Debt Is The Most Aggressively Marketed Product

Imagine strolling down a bustling city street, the vibrant energy of life swirling around you. Storefronts beckon with enticing displays, billboards flash promises of a better life, and even your phone buzzes with targeted ads. But beneath the surface of this consumer paradise lies a subtle yet pervasive force: the aggressive marketing of debt, subtly woven into the fabric of our daily existence.

This article explores how debt, often disguised as opportunity and convenience, has become the most aggressively marketed product in our modern world. We will delve into the strategies used to normalize and promote borrowing, examine the implications of this trend, and consider how individuals can navigate this landscape with greater awareness and financial well-being.

The Ubiquity of Debt Marketing

Everywhere we look, debt is being packaged and presented as a solution, not a burden. From credit card offers promising rewards points and cashback to "buy now, pay later" schemes that make instant gratification irresistible, the message is clear: you can have what you want, when you want it, with minimal immediate cost.

This relentless marketing is not accidental. Financial institutions spend billions of dollars annually to convince consumers that debt is a necessary and even desirable tool for achieving their goals. Consider the sheer volume of credit card commercials aired during sporting events or the barrage of online ads promoting personal loans for everything from vacations to home renovations.

According to a 2023 report by the Federal Trade Commission (FTC), marketing expenditures by consumer credit companies have steadily increased over the past decade, reaching a new high in the last year. This data highlights the intense competition within the lending industry to capture consumer attention and encourage borrowing.

The Psychological Angle

The marketing of debt goes beyond simply advertising available products. It taps into our deepest desires and insecurities. These campaigns often portray debt as a pathway to happiness, success, and belonging.

Advertisements frequently feature aspirational lifestyles, showcasing individuals enjoying lavish vacations, driving luxury cars, or living in beautifully furnished homes – all seemingly made possible by the magic of credit. This creates a powerful emotional connection, suggesting that borrowing is the key to unlocking a better version of ourselves.

Furthermore, many debt products are marketed using psychological techniques such as "anchoring" (presenting a high price point to make a lower price seem more appealing) and "loss aversion" (highlighting the potential benefits missed by not taking on debt). These tactics subtly influence our decision-making, making us more likely to borrow than we otherwise would be.

The Normalization of Debt

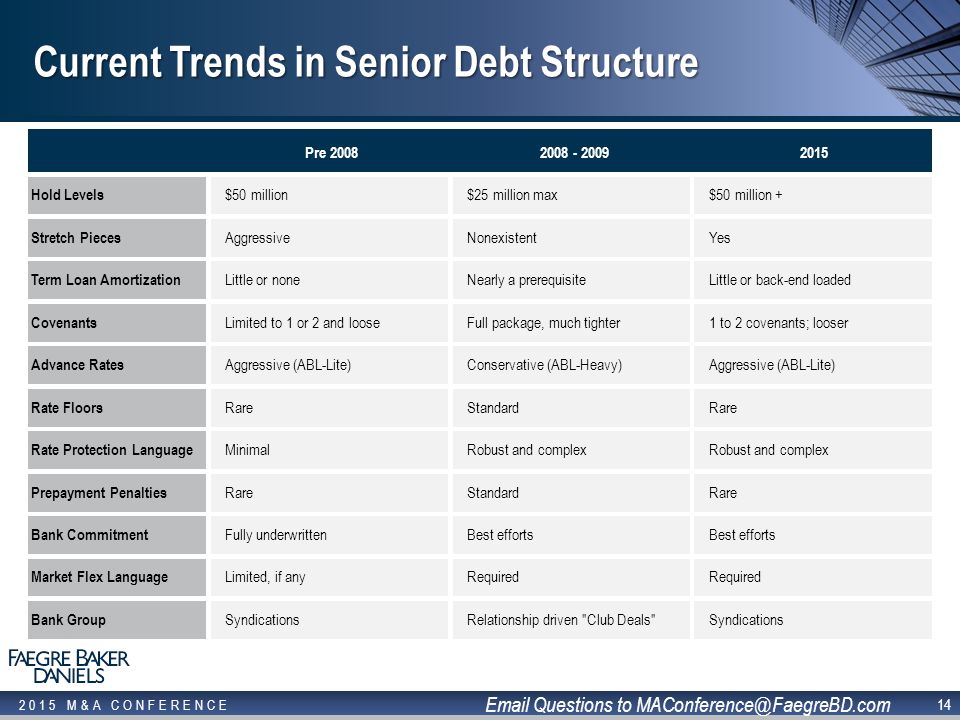

Decades ago, borrowing was often viewed with caution and even stigma. Today, it is widely accepted and even encouraged as a normal part of life. This shift in perception is largely due to the consistent and persuasive marketing efforts of the financial industry.

The normalization of debt begins early in life. Students are bombarded with credit card offers as soon as they enter college, often before they have a full understanding of financial responsibility. Mortgages, car loans, and other forms of debt are presented as essential steps toward adulthood and financial security.

This pervasive messaging can lead individuals to believe that debt is simply an unavoidable aspect of modern living. Many fail to recognize the potential risks and long-term consequences of excessive borrowing.

