Which Of The Following Appear On The Income Statement

Imagine sitting down at your kitchen table, a steaming mug in hand, facing a mountain of financial papers. The tax season looms, and you're staring at forms filled with numbers and jargon. Among them, the income statement, a critical snapshot of your company's financial health, beckons with its promise of clarity, but also, perhaps, a bit of confusion. What exactly belongs on this crucial document?

The income statement, often called the profit and loss (P&L) statement, is a financial report that shows a company's financial performance over a specific period. This article aims to clarify which elements appear on the income statement, helping you understand this fundamental financial tool.

Understanding the Income Statement

The income statement essentially tells a story: It reveals how much money a company earned (revenues), how much it cost to earn that money (expenses), and ultimately, how much profit was generated. It’s a simple concept, but the devil is in the details.

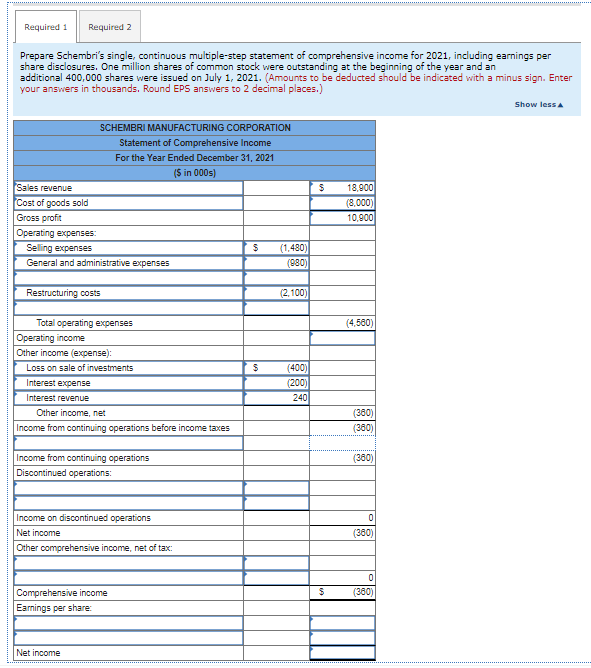

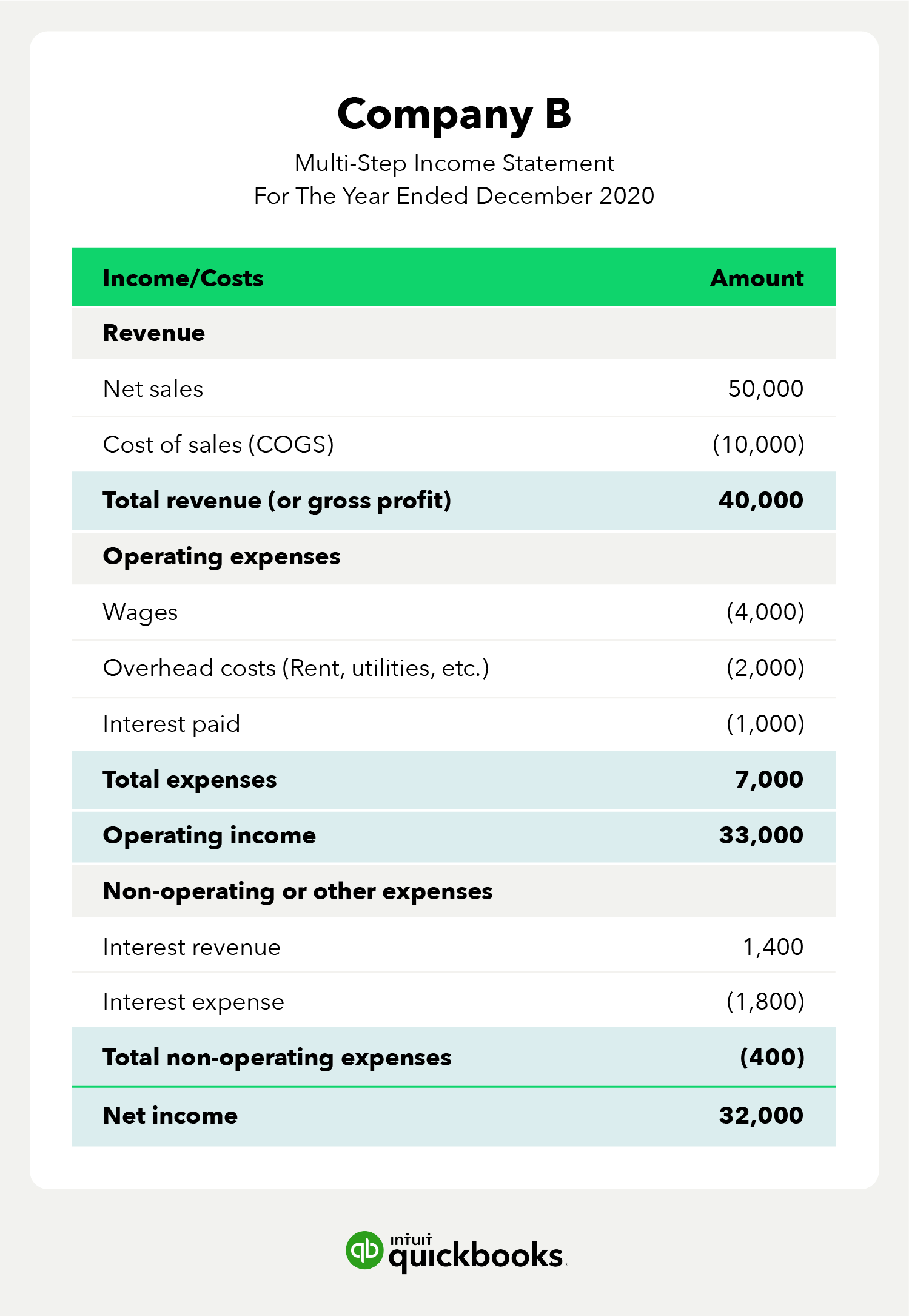

At its core, the income statement follows a logical progression, starting with the top line and working its way down to the bottom line. The structure is usually fairly standardized, making it easier to compare the performance of different companies, or the same company over different periods.

