Do I Need An Account To Cash A Check

/how-to-write-a-check-4019395_FINAL-eec64c4ad9804b12b8098331b5e25809.jpg)

The simple act of cashing a check, a financial transaction many take for granted, can quickly become a hurdle for those without a bank account. Millions of Americans find themselves in this situation, navigating a landscape of fees, limitations, and potential risks just to access their own funds. The question, "Do I need an account to cash a check?" is more pertinent and complex than it appears on the surface.

This article delves into the intricacies of cashing checks without a bank account, examining the alternatives available, associated costs, potential pitfalls, and the broader implications for financial inclusion. Understanding these options is crucial for those unbanked or underbanked, as well as anyone seeking clarity on the most efficient and cost-effective ways to access their money.

Cashing Checks Without a Bank Account: Options and Considerations

While having a bank account certainly streamlines the process, several alternatives exist for cashing checks without one. Each option carries its own set of pros and cons, particularly concerning fees and accessibility.

The Issuing Bank

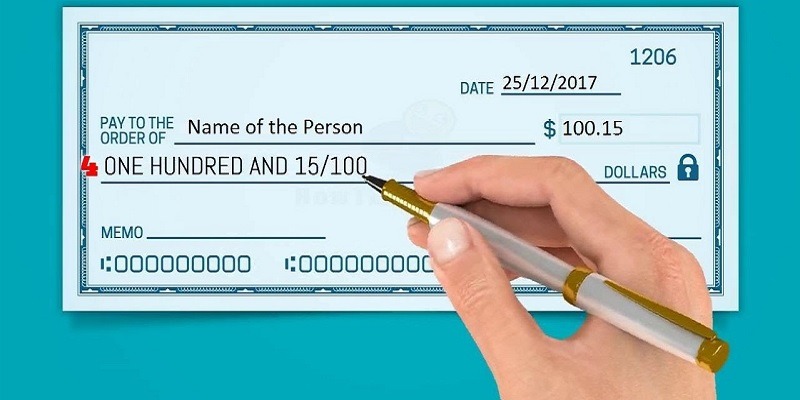

One of the most straightforward options is to cash the check at the bank that issued it. This often requires identification verification, and while it *may* be free, it's becoming increasingly common for banks to charge non-customers a fee, even for cashing their own checks.

Check-Cashing Stores

Check-cashing stores, like ACE Cash Express or Money Mart, offer immediate access to funds but typically charge a percentage of the check amount. These fees can be substantial, especially for larger checks, making them a costly long-term solution.

Retail Stores

Some retail stores, particularly large chains like Walmart, offer check-cashing services. They usually have limits on the check amount and may require a small fee, but often provide a more affordable alternative to dedicated check-cashing stores.

Prepaid Debit Cards

Another option is to load the check onto a prepaid debit card. While this provides convenient access to the funds electronically, be aware of associated fees for activation, loading, and usage, eroding the value of the check.

Fees and Costs: A Significant Factor

Fees are a major consideration when cashing checks without a bank account. These fees can range from a flat rate to a percentage of the check amount, potentially costing a significant portion of the funds.

According to the FDIC, the average check-cashing fee ranges from 1% to 3% of the check amount. These seemingly small percentages can add up, especially for individuals relying on regular check cashing.

Beyond the direct fees for cashing the check, hidden costs associated with transportation and time off work should also be factored in. These indirect costs can further strain already tight budgets.

