Debt Free Listed Companies In India

Imagine a bustling marketplace, vendors calling out their wares, each vying for attention. But in a quiet corner, a few stalls stand apart – businesses that own their inventory outright, their owners free from the burden of loans. This is a snapshot of a unique segment within the Indian stock market: debt-free listed companies.

This article explores the intriguing world of publicly traded Indian companies that operate without debt. These firms represent a beacon of financial prudence, showcasing stability and resilience in a dynamic economic landscape.

Operating without debt is a significant achievement, especially in a developing economy like India where businesses often rely on borrowing to fuel growth. These companies demonstrate a commitment to sustainable practices and strategic financial management.

The Rarity and Appeal of Debt-Free Companies

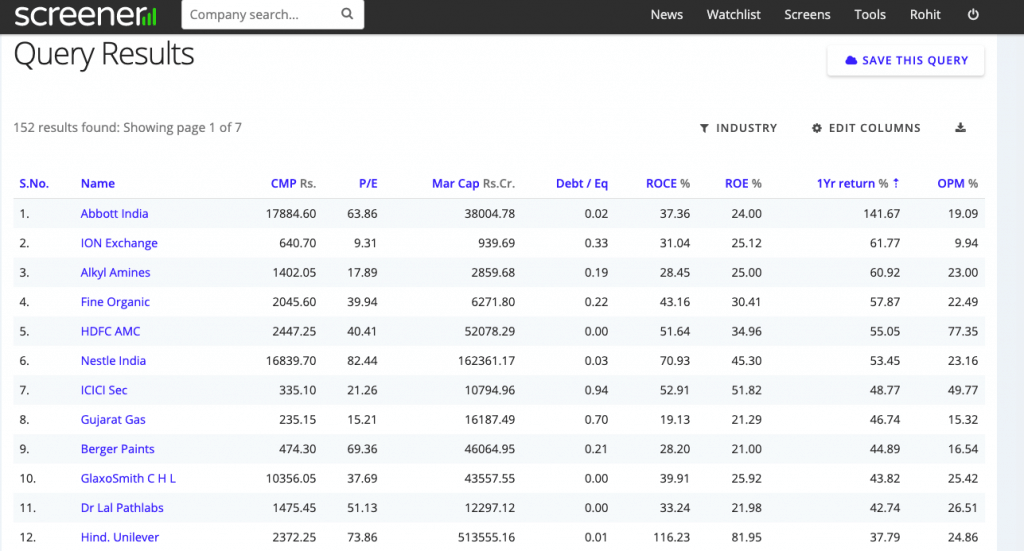

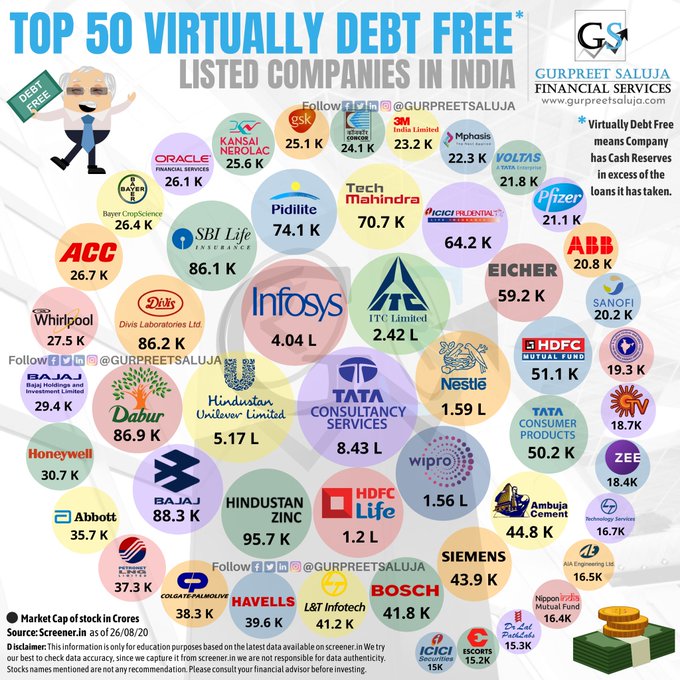

Debt-free listed companies are relatively rare. A 2023 report by ICRA Limited noted that only a small percentage of listed companies in India maintain a consistently debt-free status. Their scarcity makes them particularly attractive to investors seeking stability and long-term value.

These companies are often viewed as safer investments. They are less vulnerable to economic downturns and interest rate fluctuations. They have greater financial flexibility to pursue growth opportunities or weather unforeseen challenges.