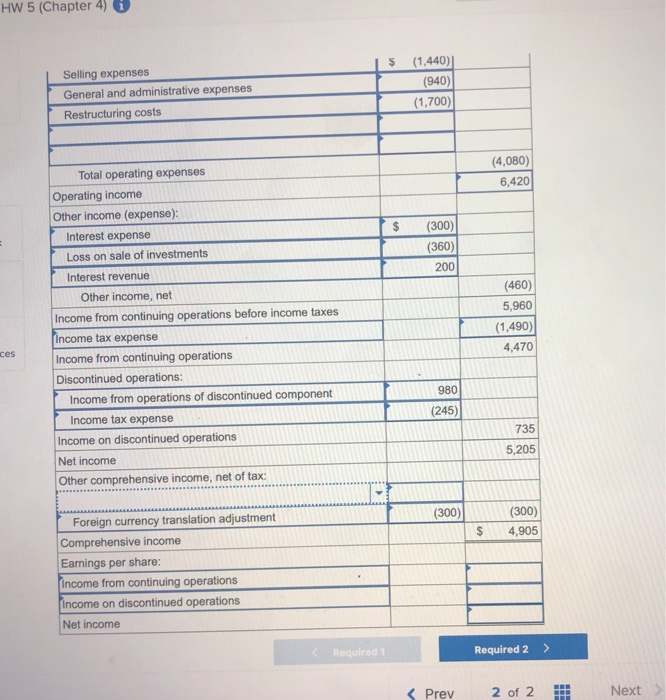

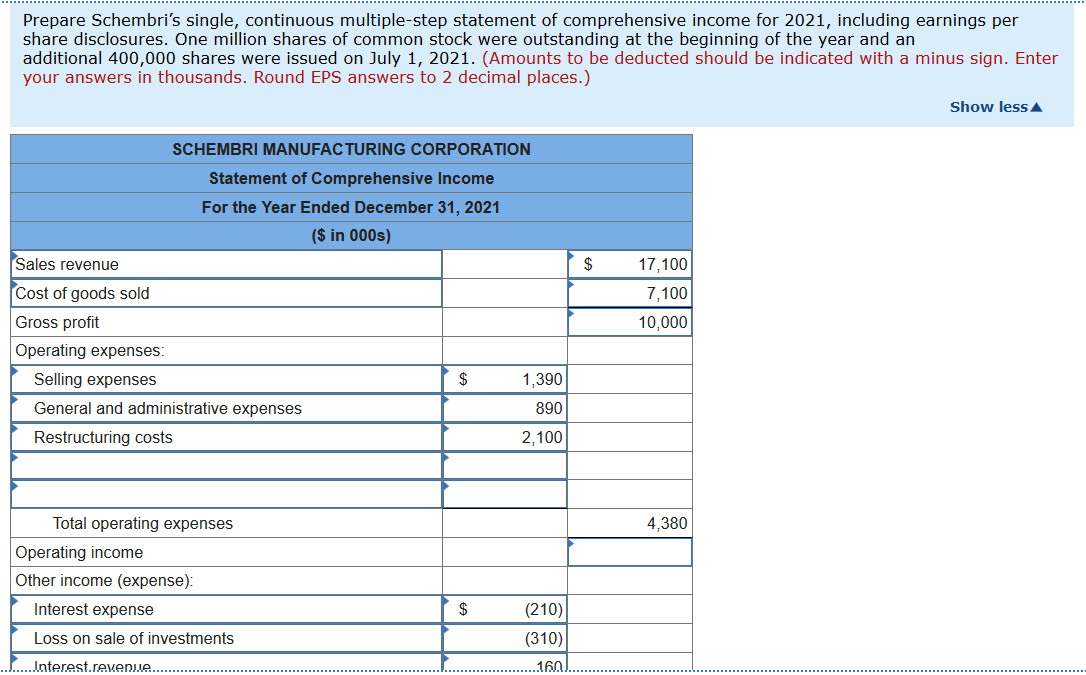

The Key Components

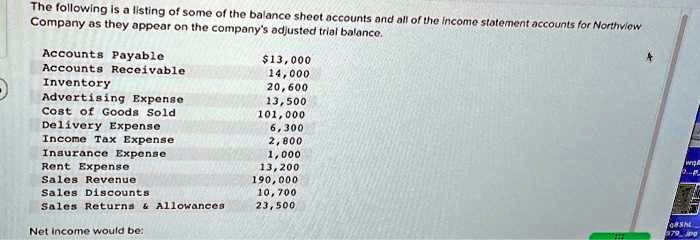

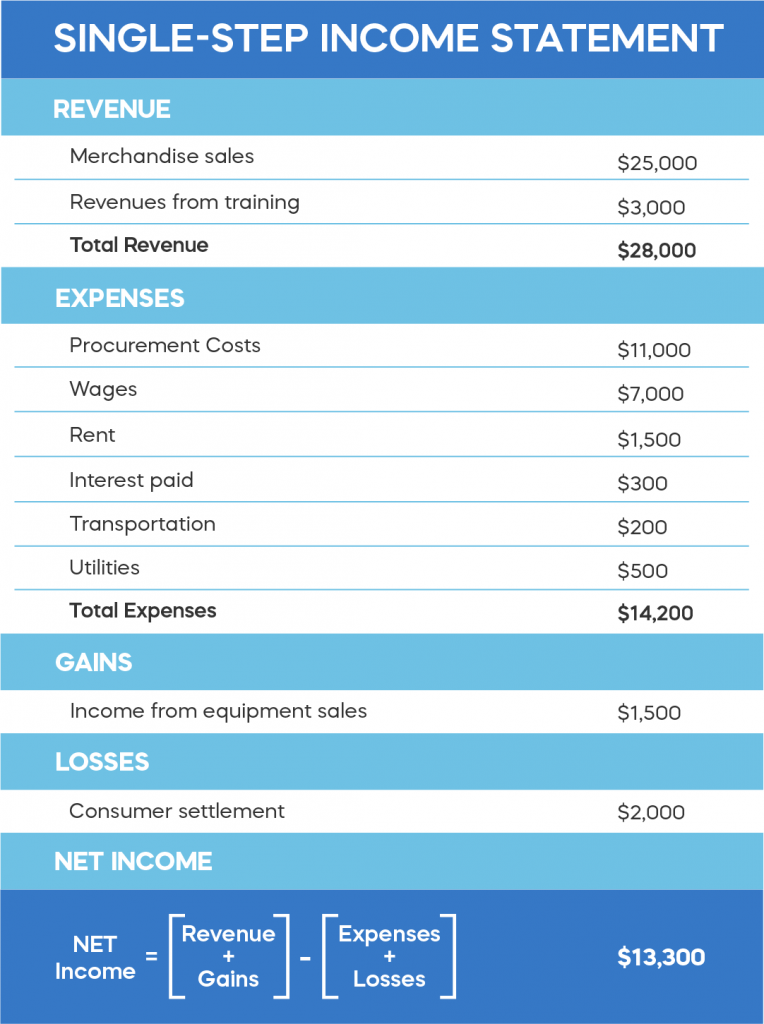

Revenue: This is the starting point, representing the total amount of money a company earned from its primary business activities. This is the gross income before any deductions.

Think of it as the total sales generated by selling products or services.

Cost of Goods Sold (COGS): This represents the direct costs associated with producing the goods or services that a company sells. For a manufacturing company, this includes the cost of raw materials, direct labor, and manufacturing overhead.

For a retailer, this would be the purchase price of the merchandise they sell.

Gross Profit: This is calculated by subtracting COGS from revenue. It shows how much profit a company makes after accounting for the direct costs of its products or services.

It's a crucial indicator of a company's efficiency in production or procurement.

Operating Expenses: These are the costs a company incurs to run its business, excluding COGS. Common operating expenses include salaries, rent, utilities, marketing, and research and development (R&D).

These are the day-to-day expenses needed to keep the business running smoothly.

Operating Income: This is calculated by subtracting operating expenses from gross profit. It represents a company's profit from its core operations before accounting for interest, taxes, and other non-operating items.

Operating income is a good measure of a company's ability to generate profits from its core business.

Interest Expense: This is the cost a company incurs for borrowing money. It includes interest paid on loans, bonds, and other forms of debt.

This is a non-operating expense as it is not directly related to the company's core business operations.

Income Before Taxes (Earnings Before Taxes - EBT): This is calculated by subtracting interest expense from operating income. It represents a company's profit before accounting for income taxes.

Income Tax Expense: This is the amount of income tax a company owes to the government. It is calculated based on the company's taxable income and the applicable tax rate.

Net Income: This is the bottom line, representing a company's profit after all expenses and taxes have been deducted. Net income is often referred to as earnings or profit.

It is the ultimate measure of a company's profitability over a specific period.

