What Are The Stages Of Business Cycle

The economic landscape is never static. It's a constantly evolving series of expansions and contractions that impact businesses, individuals, and governments alike. Understanding these cyclical shifts is crucial for making informed decisions and navigating the uncertainties of the market.

At the heart of this ever-changing environment lies the business cycle, a recurring but not periodic sequence of economic growth and decline. This article will break down the distinct stages of the business cycle, offering insights into their characteristics, drivers, and potential impact on the economy.

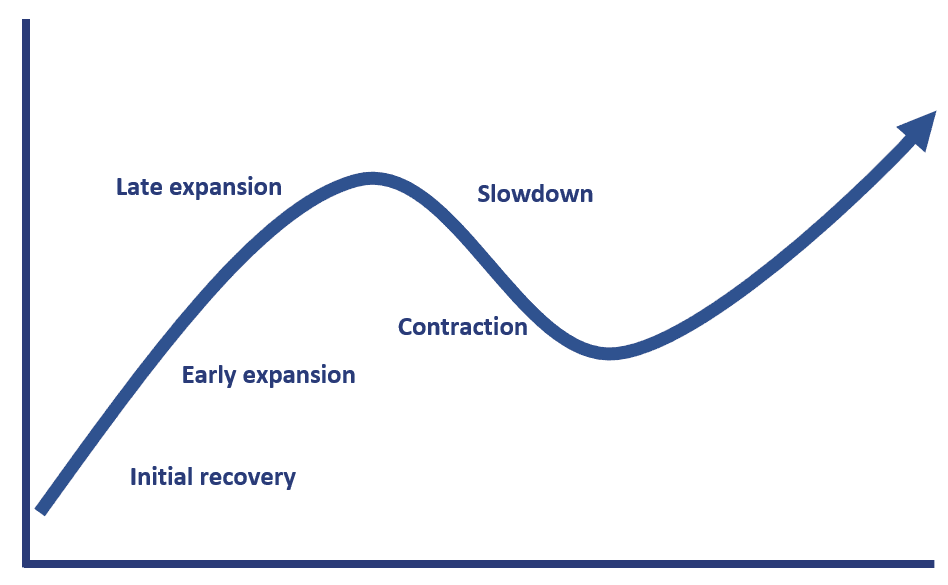

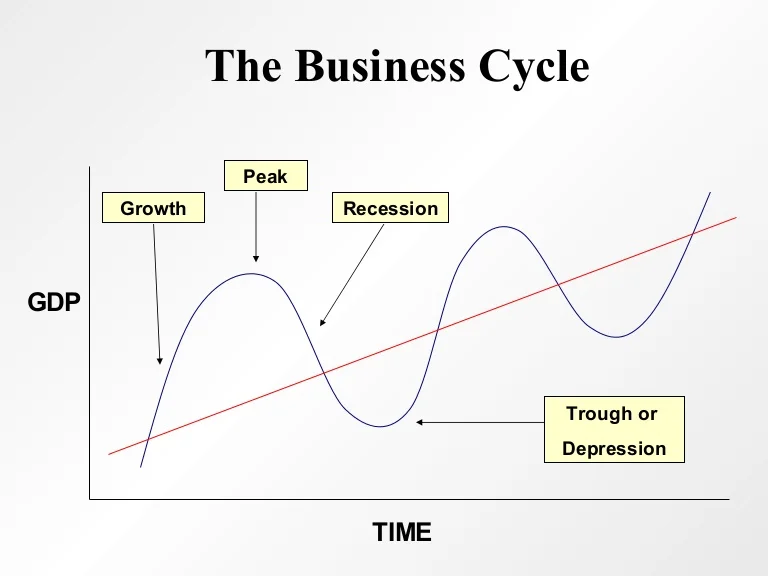

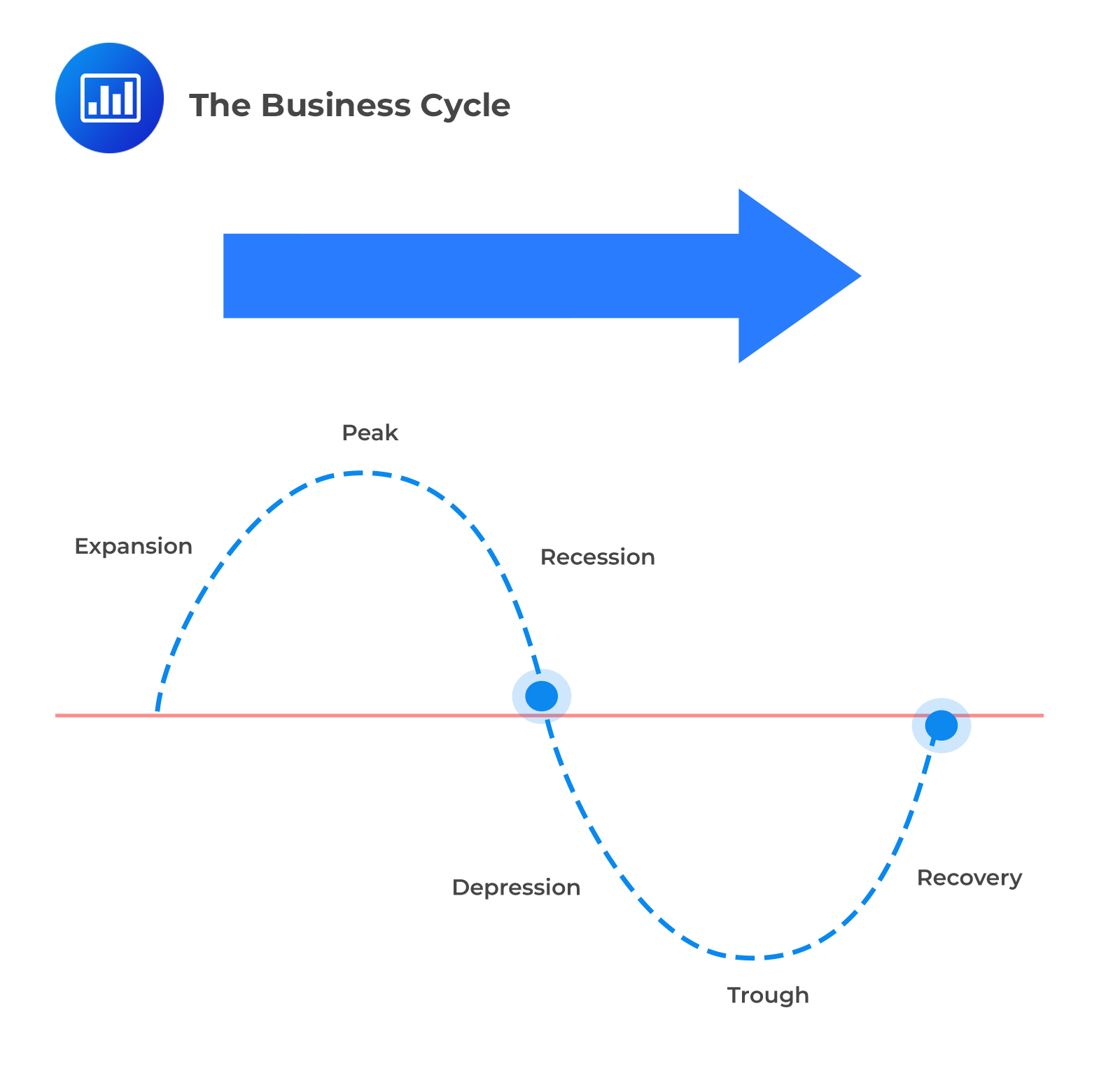

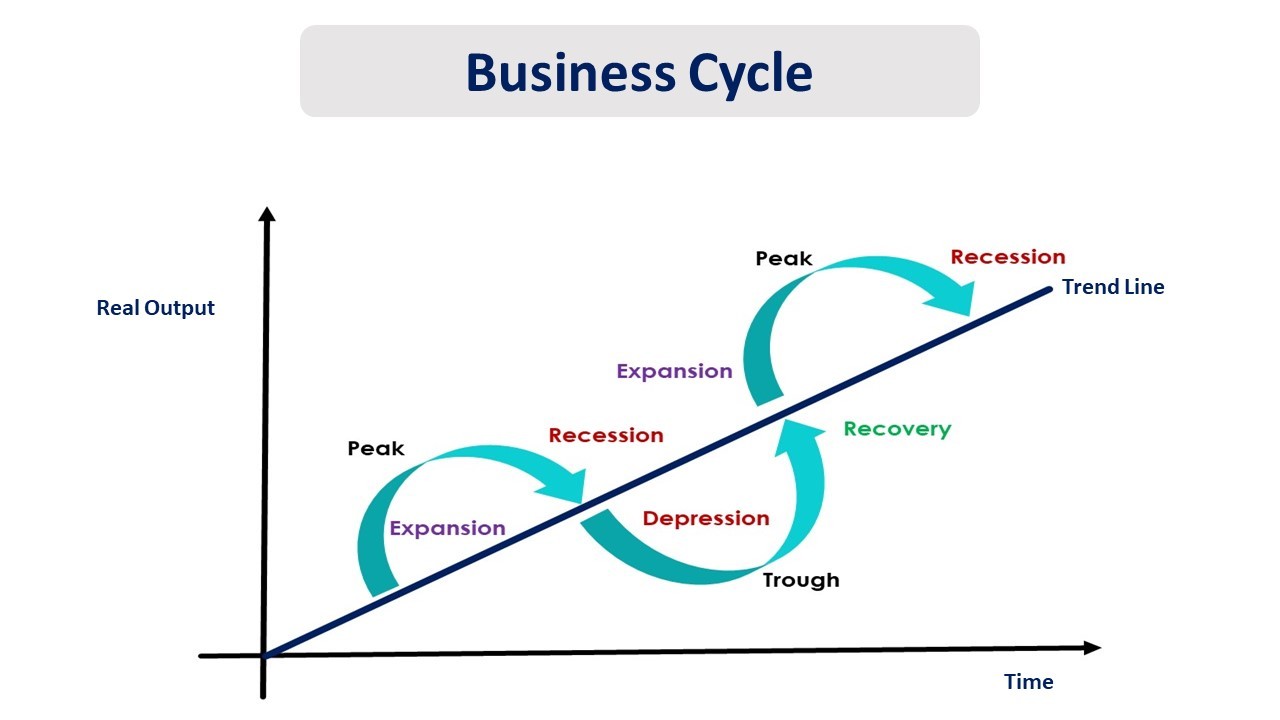

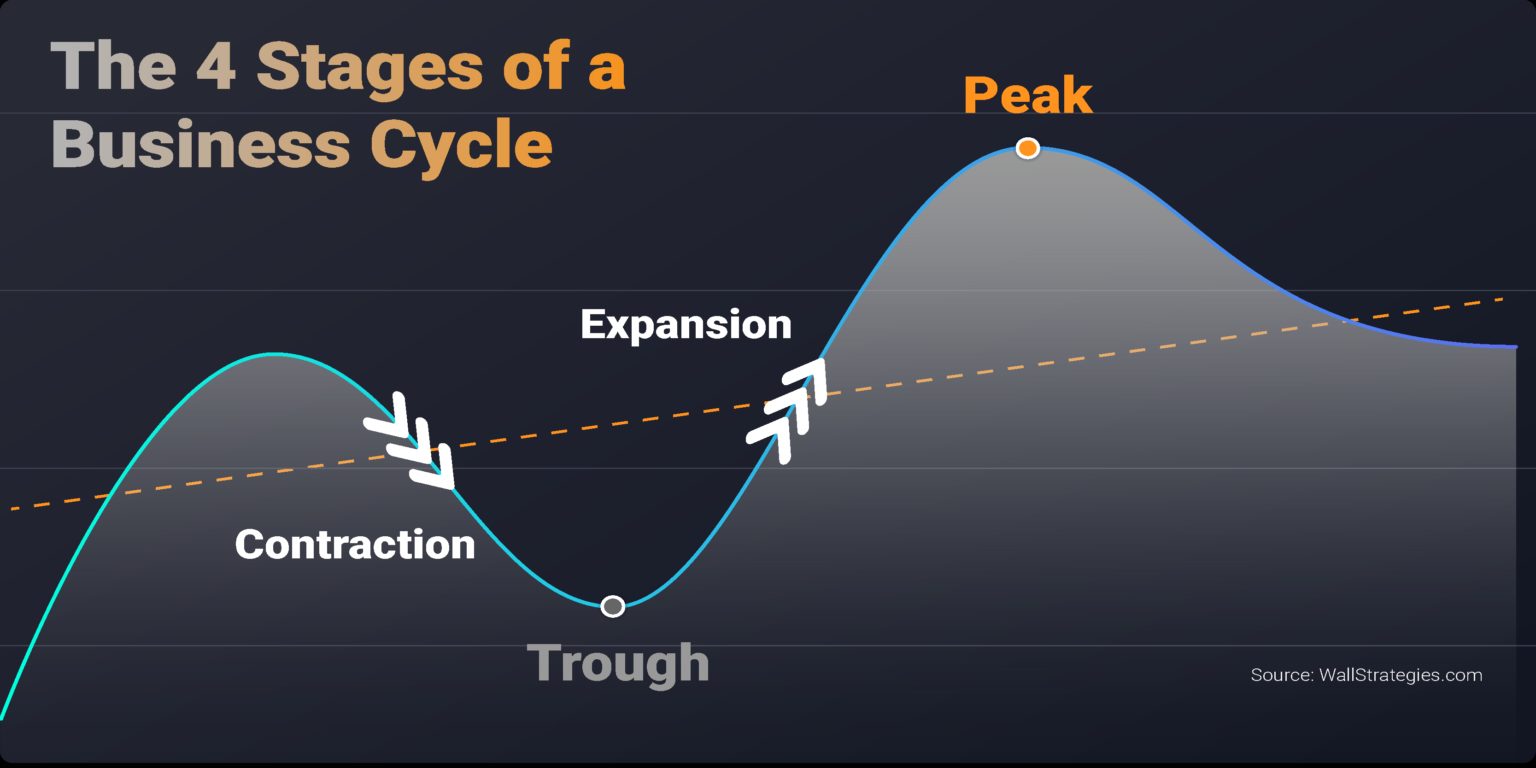

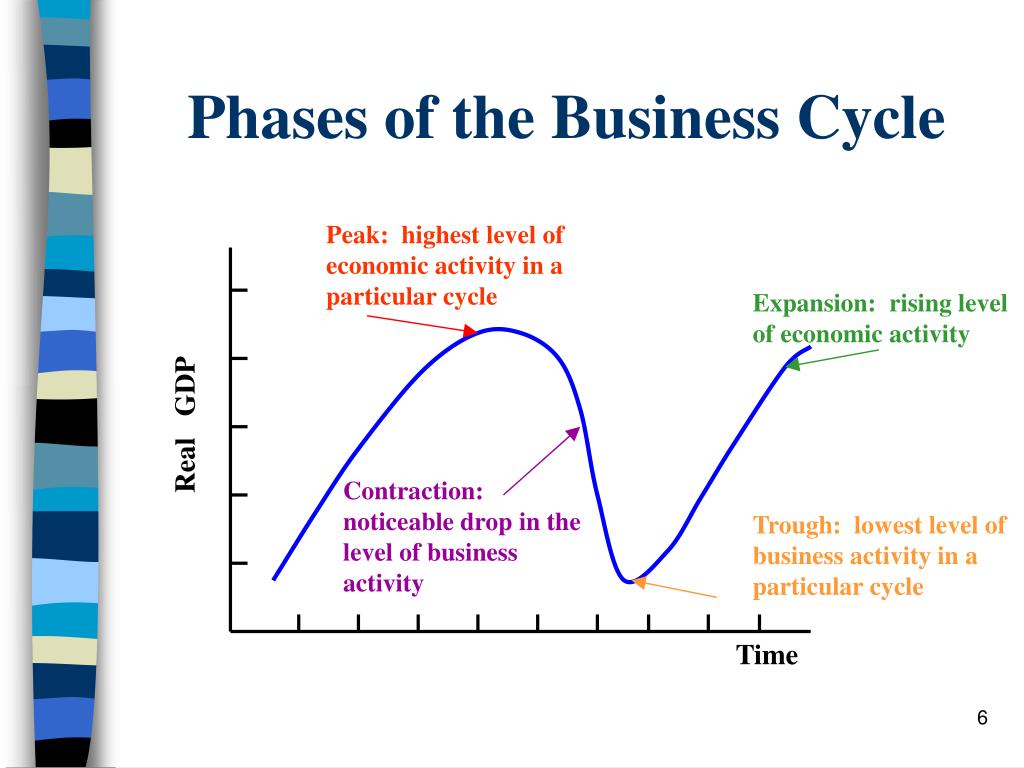

The Four Stages of the Business Cycle

