Does Market Discount Increase Or Decrease Gain

In the high-stakes world of finance, where milliseconds can translate into fortunes, a fundamental question continues to stir debate: Does the market's tendency to "discount" future events—incorporating expectations into current prices—ultimately increase or decrease potential gains for investors? The answer is far from straightforward, contingent on factors ranging from market efficiency and the accuracy of information to individual investment strategies and risk tolerance. This ongoing tug-of-war between anticipation and reality shapes investment decisions and determines who profits in the long run.

This article dives deep into the complex relationship between market discounting and investor gains. It analyzes how the anticipation of future events, reflected in current market prices, affects the potential for profit. Furthermore, it examines different perspectives and provides a balanced view on this critical aspect of financial markets.

Understanding Market Discounting

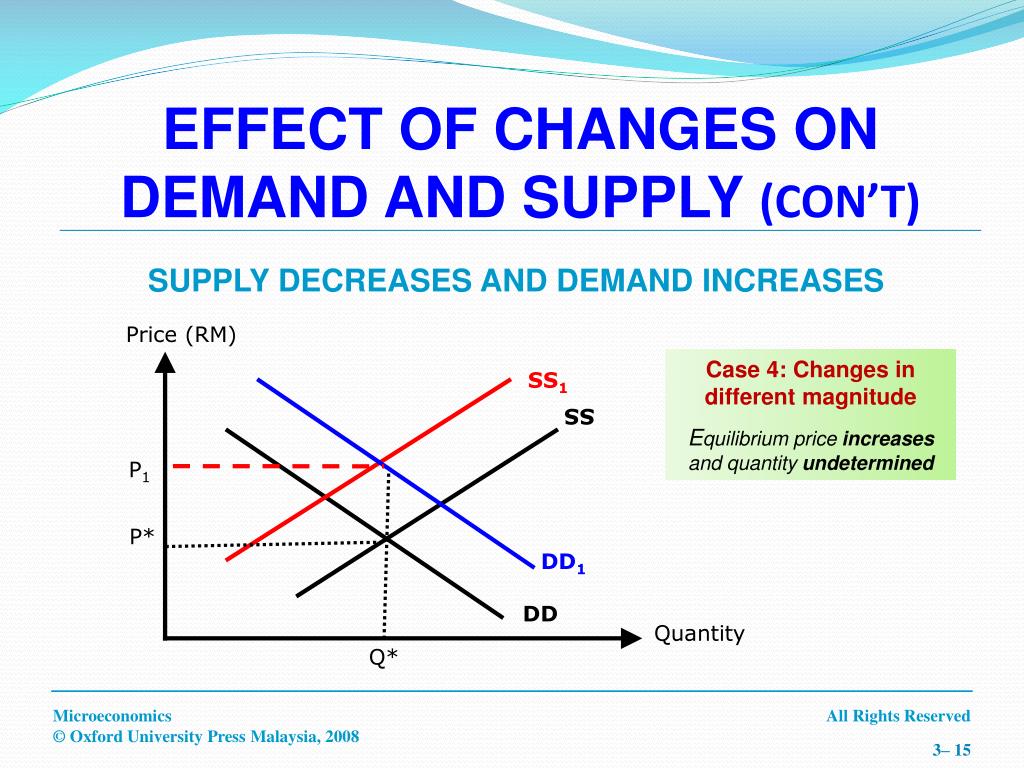

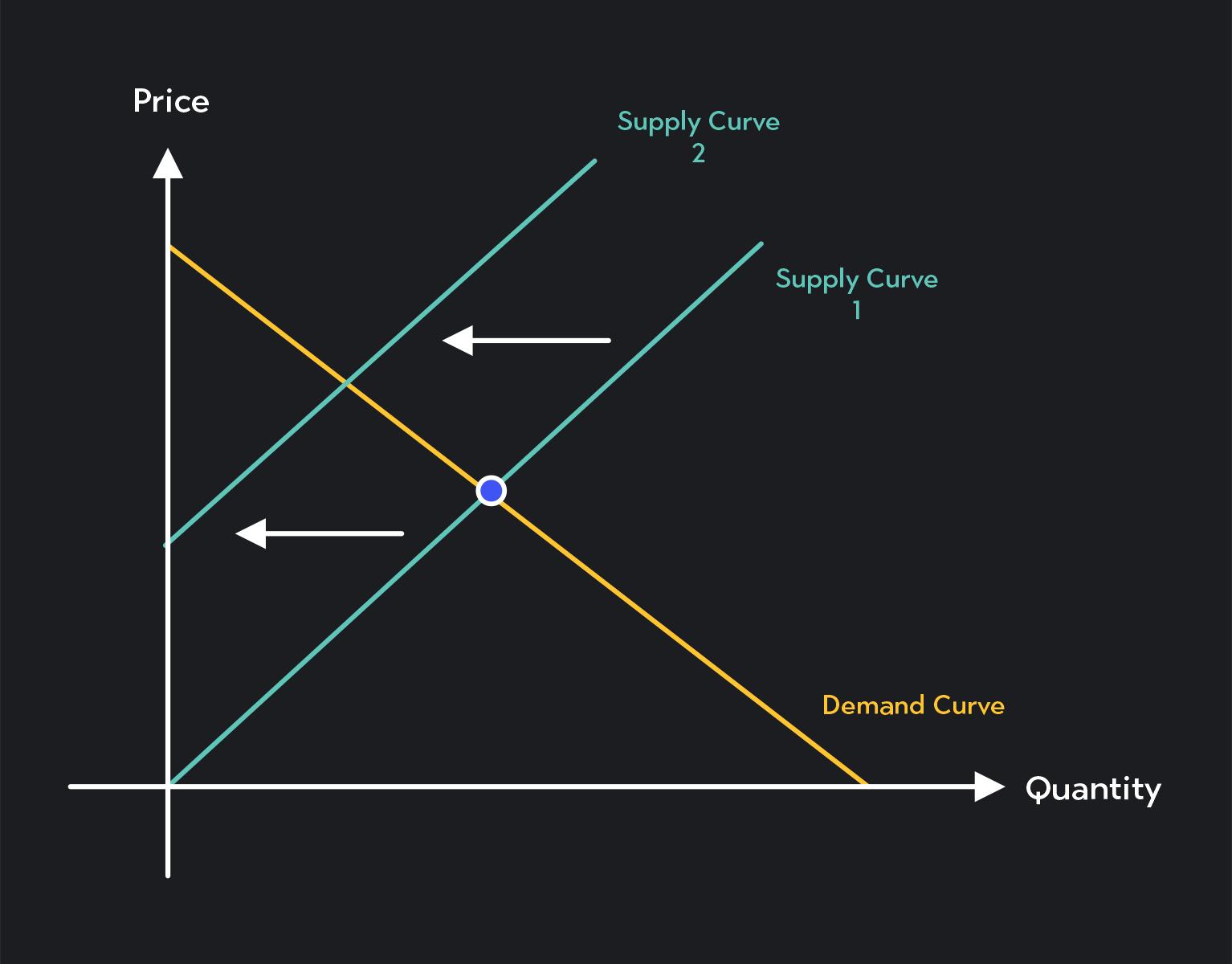

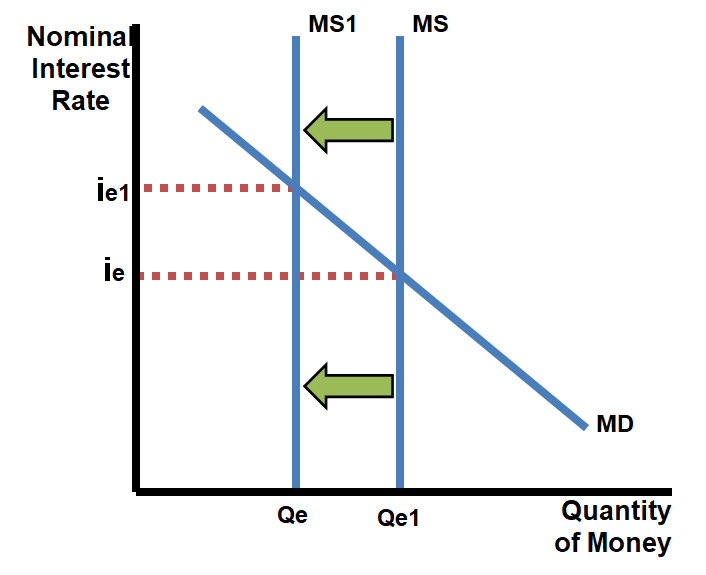

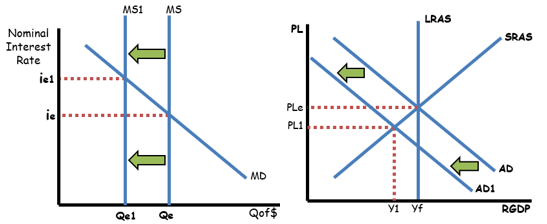

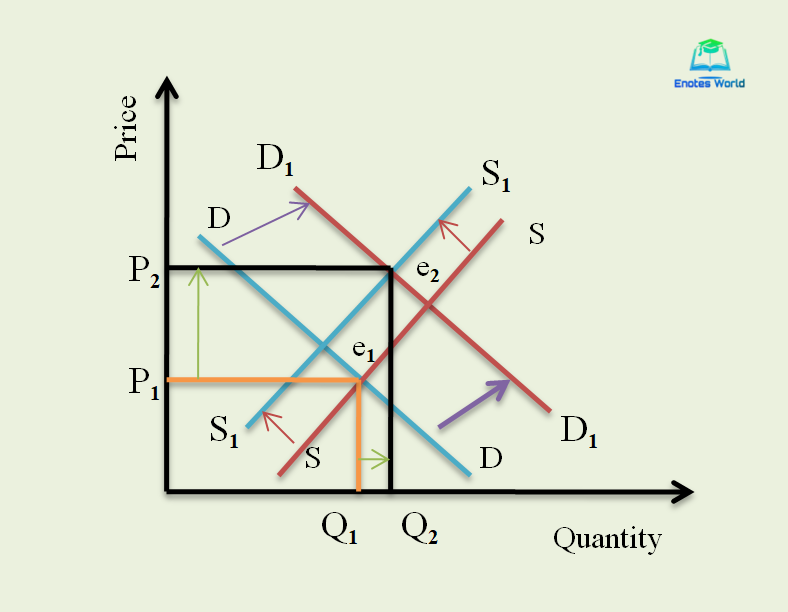

Market discounting refers to the phenomenon where asset prices reflect the market's collective expectations about future events. These events can be anything from interest rate changes and earnings reports to geopolitical events and technological advancements. The efficient market hypothesis (EMH) posits that all available information is already incorporated into asset prices.

Consequently, beating the market consistently becomes impossible except through luck or access to non-public information, a practice known as insider trading and strictly illegal. The extent to which a market discounts future events is a subject of ongoing debate, with varying degrees of efficiency attributed to different markets and asset classes.

The Argument for Decreased Gains

One school of thought argues that market discounting actually decreases the potential for significant gains. If the market efficiently prices in all available information, then opportunities for outsized returns diminish significantly. Investors who rely on publicly available information are essentially arriving late to the party.

Profiting becomes a game of incremental gains rather than exponential growth, as any predictable future event is already factored into the current price. This perspective is supported by empirical evidence suggesting that it's extremely difficult to consistently outperform the market over the long term.

According to a 2023 report by S&P Dow Jones Indices, a significant majority of actively managed funds fail to beat their benchmark indices over extended periods, further reinforcing the notion that market efficiency limits the potential for above-average returns.

