Difference Between Payday Loan And Installment Loan

In the landscape of short-term borrowing options, two common types of loans often appear: payday loans and installment loans. While both offer quick access to funds, understanding their fundamental differences is crucial for borrowers to make informed financial decisions.

This article will delve into the key distinctions between these two loan types, exploring their structures, terms, and associated risks, helping individuals navigate the complexities of short-term lending.

Understanding Payday Loans

Payday loans are short-term, high-interest loans typically designed to be repaid on the borrower's next payday. They are often marketed as a quick fix for unexpected expenses or financial emergencies. The Consumer Financial Protection Bureau (CFPB) describes them as loans with a high fee, often due in two weeks.

These loans are usually for smaller amounts, ranging from a few hundred dollars to maybe $1000, depending on state regulations and the lender. The application process is generally straightforward, often requiring minimal credit checks and quick approval times.

Key Features of Payday Loans

Short Repayment Term: Payday loans are characterized by their extremely short repayment term, usually two to four weeks. The entire loan amount, including the principal and fees, is typically due in a single lump sum payment.

High Interest Rates and Fees: Payday loans come with exorbitant interest rates and fees, often expressed as an Annual Percentage Rate (APR) that can reach triple digits. These high costs make them one of the most expensive forms of borrowing.

Rollover Option: If a borrower is unable to repay the loan on the due date, they may have the option to "rollover" or renew the loan. However, this comes at a cost, as additional fees are charged, trapping borrowers in a cycle of debt.

