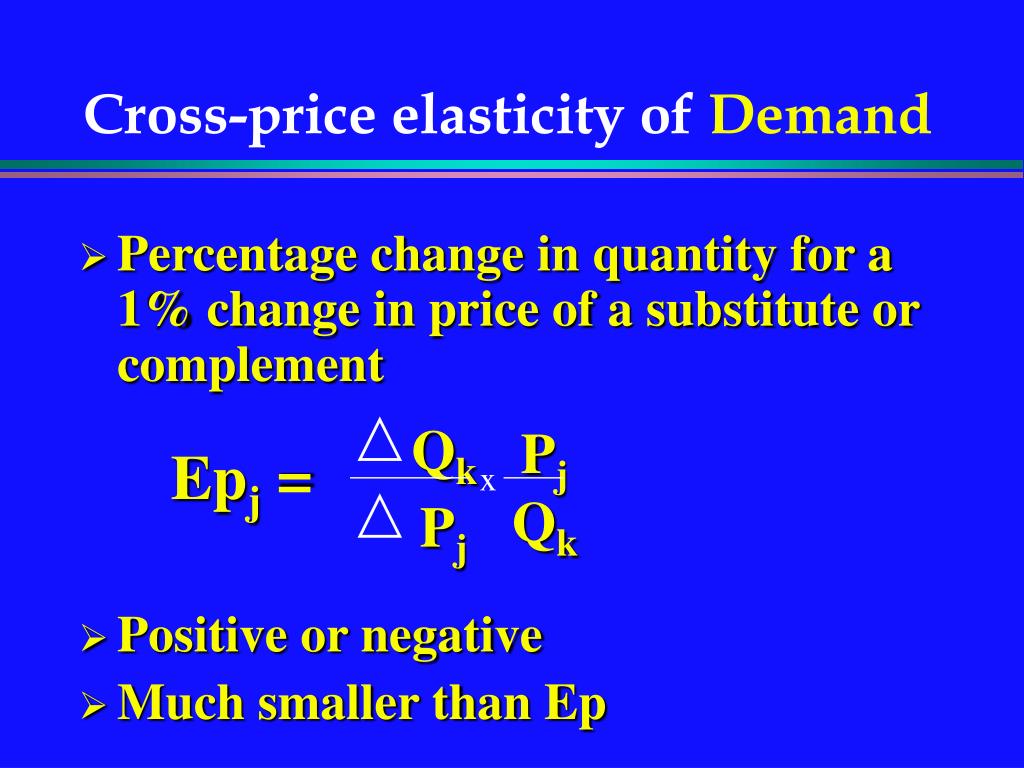

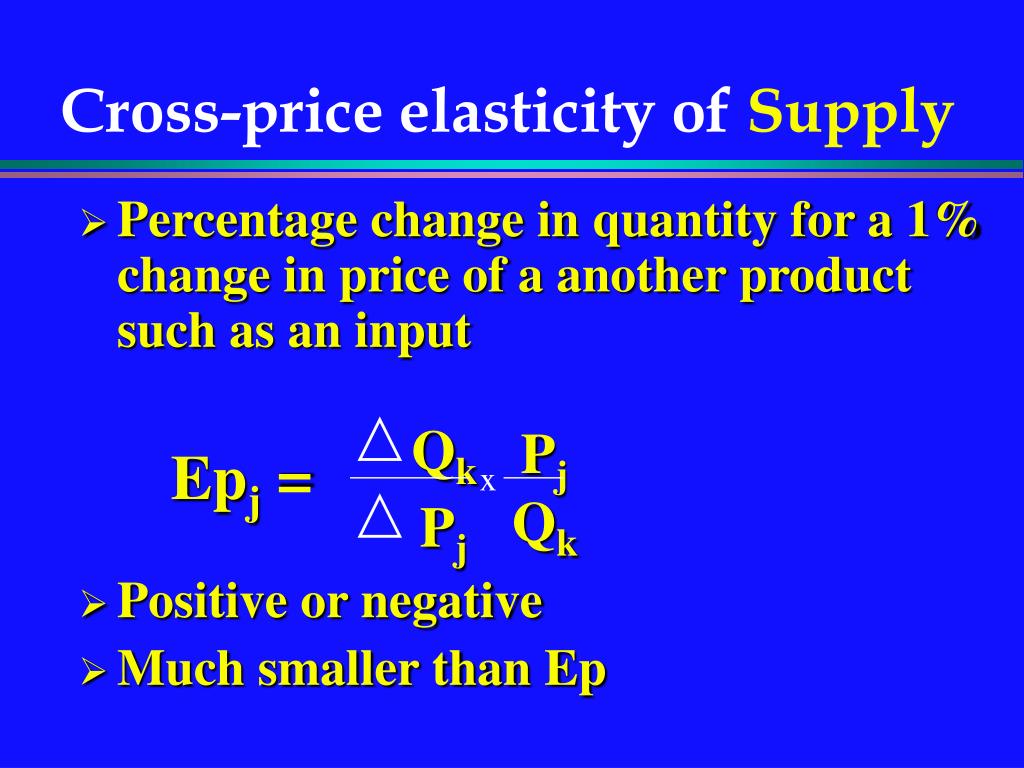

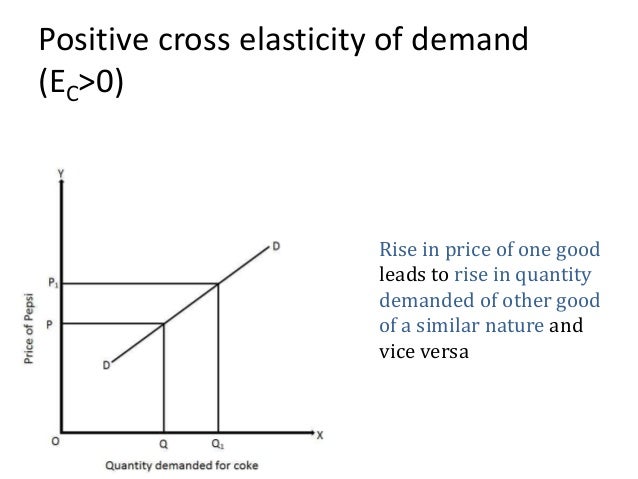