The business cycle is generally defined by four primary stages: expansion, peak, contraction (or recession), and trough. Each stage has its own defining characteristics and influence on economic activity. Let's delve into each of these stages in detail.

Expansion

The expansion phase is a period of economic growth. During this time, GDP (Gross Domestic Product) is increasing, unemployment rates are falling, and consumer confidence is typically high.

Businesses are investing, hiring, and expanding their operations. Credit is readily available, and the stock market often performs well.

Key indicators of expansion include rising consumer spending, increased manufacturing activity, and growing business investment. Government policies, such as lower interest rates, can sometimes fuel expansion.

Peak

The peak represents the highest point of economic activity in the business cycle. It marks the end of the expansion phase and the beginning of a contraction.

At the peak, resources are often fully utilized, and inflationary pressures may start to build. Demand may outstrip supply, leading to higher prices.

Warning signs of a peak include slowing economic growth, rising interest rates, and a potential decline in consumer confidence. Identifying the peak is difficult in real-time, and it's often recognized only in retrospect.

Contraction (Recession)

The contraction phase, also known as a recession, is a period of economic decline. GDP is decreasing, unemployment rates are rising, and consumer confidence is typically low.

Businesses may reduce investment, lay off employees, and scale back operations. Credit becomes tighter, and the stock market often declines.

A recession is often defined as two consecutive quarters of negative GDP growth. However, the National Bureau of Economic Research (NBER), considered the authority on dating U.S. business cycles, uses a broader definition that considers several economic indicators.

A quote from NBER, "A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

Trough

The trough represents the lowest point of economic activity in the business cycle. It marks the end of the contraction phase and the beginning of an expansion.

