Wisdomtree Europe Defence Ucits Etf - Eur Acc

European defense stocks are surging as geopolitical tensions escalate, prompting investors to flock to the WisdomTree Europe Defence UCITS ETF - EUR Acc. The ETF is experiencing increased trading volume and price appreciation amid ongoing conflict and heightened security concerns.

This ETF, traded under the ticker ESPD, offers targeted exposure to European companies involved in the defense sector, capitalizing on increased government spending and renewed focus on national security.

ETF Performance and Composition

The WisdomTree Europe Defence UCITS ETF (ESPD) has seen a significant uptick in performance. Year-to-date, the ETF has outperformed broader market indices as investors respond to the evolving geopolitical landscape.

As of October 26, 2023, the ETF's price is around EUR 29.53. This price has been increasing recently as the war keeps escalating.

The ETF's holdings primarily consist of companies engaged in the research, development, and manufacturing of military equipment, cybersecurity solutions, and aerospace technologies.

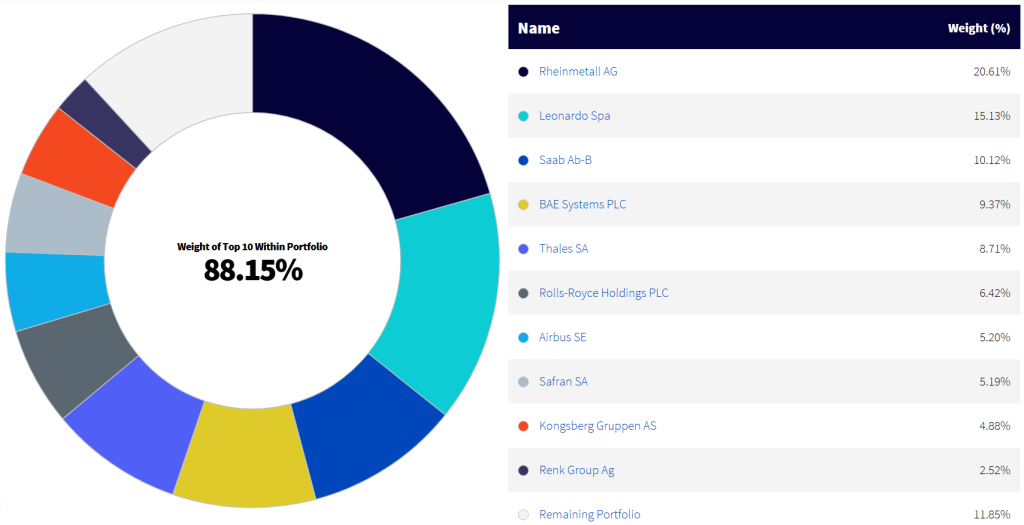

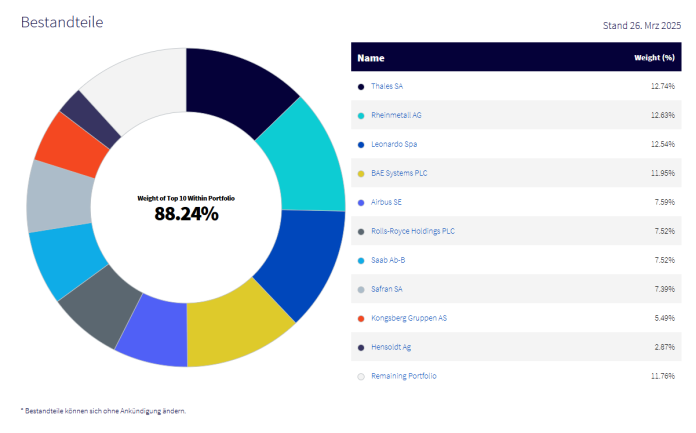

Key Holdings

Among the top holdings are prominent European defense contractors such as Safran, Thales, and Leonardo. These companies are benefiting from increased orders and government contracts related to defense modernization and security enhancements.

These companies have seen orders increase significantly. The companies are all benefiting of their government’s support of the war.

Investors are betting on these companies growing in the future.

Factors Driving the Surge

Increased geopolitical instability, particularly the ongoing conflict in Ukraine, is the primary catalyst behind the ETF's recent surge. European nations are bolstering their defense capabilities, leading to increased demand for defense-related products and services.

Government spending on defense is rising across Europe. This trend is fueling investor confidence in the long-term growth potential of defense companies.

NATO members are increasing the spending on defense. This is also driving the increase of the stock prices.

Increased Defense Spending

Many European countries have pledged to increase their defense spending to meet NATO's target of 2% of GDP. This commitment translates into billions of euros allocated to defense procurement and research, directly benefiting companies held by the ESPD ETF.

Germany, for example, has announced a significant increase to its defense budget. This is being seen as a pivotal shift in its security policy.

Other nations like Poland and the UK are also substantially increasing their defense spending.

Investor Sentiment and Trading Volume

Investor sentiment towards the defense sector is overwhelmingly positive. This is reflected in the increased trading volume of the WisdomTree Europe Defence UCITS ETF.

The ETF's trading volume has reached record levels. This signals strong investor interest and confidence in the sector's prospects.

The number of shares traded per day shows the rising interest.

Risk Considerations

While the defense sector presents opportunities, investors should be aware of potential risks. These risks include geopolitical volatility, regulatory changes, and potential shifts in government policies related to defense spending.

Dependence on government contracts can also pose a risk. Any decrease in those contracts may lead to significant financial downside.

The defense industry is also subject to ethical considerations. Some investors may not be comfortable investing in companies involved in the production of weapons.

Expert Analysis

Analysts at Bloomberg and Reuters note that the WisdomTree Europe Defence UCITS ETF offers a focused and efficient way to gain exposure to the European defense sector. However, they caution investors to carefully assess their risk tolerance and investment objectives before investing.

One analyst said:

"The ETF provides a targeted approach to capitalize on the increased defense spending in Europe."

Investment firms have provided insights and recommendations.

Next Steps

Investors should continue to monitor geopolitical developments and assess their potential impact on the defense sector. The WisdomTree Europe Defence UCITS ETF remains a key indicator of investor sentiment and the overall health of the European defense industry.

Monitoring geopolitical events is critical.

Ongoing analysis will be required to fully evaluate the impact of the events.