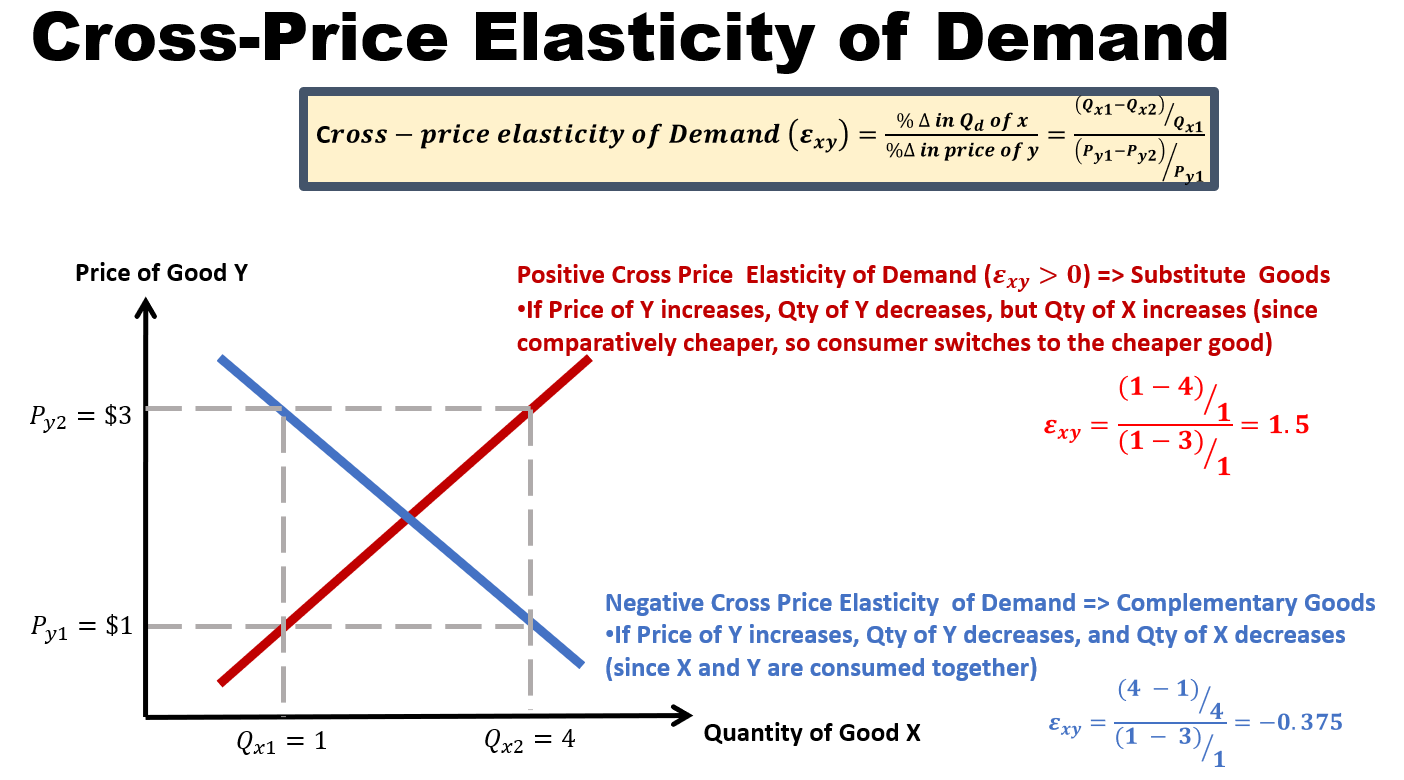

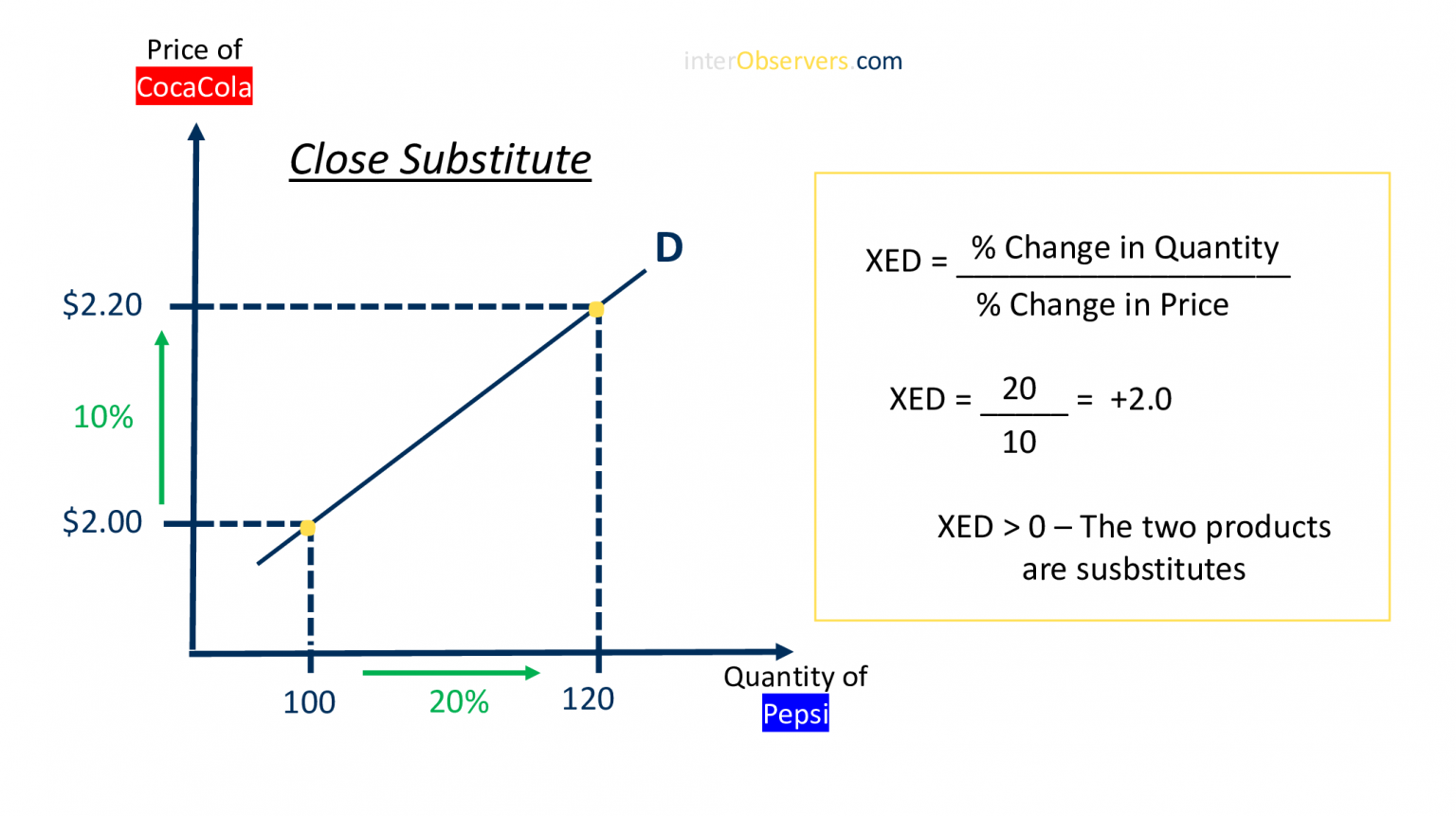

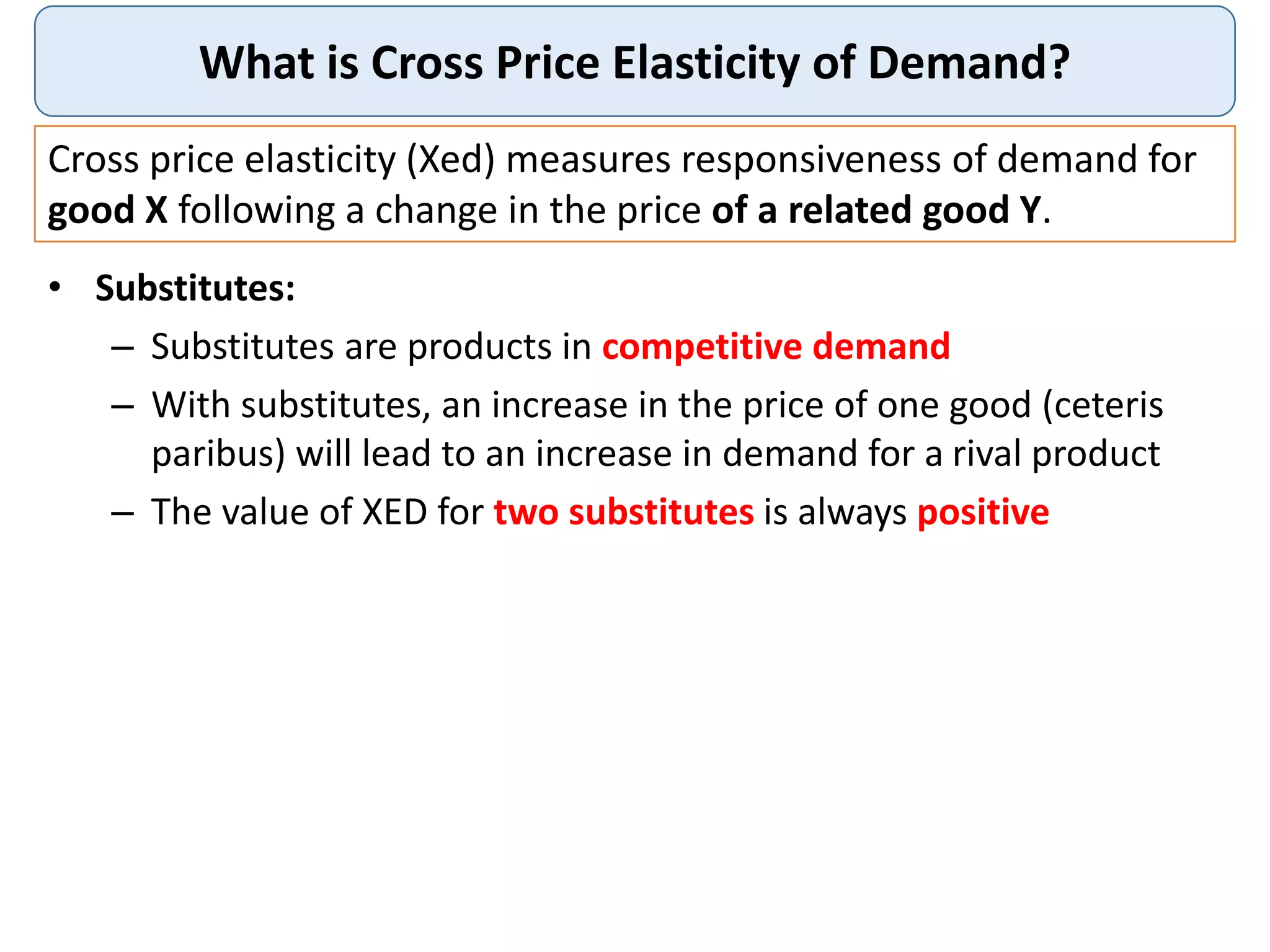