The Impact on Financial Well-being

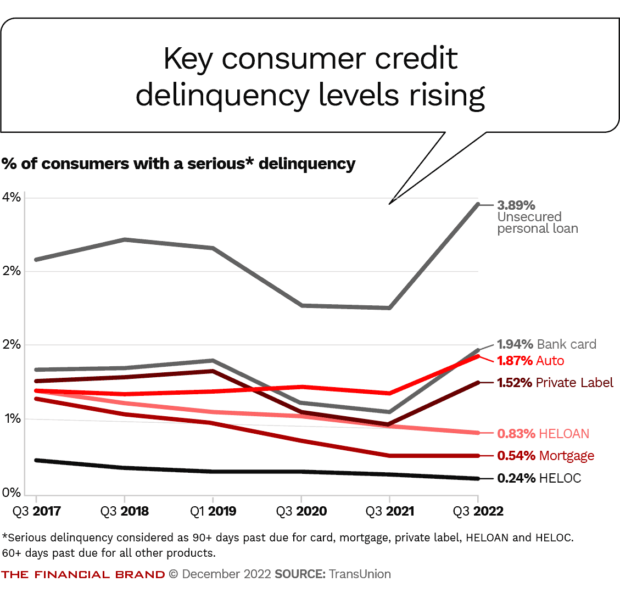

The aggressive marketing of debt has significant implications for individual and societal financial well-being. Over-indebtedness can lead to stress, anxiety, and even depression. It can also limit opportunities for saving, investing, and achieving long-term financial goals.

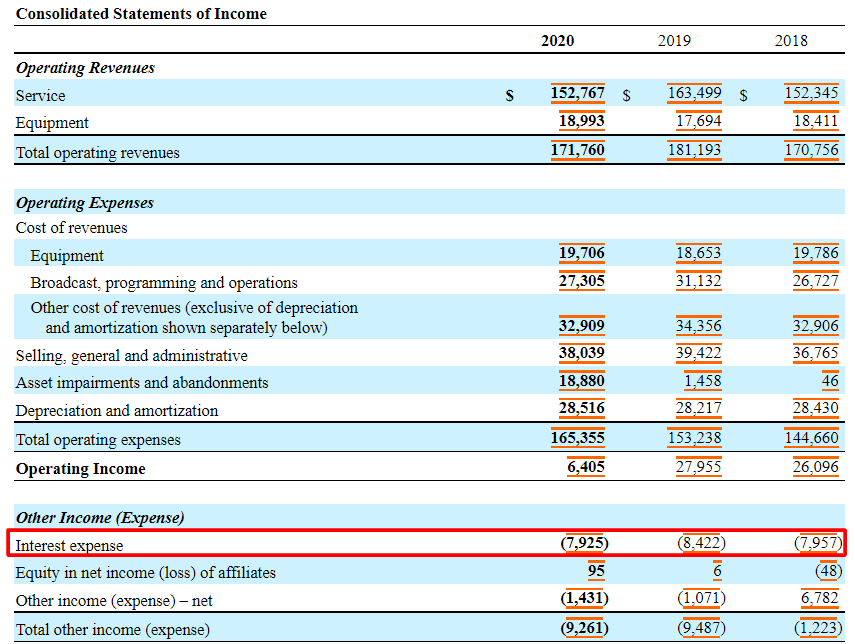

According to the National Foundation for Credit Counseling (NFCC), a significant percentage of Americans are struggling with debt. They report difficulties paying bills, managing credit card balances, and saving for retirement. The NFCC found that a major contributing factor is the ease and convenience with which consumers can access credit, fueled by constant marketing.

Furthermore, high levels of consumer debt can have a negative impact on the economy as a whole. It can reduce consumer spending, stifle economic growth, and increase the risk of financial instability. Economists at the International Monetary Fund (IMF) have warned that excessive household debt can pose a systemic risk to financial systems.

Navigating the Debt Landscape

Despite the pervasive marketing of debt, individuals can take steps to protect their financial well-being. The key is to approach borrowing with awareness, caution, and a clear understanding of the risks involved.

First, it is essential to develop a strong financial literacy. This includes learning about interest rates, credit scores, and the different types of debt available. Resources like the Consumer Financial Protection Bureau (CFPB) offer free educational materials and tools to help consumers make informed financial decisions.

Second, it is crucial to resist the pressure to "keep up with the Joneses" and avoid making impulsive borrowing decisions based on emotions or marketing appeals. Instead, focus on creating a budget, setting realistic financial goals, and prioritizing saving over spending. Consider using cash or debit cards instead of credit cards whenever possible.

Finally, seek professional financial advice if you are struggling with debt or need help managing your finances. Credit counseling agencies can provide guidance and support, helping you to develop a debt repayment plan and improve your financial situation.

Conclusion

Debt has undeniably become one of the most aggressively marketed products in our modern world. The constant barrage of advertisements, coupled with sophisticated psychological techniques, has normalized borrowing and encouraged consumers to take on more debt than they can comfortably manage. By cultivating financial literacy, resisting impulsive spending, and seeking professional guidance, individuals can navigate the debt landscape with greater awareness and build a more secure financial future. It's not about demonizing debt, but rather about being conscious and making informed choices that align with our long-term well-being.