At the trough, economic activity is at its lowest, but there are often signs of stabilization. Businesses may start to see opportunities for investment, and consumer confidence may begin to improve.

Key indicators of a trough include a bottoming out of economic activity, a slowing in the rate of job losses, and a potential increase in consumer spending. Government policies, such as increased spending or lower interest rates, can help stimulate recovery.

Factors Influencing the Business Cycle

Numerous factors can influence the business cycle, including monetary policy, fiscal policy, technological innovation, and global events. Changes in interest rates by central banks, like the Federal Reserve in the U.S., can significantly impact borrowing costs and investment decisions.

Government spending and taxation policies can also stimulate or restrain economic activity. For instance, increased government spending on infrastructure can boost demand and create jobs.

Technological advancements can drive productivity growth and lead to new industries and job creation. Geopolitical events, such as trade wars or pandemics, can disrupt supply chains and impact global economic growth.

Looking Ahead

Predicting the exact timing and duration of business cycles is challenging. However, understanding the different stages and their characteristics can help businesses and policymakers make more informed decisions.

Monitoring key economic indicators, such as GDP growth, unemployment rates, and inflation, is crucial for identifying potential turning points in the cycle. While past performance is not indicative of future results, historical patterns can provide valuable insights into potential risks and opportunities.

By staying informed and adaptable, businesses and individuals can better navigate the ups and downs of the business cycle and achieve long-term success. Continuous learning and a proactive approach are essential for thriving in a dynamic economic environment.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)