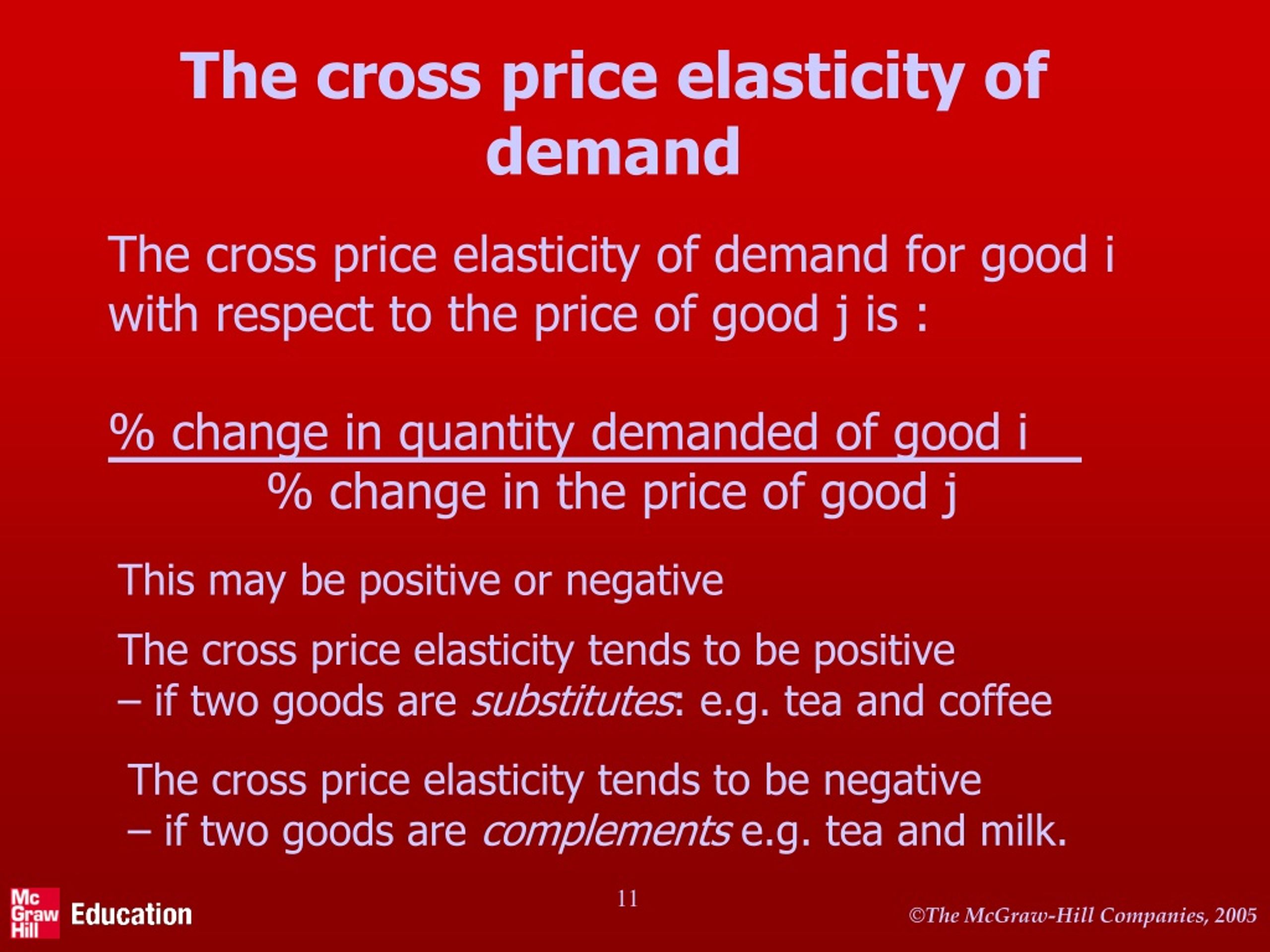

Cross price elasticity of demand (CPED) quantifies the responsiveness of the quantity demanded for one product to a change in the price of another. The formula is straightforward: percentage change in quantity demanded of good A divided by the percentage change in price of good B. The resulting sign, either positive or negative, is what reveals the nature of the relationship.

