Authorized Common Stock Refers To The Total Number Of Shares:

Breaking: Investors brace for potential dilution as TechForward Inc. announces a significant increase in authorized common stock. The move signals a possible capital raise, impacting shareholder value and market dynamics.

This development comes amid growing concerns about TechForward's long-term financial stability and its aggressive expansion plans. The decision to increase authorized shares raises questions about the company's future strategy and its ability to generate organic growth.

What is Authorized Common Stock?

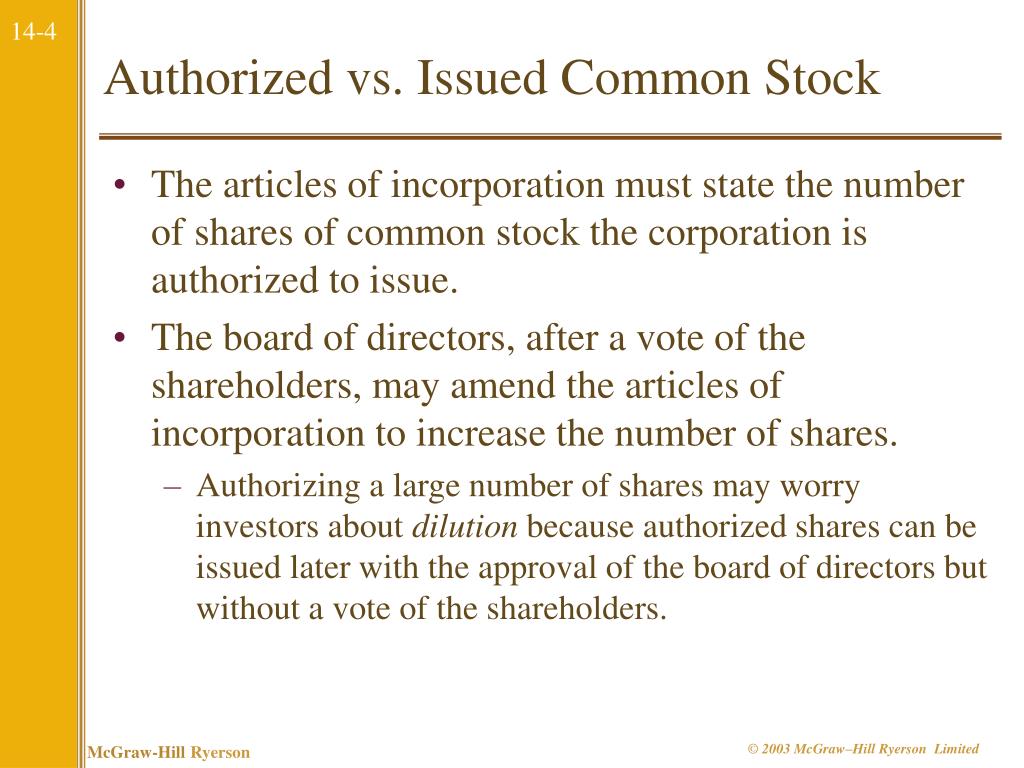

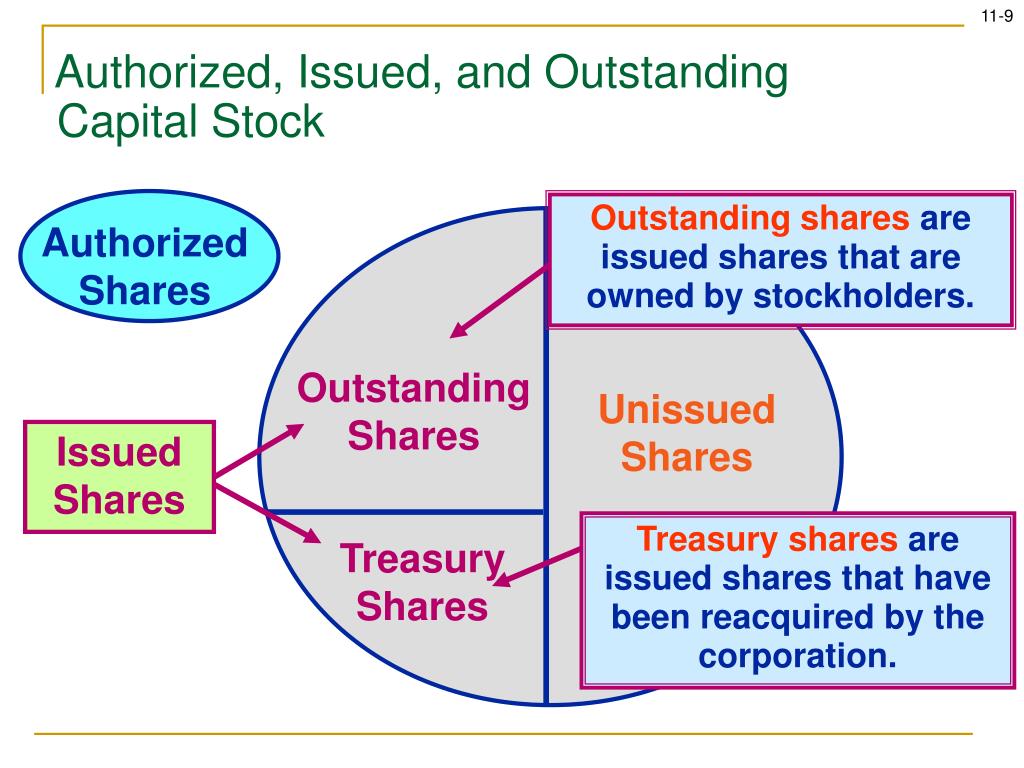

Authorized common stock represents the maximum number of shares a company is legally permitted to issue. This number is defined in the company's corporate charter and can only be increased through a shareholder vote.

