Digital Transformation In Tax Services Axiumtech

The relentless march of digital transformation is reshaping industries across the globe, and the tax services sector is no exception. Firms are grappling with mounting pressure to deliver faster, more accurate, and more transparent services while navigating increasingly complex regulations. One company, Axiumtech, is positioning itself at the forefront of this digital revolution, but its approach and impact are drawing both attention and scrutiny.

This article delves into Axiumtech's role in digital transformation within tax services. We will explore its strategies, the technologies it employs, the benefits and challenges it presents, and how it's impacting traditional accounting practices and the wider tax ecosystem. The key questions we'll address include: How is Axiumtech leveraging technology to transform tax services? What are the benefits and drawbacks of its approach for both businesses and tax professionals? And what is the overall impact of this shift on the future of taxation?

Axiumtech's Digital Approach

Axiumtech offers a suite of cloud-based solutions designed to automate and streamline various tax-related processes. These services range from tax preparation and filing to compliance management and tax planning. Central to their approach is the use of artificial intelligence (AI) and machine learning (ML) to automate tasks, analyze data, and identify potential tax savings opportunities.

According to a statement released by Axiumtech's CEO, "[Our] platform is designed to empower tax professionals and businesses alike." The company asserts that its technology reduces errors, improves efficiency, and ultimately leads to better tax outcomes. They emphasize the use of data analytics to proactively identify potential tax risks and optimize tax strategies.