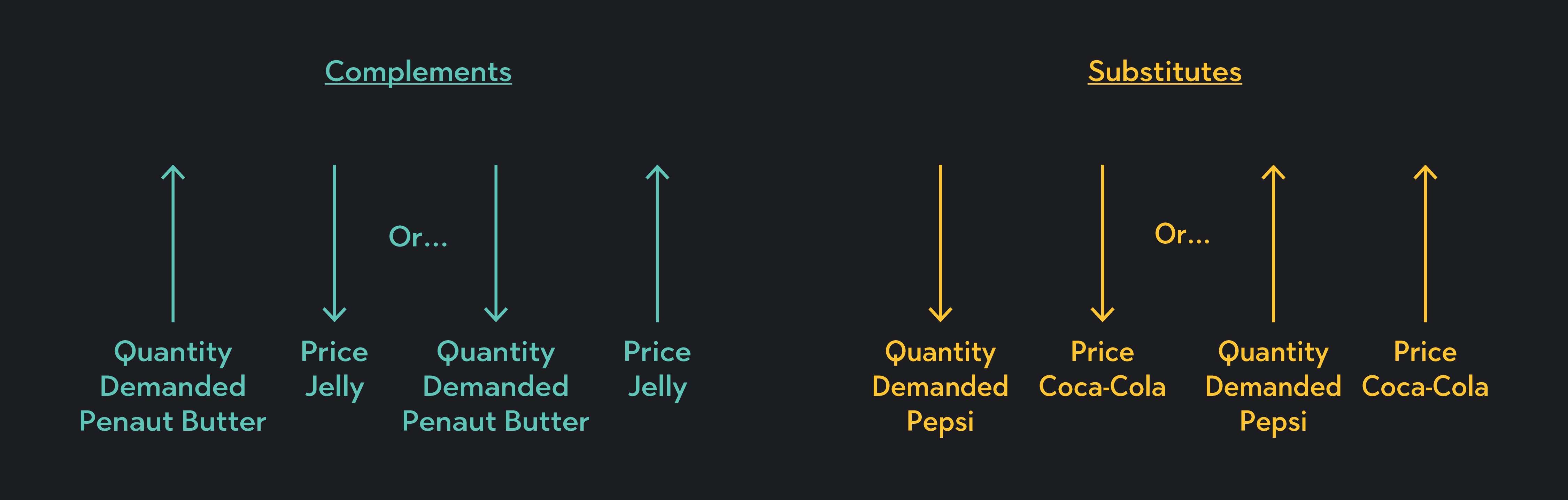

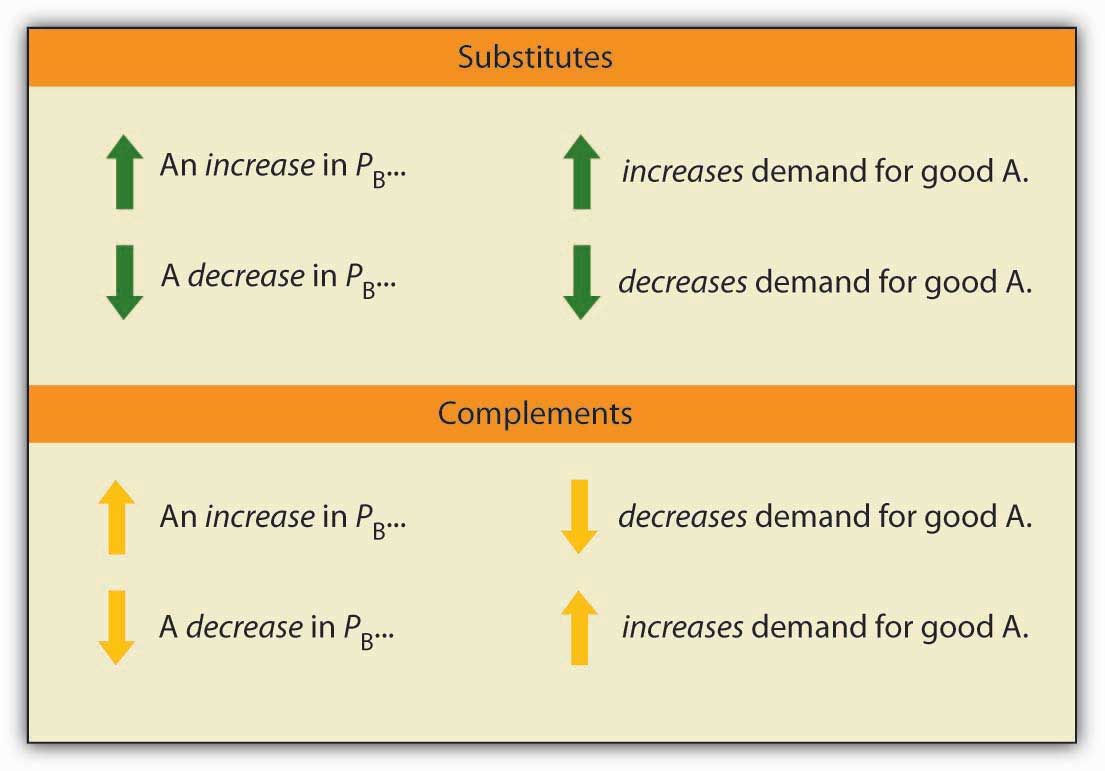

A positive CPED indicates that the two goods are substitutes. Think of coffee and tea; if the price of coffee increases, consumers may switch to tea, leading to a higher demand for tea. This substitution effect is key.

Conversely, a negative CPED signifies that the two goods are complements. Consider cars and gasoline. An increase in the price of gasoline may lead to a decrease in the demand for cars, as the overall cost of car ownership rises.

The Significance of the Sign

The sign of the cross price elasticity is more than just a mathematical result; it's a powerful indicator for businesses and policymakers. Understanding these relationships can inform pricing strategies, predict consumer behavior, and even shape government interventions in the market.

For businesses, knowing that two products are substitutes allows for strategic pricing adjustments. If a company anticipates a competitor raising prices, it might choose to maintain its own prices to capture a larger market share.

Alternatively, if a company sells complementary goods, it can use that knowledge to bundle products together or offer discounts on one to boost sales of the other. These kinds of strategies are common in many industries.

Real-World Examples and Implications

The recent increase in public transportation ridership following a rise in gasoline prices perfectly illustrates a positive cross price elasticity of demand. People viewed public transportation as a substitute for driving their cars, especially with rising fuel costs.

According to data released by the American Public Transportation Association (APTA), several major cities reported a noticeable increase in ridership last month. In New York City, subway ridership increased by 5%, while in Los Angeles, bus ridership saw a 7% jump.

