Real Estate Offering Memorandum Template Free

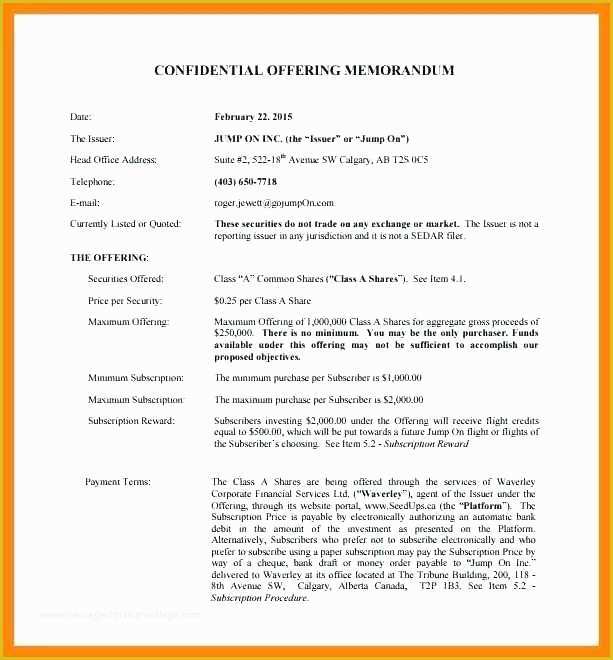

In the high-stakes world of commercial real estate, the offering memorandum (OM) is a critical document, a comprehensive prospectus that attracts investors and facilitates multi-million dollar deals. The availability of free, downloadable templates for crafting these OMs has ignited a debate, raising concerns about accuracy, completeness, and the potential pitfalls for both novice investors and seasoned professionals.

This article delves into the increasing prevalence of "free" real estate offering memorandum templates. We explore the potential benefits and significant risks associated with using such resources, and offer expert insights on navigating the complex landscape of real estate investment disclosures. Understanding the nuances of an OM, and whether a free template adequately serves its purpose, is paramount for anyone involved in commercial property transactions.

The Allure of Free: Convenience vs. Compliance

The appeal of a free OM template is undeniable, especially for smaller investment firms or individuals entering the commercial real estate market. These templates promise to streamline the process of creating a professional-looking document, saving time and potentially significant legal and consulting fees.

However, experts caution that the convenience of a free template often comes at a price. Generic templates may not adequately address the specific nuances of a particular property, local regulations, or investment structure.

"A free template might seem like a great shortcut, but it can quickly become a liability if it doesn't accurately reflect the property's details or comply with all applicable laws," warns David Miller, a real estate attorney specializing in securities law at Miller & Zois.

