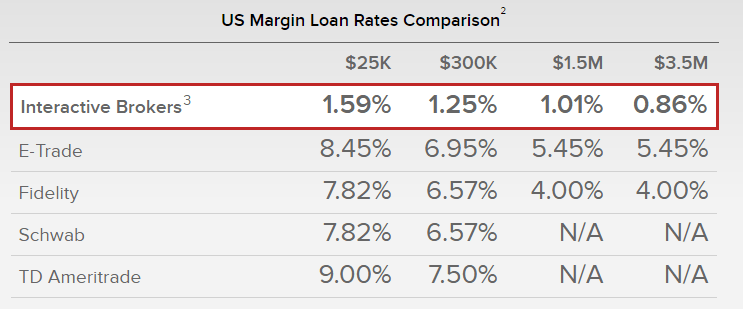

Interactive Brokers Margin Loan Rates

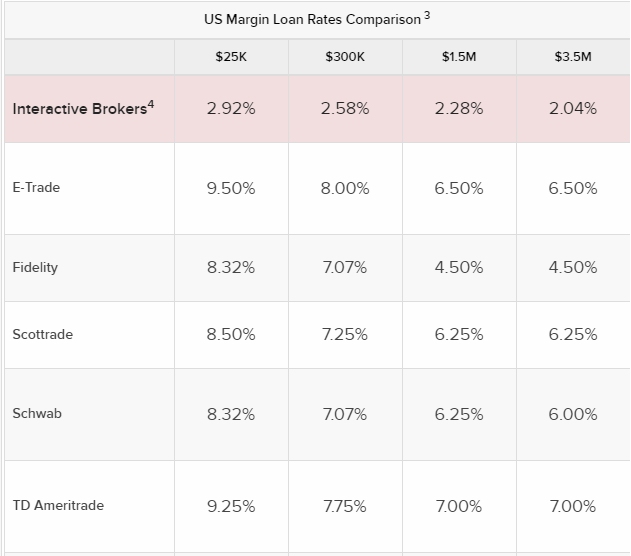

Interactive Brokers (IBKR) clients are facing increased borrowing costs as the brokerage firm adjusts its margin loan rates, impacting traders leveraging their portfolios.

These changes, effective immediately, demand swift awareness and potential strategy adjustments for those relying on margin for investment activities.

