Deposit Check Online How Long Does It Take

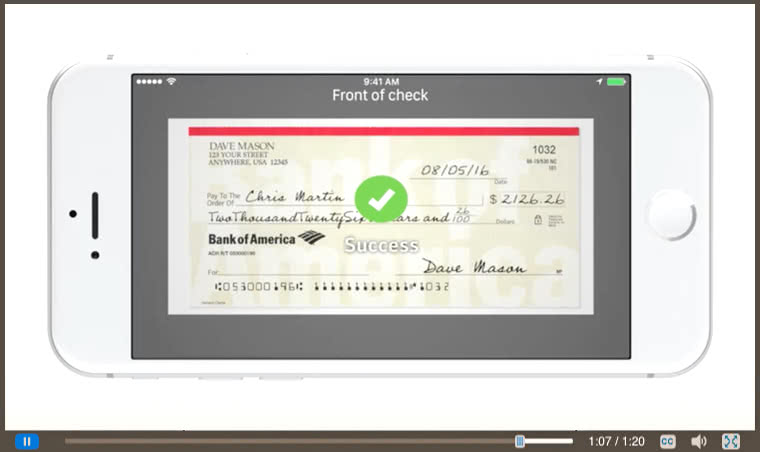

The convenience of mobile banking has revolutionized how we manage our finances, but depositing checks online isn't always instantaneous. Many users are surprised to find that the funds are not immediately available, leading to confusion and potential financial strain. Understanding the processing timelines for mobile check deposits is crucial for effective financial planning.

This article will explore the factors that influence how long it takes for a mobile check deposit to clear, including bank policies, check amounts, and potential holds. We will delve into the regulatory framework governing these processes and provide practical tips for managing your finances while awaiting deposited funds. Ultimately, our goal is to empower readers with the knowledge necessary to navigate the intricacies of mobile check deposits effectively and avoid unexpected delays.

Factors Affecting Deposit Times

Several elements can impact how quickly funds become available after depositing a check online. These range from the bank's internal policies to the amount of the check itself. Understanding these factors is the first step towards managing your expectations.

Bank Policies and Hold Times

Each bank has its own policy regarding check holds. These policies are designed to mitigate risk and prevent fraud. The Expedited Funds Availability Act (EFAA) sets the legal framework for these holds, but banks can implement stricter guidelines.

Generally, banks must make the first $225 of a deposited check available the next business day. The remaining funds may be subject to a longer hold, depending on various factors.