Key Technologies Employed

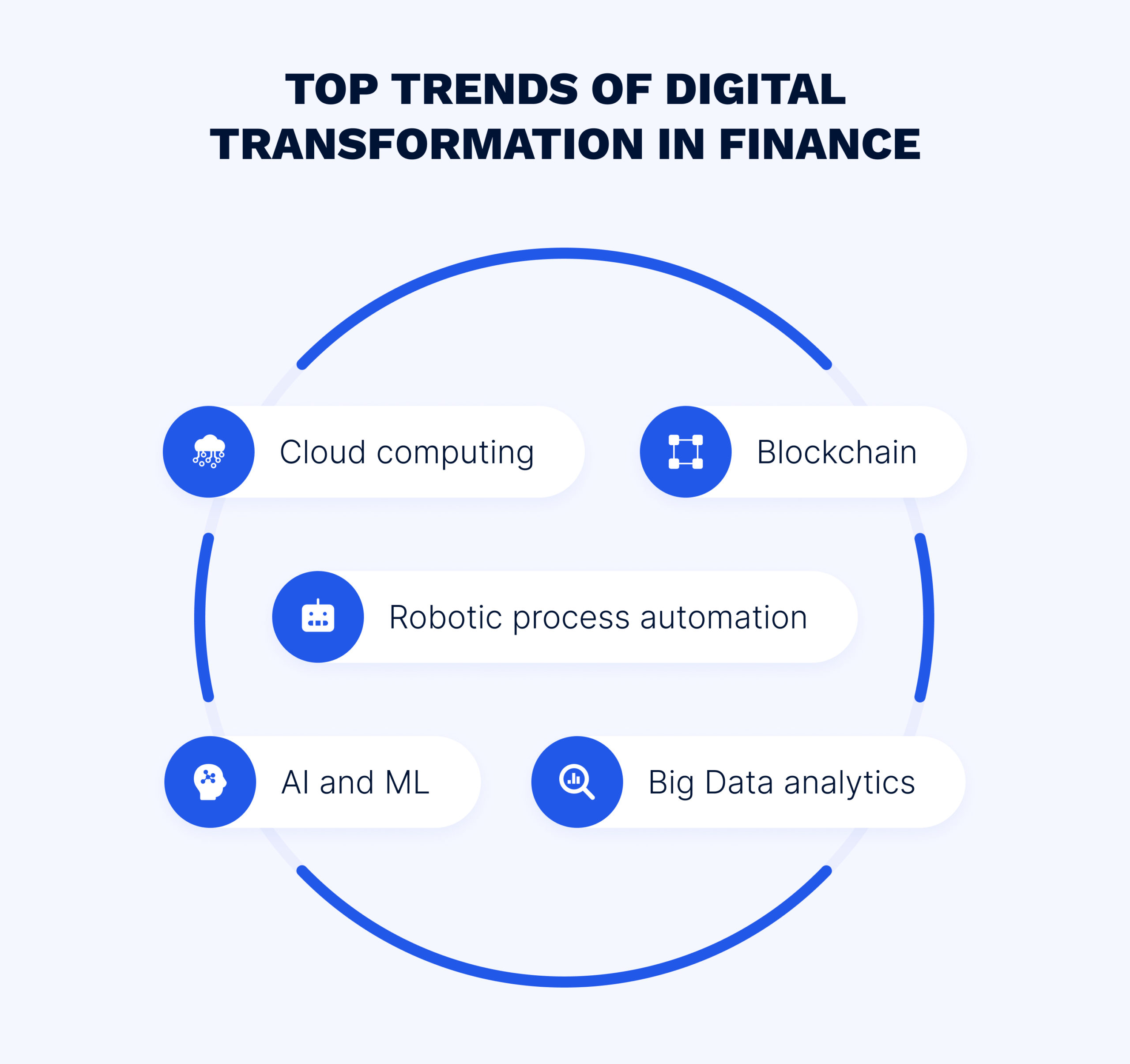

Axiumtech's solutions heavily rely on several key technologies. Cloud computing provides the infrastructure for scalability and accessibility. Robotic Process Automation (RPA) automates repetitive tasks, such as data entry and reconciliation.

AI and ML algorithms analyze vast datasets to identify patterns, predict tax liabilities, and detect fraudulent activities. Blockchain technology, although still in its early stages of adoption in tax, is being explored by Axiumtech for its potential to enhance data security and transparency in tax transactions.

Benefits of Digital Transformation in Tax

The shift towards digital tax services offers several potential advantages. Businesses can benefit from reduced compliance costs, improved accuracy, and increased efficiency.

According to a report by Deloitte, digital transformation can lead to a 20-30% reduction in tax compliance costs. Furthermore, automated systems are less prone to human error, which can lead to significant cost savings and reduced risk of penalties.

"Digital transformation is not just about technology; it's about fundamentally changing the way businesses operate and creating value,"said Sarah Jones, a tax partner at Deloitte, in the report.

Increased Efficiency and Accuracy

Automation streamlines tax processes, reducing the time and effort required for tasks such as data collection, preparation, and filing. This allows tax professionals to handle a larger volume of clients while maintaining accuracy and compliance.

AI-powered tools can automatically identify errors and inconsistencies in tax data, reducing the risk of penalties and audits. Real-time data analytics provide insights into tax liabilities and potential savings opportunities, enabling businesses to make more informed decisions.

Challenges and Concerns

Despite the potential benefits, the digital transformation of tax services also presents several challenges. One of the primary concerns is data security and privacy.

Another concern is the potential for job displacement. As automation replaces manual tasks, some tax professionals may find their jobs at risk. There are also concerns about the algorithmic bias in AI-powered tax tools, which could lead to unfair or discriminatory outcomes.

Data Security and Privacy Risks

Protecting sensitive tax data from cyber threats is a top priority. Businesses and tax professionals must implement robust security measures, such as encryption, multi-factor authentication, and regular security audits. Compliance with data privacy regulations, such as GDPR and CCPA, is also essential.

The increasing sophistication of cyberattacks requires constant vigilance and investment in cybersecurity. Data breaches can lead to significant financial losses, reputational damage, and legal liabilities.

Impact on Traditional Tax Practices

The rise of digital tax services is forcing traditional accounting firms to adapt or risk becoming obsolete. Many firms are investing in new technologies and training their staff to use them effectively.

Some firms are partnering with technology companies like Axiumtech to offer a wider range of digital services to their clients. Others are developing their own in-house digital solutions. The ability to embrace and integrate technology is becoming a critical success factor for accounting firms.

The Evolving Role of Tax Professionals

The role of tax professionals is evolving from data entry and compliance to more strategic advisory work. Tax professionals are becoming more involved in tax planning, risk management, and data analysis.

They are also playing a crucial role in helping businesses navigate the complex regulatory landscape. The skills required for tax professionals are also changing, with a greater emphasis on data analytics, technology, and communication skills.

Looking Ahead: The Future of Tax

The digital transformation of tax services is still in its early stages, but it is clear that it will continue to reshape the industry. We can expect to see even more automation, AI-powered solutions, and cloud-based services in the future.

Blockchain technology may also play a greater role in enhancing data security and transparency. The future of tax will be characterized by greater efficiency, accuracy, and transparency. However, it will also require careful attention to data security, privacy, and ethical considerations.

Axiumtech, and companies like it, will continue to play a significant role in driving this transformation. Success will depend on their ability to innovate, adapt, and address the challenges and concerns associated with digital tax services. The need to upskill professionals to work alongside AI and to ensure ethical and unbiased algorithmic implementation will be paramount.

![Digital Transformation In Tax Services Axiumtech Digital Services Tax Guide for US Businesses [DST]](https://mytaxhack.com/wp-content/uploads/2023/06/digital-services-tax.png)

.jpeg#keepProtocol)