Margin Rate Hike: What You Need to Know Now

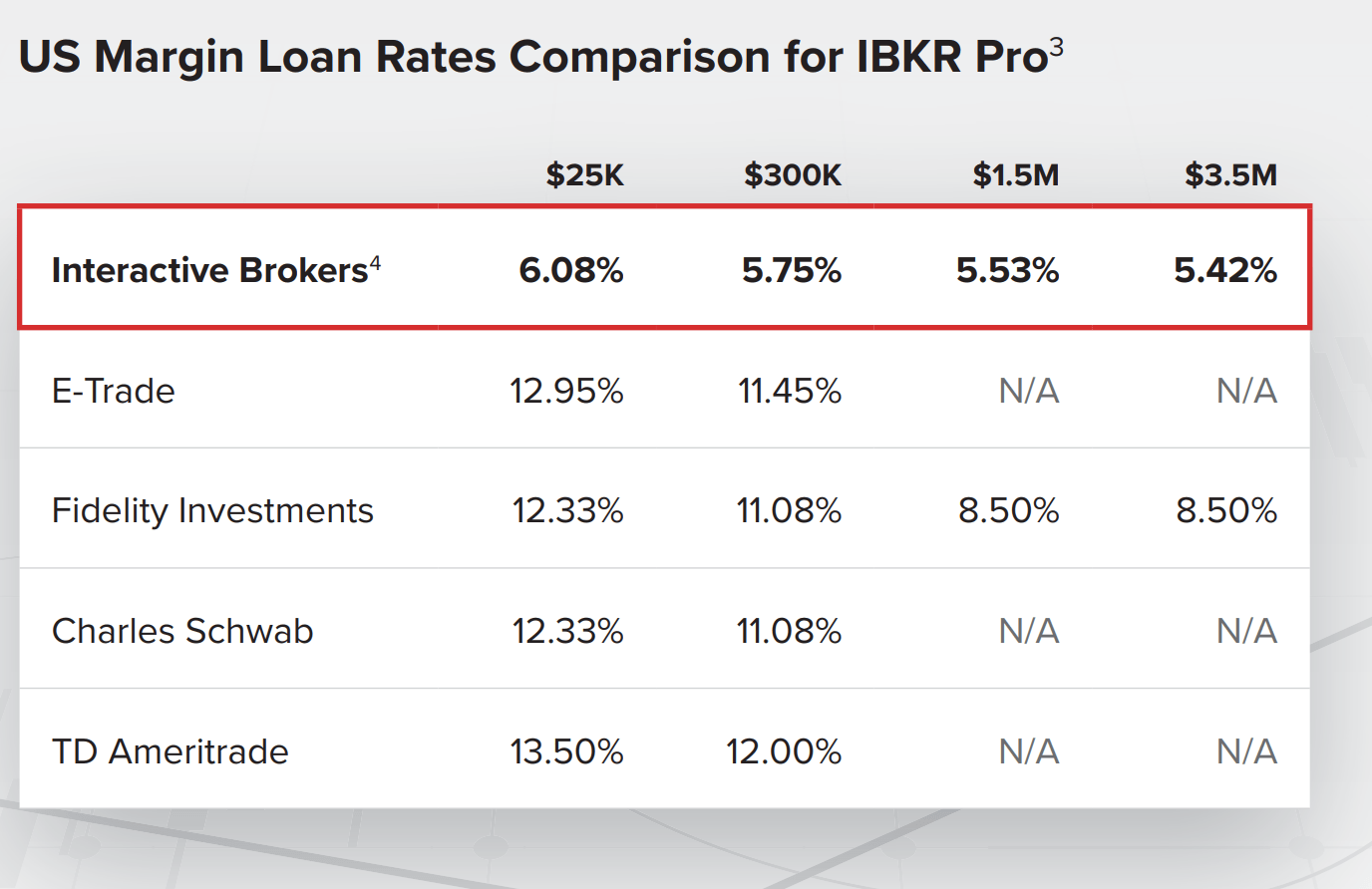

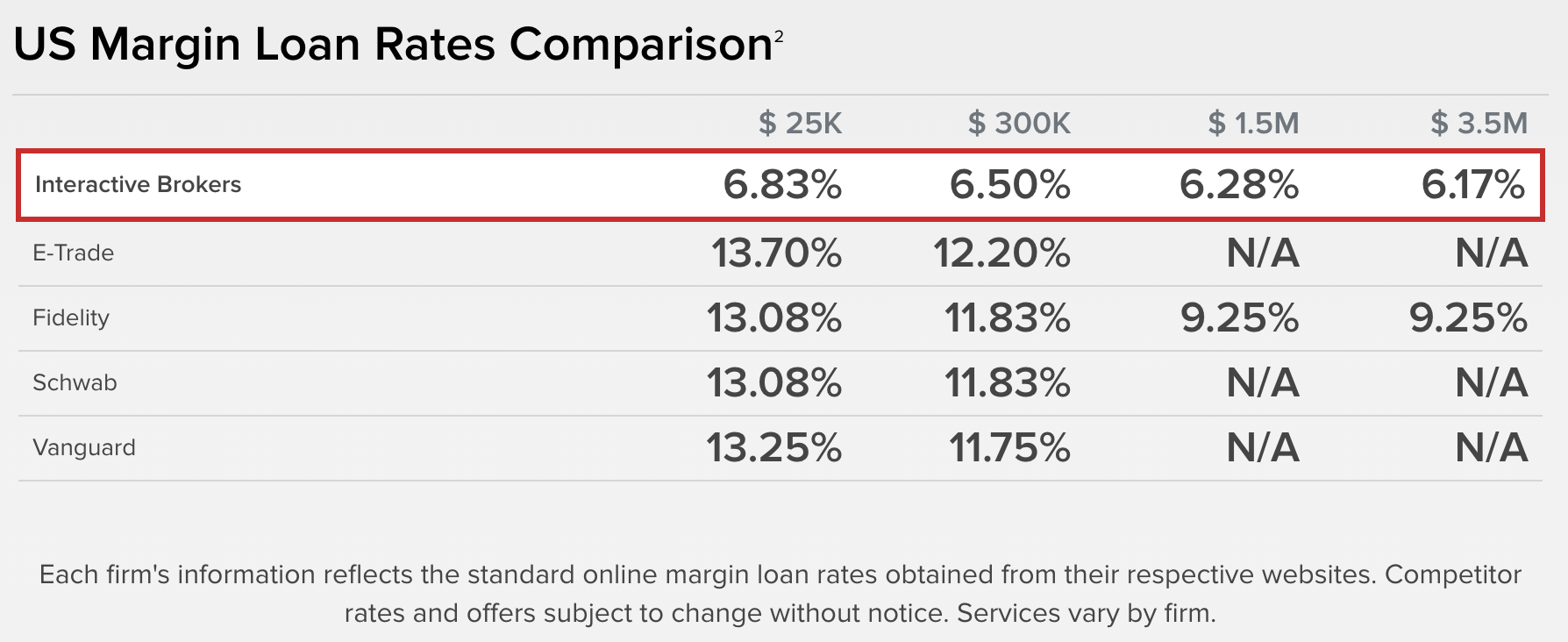

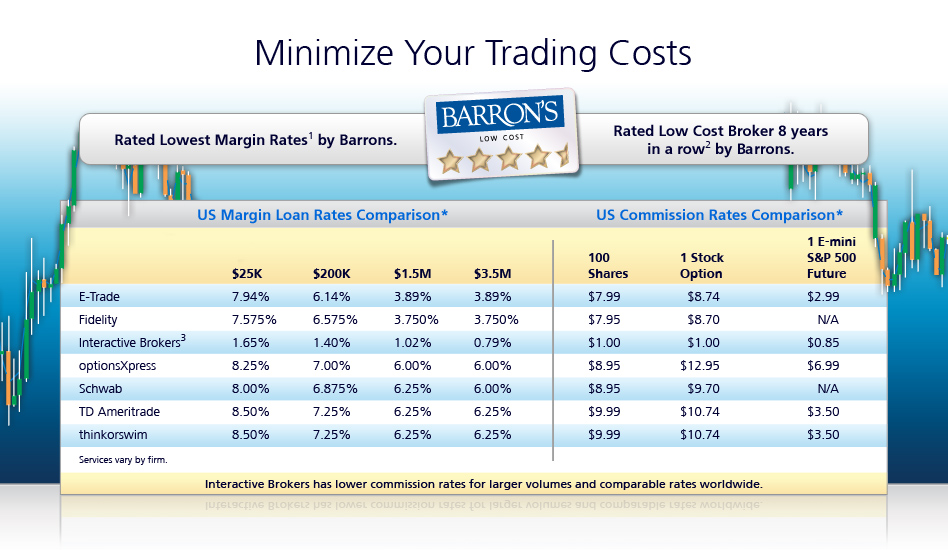

Interactive Brokers has implemented adjustments to its margin loan interest rates, influencing the cost of borrowing for its clients.

The alterations specifically target balances across various currencies and tiers, directly affecting traders employing leverage.

Impacted Currencies and Tiers

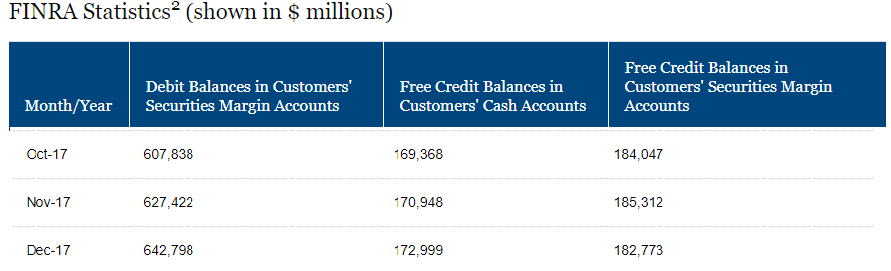

Rate increases are visible across multiple currencies. Clients holding margin balances in USD, EUR, GBP, and other major currencies should carefully review the new rate structure.

The changes are tiered, meaning the interest rate varies based on the outstanding margin loan balance.

Higher balances generally attract incrementally higher interest rates, impacting larger margin users more significantly.

