Did You Materially Participate In The Operation Of This Business

Imagine a sun-drenched patio, the clinking of glasses, and the murmur of happy customers enjoying handcrafted cocktails at your dream bar. Now picture the stack of tax forms on your desk, a stark contrast to that idyllic scene. One question looms large, casting a shadow on your entrepreneurial aspirations: "Did you materially participate in the operation of this business?" The answer, seemingly simple, can unlock significant tax benefits or lead to a painful audit.

Understanding the concept of material participation is crucial for anyone involved in a business, especially those operating as sole proprietorships, partnerships, or S corporations. It determines whether losses from a business activity can be deducted against other income, potentially saving thousands of dollars in taxes. Navigating the complexities of material participation requires a clear understanding of the rules and a careful assessment of your involvement.

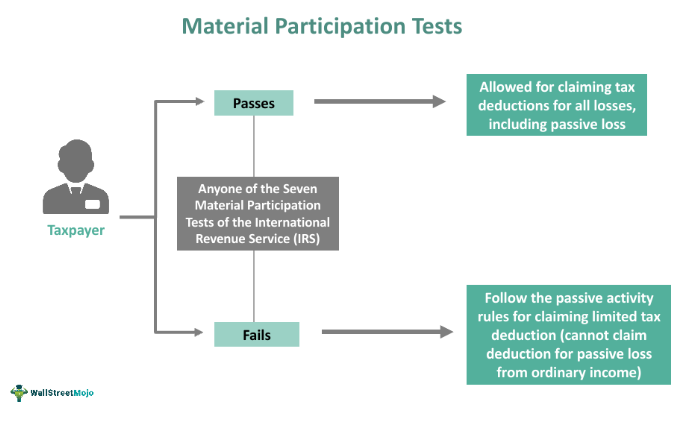

The Nut Graf: Material participation, in the eyes of the IRS, signifies substantial and active involvement in the operations of a business. Meeting specific criteria, outlined by the IRS, allows business owners to deduct losses from the business against their other income. Failure to meet these criteria can result in the business being classified as a passive activity, severely limiting the deductibility of losses.

The Backstory: From Passive Investor to Active Entrepreneur

The concept of material participation arose from the need to prevent taxpayers from claiming losses from businesses in which they were only passive investors. Prior to the Tax Reform Act of 1986, individuals could shelter income from other sources by investing in businesses, often real estate ventures, that generated paper losses. These losses, often derived from depreciation deductions, could then be used to offset their active income.

The 1986 Act introduced the passive activity loss rules, designed to curb this practice. These rules distinguish between active and passive business activities, with material participation being the key determinant. The goal was to ensure that only those who were genuinely involved in the day-to-day operations of a business could deduct losses against their other income.

The IRS's Seven Tests: A Path to Material Participation

The IRS has established seven tests to determine whether an individual materially participates in a business activity. Meeting just one of these tests is sufficient to qualify for material participation. These tests, while seemingly straightforward, often require careful documentation and interpretation.

Test 1: The 500-Hour Rule

This is perhaps the most well-known and frequently used test. If you participate in the activity for more than 500 hours during the tax year, you are considered to have materially participated. Tracking your time meticulously is crucial for this test; contemporaneous records are always best.

Test 2: Substantially All Participation

If your participation constitutes substantially all of the participation in the activity for the year, you meet the material participation standard. This test is more common in smaller businesses where one individual shoulders the majority of the workload.

Test 3: More Than 100 Hours and No One Else More

You materially participate if you participate for more than 100 hours during the tax year, and your participation is not less than the participation of any other individual, including non-owners. This means you must be one of the most involved people in the business.

Test 4: Significant Participation Activities

This test applies if you participate in several "significant participation activities" (SPAs) and your combined participation in those activities exceeds 500 hours. An SPA is a business activity in which you participate for more than 100 hours but do not meet any of the other material participation tests.

Test 5: Material Participation in Any Five of the Last Ten Years

If you materially participated in the activity for any five of the preceding ten tax years, you are considered to have materially participated in the current year. This test recognizes the long-term commitment and knowledge base built up over time.

Test 6: Material Participation in a Personal Service Activity in Any Three Prior Years

If the activity is a personal service activity (e.g., law, accounting, consulting), and you materially participated in the activity for any three prior tax years, you are considered to have materially participated in the current year. This acknowledges the continued expertise and reputation gained over time.

Test 7: Facts and Circumstances

This is the most subjective test and is used only when the other six tests don't apply. Under this test, you must show that you participated in the activity on a regular, continuous, and substantial basis during the year. Management activities generally don't count toward material participation under this test unless you are directly involved in the day-to-day operations of the business.

The Case of Maria's Boutique: A Real-World Example

Consider the story of Maria, who opened a small boutique in a bustling urban area. Maria spent countless hours selecting merchandise, arranging displays, and managing the store's social media presence. She also hired two part-time employees to assist with sales and customer service. Maria meticulously tracked her time, documenting over 600 hours dedicated to the boutique's operation.

