Which Of The Following Are Assumptions Of Cost-volume-profit Analysis

Imagine you're Sarah, a budding entrepreneur, nervously clutching a business plan. She dreams of opening a charming little bakery, filled with the aroma of freshly baked bread and the sweet scent of pastries. But the numbers swim before her eyes: costs, volumes, profits. Can she really make this dream a reality? This is where cost-volume-profit (CVP) analysis comes in, a powerful tool to guide decisions, but one built on certain fundamental assumptions.

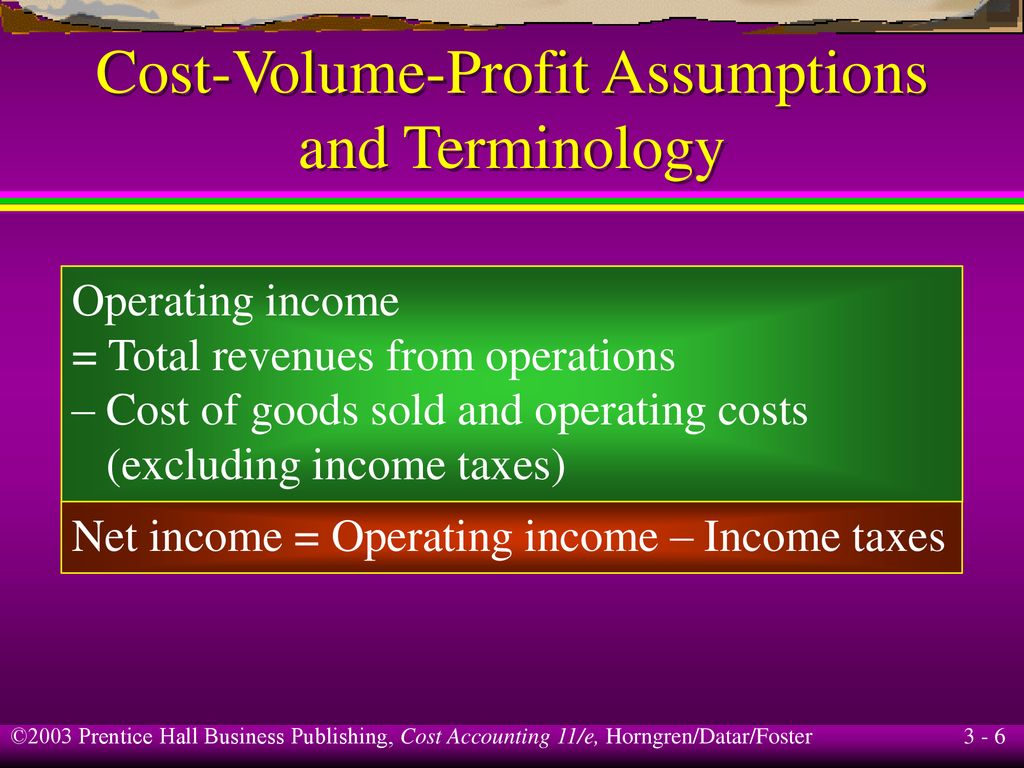

At its core, CVP analysis helps businesses understand the relationship between costs, the volume of goods or services sold, and the resulting profit. However, its accuracy hinges on several underlying assumptions that may not always hold true in the real world. Understanding these assumptions is crucial for using CVP analysis effectively and making informed business decisions. It’s about seeing beyond the simplified model to the complexities of the market.

