What Is The Value Of White Gold

In the shimmering world of precious metals, white gold often stands in the shadow of its yellow counterpart, leading many to wonder about its true worth. Is it a mere imitation, a budget-friendly alternative, or does it possess a value that rivals, or even surpasses, the traditional allure of gold? The answer, as with most things in the realm of commodities, is complex and multifaceted, influenced by a confluence of factors ranging from market demand to the intricacies of the manufacturing process.

Understanding the value of white gold requires a deeper dive than simply comparing its price tag to yellow gold. This article dissects the composition, manufacturing processes, and market forces that determine white gold's worth, revealing its distinct characteristics and shedding light on its position within the broader precious metals landscape. We will explore the intricacies of alloy composition, the role of rhodium plating, and the fluctuating influence of supply and demand, aiming to provide a comprehensive understanding of the true value of white gold.

What Exactly is White Gold?

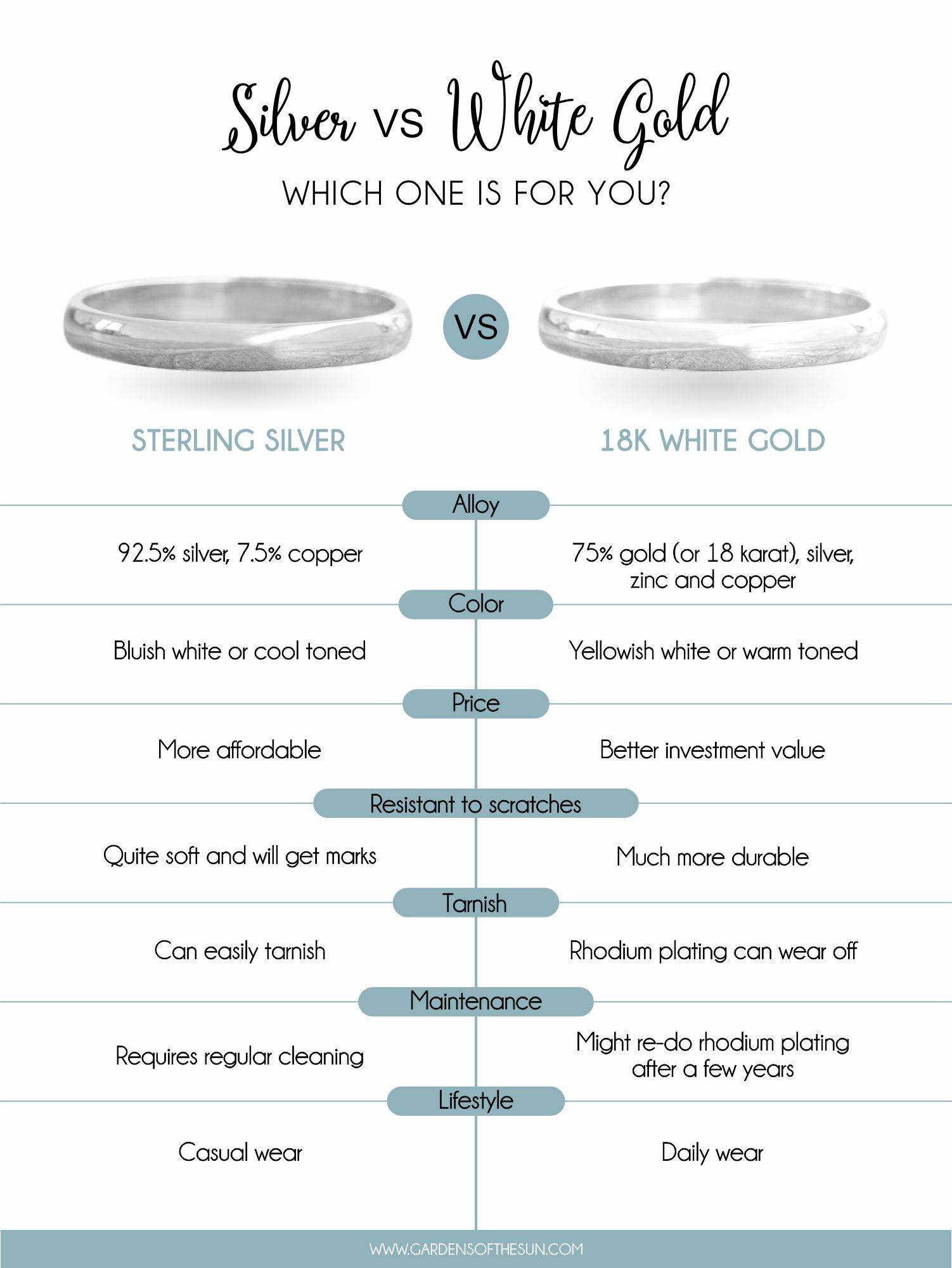

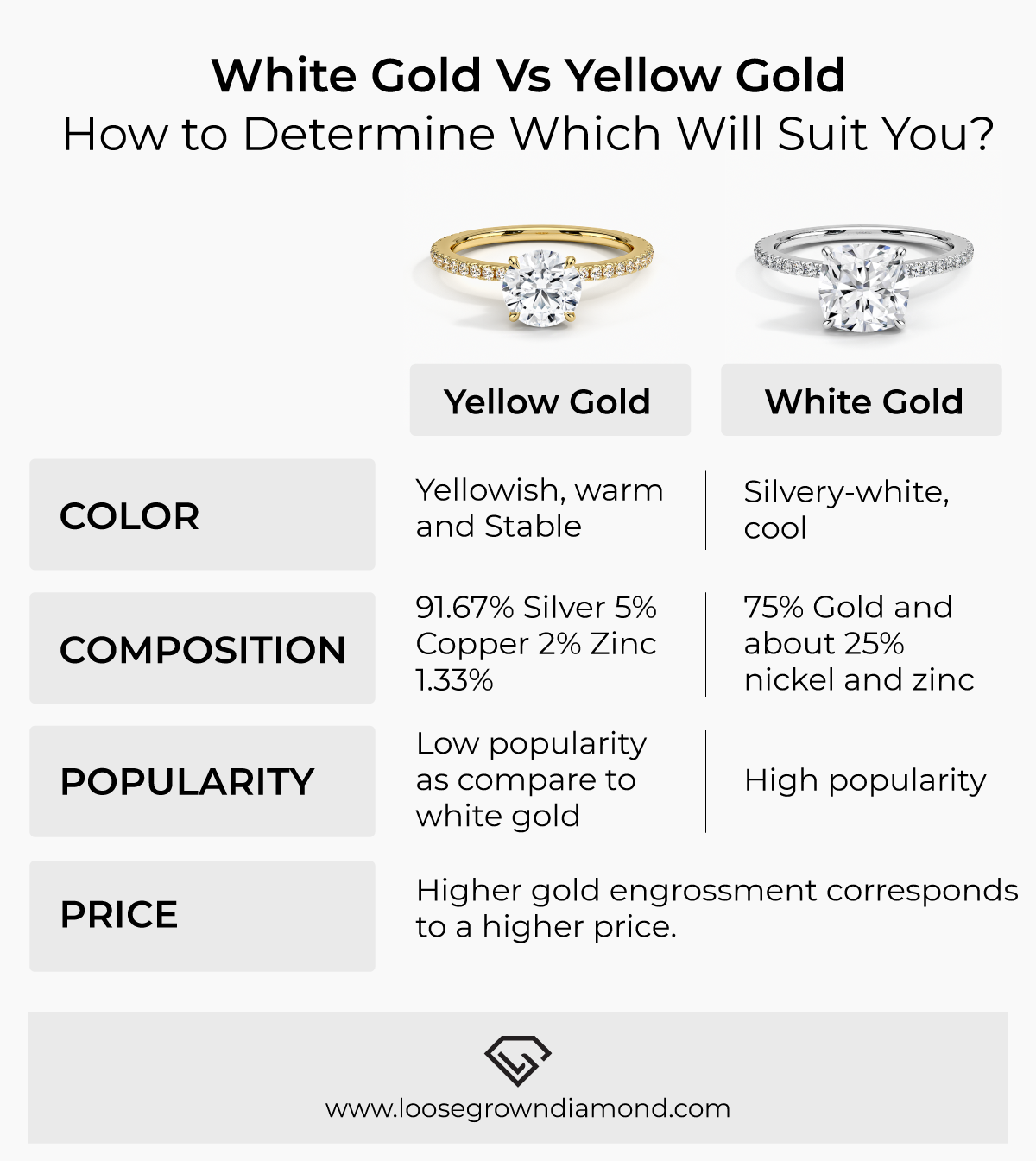

White gold isn't pure gold. It's an alloy, meaning it's a mixture of gold with other white metals. Typically, these metals include nickel, silver, or palladium.

The addition of these metals serves two primary purposes: to lighten the yellow color of pure gold and to increase its durability. Pure gold is quite soft and easily scratched, making it unsuitable for everyday wear in jewelry.