The Perils of Incomplete Disclosure

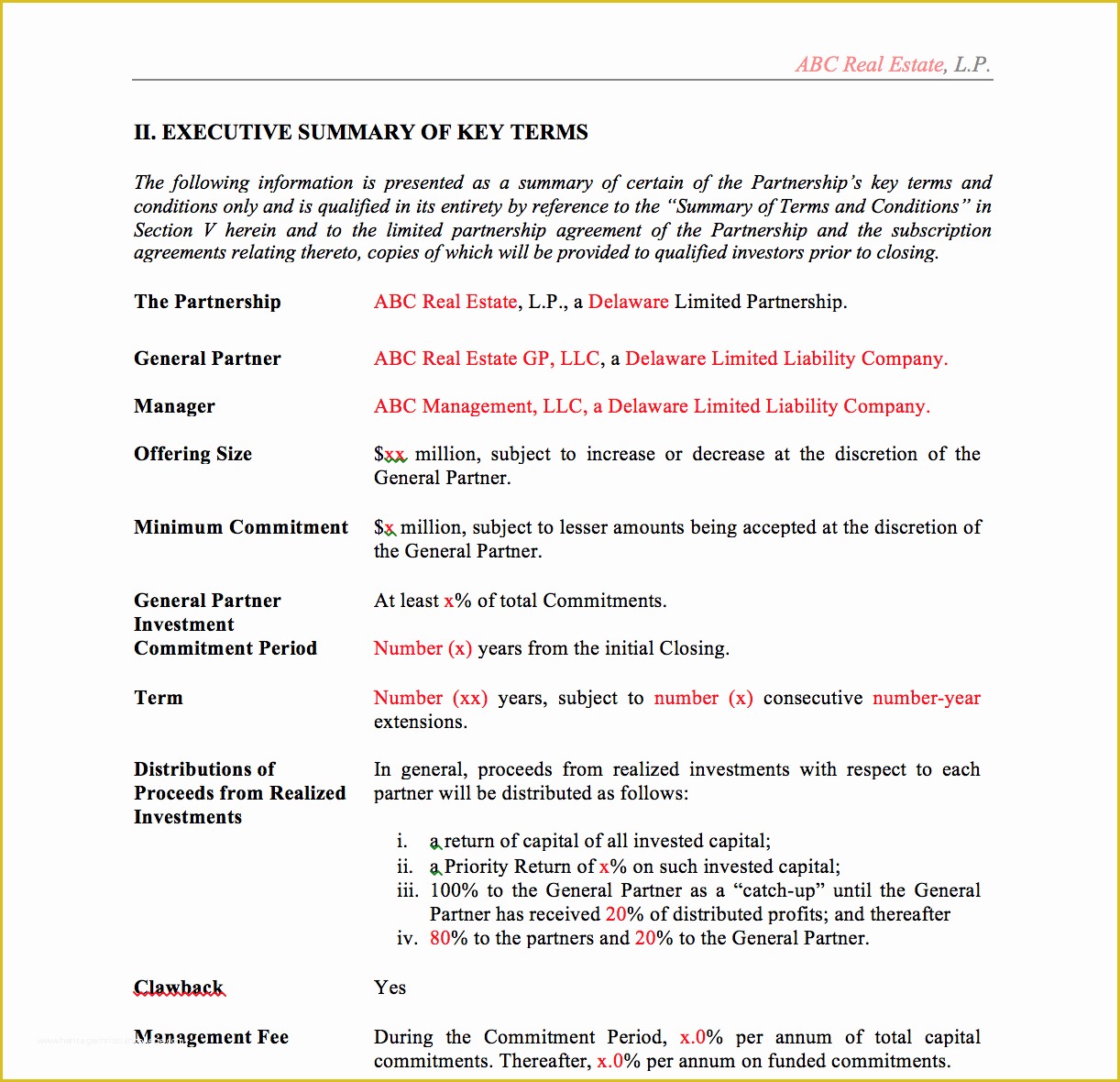

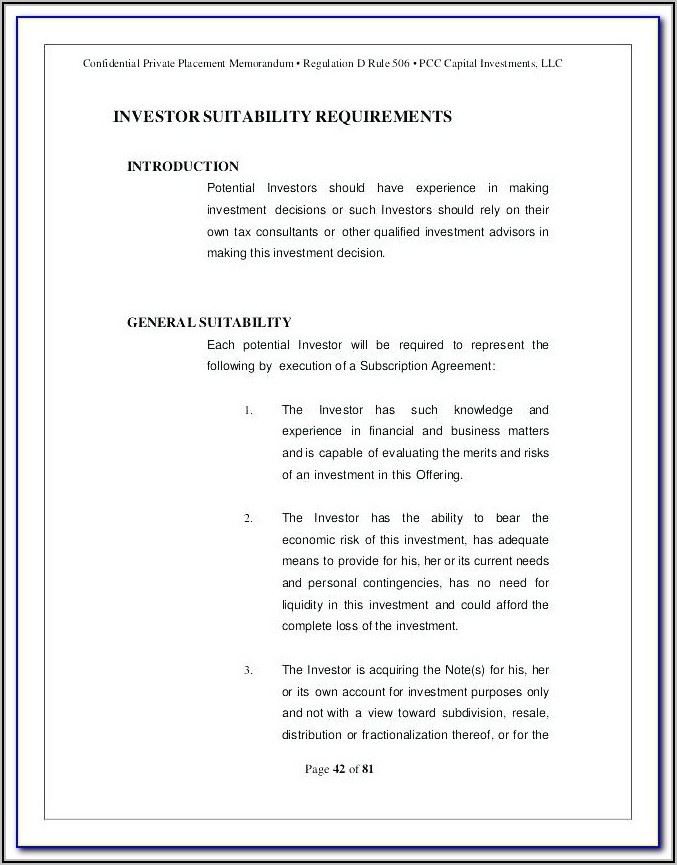

One of the most significant dangers of using a generic template is the risk of incomplete or inadequate disclosure. An OM must provide potential investors with a comprehensive overview of the property, including its financial performance, physical condition, market analysis, and potential risks.

Failing to disclose material information can lead to legal repercussions, including lawsuits from disgruntled investors and regulatory penalties. Templates downloaded from unverified sources may contain outdated information or omit critical sections, leaving the issuer vulnerable to liability.

"An OM is not just a marketing document; it's a legal document. It needs to be accurate, complete, and thoroughly vetted to protect both the issuer and the investors," emphasizes Sarah Chen, a seasoned real estate broker at Coldwell Banker Commercial.

Content Considerations

An effective offering memorandum contains specific sections tailored to the specifics of the investment. These sections go beyond basic property information.