The Argument for Increased Gains

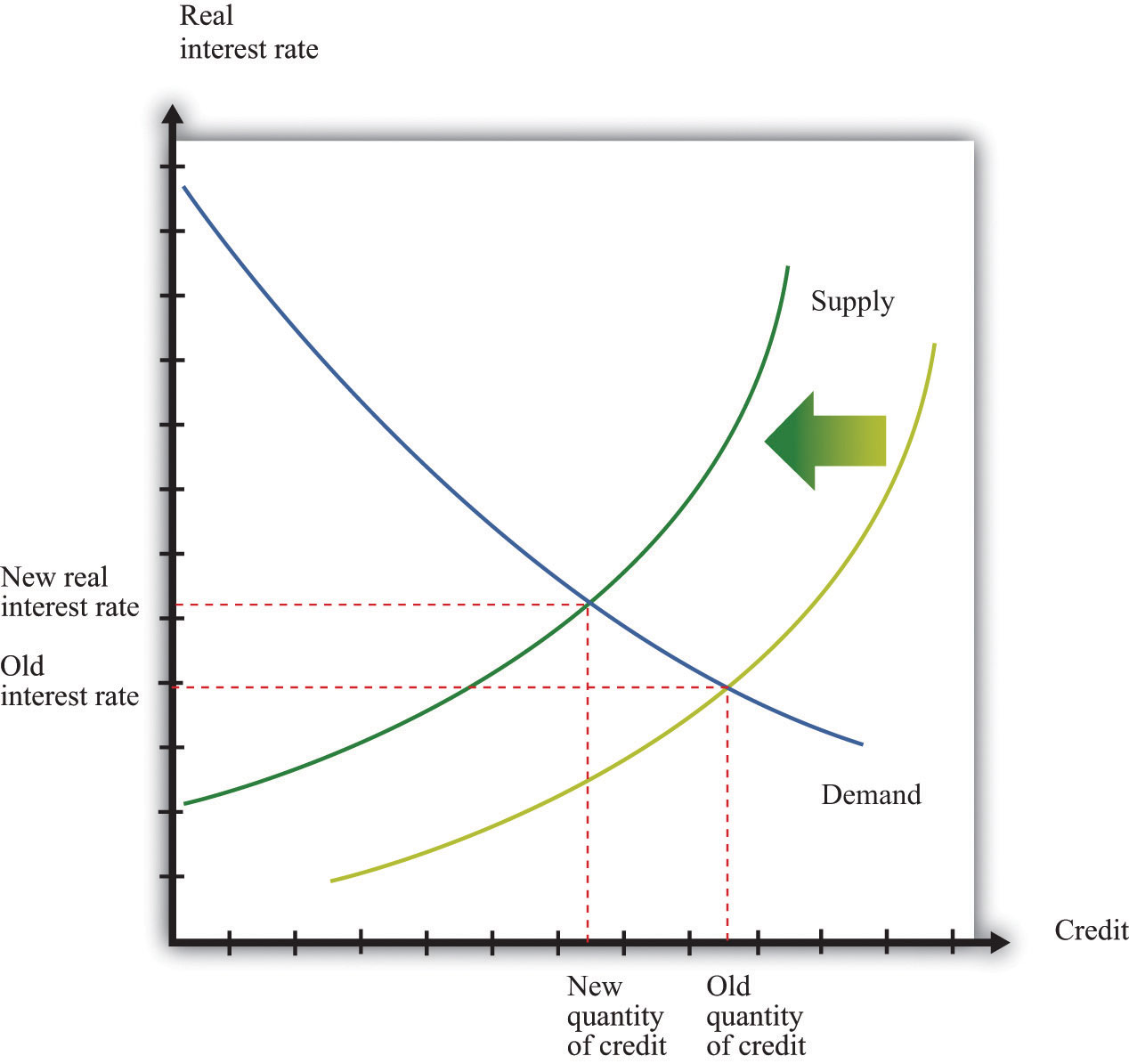

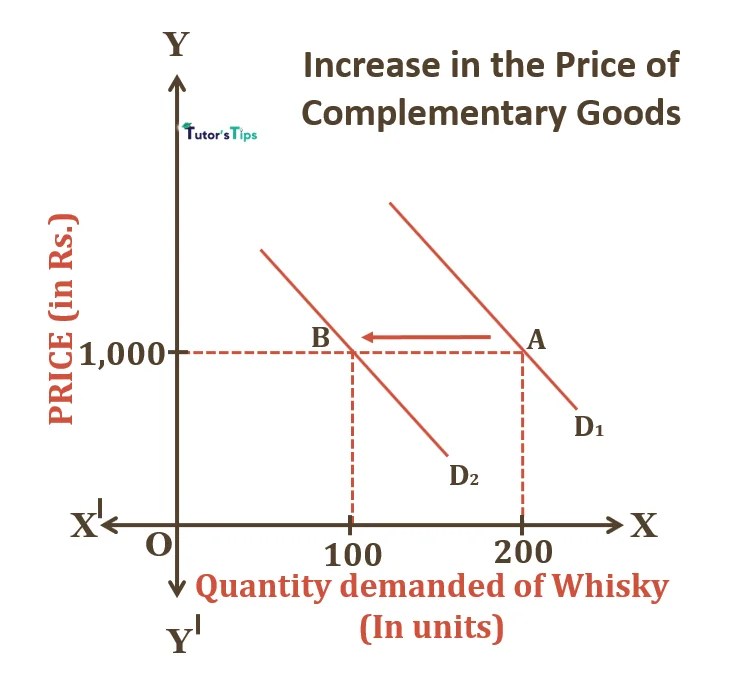

Conversely, some argue that market discounting can actually increase potential gains, albeit for a select group of investors. This perspective relies on the belief that markets are not perfectly efficient and that opportunities exist to exploit mispricings.