Security and Risks

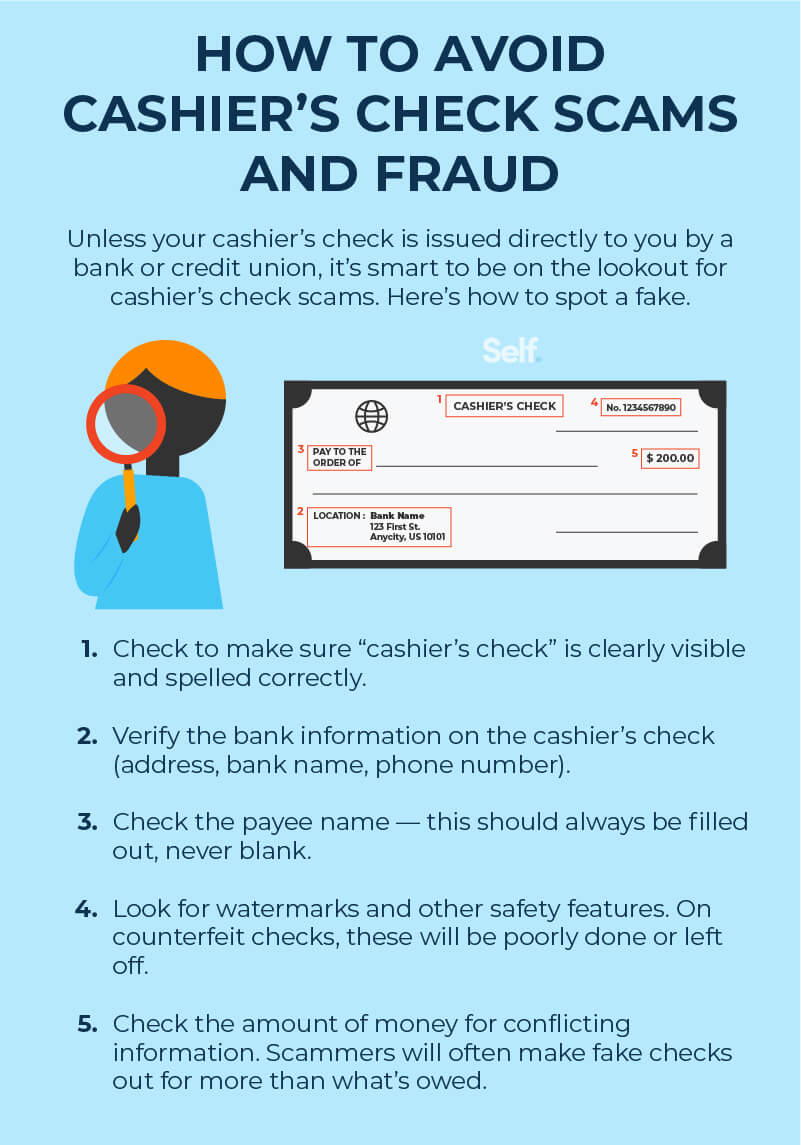

Cashing checks at non-bank entities can also present security risks. Carrying large amounts of cash increases the risk of theft, and less regulated check-cashing services may be more susceptible to fraud.

Always verify the legitimacy of the check-cashing service and ensure they have proper security measures in place. Be wary of offers that seem too good to be true, as they could be scams.

The Broader Context: Financial Inclusion

The difficulty in cashing checks without a bank account underscores the broader issue of financial inclusion. Millions of Americans are unbanked, often due to lack of trust in banks, high fees, or difficulty meeting account requirements.

"The unbanked rate in the United States remains a persistent challenge, disproportionately affecting low-income households and minority communities," stated a recent report by the Consumer Financial Protection Bureau (CFPB).

This lack of access to mainstream financial services can create a cycle of financial exclusion, making it harder for individuals to save, build credit, and achieve financial stability.

Looking Ahead: Potential Solutions

Efforts are underway to expand financial inclusion and make banking services more accessible. These include initiatives to promote low-cost bank accounts, mobile banking solutions, and financial literacy programs.

Advocates are also pushing for greater transparency in check-cashing fees and regulations to protect consumers from predatory practices. Increased awareness and advocacy can play a crucial role in creating a more equitable financial system.

Ultimately, addressing the challenges of cashing checks without a bank account requires a multi-faceted approach. By improving access to affordable banking services and promoting fair and transparent financial practices, we can empower more individuals to participate fully in the economy and build a more secure financial future.