Exploring Installment Loans

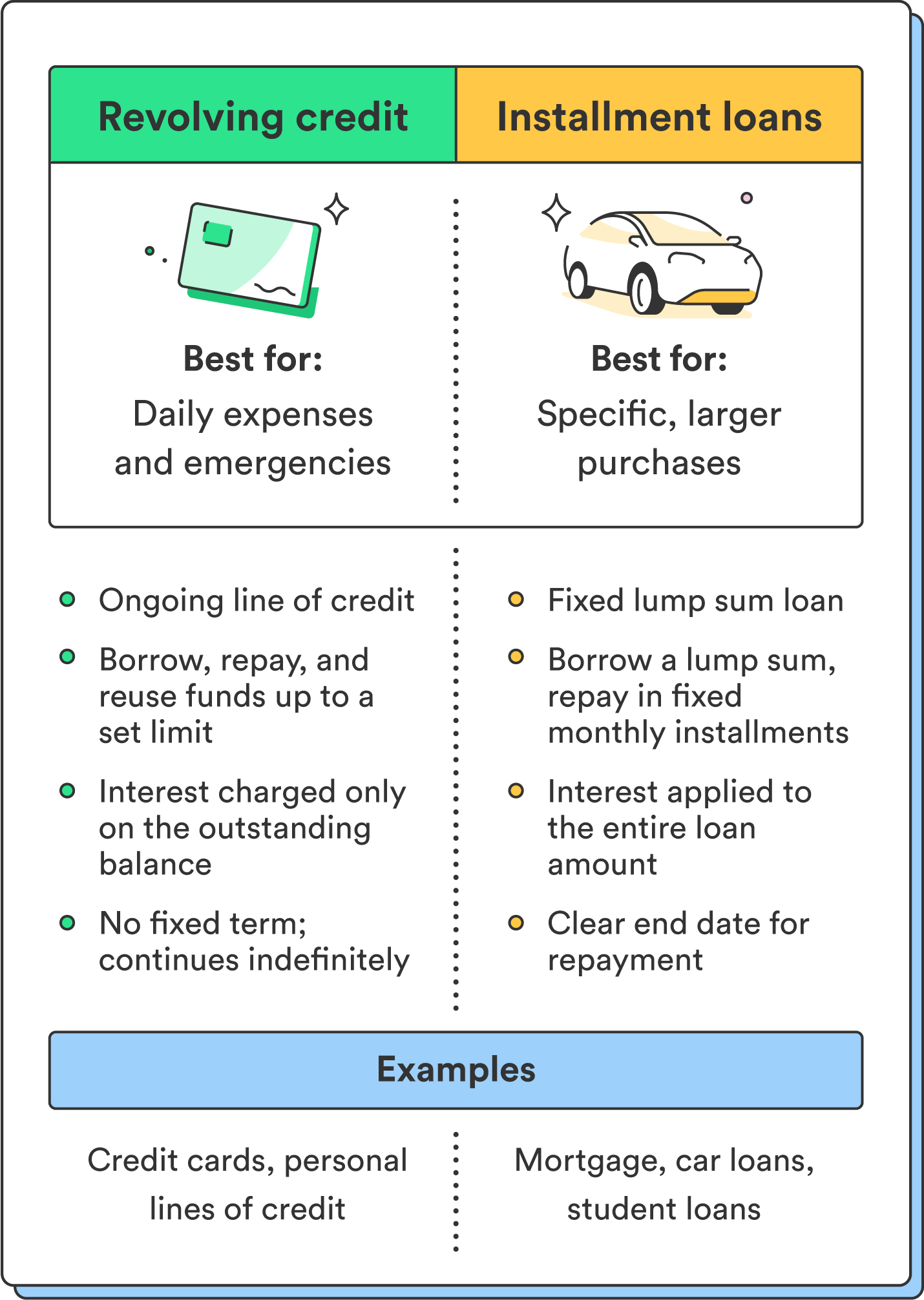

Installment loans, on the other hand, are repaid over a longer period through a series of fixed, scheduled payments. These loans are available from various lenders, including banks, credit unions, and online lenders.

Installment loans can be used for a variety of purposes, such as debt consolidation, home improvements, or large purchases. The loan amount and repayment term can vary significantly depending on the borrower's creditworthiness and the lender's policies.

Key Features of Installment Loans

Fixed Repayment Schedule: Installment loans are repaid through regular, fixed payments over a defined period, typically ranging from several months to several years. This predictable repayment schedule allows borrowers to budget accordingly.

Lower Interest Rates: Generally, installment loans have lower interest rates compared to payday loans. The APR on an installment loan will depend on factors such as the borrower's credit score, loan amount, and repayment term.

Larger Loan Amounts: Installment loans usually involve larger sums of money compared to payday loans. Borrowers can often access several thousand dollars or more, depending on their needs and qualifications.

Key Differences Summarized

The most significant difference lies in the repayment structure. Payday loans demand a lump-sum repayment within weeks, whereas installment loans offer a series of payments spread over a more extended duration.

Another crucial distinction is the cost of borrowing. Payday loans typically have much higher fees and APRs compared to installment loans, making them a more expensive option in the long run.

Furthermore, the amount of money accessible usually varies greatly. Payday loans cater to smaller, immediate needs, whereas installment loans accommodate larger borrowing requirements.

Potential Impact and Considerations

The choice between a payday loan and an installment loan can significantly impact a borrower's financial well-being. While payday loans may provide quick relief, their high costs and short repayment terms can lead to a cycle of debt.

Installment loans, with their more manageable payment schedules and lower interest rates, may offer a more sustainable borrowing solution for some borrowers. However, it's crucial to consider one's ability to repay the loan before committing to any borrowing agreement.

According to the Pew Charitable Trusts, payday loans are often unaffordable for borrowers, leading to repeat borrowing. Responsible borrowing practices and careful consideration of available alternatives are essential to avoid financial distress.

Conclusion

Understanding the differences between payday loans and installment loans is vital for making informed financial decisions. Payday loans, with their short terms and high costs, pose a greater risk of debt cycles, whereas installment loans may offer a more manageable and affordable option for some.

Borrowers should carefully evaluate their financial needs, explore alternative borrowing options, and prioritize responsible borrowing practices to ensure they make the best choice for their circumstances.

Seeking financial advice from a qualified professional can also provide valuable guidance in navigating the complexities of short-term lending and making informed decisions about borrowing.

:max_bytes(150000):strip_icc()/dotdash-title-loans-vs-payday-loans-which-are-better-Final-a61111fe80ff4f4f9a9b0eb9428ba803.jpg)

:max_bytes(150000):strip_icc()/how-installment-loans-work.asp-Final-fe2585ceb90e430188f95733504dbd40.jpg)