Key Sectors and Examples

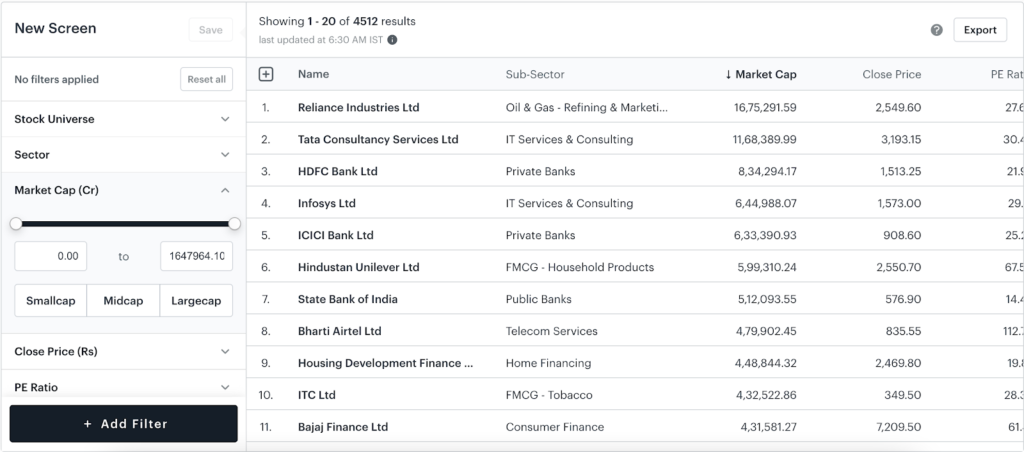

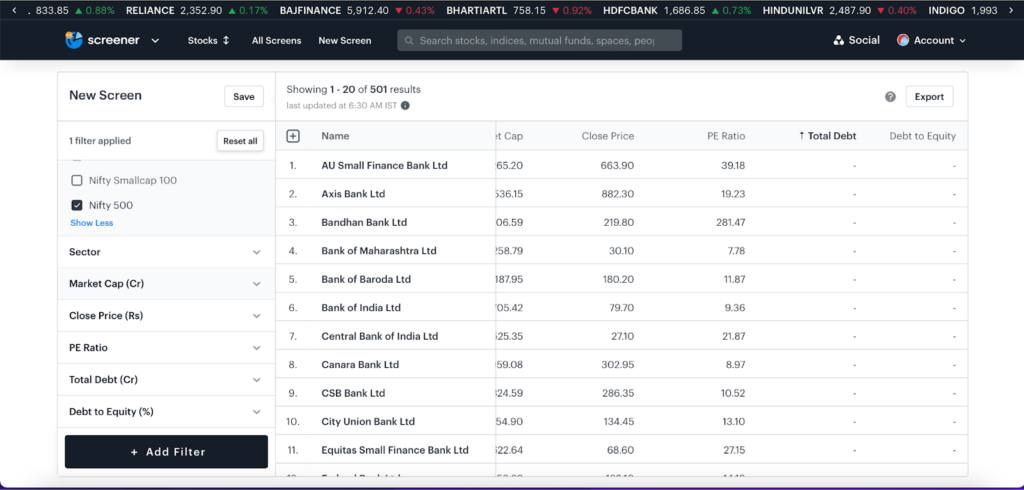

Debt-free companies can be found across various sectors in India. Information technology, fast-moving consumer goods (FMCG), and pharmaceuticals are some sectors where debt-free firms often thrive. Their strong cash flows and established market positions allow them to self-finance their operations.

While specific names fluctuate depending on market conditions and financial performance, some companies that have historically maintained low or no debt levels include firms in the IT services and consumer goods space. It's crucial to consult the latest financial reports for the most up-to-date information.

Take, for example, a hypothetical company, "Arya Tech," a fictitious IT services firm. If Arya Tech consistently reinvests its profits into research and development and maintains a robust cash reserve, it could potentially operate debt-free for extended periods.

The Significance of a Debt-Free Status

Being debt-free sends a powerful message to the market. It signals financial strength and discipline. It indicates to investors that the company is less likely to face financial distress, even in turbulent times.

This financial health translates into other advantages. Debt-free companies often have a higher credit rating, making it easier and cheaper to access capital if they ever choose to borrow. They can also focus on innovation and growth, rather than being burdened by debt repayment obligations.

Furthermore, a debt-free status enhances a company's reputation. It builds trust with suppliers, customers, and employees. It reinforces the perception of a well-managed and sustainable business.

Challenges and Considerations

While being debt-free is generally advantageous, it's not without potential drawbacks. Some argue that companies might miss out on growth opportunities by avoiding leverage. Strategic use of debt can sometimes accelerate expansion and increase shareholder value.

Also, simply being debt-free doesn't guarantee success. Companies still need to have a strong business model, effective management, and adapt to changing market dynamics. Financial prudence must be coupled with innovation and strategic vision.

Therefore, investors should conduct thorough due diligence. They should analyze a company's overall financial performance, competitive position, and growth prospects, rather than solely relying on its debt-free status as the sole indicator of investment potential.

Looking Ahead

The presence of debt-free listed companies in India offers a valuable perspective on sound financial management. These firms demonstrate that sustainable growth and long-term value creation are possible without excessive reliance on borrowing.

As the Indian economy continues to evolve, these companies may serve as inspiration for others. By embracing financial prudence and disciplined resource allocation, more businesses can aspire to achieve similar levels of financial independence.

Ultimately, the journey to becoming and remaining debt-free is a testament to strong leadership and a commitment to long-term success. It's a path that requires careful planning, disciplined execution, and a relentless focus on building a resilient and sustainable business.

![Debt Free Listed Companies In India How to find debt free companies in India? [Using Screener]](https://tradebrains.in/wp-content/uploads/2017/12/top-large-companies-with-zero-debt.png)

![Debt Free Listed Companies In India Debt-Free Companies: Are All Zero Debt Stocks Good? [2024] - GETMONEYRICH](https://getmoneyrich.com/wp-content/uploads/2015/05/Debt-free-companies-in-India-image.png)