These mispricings can arise from behavioral biases, information asymmetry, or simply the market's inability to accurately predict the future. Skilled analysts and informed investors who can accurately assess the potential impact of future events before they are fully priced in by the market can reap substantial rewards.

For example, Warren Buffett's value investing strategy hinges on identifying companies whose intrinsic value is underestimated by the market. By purchasing these undervalued assets before the market recognizes their true potential, investors can realize significant capital appreciation.

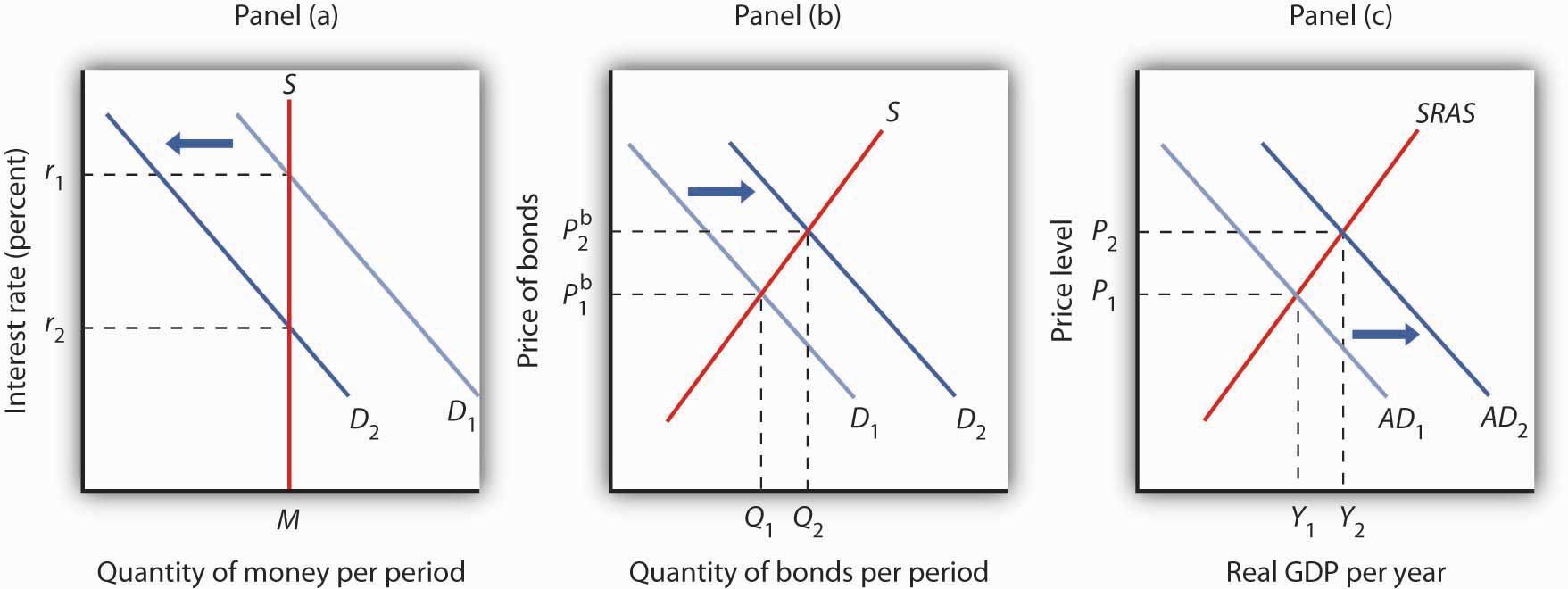

Exploiting Inefficiencies and Information Asymmetry

The key to capitalizing on market discounting lies in identifying situations where the market's expectations diverge from reality. This requires in-depth analysis, a thorough understanding of the underlying fundamentals, and the ability to anticipate future events more accurately than the consensus view. Information asymmetry, where certain investors possess access to information not yet reflected in market prices (legally obtained), can also create opportunities for profit.

However, it's crucial to remember that attempting to exploit market inefficiencies carries significant risk. The market can remain irrational longer than you can remain solvent, as the saying goes.

