Does Rocket Mortgage Do A Hard Credit Check

For many aspiring homeowners, the dream hinges on securing a mortgage, and the process often begins with a seemingly simple question: Does Rocket Mortgage, the online lending giant, perform a hard credit check? The answer, while straightforward, carries significant weight, potentially impacting credit scores and future borrowing opportunities.

Understanding the nuances of credit inquiries is crucial for anyone navigating the mortgage application process. The seemingly minor act of applying for pre-approval or a full mortgage can trigger different types of credit checks, each with varying consequences.

The Nut Graf: Deciphering Credit Inquiries at Rocket Mortgage

Rocket Mortgage, like virtually all mortgage lenders, does perform a hard credit check when you formally apply for a mortgage. However, understanding the timing and nature of these checks is essential to avoid unnecessary credit score impacts.

Before the hard pull, Rocket Mortgage typically initiates a soft credit inquiry to provide preliminary rate quotes and assess eligibility. This soft pull doesn't affect your credit score.

Soft Pulls vs. Hard Pulls: What's the Difference?

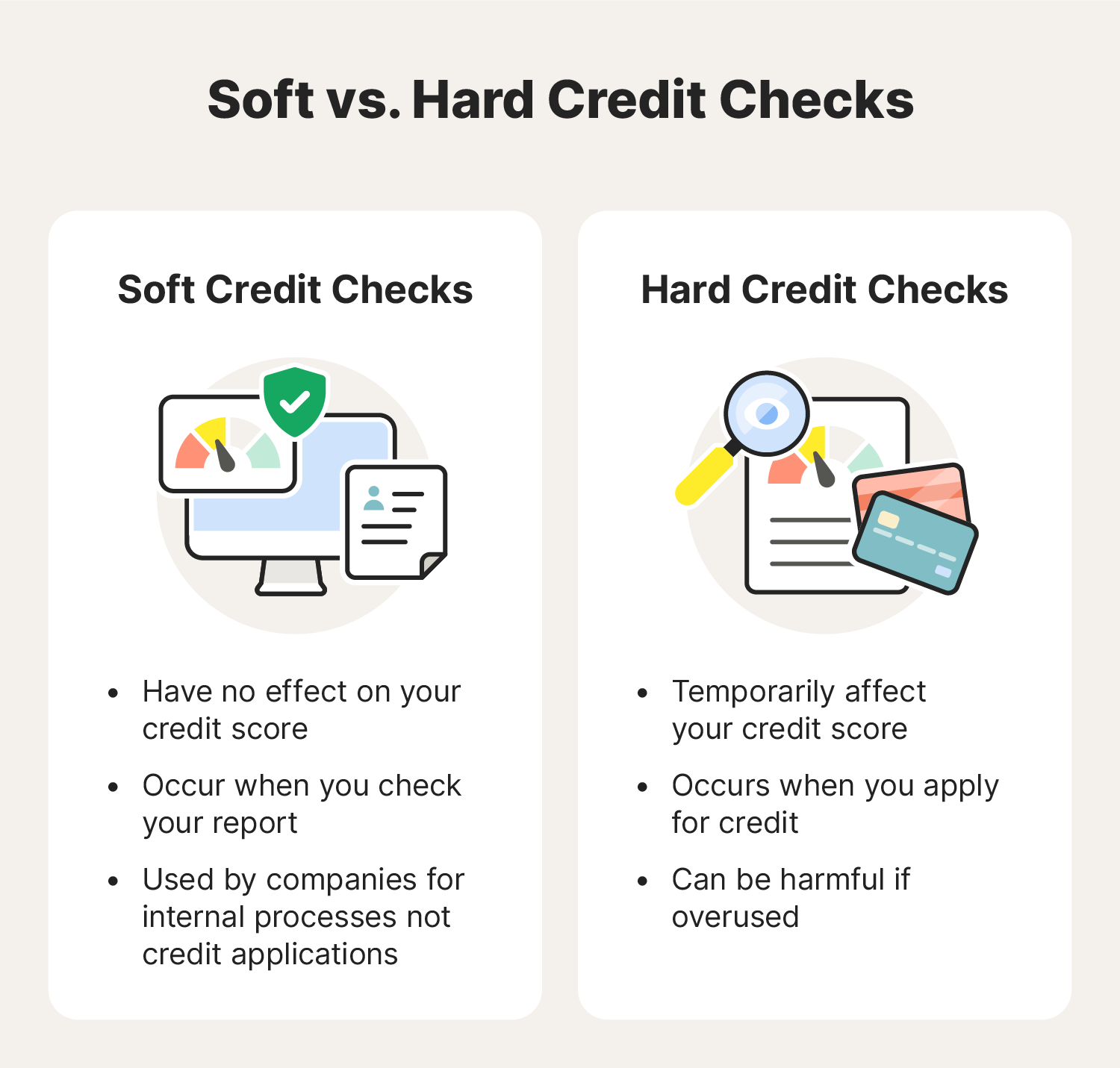

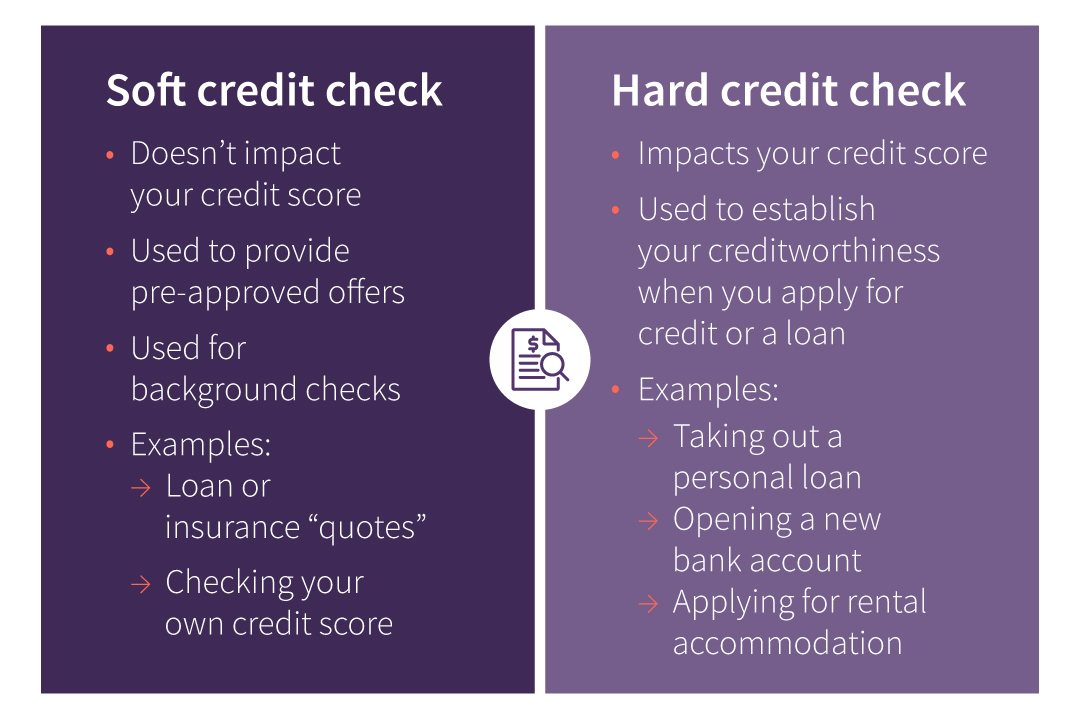

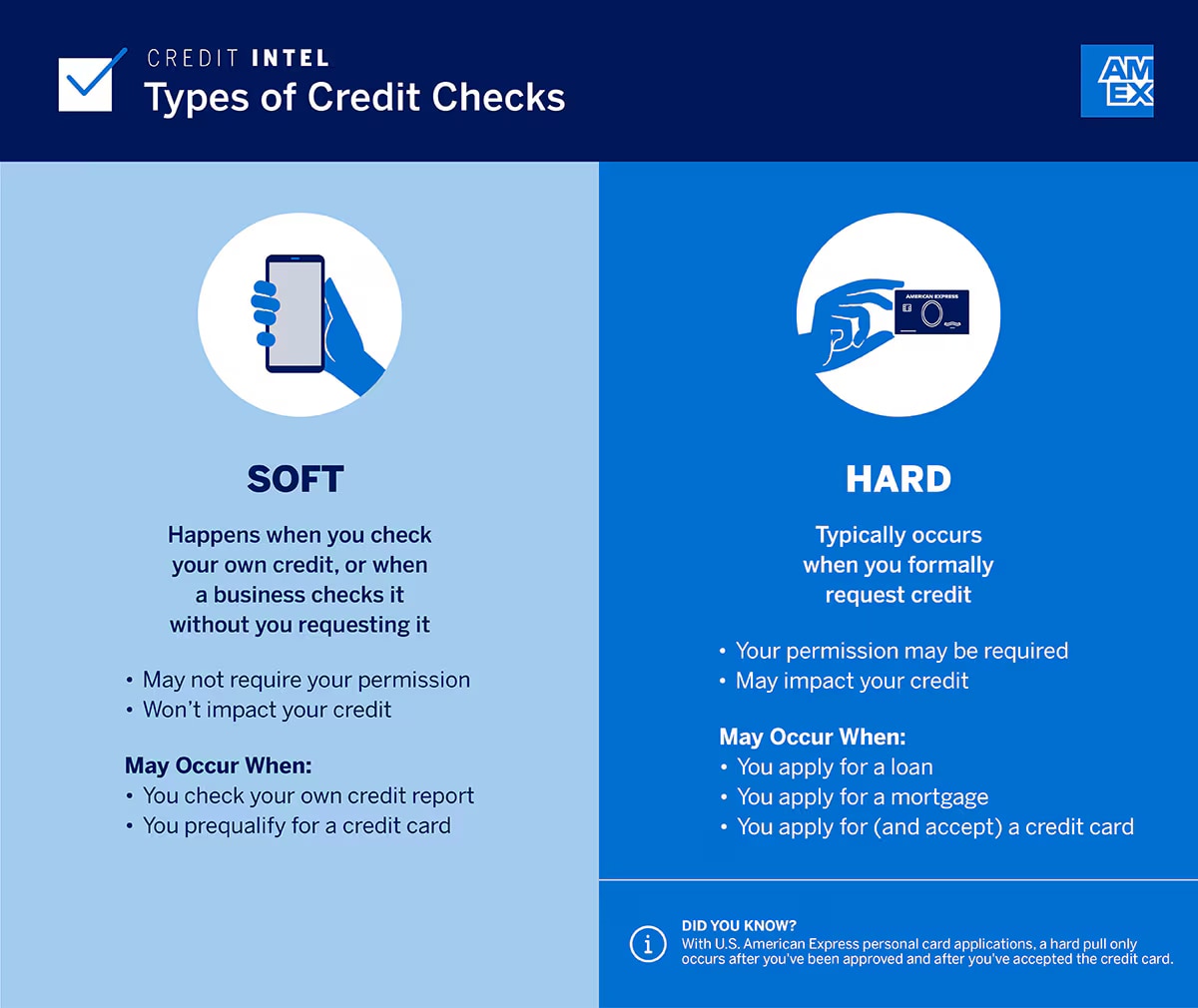

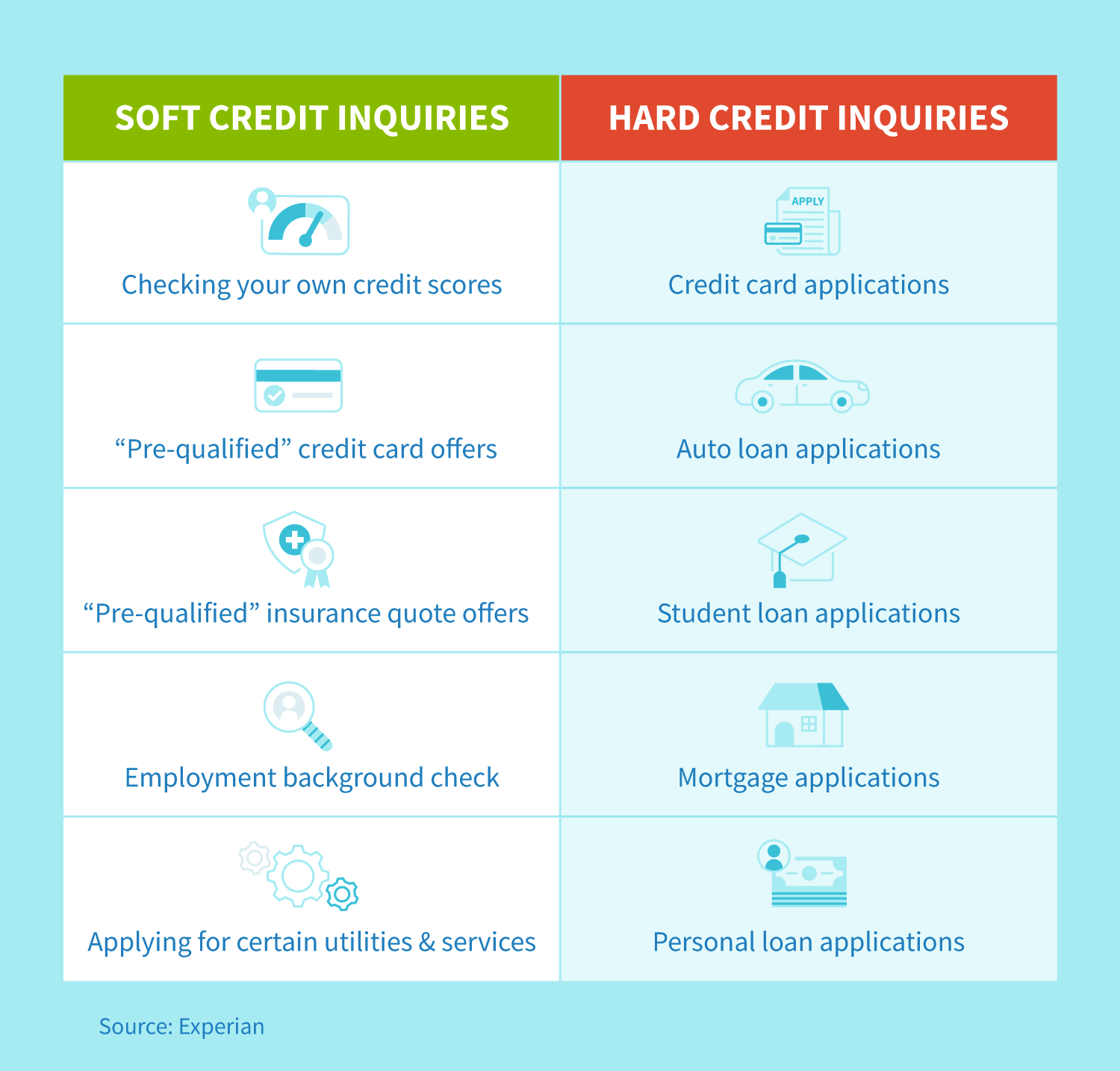

Soft credit inquiries, also known as soft pulls, occur when lenders check your credit report for pre-approval offers or background checks. These inquiries are invisible to other lenders and do not affect your credit score.