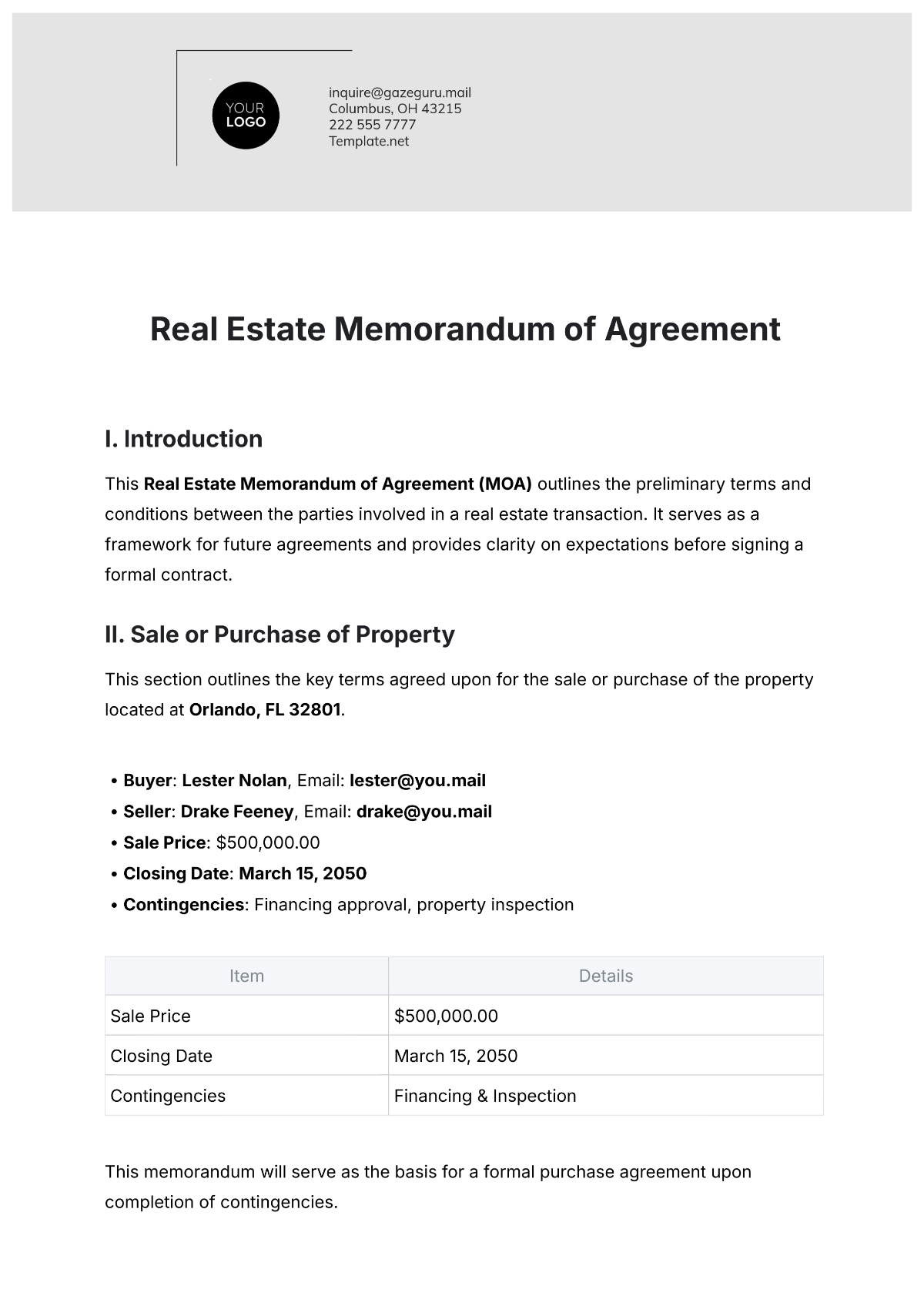

A strong OM would feature an executive summary, detailed property description and market analysis including comparable sales data, financial projections supported by documented data, and a thorough discussion of potential risks and mitigations.

Legal disclaimers and investor suitability standards are also vital to protect those parties involved.

Due Diligence and Verification: A Must

Even if a template appears comprehensive, it's crucial to conduct thorough due diligence and verify all information before including it in the OM. This includes obtaining independent appraisals, environmental reports, and legal reviews.

Relying solely on the template's pre-written content without independent verification can expose the issuer to significant risk. Third-party validation is paramount to ensure the accuracy and reliability of the information presented.

"We always advise our clients to treat a free template as a starting point, not a finished product," states Maria Rodriguez, a financial analyst at Integra Realty Resources. "Independent verification and expert review are essential to ensure the OM is accurate and compliant."

Alternatives to Free Templates

For those seeking cost-effective alternatives to hiring expensive legal and consulting teams, several options exist. Consider subscription-based services that offer customizable OM templates tailored to specific property types and investment structures.

These services often provide ongoing updates to ensure compliance with changing regulations. Engage with experienced real estate professionals, such as brokers, appraisers, and attorneys, to review and refine the OM before distribution.

Investing in professional guidance, even on a limited basis, can significantly reduce the risk of errors and omissions, ultimately protecting both the issuer and the investors.

The Future of OM Creation

The real estate industry is increasingly embracing technology to streamline the OM creation process. Artificial intelligence (AI) and machine learning are being used to automate data collection, analyze market trends, and identify potential risks, facilitating more accurate and efficient document creation.

These advancements promise to make the process more accessible and affordable, but human oversight and expert review will remain essential to ensure accuracy, compliance, and ethical considerations.

"Technology can be a powerful tool, but it's not a substitute for human judgment and expertise. The best approach is to combine technology with professional guidance to create a robust and reliable offering memorandum," concludes David Miller.

Conclusion: Proceed with Caution

While the allure of a free real estate offering memorandum template is understandable, the risks associated with using such resources should not be underestimated. Incomplete disclosures, inaccurate information, and non-compliance with regulations can lead to significant legal and financial repercussions.

Before using a free template, carefully assess your risk tolerance, the complexity of the transaction, and your access to professional expertise. Investing in professional guidance and thorough due diligence is crucial to ensuring the OM is accurate, compliant, and effectively protects your interests and those of your investors.

Ultimately, in the world of commercial real estate, perceived savings at the outset can lead to considerable expenses later on. Choose wisely and proceed with caution.