The Role of Risk Tolerance and Investment Strategy

The impact of market discounting on potential gains is also heavily influenced by an investor's risk tolerance and investment strategy. Investors with a high risk tolerance may be more willing to pursue opportunities based on their own assessment of future events.

Actively managed funds, hedge funds, and venture capital firms often employ strategies that involve taking calculated risks to outperform the market. Conversely, risk-averse investors may prefer a more passive approach, such as investing in index funds or ETFs, which aim to replicate market returns rather than beat them.

The Impact of Market Bubbles and Crashes

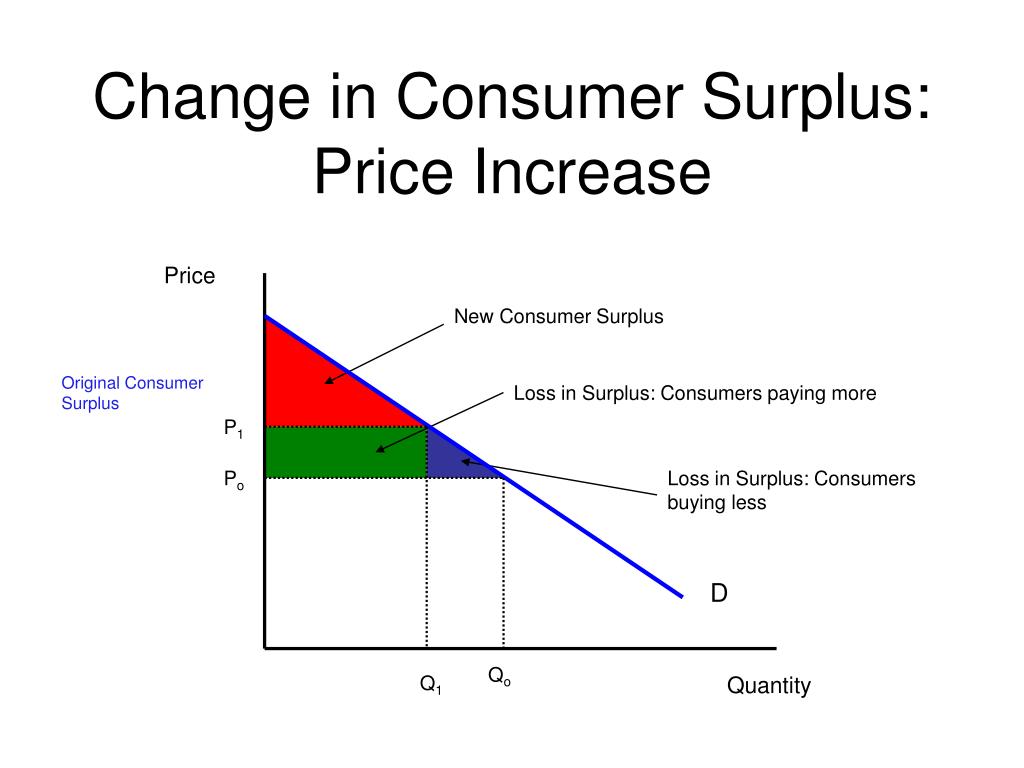

Market bubbles and crashes exemplify the potential consequences of inaccurate or overzealous market discounting. During a bubble, asset prices become detached from their underlying fundamentals as investors irrationally extrapolate past gains into the future.

This leads to overvaluation and an eventual correction, often resulting in significant losses for those who bought at the peak. Similarly, during a market crash, fear and panic can drive prices below their fair value, creating opportunities for astute investors to acquire assets at bargain prices.

The 2008 financial crisis serves as a stark reminder of the dangers of unchecked market discounting and the importance of fundamental analysis.

Looking Ahead

The debate over whether market discounting increases or decreases potential gains is likely to continue as long as financial markets exist. The reality is that the answer depends on a multitude of factors, including market efficiency, information availability, investor skill, risk tolerance, and the accuracy of forecasts.

As technology continues to advance and information becomes more readily available, markets may become more efficient, making it increasingly difficult to consistently outperform the market. However, human psychology and behavioral biases will likely continue to create opportunities for skilled and disciplined investors to exploit market mispricings.

Ultimately, successful investing requires a nuanced understanding of market dynamics, a rigorous analytical framework, and a healthy dose of skepticism. Investors should focus on identifying their own strengths and weaknesses, developing a well-defined investment strategy, and managing risk effectively, rather than chasing elusive guarantees of market-beating returns.