Do You Need A Down Payment For A Personal Loan

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9-c5b260ea1f384a3ca1741b548106ea45.jpg)

Personal loans offering hope without down payments are increasingly common, but borrowers beware: understanding the fine print is critical. Misinformation can lead to financial pitfalls, so due diligence is essential.

This article cuts through the confusion surrounding personal loans, clarifying whether a down payment is typically required and highlighting the crucial factors that determine loan eligibility and costs.

Down Payments: The Truth About Personal Loans

Generally, no, you do not need a down payment for a personal loan. Unlike mortgages or auto loans, personal loans are usually unsecured. This means they are not backed by specific collateral.

Instead, lenders rely on your creditworthiness and ability to repay. Experian reports that the average personal loan interest rate is influenced heavily by your credit score, with lower scores translating to significantly higher rates.

Secured personal loans do exist. However, these are less common and require you to pledge an asset like a car or savings account as collateral.

The Crucial Factors That Determine Your Loan

Lenders meticulously evaluate several factors before approving a personal loan. Your credit score is paramount.

A higher credit score demonstrates a history of responsible borrowing. According to TransUnion, individuals with scores above 700 generally qualify for the best rates and terms.

Your debt-to-income ratio (DTI) is also critical. This ratio represents the percentage of your gross monthly income that goes towards debt payments.

A lower DTI indicates you have more disposable income. Lenders generally prefer a DTI below 43%, as reported by the Consumer Financial Protection Bureau (CFPB).

Lenders also consider your employment history and income stability. Consistent employment and a steady income stream reassure lenders of your ability to repay the loan.

Interest Rates and Fees: Understand the True Cost

While a down payment might not be required, personal loans come with interest rates and fees. Interest rates can vary significantly depending on your creditworthiness.

Shop around and compare rates from multiple lenders. Online lenders, credit unions, and traditional banks all offer personal loans.

Be aware of potential fees such as origination fees, prepayment penalties, and late payment fees. Origination fees, charged upfront, can significantly increase the overall cost of the loan.

Bankrate advises borrowers to carefully review the loan agreement for all associated fees before signing.

Red Flags to Watch Out For

Be wary of lenders who guarantee approval regardless of your credit history. These lenders often charge exorbitant interest rates and fees.

Avoid lenders who pressure you to borrow more than you need. Borrow only what you can comfortably repay.

The Federal Trade Commission (FTC) warns against lenders who are not transparent about their terms and conditions. Always read the fine print and ask questions if anything is unclear.

Alternatives to Personal Loans

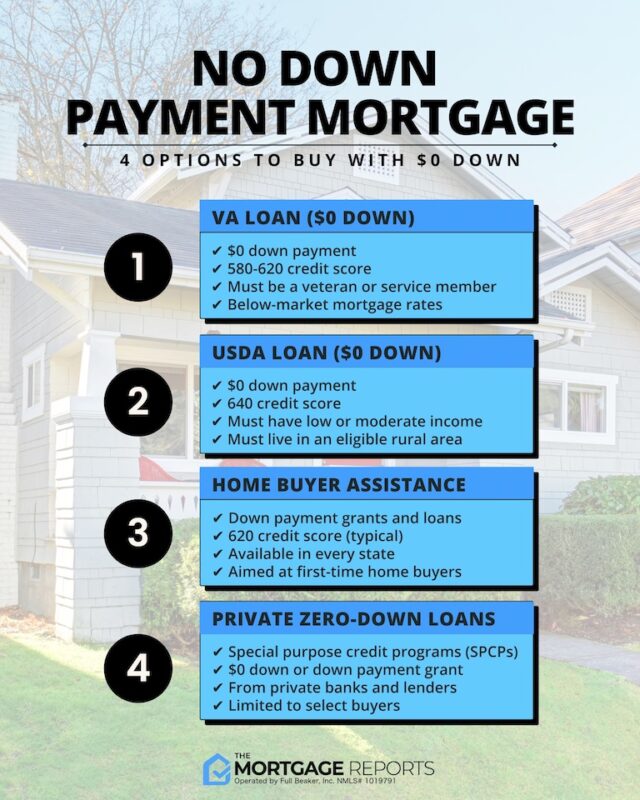

If you are struggling to qualify for a personal loan, explore alternative options. Credit cards with introductory 0% APR offers can be a viable option for short-term borrowing.

However, be mindful of the interest rate that will apply after the introductory period ends. Consider a secured loan, using an asset as collateral, if you have difficulty qualifying for an unsecured loan.

Borrowing from friends or family can be another option. But clearly define the terms of repayment to avoid damaging relationships.

The Role of Credit Unions

Credit unions often offer more favorable terms and lower interest rates than traditional banks. Because they are member-owned, they may be more willing to work with borrowers who have less-than-perfect credit.

NerdWallet consistently rates credit unions as top choices for personal loans due to their competitive rates and customer-friendly service.

Online Lenders: Convenience and Speed

Online lenders offer convenience and speed in the application process. Many online lenders provide pre-qualification options that allow you to check your potential interest rate without affecting your credit score.

However, be diligent in researching online lenders. Ensure they are reputable and have transparent terms and conditions. Verify their credentials through organizations like the Better Business Bureau (BBB).

The Bottom Line: Due Diligence Is Key

While a down payment is not typically required for a personal loan, understanding the associated costs and risks is crucial. Compare offers from multiple lenders, scrutinize the terms and conditions, and borrow only what you can afford to repay.

Take proactive steps to improve your credit score and DTI. This will increase your chances of qualifying for a loan with favorable terms. Stay informed and protect yourself from predatory lending practices.

Continue monitoring updates from reputable financial institutions and the CFPB for the latest guidelines and resources related to personal loans. Make informed financial decisions and prioritize your long-term financial well-being.

:max_bytes(150000):strip_icc()/how-much-do-we-need-as-a-down-payment-to-buy-a-home-1798252_FINAL-d436ccb9c27f4ced9c60c70eb01a4fdb.png)

![Do You Need A Down Payment For A Personal Loan What You Need To Know About Down Payments [INFOGRAPHIC]](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20231214/20231214-KCM-Share.png)