Does Chase Check Credit To Open Checking Account

Imagine strolling into a sunlit Chase branch, the scent of freshly brewed coffee subtly mingling with the crisp air. You're greeted with a warm smile, ready to open a new chapter in your financial journey. But a nagging question lingers: Will opening this seemingly simple checking account impact your credit score?

The central question many prospective Chase customers have is whether Chase checks your credit report when you apply for a checking account. While Chase does perform a type of background check, it doesn't typically involve a hard pull of your credit report for standard checking accounts.

Understanding Chase's Verification Process

Opening a checking account at a major institution like Chase requires a degree of verification to prevent fraud and comply with federal regulations.

This process usually involves confirming your identity and reviewing your banking history.

Chase utilizes systems like ChexSystems and Early Warning Services to assess an applicant's banking history.

What are ChexSystems and Early Warning Services?

These are consumer reporting agencies that specialize in collecting data about how people manage their checking accounts.

They track information such as bounced checks, unpaid overdraft fees, and suspected fraudulent activity.

Banks use these reports to evaluate the risk associated with opening an account for a new customer.

According to Chase's official disclosures and publicly available information, these checks are more about assessing your banking behavior rather than your creditworthiness. They want to see how you've managed accounts in the past. This helps them determine the likelihood of you responsibly managing a new account.

Credit Checks vs. Banking History Checks

It's essential to distinguish between a credit check and a banking history check.

A credit check, or a "hard pull," can slightly lower your credit score, especially if you have multiple inquiries in a short period.

Banking history checks, on the other hand, don't affect your credit score, as they're not reported to the major credit bureaus like Experian, Equifax, or TransUnion.

Opening a standard Chase checking account is unlikely to impact your credit score. Chase uses systems like ChexSystems and Early Warning Services to assess your banking history.

These systems provide a picture of your past banking behavior, informing Chase about potential risks.

Unlike credit checks, these banking history checks don’t influence your credit score.

Exceptions to the Rule

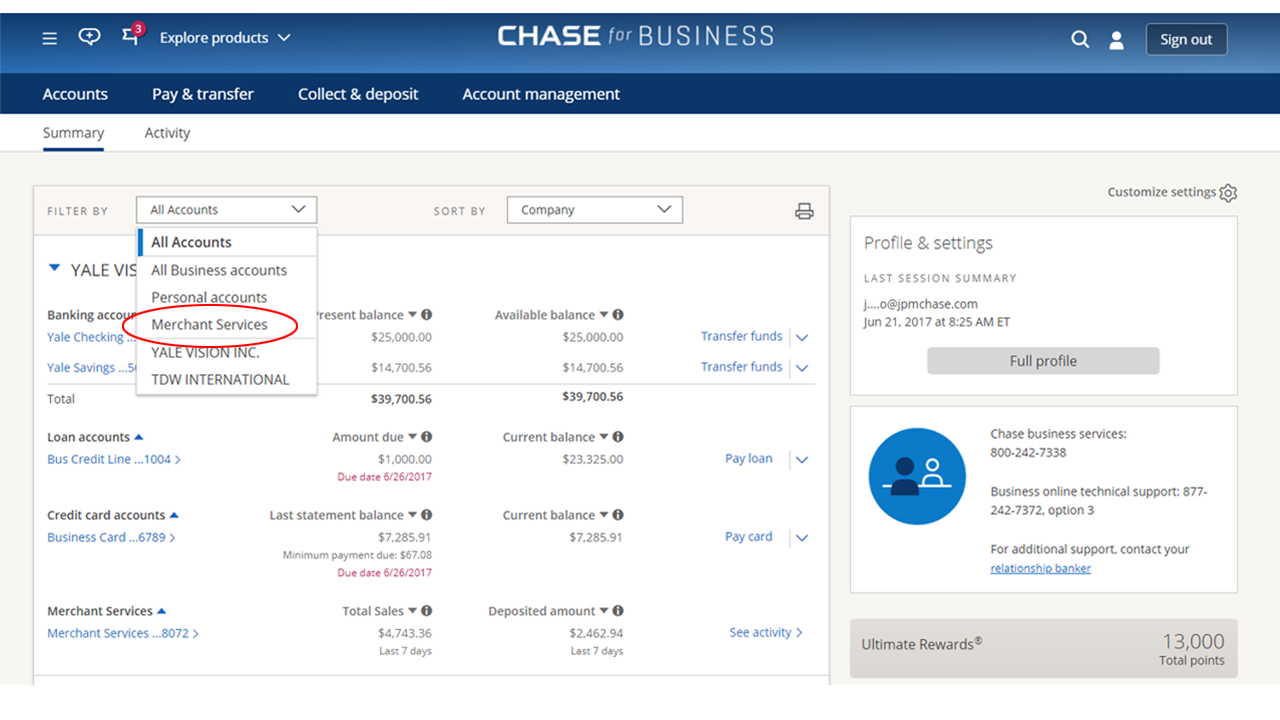

While a standard checking account typically doesn't trigger a credit check, there can be exceptions.