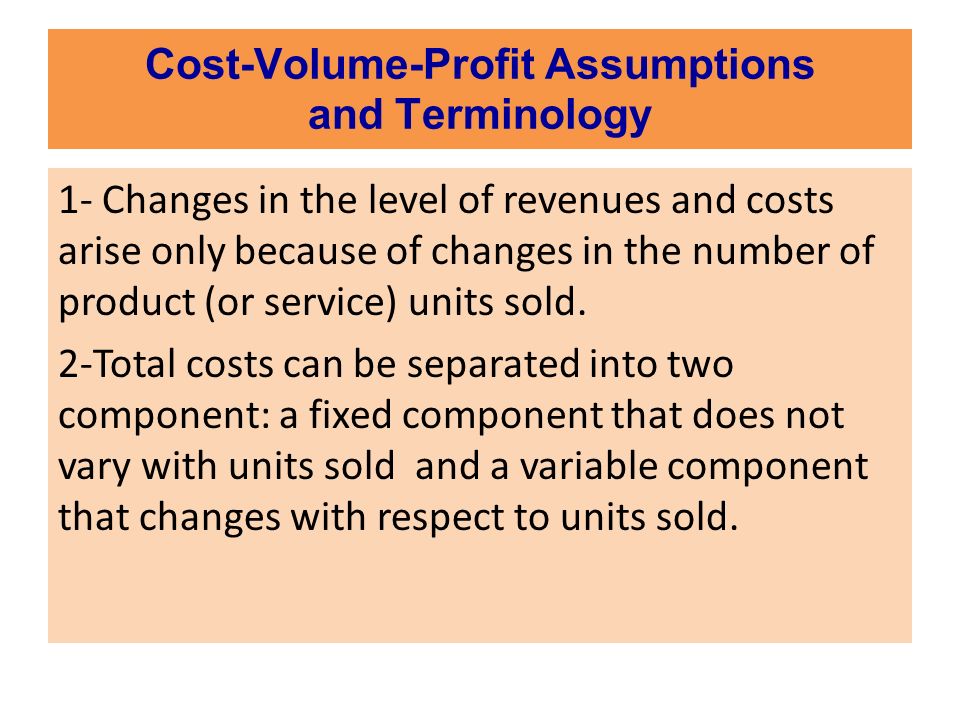

The Foundation of CVP: Unveiling the Assumptions

CVP analysis isn't a crystal ball; it's a tool, and like any tool, it works best when its limitations are understood. These limitations stem from the assumptions upon which the analysis is built. Let's explore these fundamental assumptions that underpin the calculations and interpretations of CVP analysis. Ignoring these assumptions can lead to inaccurate predictions and ultimately, poor decision-making.