Beyond transportation, consider the relationship between smartphones and mobile apps. A decrease in the price of smartphones, driven by increased competition, has arguably led to an increase in the demand for mobile apps. This is because more people now have access to devices on which to use these apps.

The video game console market also provides a clear example. Consoles and games for that console are complementary goods. If Sony lowers the price of the PlayStation 5, they can expect to see an increase in the demand for PlayStation 5 games, and vice-versa.

Potential Impact and Considerations

Understanding cross price elasticity is also critical for predicting the impact of government policies. For example, a tax on sugary drinks might lead to an increase in the demand for diet sodas or other sugar-free beverages. These are considered substitutes.

Conversely, a subsidy on electric vehicles could lead to an increase in the demand for charging stations, as these are complementary goods. Policy makers need to analyze these relationships.

However, accurately measuring cross price elasticity can be challenging. Various factors can influence consumer behavior, and isolating the effect of price changes from other variables requires careful statistical analysis.

Furthermore, the relationship between goods can change over time. What was once considered a substitute might become a complement, or vice versa, due to technological advancements or changing consumer preferences. This dynamic nature needs to be considered.

Conclusion

The cross price elasticity of demand, whether positive or negative, provides valuable insights into the relationships between goods and the dynamics of the market. Businesses and policymakers can leverage this understanding to make informed decisions, predict consumer behavior, and effectively shape market outcomes.

As market conditions continue to evolve, staying attuned to these relationships and their implications will be crucial for success.