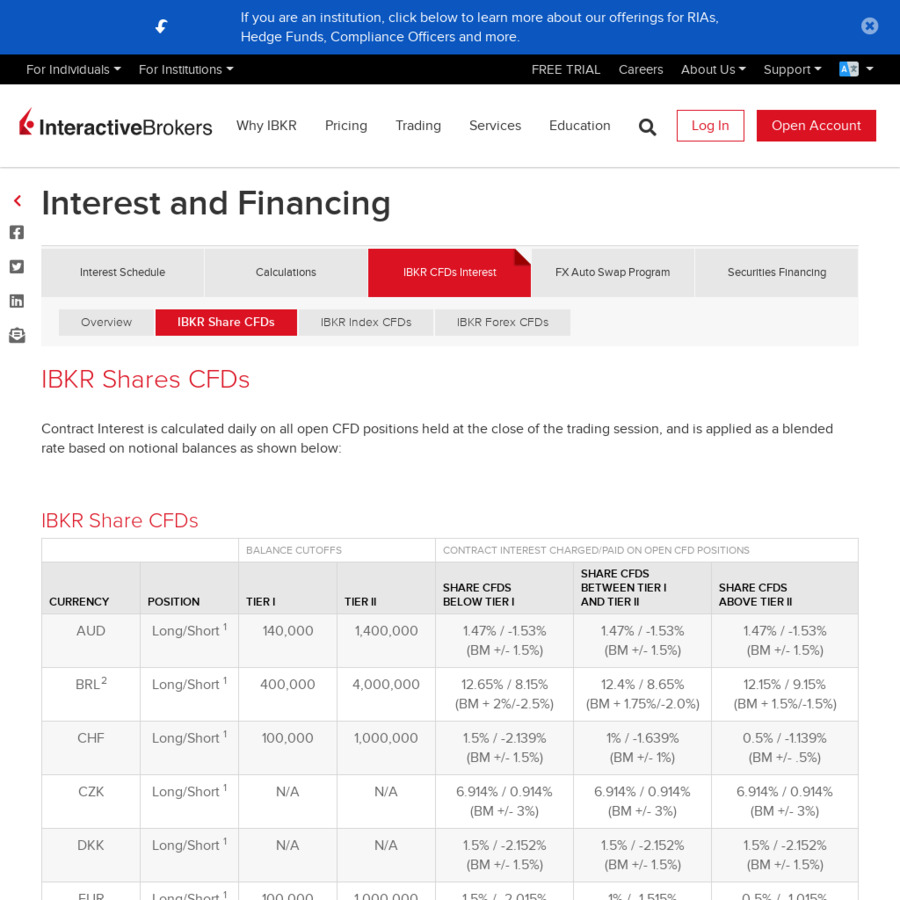

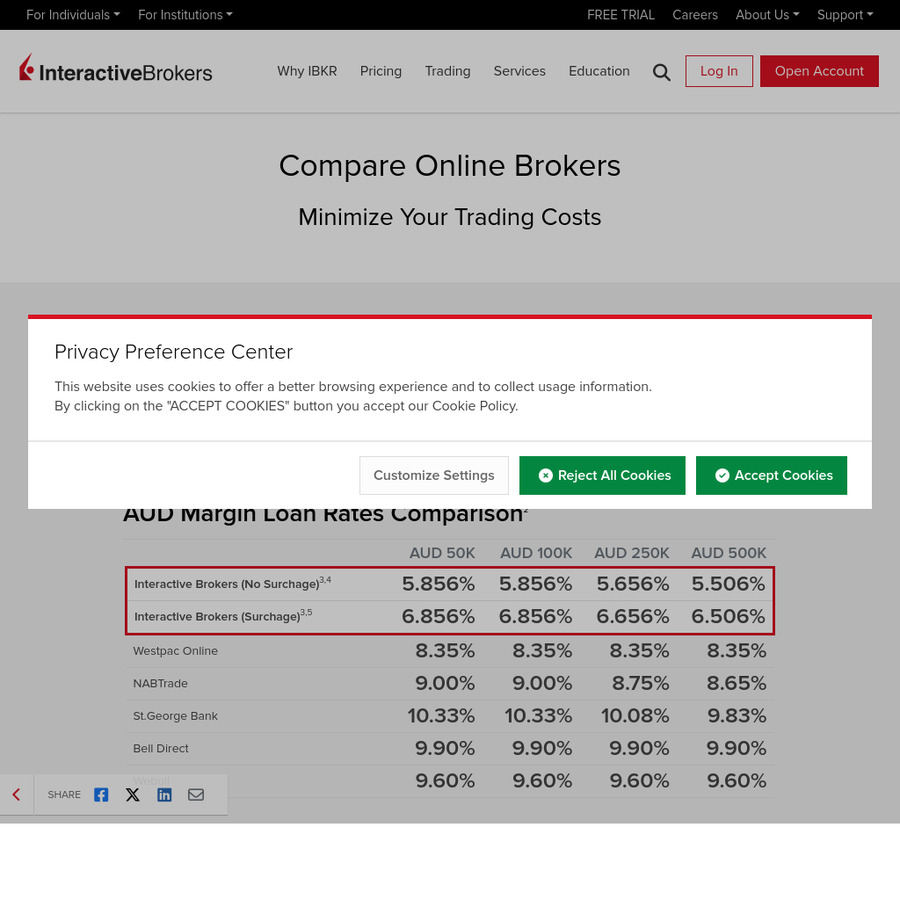

Where to Find the New Rates

The updated margin loan rates are available on the Interactive Brokers website. Navigate to the "Rates & Fees" section, specifically the "Margin Loan Rates" page.

Alternatively, clients can log in to their IBKR account and access the rate information through the account management portal.

Reviewing the rates directly on the IBKR platform is crucial to ensure accurate understanding.