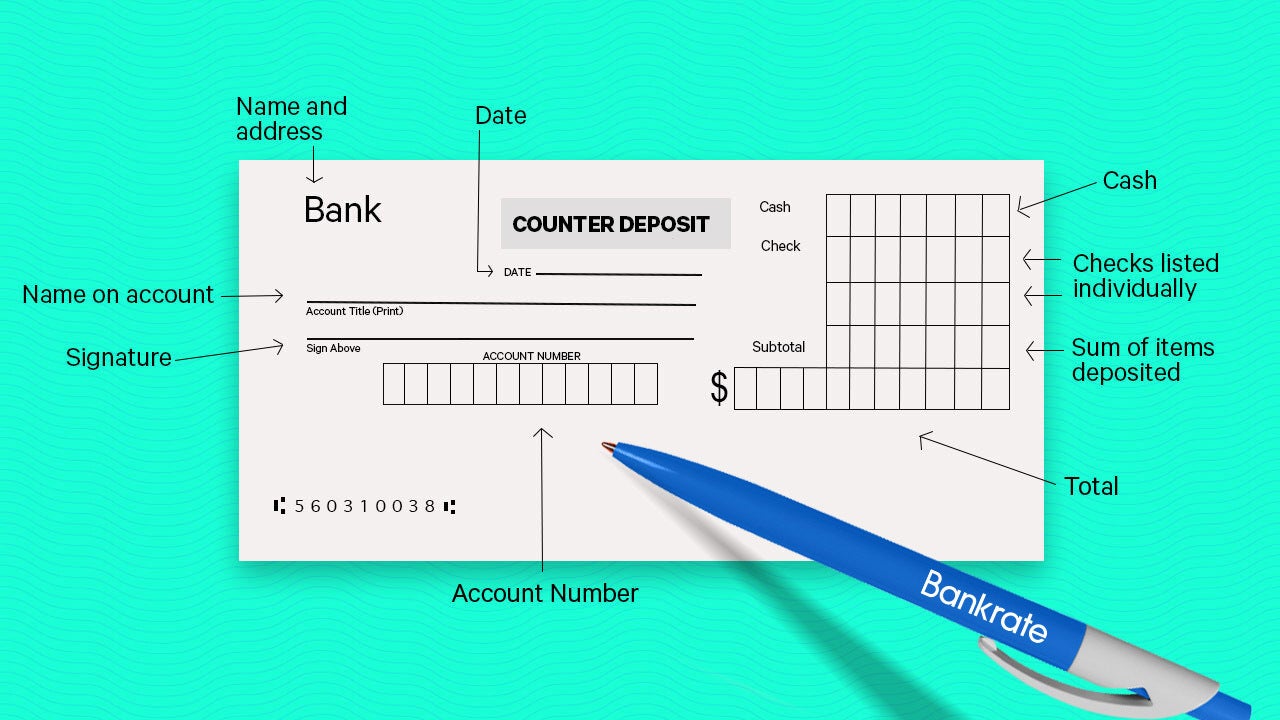

Check Amount

Larger check amounts often trigger longer hold times. Banks scrutinize these deposits more carefully due to the increased risk of fraud or insufficient funds. A deposit of $5,000, for example, is more likely to be held than a deposit of $50.

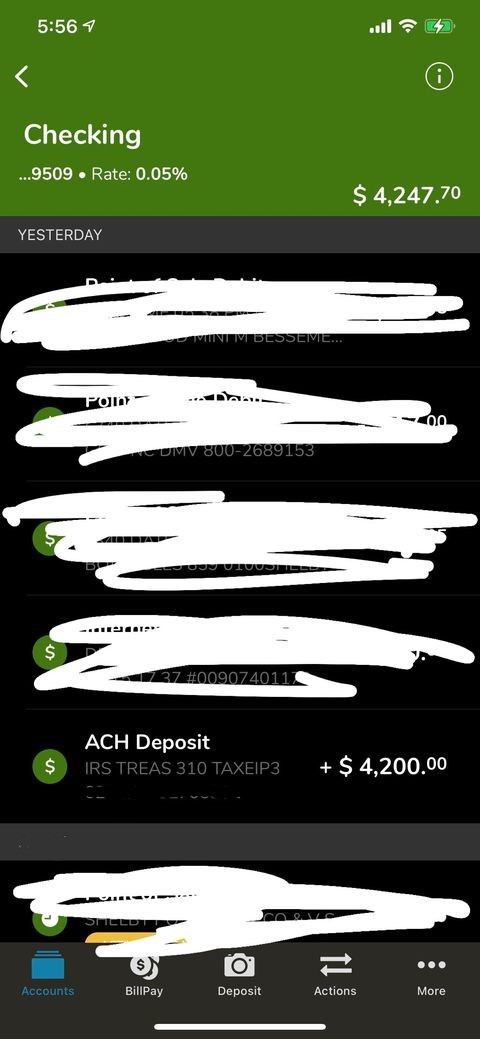

Customer History

Your banking history plays a significant role. Customers with established accounts in good standing often experience faster processing times. New accounts or those with a history of overdrafts are more likely to face longer holds.

Regulatory Framework and the EFAA

The EFAA is a key piece of legislation designed to ensure consumers have timely access to their deposited funds. However, the law also allows banks to implement safeguards to protect themselves from losses. Understanding your rights under the EFAA is essential.

The EFAA outlines specific timeframes for fund availability based on the type of deposit and the customer's relationship with the bank. It also addresses exceptions, such as situations involving suspected fraud or repeated overdrafts.

Banks are required to disclose their fund availability policies to customers. This information is typically found in the account agreement or on the bank's website. Be sure to review this information carefully.

Practical Tips for Managing Deposit Delays

While you cannot entirely eliminate the possibility of a check hold, there are steps you can take to minimize delays and manage your finances effectively. Proactive planning and communication are key.

Communicate with Your Bank

If you anticipate needing the funds immediately, contact your bank before making the deposit. Inquire about their specific hold policies and whether they can expedite the process. Open communication can often resolve potential issues before they arise.