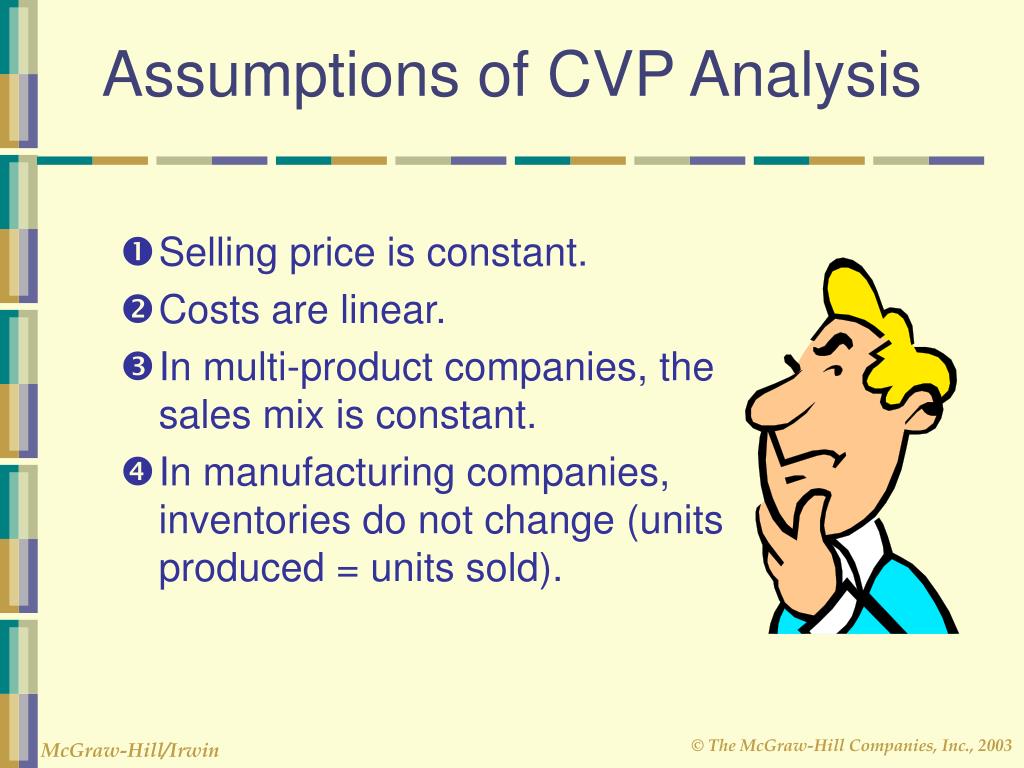

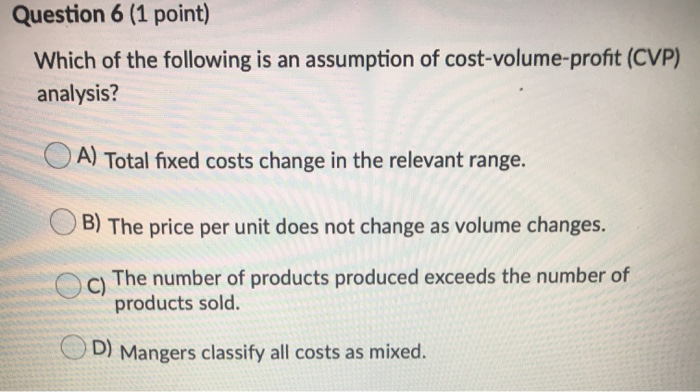

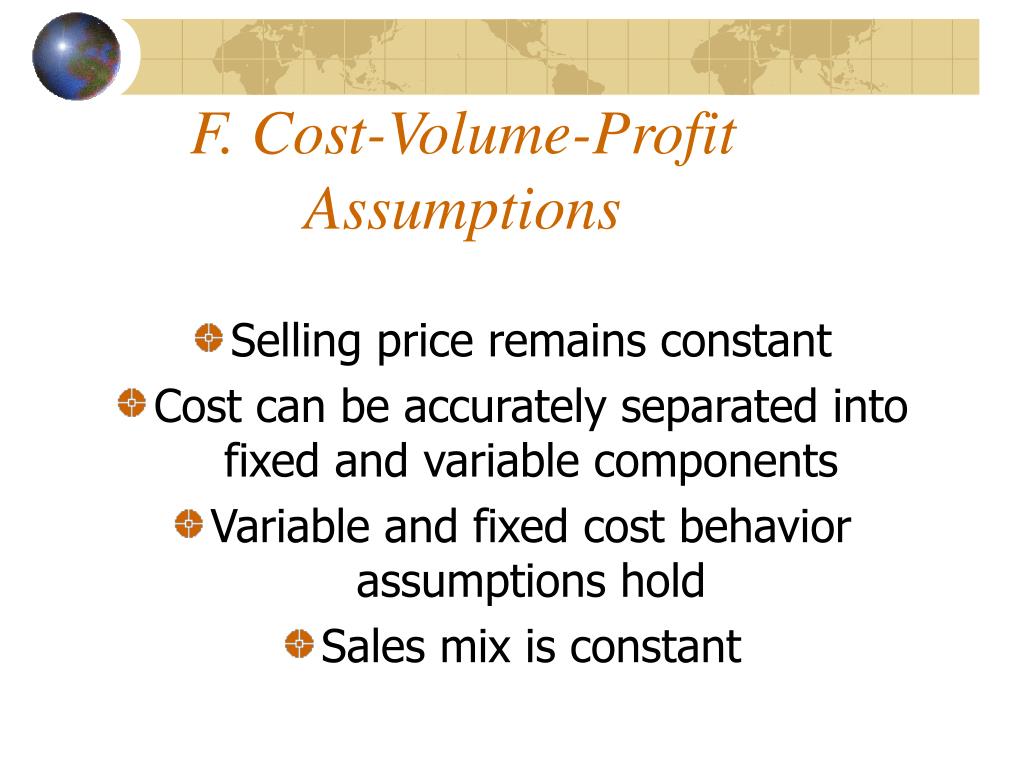

1. Constant Selling Price

The most basic assumption of CVP is that the selling price per unit remains constant, regardless of the volume of sales. This assumes a stable market, without price fluctuations due to competition, discounts, or changes in customer demand. In reality, businesses often adjust prices to attract customers or respond to market pressures.