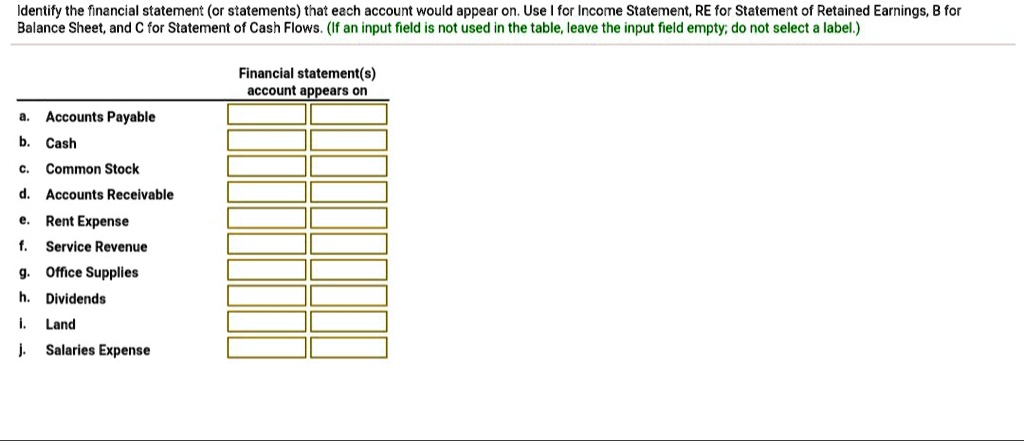

Items That Do NOT Appear on the Income Statement

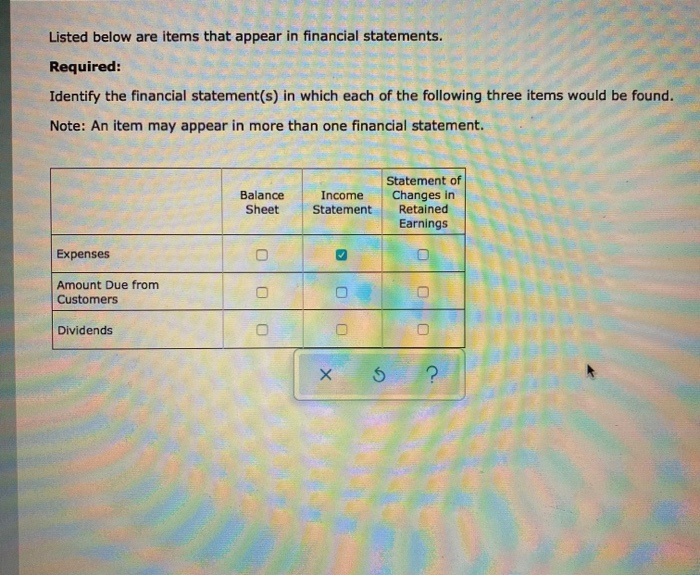

While the income statement provides a comprehensive view of a company's financial performance, certain items are not included. These typically appear on other financial statements, such as the balance sheet or the statement of cash flows.