Based on her detailed time logs and her significant involvement in all aspects of the business, Maria easily met the 500-hour rule (Test 1). This allowed her to deduct any losses from the boutique against her other income, significantly reducing her overall tax burden. Without understanding the material participation rules and diligently tracking her time, Maria might have missed out on this valuable tax benefit.

The Implications of Passive Activity: A Warning Sign

If you do not materially participate in a business activity, it is classified as a passive activity. Passive activity losses can only be deducted against passive income. This means that if your business generates a loss, you cannot deduct that loss against your wages, investment income, or other sources of income.

The disallowed losses are carried forward and can be deducted in future years when you have passive income or when you dispose of your entire interest in the passive activity. Understanding the difference between active and passive activities is crucial for effective tax planning.

Beyond the Tests: The Importance of Documentation

Regardless of which test you rely on to demonstrate material participation, thorough documentation is essential. Keep detailed records of your time spent on the business activity, including dates, specific tasks performed, and the number of hours dedicated to each task. Contemporaneous records are the most credible and will be invaluable in the event of an audit.

Supporting documentation can include appointment calendars, meeting minutes, emails, invoices, and any other records that demonstrate your involvement in the business. Consult with a qualified tax professional to ensure you are properly documenting your participation and complying with all applicable tax laws.

Looking Ahead: Navigating the Evolving Business Landscape

The definition of material participation remains relevant in today’s evolving business landscape. The rise of remote work and virtual businesses necessitates a careful consideration of how participation is defined and documented in these contexts. While physical presence is not always required, active engagement and decision-making remain key indicators of material participation.

Tax laws and regulations are constantly subject to change. Staying informed about the latest updates and seeking professional guidance will help ensure you remain compliant and maximize your tax benefits.

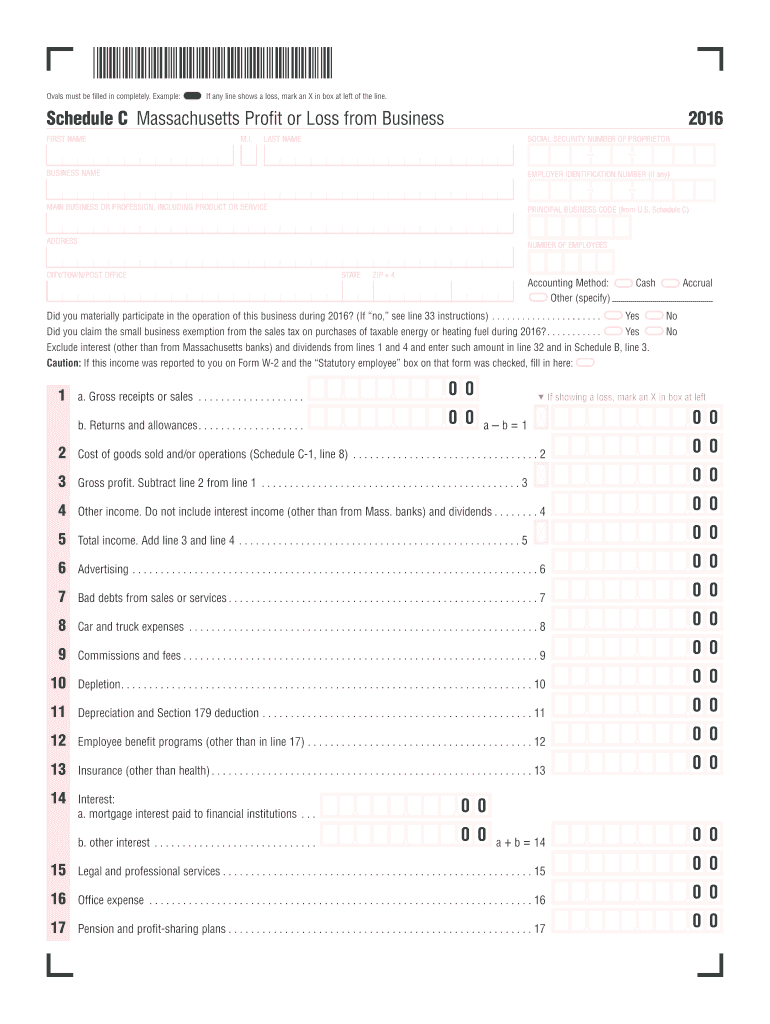

In Conclusion: The question "Did you materially participate in the operation of this business?" is more than just a checkbox on a tax form. It represents the heart and soul of your entrepreneurial endeavor, the time and effort you've invested in building your dream. Understanding the rules, documenting your involvement, and seeking professional advice will empower you to navigate the complexities of material participation and reap the rewards of your hard work.