2. Constant Variable Costs Per Unit

CVP analysis assumes that variable costs per unit, such as direct materials and direct labor, remain constant. This means that the cost of producing each additional unit is the same, regardless of the total volume produced. However, economies of scale, bulk discounts on materials, or changes in labor efficiency can affect variable costs per unit as production volume changes.

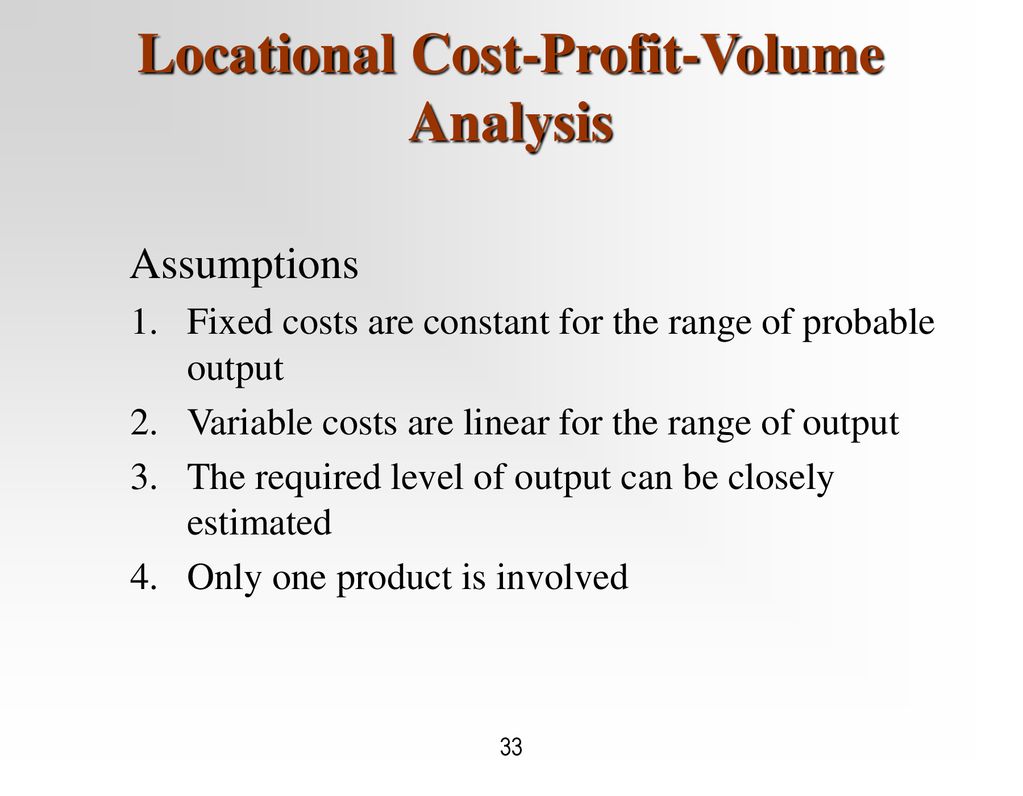

3. Constant Fixed Costs

Fixed costs, such as rent, salaries, and depreciation, are assumed to remain constant in total within a relevant range of activity. This means that these costs do not change regardless of the volume of production or sales within a certain range. Outside of this relevant range, fixed costs may change. For example, if a business needs to expand its production capacity, it may need to rent a larger facility, increasing fixed costs. Consider a scenario where Sarah's bakery expands; she'd need a larger oven, significantly increasing her fixed costs.

