Does H&r Block Help With Back Taxes

Facing the complexities of back taxes can be a daunting experience for many individuals and businesses. H&R Block, a well-known name in tax preparation, often comes to mind when seeking assistance. But can they truly help navigate the intricate landscape of past-due taxes?

The core question is, does H&R Block offer services to address back taxes, and if so, what is the extent of their assistance? Understanding the specific services they provide, the qualifications needed, and the potential costs involved is crucial for anyone considering their services. This article aims to provide an objective overview of H&R Block's back tax assistance based on publicly available information and expert insights.

H&R Block's Back Tax Services: An Overview

H&R Block offers various services related to back taxes, aiming to guide taxpayers through the process of resolving their tax liabilities. These services typically include assisting with filing delinquent returns, negotiating with the IRS, and exploring available payment options.

It is crucial to understand that while H&R Block assists with these processes, they do not guarantee specific outcomes, such as penalty abatement or acceptance of payment plans. The ultimate decision rests with the IRS or relevant tax authorities.

Key Services Offered

H&R Block’s services related to back taxes can be broadly categorized as follows: Preparation and filing of past-due tax returns is one of the main offerings. This ensures compliance with tax laws and potentially minimizes penalties.

They also provide representation before the IRS. This involves communicating with the IRS on the taxpayer's behalf and advocating for favorable outcomes.

H&R Block assists with exploring payment options, such as installment agreements, offers in compromise (OIC), and other resolution strategies. Each option has specific requirements and implications.

Representation and Negotiation: H&R Block's tax professionals can represent clients before the IRS, attending meetings and negotiating on their behalf. This can be particularly helpful for taxpayers who feel overwhelmed or lack the expertise to navigate the complexities of tax law.

Offer in Compromise (OIC) Assistance: An OIC allows certain taxpayers to settle their tax debt for a lower amount than what they owe. H&R Block can assess eligibility and assist with preparing and submitting the required documentation. Eligibility for an OIC is based on factors such as ability to pay, income, expenses, and asset equity.

Payment Plan Assistance: When full payment is not feasible, H&R Block can help taxpayers set up installment agreements with the IRS. This allows taxpayers to make manageable monthly payments over a specified period.

Factors to Consider

Expertise and Qualifications: The effectiveness of H&R Block's back tax assistance depends heavily on the expertise of the individual tax professional assigned to the case. Ask about the preparer's credentials, experience with back tax issues, and specific qualifications.

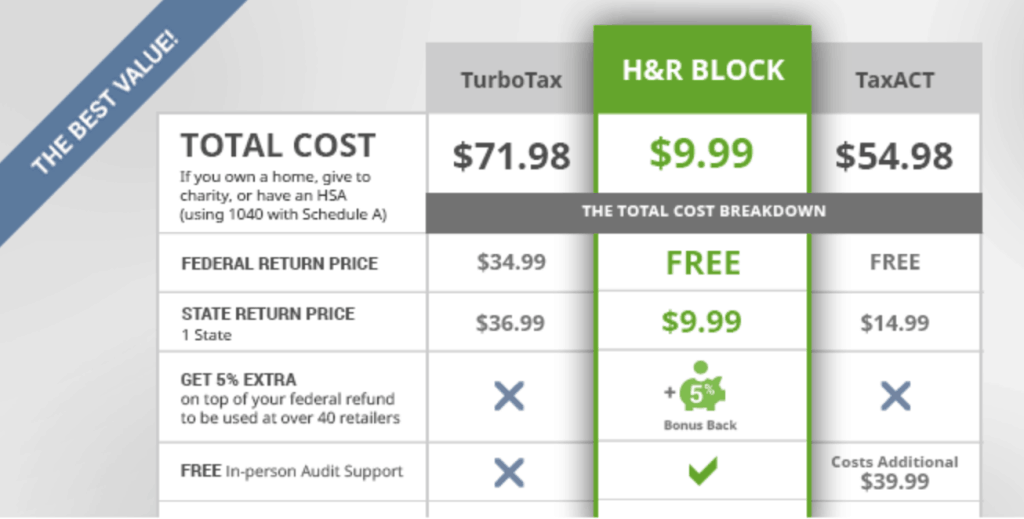

Cost and Fees: H&R Block charges fees for their back tax services, and these fees can vary depending on the complexity of the case and the services required. It is important to obtain a clear understanding of the fee structure upfront.

Guarantees and Outcomes: It's critical to remember that no tax preparation service can guarantee a specific outcome when dealing with back taxes. The IRS ultimately makes the decisions, and H&R Block can only assist with the process and advocate for the taxpayer.

Alternative Options

While H&R Block is a viable option, it's prudent to explore other avenues for back tax assistance. These include working with a certified public accountant (CPA), an enrolled agent, or a tax attorney.

Additionally, many resources are available directly from the IRS, including publications, online tools, and free tax clinics. These resources can provide valuable information and guidance for taxpayers seeking to resolve their back tax issues.

Ultimately, determining whether H&R Block is the right choice depends on individual circumstances, the complexity of the tax situation, and personal preferences. Careful evaluation of available options and a clear understanding of the services provided are essential for making an informed decision.

Navigating back taxes can be a challenging task, but with the right resources and guidance, individuals and businesses can work towards resolving their tax liabilities and achieving financial peace of mind.