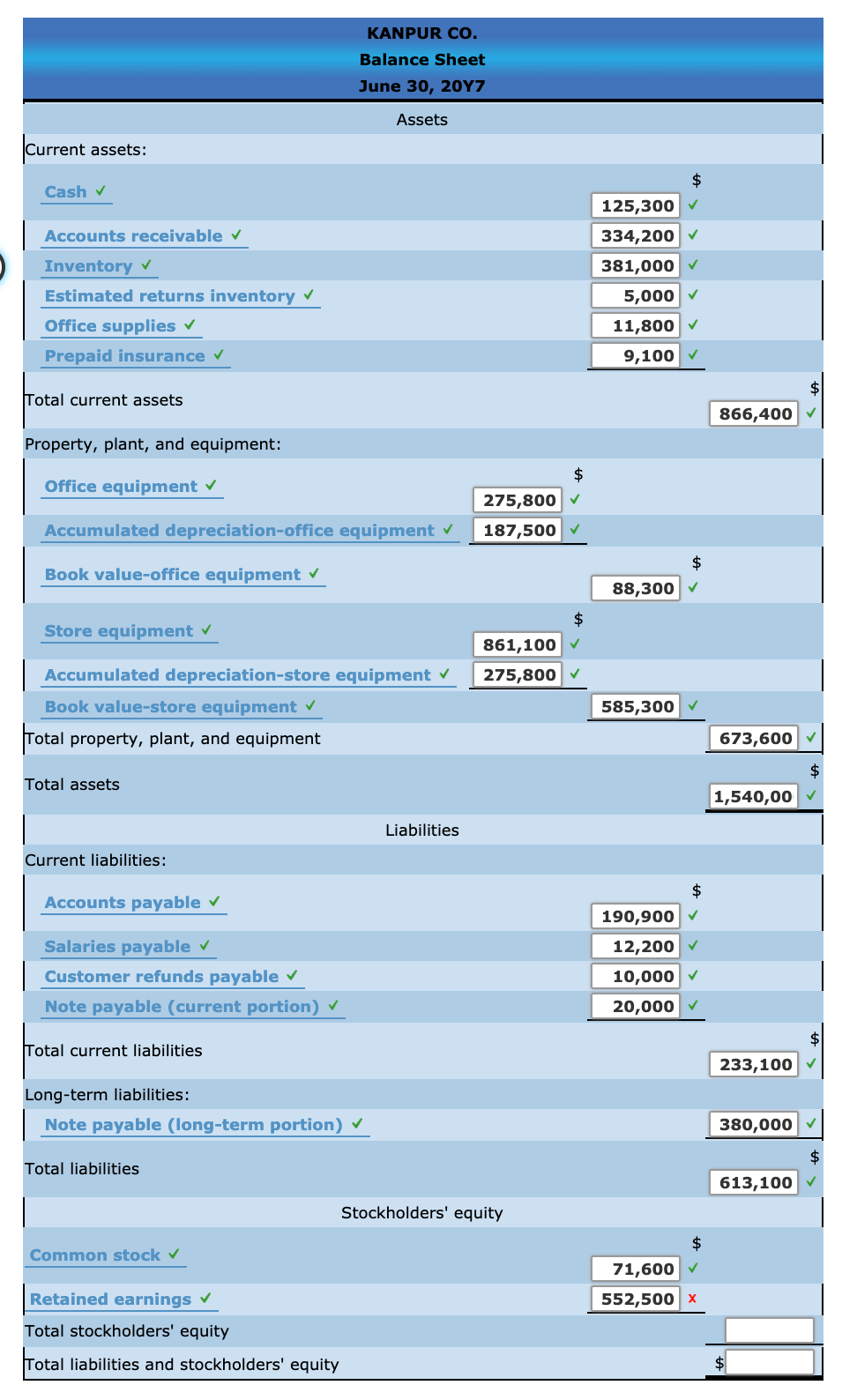

Assets: These are resources owned by a company, such as cash, accounts receivable, inventory, and property, plant, and equipment (PP&E). Assets are reported on the balance sheet, not the income statement.

Liabilities: These are obligations owed by a company to others, such as accounts payable, salaries payable, and loans payable. Liabilities are also reported on the balance sheet.

Equity: This represents the owners' stake in a company, including common stock, retained earnings, and additional paid-in capital. Equity is reported on the balance sheet.

Dividends Paid: These are distributions of a company's profits to its shareholders. While dividends affect retained earnings, they are not reported as an expense on the income statement. They are usually found on the statement of retained earnings or the statement of cash flows.

Cash Flow Activities: The statement of cash flows details the movement of cash both into and out of a company. These activities are classified into operating, investing, and financing activities, and are separate from the income statement.

Importance of the Income Statement

The income statement provides crucial insights into a company's profitability and financial health. It allows investors and analysts to assess a company's ability to generate profits, manage expenses, and ultimately, create value for its shareholders.

The income statement is used to calculate important financial ratios, such as gross profit margin, operating profit margin, and net profit margin. These ratios help investors compare a company's profitability to that of its competitors.

Lenders also use the income statement to assess a company's ability to repay its debts.