For instance, if you're applying for a checking account with overdraft protection that's linked to a line of credit, Chase might perform a credit check.

This is because the overdraft protection effectively extends credit to you, and lenders typically assess creditworthiness before extending credit.

Also, Chase offers Second Chance Checking accounts. These are designed for people who have had trouble managing checking accounts in the past.

The requirements for these accounts can vary, and it's possible that a credit check might be involved in some cases.

Always clarify the specific terms and conditions with a Chase representative if you're considering such an account.

Before You Apply: Key Considerations

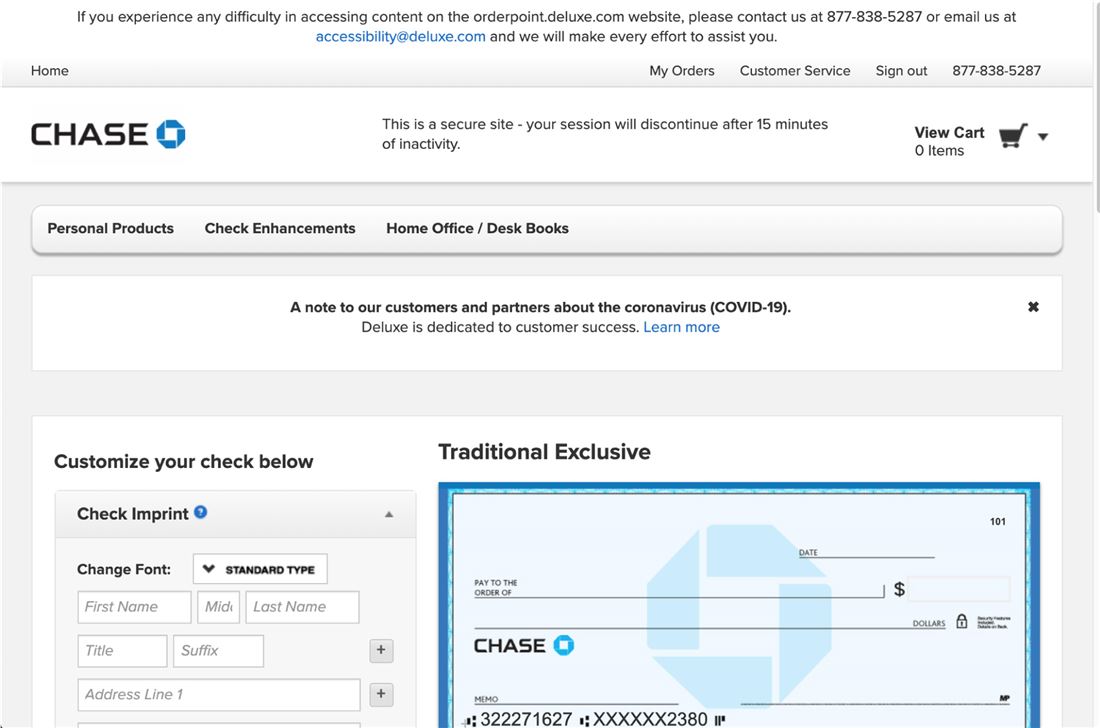

Before you apply for a Chase checking account, it’s good to be prepared.

Review your banking history to identify any potential red flags in your ChexSystems or Early Warning Services report.

Ensure that you meet Chase's eligibility requirements, such as having a valid form of identification and sufficient funds for the initial deposit.

For example, if you have a history of overdrafts or unpaid fees, consider resolving these issues before applying.

This can improve your chances of approval.

Also, explore different account options to find one that aligns with your financial needs and goals.

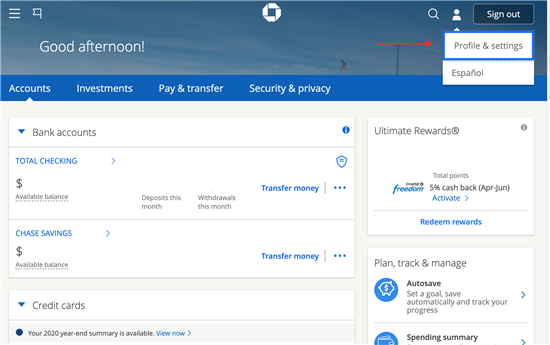

The Bottom Line

Opening a Chase checking account usually doesn't impact your credit score, thanks to their reliance on banking history checks.

However, it's important to be aware of the exceptions, such as overdraft protection linked to a line of credit.

By understanding the verification process and preparing accordingly, you can confidently embark on your banking journey with Chase.

Ultimately, opening a checking account is a positive step toward financial management, and understanding the process empowers you to make informed decisions.

So, step into that Chase branch with confidence, knowing that your credit score is likely safe and sound.

And remember, responsible banking habits are the key to a brighter financial future.

![Does Chase Check Credit To Open Checking Account [Expired] Chase $500 Checking and Savings Bonus Publicly Available](https://www.doctorofcredit.com/wp-content/uploads/2018/03/chase-checking.png)