Do You Pay Yourself When You Own A Business

The question of how business owners compensate themselves is a complex one, fraught with implications for personal finance, business growth, and tax obligations. Many entrepreneurs grapple with the intricacies of "paying themselves" when they are the head of their own company.

Understanding the nuances of owner compensation is crucial for ensuring both personal financial stability and the long-term viability of the business. This article explores the various methods entrepreneurs use to draw income from their companies, the associated tax consequences, and the strategic considerations involved in setting an appropriate compensation level.

Methods of Owner Compensation

The method by which an owner draws money from their business depends heavily on the legal structure of the entity. Sole proprietorships and partnerships typically utilize owner's draws. S corporations and C corporations, on the other hand, often use a combination of salary and dividends.

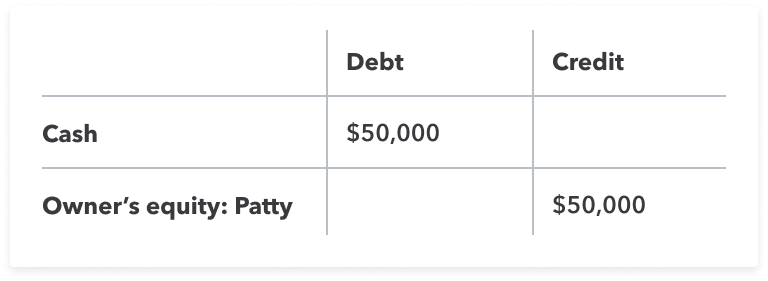

Owner's Draws

In sole proprietorships and partnerships, owners don't receive a traditional salary. Instead, they take owner's draws from the business's profits. These draws are not subject to payroll taxes, but the profits are still subject to self-employment taxes and income tax.

According to the IRS, self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves.

Salary

Owners of S corporations and C corporations can pay themselves a salary. This salary is subject to payroll taxes, including Social Security, Medicare, and unemployment taxes. Additionally, the salary is deductible for the business, reducing its taxable income.

A reasonable salary must be determined by market research according to industry standards, skill level, time commitment and other relevant information to avoid issues with the IRS.

Dividends

C corporations can also distribute profits to shareholders, including the owner, in the form of dividends. Dividends are not tax-deductible for the corporation and are subject to income tax at the shareholder level. However, they are not subject to payroll taxes.

S corporations may also distribute dividends, but they are scrutinized by the IRS to ensure that owners are not avoiding payroll taxes by taking excessive distributions instead of a reasonable salary.

Tax Implications

The way an owner is compensated has significant tax implications. Each method has its own rules governing taxable income, deductions, and tax rates. Careful consideration of these factors is essential for tax planning and compliance.

A Certified Public Accountant (CPA) is often brought on to evaluate tax implications.

Strategic Considerations

Setting an appropriate compensation level requires balancing personal financial needs with the financial health of the business. Paying too much can strain the business's resources, while paying too little can impact the owner's personal well-being and motivation.

Factors such as the business's profitability, cash flow, and future investment needs should be taken into account. The owner's personal financial obligations, such as mortgage payments and living expenses, must also be considered.

Impact on Business Growth

An owner's compensation strategy can directly impact business growth. By reinvesting profits instead of taking excessive draws or salaries, the business can fund expansion, invest in new equipment, and hire additional employees.

Conversely, a poorly planned compensation strategy can hinder growth and even threaten the business's survival. Cash flow management is essential for the long-term success of any enterprise.

Conclusion

Determining how to pay oneself as a business owner is a critical decision with far-reaching consequences. Understanding the various compensation methods, their tax implications, and the strategic considerations involved is essential for achieving both personal financial security and business success.

Consulting with a qualified tax advisor or financial planner is highly recommended to develop a compensation strategy that aligns with the owner's individual circumstances and business goals.