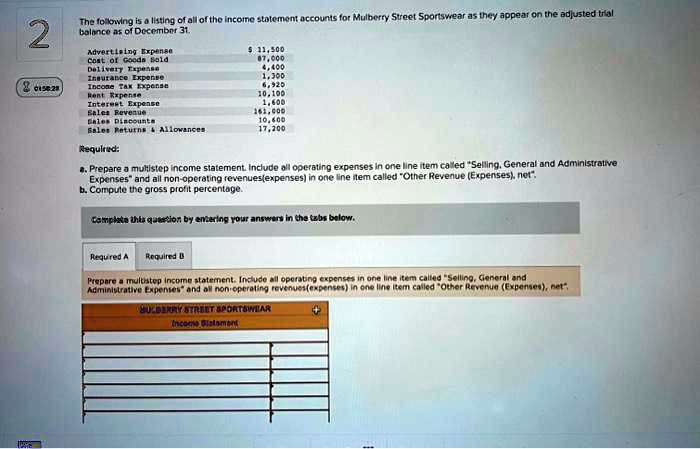

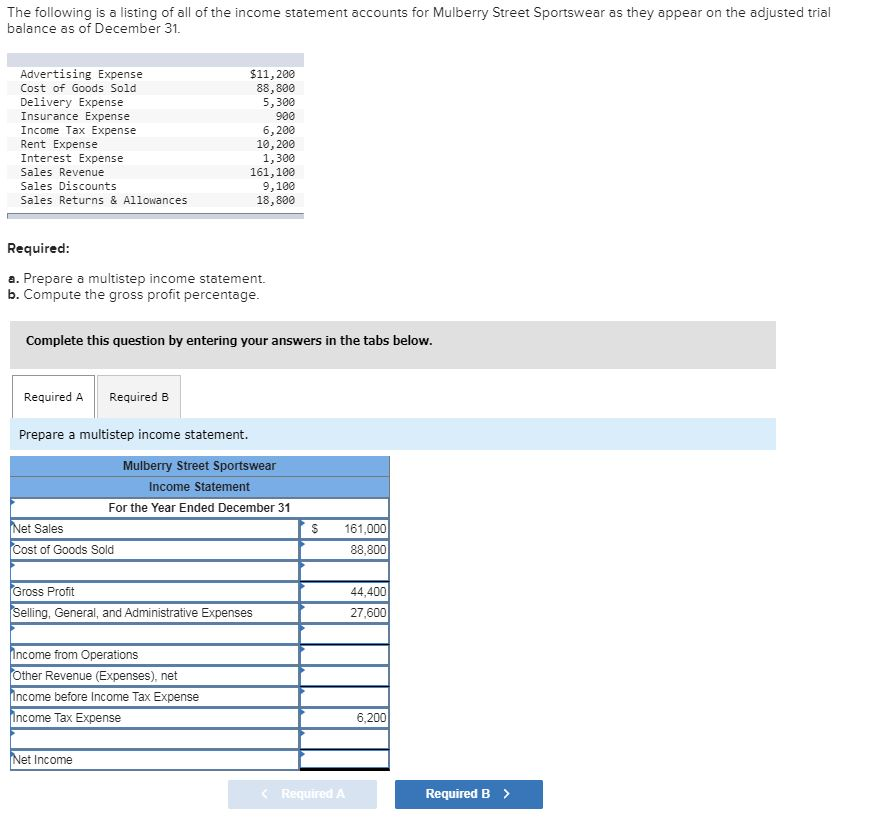

Real-World Example

Let's consider a hypothetical example of a small bakery, "Sweet Sensations". In one year, Sweet Sensations generated $200,000 in revenue from selling cakes and pastries.

The cost of ingredients and direct labor (COGS) was $80,000. This gives a gross profit of $120,000.

The bakery incurred $50,000 in operating expenses, including rent, utilities, and salaries for non-production staff. This yields an operating income of $70,000.

Sweet Sensations paid $5,000 in interest on a business loan, resulting in income before taxes of $65,000. The company paid $15,000 in income taxes, leaving a net income of $50,000.

This simple example demonstrates how the income statement presents a clear picture of Sweet Sensations' financial performance.

According to a report by the Securities and Exchange Commission (SEC), publicly traded companies are required to file income statements (as part of their 10-K and 10-Q filings) to provide transparency and comparability to investors.

Conclusion

The income statement is a fundamental tool for understanding a company's financial performance. By understanding which items appear on the income statement – revenue, COGS, operating expenses, interest, and taxes – you can gain valuable insights into a company's profitability and financial health.

Remember that the income statement is just one piece of the puzzle. To get a complete picture of a company's financial situation, it's essential to also analyze the balance sheet and statement of cash flows.

So, the next time you're faced with deciphering financial statements, take a deep breath, grab that mug of tea, and remember the basic structure of the income statement. You'll be surprised at how much clearer things become.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-4197fc36cd71402dbfa40d23ac1e840c.png)