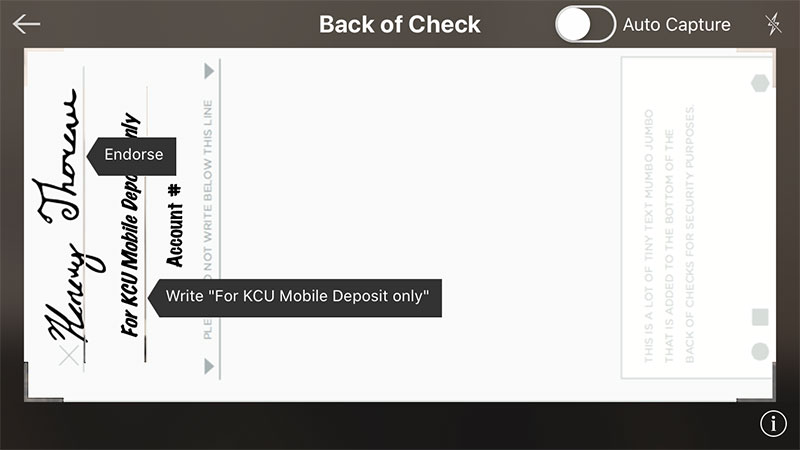

Consider Alternative Payment Methods

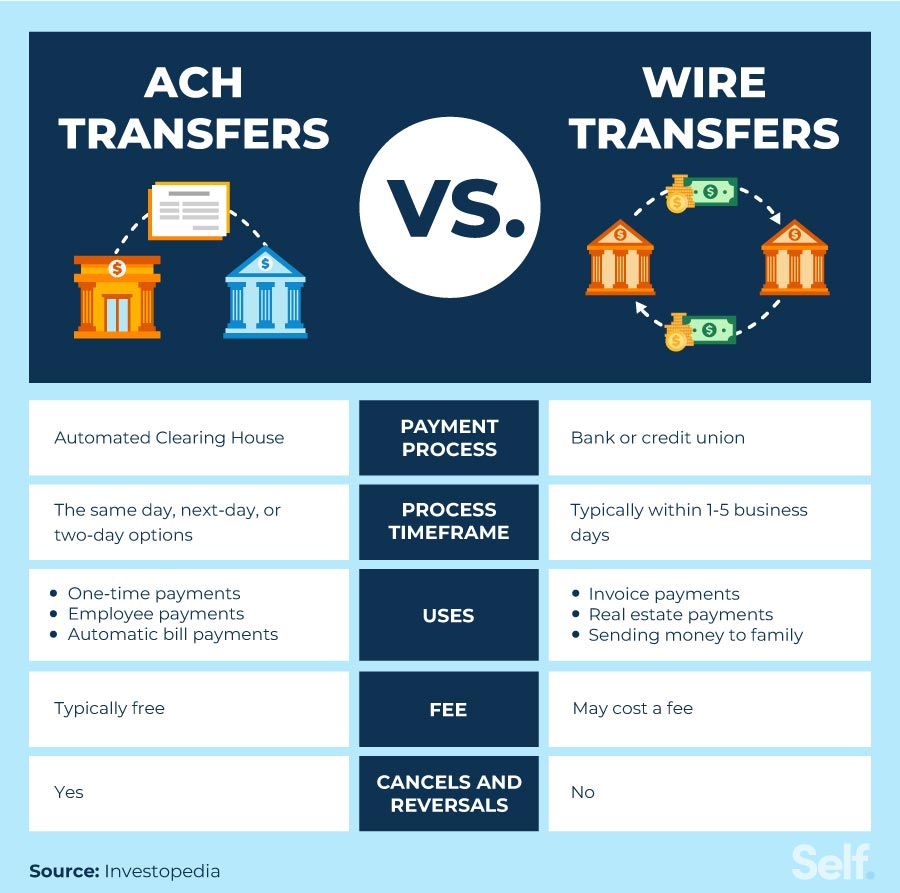

Explore alternative payment methods like direct deposit or electronic transfers whenever possible. These methods typically offer faster and more reliable access to funds compared to check deposits. Utilizing these methods can help avoid potential hold times.

Maintain Sufficient Account Balance

Ensure you have sufficient funds in your account to cover any outstanding payments or expenses. This will help prevent overdraft fees and potential disruptions to your finances while awaiting the deposit to clear. Careful financial planning is crucial.

The Future of Mobile Check Deposits

The technology behind mobile check deposits continues to evolve. Future advancements are likely to focus on reducing processing times and enhancing security measures. Blockchain technology and AI-powered fraud detection could play a significant role.

As technology improves, we can expect to see more banks offering instant or near-instant check deposits. Competition among financial institutions will likely drive innovation in this area.

Ultimately, understanding the current limitations and future potential of mobile check deposits is crucial for navigating the modern financial landscape. Staying informed will empower you to make the best financial decisions for your individual circumstances. Continue to monitor changes in banking regulations and technological advancements to stay ahead of the curve.