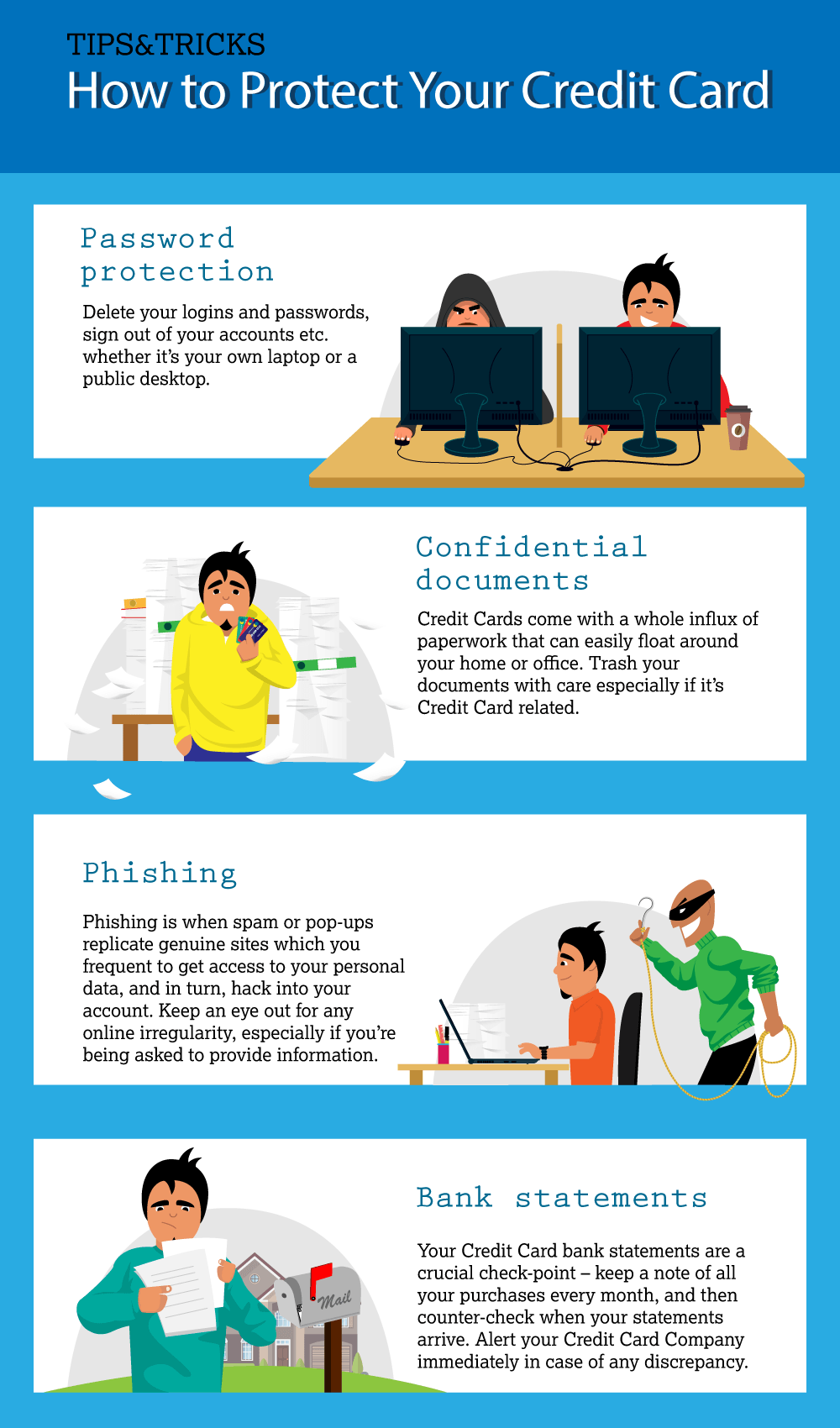

How To Protect Your Credit Card In Your Wallet

In today's digital age, safeguarding your credit cards from physical threats while they're in your wallet is a growing concern. With advancements in technology come increasingly sophisticated methods of theft, making proactive protection more critical than ever.

This article provides practical strategies and expert advice on how to protect your credit cards from damage, theft, and unauthorized access while in your wallet. By implementing these measures, consumers can significantly reduce their risk and maintain financial security.

Understanding the Risks

The primary risks to credit cards in wallets include physical damage, theft, and RFID skimming.

Physical damage, such as bending or scratching the magnetic stripe or chip, can render a card unusable. Theft, whether from pickpocketing or simple loss, poses a direct financial threat. RFID skimming involves using electronic readers to steal card information wirelessly.

Protecting Against Physical Damage

Choosing the right wallet is crucial. Opt for wallets with dedicated card slots that provide snug fits. This will prevent cards from rubbing against each other or bending.

Consider wallets made from rigid materials like metal or hard plastic to offer enhanced protection against external pressure. Avoid overfilling your wallet, as this increases the risk of cards bending or breaking. Keep your wallet in a secure location, such as a front pocket, rather than a back pocket.

Preventing Theft

Be vigilant in crowded areas where pickpockets operate. Keep your wallet in a location that is difficult for thieves to access, such as an inside coat pocket or a front pants pocket.

Consider using a money clip or a slim wallet to reduce the profile of your wallet. This will make it less noticeable and harder to steal. Always be aware of your surroundings and avoid displaying large amounts of cash.

Combating RFID Skimming

RFID skimming is a silent threat. Criminals use readily available technology to wirelessly steal your credit card information without physically touching your card.

The most effective defense against RFID skimming is using an RFID-blocking wallet or individual card sleeves. These products contain materials that block electromagnetic fields, preventing skimmers from accessing your card data. According to a report by the Better Business Bureau, RFID-blocking wallets are increasingly popular among consumers concerned about digital theft.

How RFID-Blocking Wallets Work

RFID-blocking wallets typically incorporate a layer of aluminum or carbon fiber. This material creates a Faraday cage, which shields the cards from electromagnetic radiation.

This effectively prevents unauthorized readers from accessing the card's chip. When choosing an RFID-blocking wallet, ensure it is certified by a reputable testing organization to guarantee its effectiveness.

Additional Security Measures

Regularly review your credit card statements for unauthorized transactions. Report any suspicious activity immediately to your bank or credit card issuer.

Consider setting up transaction alerts on your credit card accounts. This will notify you of any purchases made with your card, allowing you to quickly identify and report fraudulent activity. Keep your credit card numbers and expiration dates in a secure location, separate from your wallet.

In the event of a lost or stolen wallet, immediately report the loss to your bank or credit card issuer. They can cancel your cards and issue replacements, minimizing your financial risk.

The Human Element: A Case Study

Sarah Miller, a frequent traveler, learned the importance of wallet security the hard way. While on a business trip, her wallet was pickpocketed from her back pocket. Fortunately, she had transaction alerts set up on her credit card account.

Within minutes of the theft, she received a notification about an unauthorized purchase. Sarah was able to quickly contact her bank, cancel her cards, and limit the damage. "It was a stressful experience, but the transaction alerts saved me from potentially significant financial loss," she said.

Conclusion

Protecting your credit cards in your wallet requires a multi-faceted approach. By combining physical security measures, theft prevention strategies, and RFID-blocking technology, consumers can significantly reduce their risk of becoming victims of fraud.

Staying informed, remaining vigilant, and taking proactive steps are essential for maintaining financial security in an increasingly digital world. Remember to regularly review your credit card statements and report any suspicious activity immediately.