The Alloy Composition

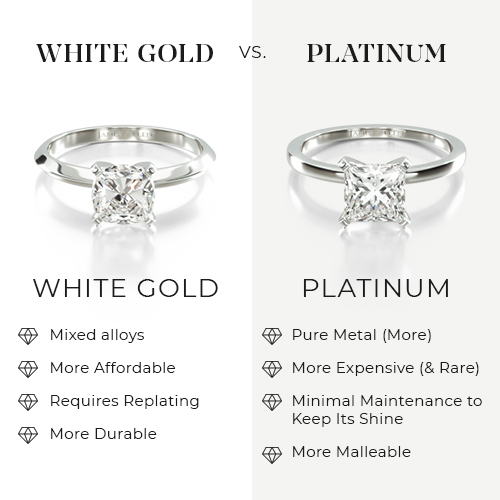

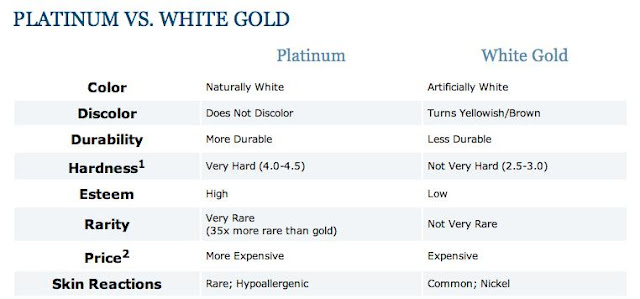

The composition of the alloy greatly impacts the color and durability of the final product. Nickel-based white gold is known for its strength and whiteness, but can sometimes cause allergic reactions in sensitive individuals.

Palladium-based white gold, on the other hand, is hypoallergenic and naturally whiter, often requiring less rhodium plating (more on that later). This difference in composition directly affects the value of the final product.

The Role of Rhodium Plating

Even with the addition of white metals, white gold often retains a slightly yellow hue. To achieve the bright, silvery-white appearance that consumers desire, it's typically coated with rhodium.

Rhodium is a rare and expensive metal belonging to the platinum family. This plating not only enhances the color but also adds an extra layer of scratch resistance.

However, rhodium plating is not permanent and will eventually wear away, revealing the underlying alloy. This necessitates re-plating every few years, adding to the long-term cost of owning white gold jewelry.

Factors Influencing the Value of White Gold

Several factors contribute to the overall value of white gold. These include the gold content, the type and amount of alloyed metals, and the cost of rhodium plating.

Market demand, consumer preferences, and ethical sourcing practices also play significant roles in shaping its perceived and actual worth.

Gold Content and Market Prices

The most significant factor determining the value of white gold is the amount of pure gold it contains. This is typically expressed in karats (k), with 24k being pure gold.

For instance, 18k white gold contains 75% pure gold, while 14k white gold contains 58.3% pure gold. The higher the karat number, the greater the gold content and, consequently, the higher the value.

The daily fluctuations in the global gold market directly impact the price of white gold. As gold prices rise, so does the value of white gold, and vice versa.

Alloy Metals and Their Cost

The metals used in the alloy also contribute to the overall cost. Palladium, being a more expensive metal than nickel or silver, will increase the price of palladium-based white gold.

Nickel-based white gold, while cheaper, may require more frequent rhodium plating due to its slightly less desirable color. This offsets some of the initial cost savings.

Rhodium Plating Costs

The cost of rhodium plating is a recurring expense associated with white gold jewelry. The price can vary depending on the jeweler, the size and complexity of the piece, and the thickness of the plating.

As rhodium prices fluctuate based on supply and demand, the cost of plating can also vary. Regular maintenance, including re-plating, should be factored into the overall cost of ownership.

Market Demand and Consumer Preferences

Fashion trends and consumer preferences heavily influence the demand for white gold. In recent years, white gold has gained popularity as a sleek and modern alternative to yellow gold.

This increased demand can drive up prices, particularly for popular designs and brands. Conversely, a shift in consumer preferences could lead to a decrease in demand and value.

Is White Gold a Good Investment?

Whether white gold is a good investment is a matter of perspective. Unlike pure gold bars or coins, white gold jewelry is primarily purchased for its aesthetic value rather than its investment potential.

While the gold content retains some inherent value, the cost of alloy metals, manufacturing, and rhodium plating are typically not fully recoverable upon resale. However, white gold jewelry can hold sentimental value and potentially appreciate in value over time as vintage or antique pieces.

Investors seeking to capitalize on gold's inherent value may find that bullion or gold-backed ETFs offer a more straightforward and liquid investment option.

The Future of White Gold

The future of white gold hinges on several factors, including sustainability concerns, technological advancements, and evolving consumer preferences. The industry is increasingly focused on ethical sourcing of precious metals and reducing the environmental impact of mining and manufacturing processes.

Innovations in alloy compositions and plating technologies could lead to more durable and tarnish-resistant white gold alternatives. Furthermore, the rise of lab-grown diamonds and other synthetic gemstones may influence the demand for white gold settings.

Ultimately, the value of white gold will continue to be shaped by a dynamic interplay of market forces, technological advancements, and consumer attitudes towards precious metals and jewelry.

In conclusion, while the intrinsic value of white gold is tied to its gold content, its overall worth is a complex equation involving alloy composition, rhodium plating, and market demand. It's not simply a cheaper substitute for yellow gold but a distinct material with its own unique characteristics and value proposition. Understanding these nuances empowers consumers to make informed decisions when purchasing and appreciating this popular precious metal.

.jpg)