Increasing the number of authorized shares doesn't automatically mean the company will issue all those shares immediately. It provides flexibility for future capital raising activities, such as equity offerings, acquisitions, or employee stock options.

TechForward's Announcement: Key Details

The announcement, released earlier today, detailed TechForward's plan to increase its authorized common stock from 500 million shares to 1 billion shares. This proposal will be put to a shareholder vote at the upcoming annual general meeting scheduled for next month.

According to the filing with the SEC, the company stated the increase is intended to "provide greater flexibility for future corporate needs." However, the specific use of the potential new shares was not explicitly outlined.

“This decision reflects our commitment to ensuring TechForward remains agile and well-positioned for future opportunities,” stated a brief press release from CEO Anya Sharma. The statement offered little additional clarity, fueling investor anxiety.

Potential Implications for Shareholders

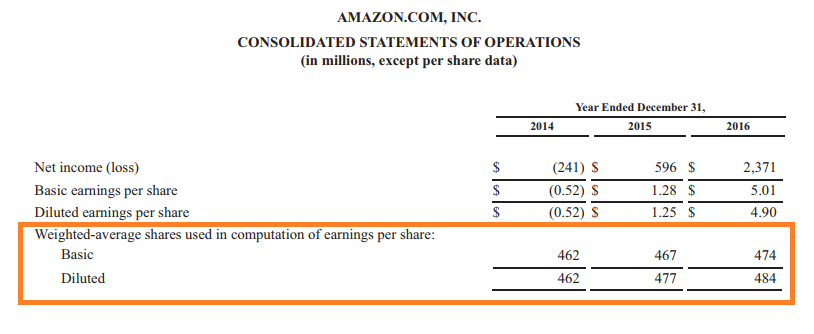

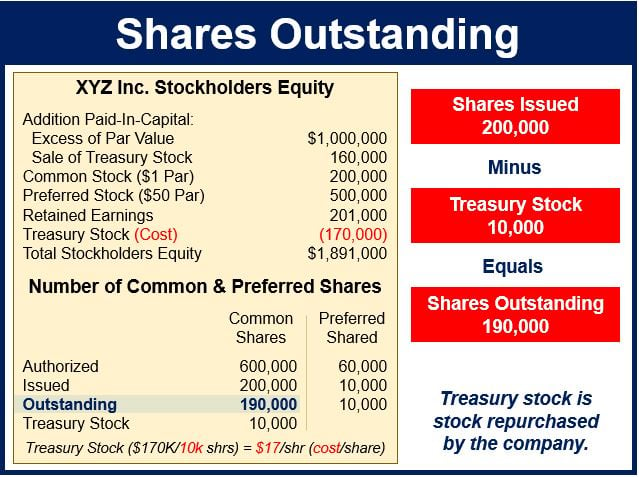

The primary concern for existing shareholders is potential dilution. Dilution occurs when new shares are issued, decreasing the ownership percentage and earnings per share (EPS) for existing shareholders.

If TechForward issues a significant number of new shares, the value of existing shares could decline. This is because the company's earnings would be spread across a larger pool of shares.

However, the increase in authorized shares does not guarantee dilution. If the company uses the new shares wisely, for example, to fund a highly profitable acquisition, the overall value of the company could increase, offsetting the dilution effect.

Market Reaction and Analyst Commentary

The market reacted negatively to the news, with TechForward's stock price dropping by 12% in early trading. Investors are clearly concerned about the potential for dilution and the lack of transparency surrounding the company's plans.

“The lack of clarity surrounding the intended use of these new shares is troubling,” said David Chen, a senior analyst at Capital Research Group. “Investors are left wondering what TechForward is planning, and uncertainty always breeds fear."

Chen further noted, “While increased flexibility can be beneficial, it's crucial for management to communicate a clear and compelling vision for the company's future. Otherwise, shareholders are likely to punish the stock."

TechForward's Financial Position

TechForward's recent financial performance has been mixed. While revenue has grown steadily, profitability has been under pressure due to rising operating expenses and increased competition.

The company's debt levels have also increased in recent quarters, raising concerns about its ability to service its obligations. Some analysts speculate that the increase in authorized shares may be a preemptive measure to address potential liquidity issues.

However, the company maintains that its financial position is strong and that it is confident in its long-term growth prospects. "We are in a solid financial position," Sharma emphasized in a separate internal memo leaked to the press.

Shareholder Vote and Next Steps

The shareholder vote on the proposed increase in authorized common stock is scheduled for [Date of Meeting]. The outcome of this vote will have a significant impact on TechForward's future.

Shareholders are urged to carefully consider the proposal and exercise their voting rights. Proxy advisory firms are expected to release their recommendations in the coming weeks, providing further guidance to investors.

TechForward is expected to hold a conference call with analysts and investors to provide more details about its plans. This call is scheduled for [Date and Time of Call].

"The coming weeks will be critical for TechForward. Management needs to clearly articulate its vision and address shareholder concerns to avoid further erosion of confidence," - Financial Times

:max_bytes(150000):strip_icc()/authorized-share-capital.asp_Final-c78362a84e65420a9bf5f6ecd0f4c0b9.png)