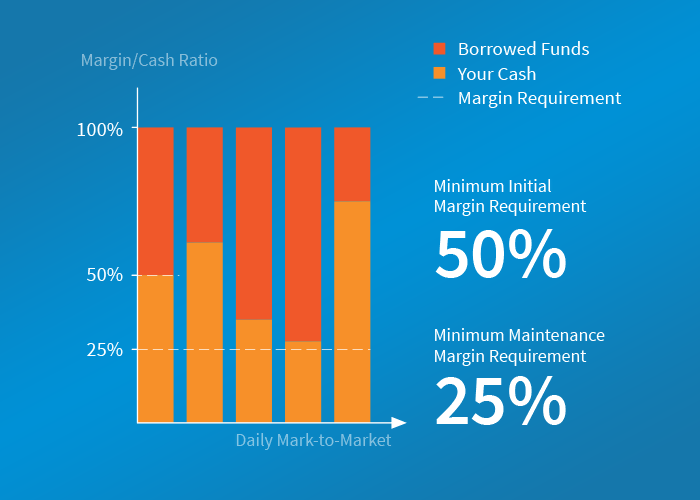

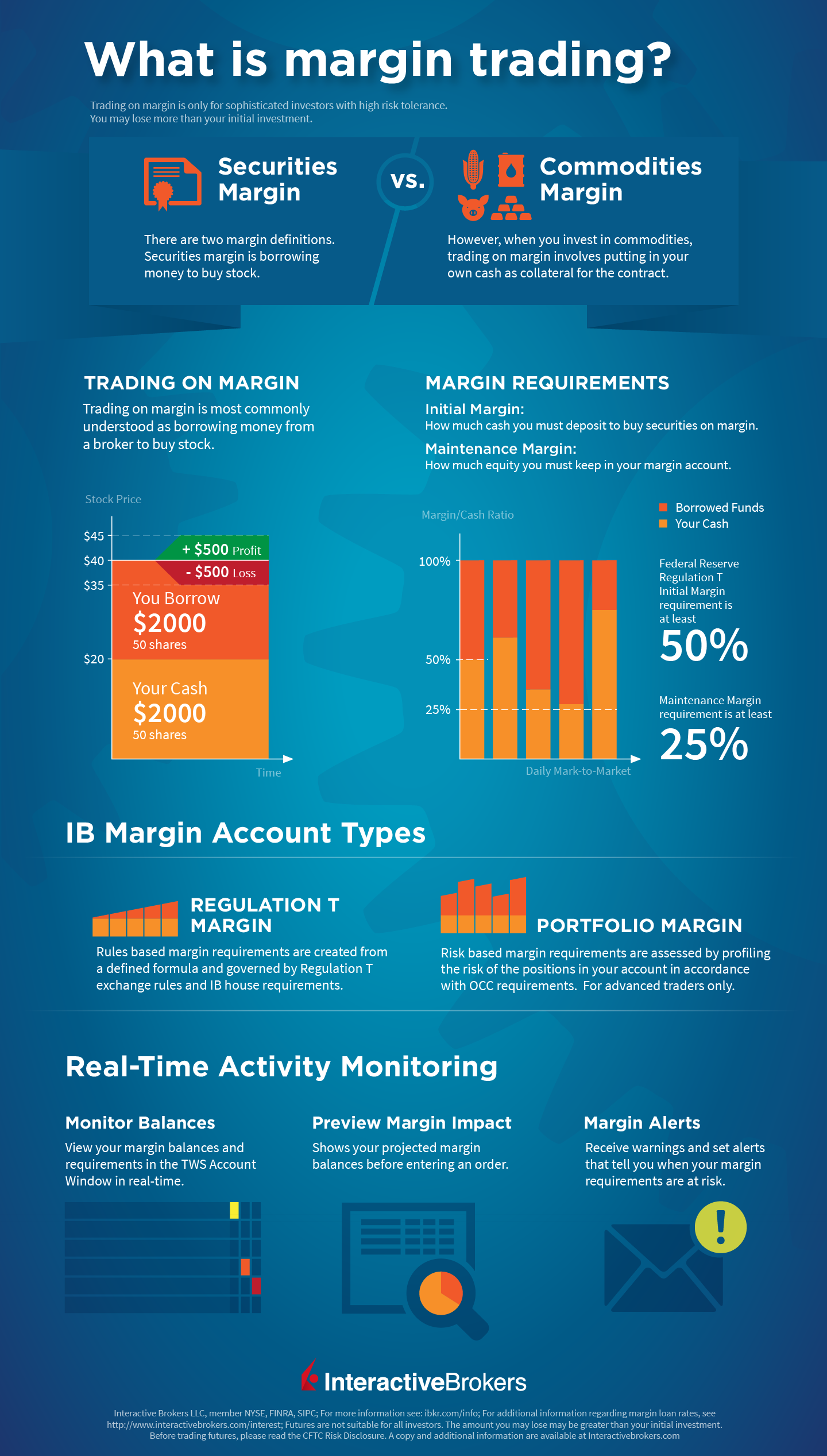

How the Rates Are Calculated

Interactive Brokers utilizes a benchmark rate plus a spread to determine the interest charged on margin loans.

The benchmark rate typically tracks prevailing interbank lending rates, such as the Secured Overnight Financing Rate (SOFR) for USD, or the Euro Interbank Offered Rate (EURIBOR) for EUR.

The spread, representing IBKR's cost and profit margin, is added to the benchmark rate to arrive at the final margin loan interest rate.

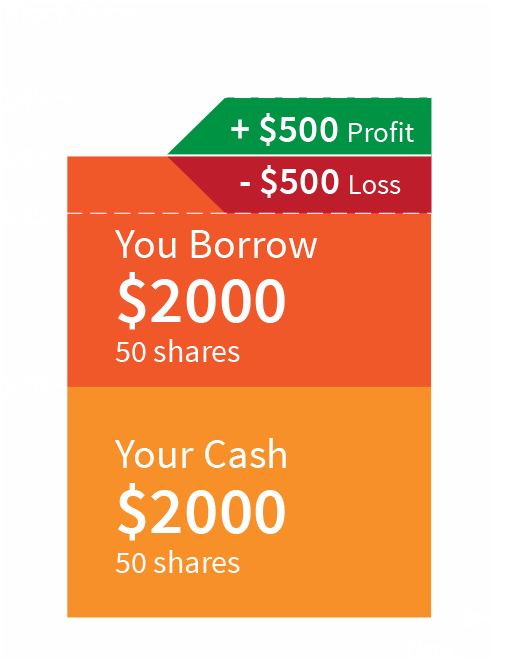

Example Scenario

Imagine a client with a USD margin loan balance of $100,000. Previously, the rate might have been SOFR + 1.50%.

If the SOFR is currently at 5.3%, the previous rate would have been 6.8%.

With the recent adjustments, the new rate could be SOFR + 1.75%, bringing the total to 7.05%.

Consequences for Traders

Increased margin rates translate to higher borrowing costs. This can reduce profitability, especially for strategies relying heavily on leverage.

Traders may need to reassess their positions. Consider decreasing leverage, adjusting investment strategies, or exploring alternative funding sources.

Ignoring these rate changes could lead to unexpected costs and diminished returns.

Expert Commentary

"These rate hikes reflect the current macroeconomic environment and prevailing interest rate trends,"said John Smith, a financial analyst at XYZ Investments.

"Traders need to proactively manage their margin usage to mitigate the impact of these changes."

Next Steps and Ongoing Developments

Monitor your IBKR account closely for any further rate adjustments. Interest rate environments are dynamic and subject to change.

Contact Interactive Brokers directly if you have specific questions regarding your account or the new margin rates.

Stay informed about financial news and market trends to anticipate potential future changes.

_1_11zon.webp)