4. Constant Sales Mix

When a company sells multiple products, CVP analysis assumes a constant sales mix. This means that the proportion of each product sold remains consistent. If the sales mix changes (e.g., a shift in customer preference towards one product), the accuracy of CVP analysis will be compromised. Imagine Sarah's bakery; if suddenly, everyone wants croissants and nobody wants muffins, her CVP analysis needs a revisit.

5. Linear Cost and Revenue Functions

CVP analysis assumes that both costs and revenues behave in a linear fashion. This means that they can be represented by a straight line on a graph. In reality, cost and revenue functions can be non-linear, especially at very high or very low levels of activity. This simplification can lead to inaccuracies in predicting profitability at extreme levels of production.

6. All Costs Can Be Classified as Fixed or Variable

A core assumption is that all costs can be neatly categorized as either fixed or variable. However, some costs, known as semi-variable or mixed costs, have both fixed and variable components. These costs need to be separated into their fixed and variable components before CVP analysis can be applied accurately. For instance, Sarah's utility bill might have a fixed monthly charge plus a variable charge based on electricity consumption.

7. Volume is the Only Cost Driver

CVP analysis assumes that the volume of production or sales is the only factor that affects costs. In reality, other factors, such as technology, efficiency, and quality, can also impact costs. Ignoring these factors can lead to an incomplete understanding of the cost structure. Perhaps Sarah invests in a new, more efficient oven that reduces energy consumption; this isn't directly related to volume, but significantly impacts her costs.

8. Production Equals Sales

CVP often assumes that all units produced are sold, meaning there is no change in inventory levels. This simplification ignores the costs associated with holding inventory, such as storage, insurance, and obsolescence. When inventory levels fluctuate, the accuracy of CVP analysis can be affected. If Sarah bakes more bread than she sells, the leftover inventory adds to her costs, which CVP analysis, in its simplest form, wouldn't account for.

The Significance of Acknowledging Assumptions

Understanding these assumptions is not about discrediting CVP analysis, but rather about using it responsibly. Recognizing the limitations allows for adjustments and a more nuanced interpretation of the results. It's about moving beyond a purely theoretical model to a more realistic and practical application. Ignoring these assumptions leads to misleading results.

By understanding these assumptions, business owners and managers can better assess the validity of the results and make more informed decisions. For example, if a business is considering a significant price change, they should adjust their CVP analysis to reflect the new selling price. Similarly, if a business is experiencing significant fluctuations in inventory levels, they should incorporate the costs of holding inventory into their analysis. Sensitivity analysis, for example, is a technique that can be used to assess the impact of changes in key assumptions on the results of CVP analysis. It helps to understand the range of possible outcomes and identify the most critical assumptions.

Beyond the Textbook: Real-World Application

In practice, businesses often use CVP analysis as a starting point for their decision-making. They then supplement the analysis with other tools and techniques, such as market research, competitor analysis, and sensitivity analysis. This comprehensive approach allows them to make more informed and strategic decisions. It’s about blending the theoretical with the practical to navigate the complexities of the business world.

For Sarah, understanding the assumptions of CVP analysis means recognizing that her initial calculations are just a starting point. She needs to consider potential price fluctuations, changes in ingredient costs, and the possibility of unsold pastries. By doing so, she can create a more realistic and robust business plan. The reality is, the business environment is very dynamic; understanding these assumptions gives the business owner the flexibility to adjust on the fly and make appropriate decisions.

Conclusion: Navigating the Landscape with Awareness

CVP analysis is a valuable tool, but its effectiveness depends on a thorough understanding of its underlying assumptions. While the world rarely aligns perfectly with these assumptions, acknowledging their existence allows for adjustments and a more nuanced interpretation of the results. By using CVP analysis with awareness and supplementing it with other analytical tools, businesses like Sarah’s bakery can navigate the complexities of the market and make informed decisions that lead to sustainable profitability.

Ultimately, it's about blending the simplicity of the model with the reality of the market, creating a powerful framework for informed decision-making. And for Sarah, it's about turning her dream into a delicious and profitable reality. Sarah's story reminds us that while models are useful, they should be applied with a healthy dose of real-world awareness.