Rocket Mortgage, along with other lenders, uses soft pulls to give potential borrowers an idea of what they might qualify for without impacting their credit. This allows consumers to shop around without fear of damaging their creditworthiness.

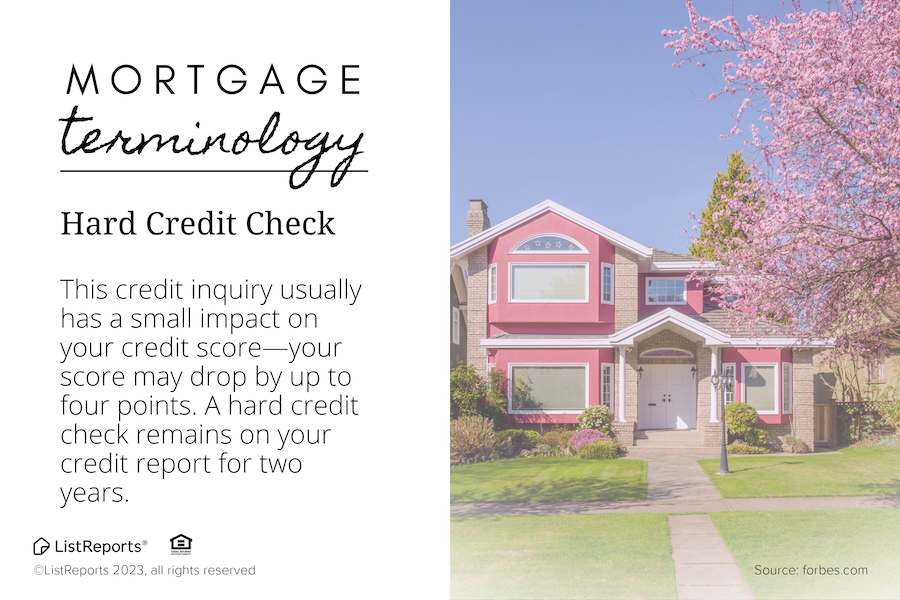

Hard credit inquiries, on the other hand, occur when you formally apply for credit, such as a mortgage, auto loan, or credit card. These inquiries are recorded on your credit report and can slightly lower your credit score.

Multiple hard inquiries for the same type of loan within a short period (typically 14-45 days, depending on the credit scoring model) are generally treated as a single inquiry. This allows borrowers to shop around for the best mortgage rates without being penalized for each application.

Rocket Mortgage's Process: When Does the Hard Pull Happen?

According to Rocket Mortgage's official documentation and customer service interactions, the hard credit check typically occurs when you submit a formal mortgage application. This is usually after you've reviewed preliminary rates and terms based on a soft credit check.

Before you formally apply, a Rocket Mortgage representative will typically explain the next steps and confirm that a hard credit check will be performed. This allows you to make an informed decision about proceeding with the application.

The timing is important because it allows you to explore your options with Rocket Mortgage without immediately impacting your credit score.

Minimizing the Impact of Hard Credit Checks

To minimize the impact of hard credit checks when shopping for a mortgage, it's crucial to limit your applications to a concentrated timeframe. As mentioned, credit scoring models typically treat multiple inquiries for the same type of loan within a short period as a single inquiry.

Gather all your necessary documents and research lenders before starting the application process. This will help you narrow down your options and avoid applying to multiple lenders unnecessarily.

Maintaining a healthy credit profile, including paying bills on time and keeping credit utilization low, is also essential to mitigate the impact of any hard credit inquiries.

Alternative Perspectives and Considerations

While a hard credit check is a standard practice, some borrowers may express concerns about its potential impact on their credit score. It’s important to remember that the impact is usually minimal and temporary.

Some borrowers might explore credit monitoring services to track their credit score and receive alerts about any new inquiries. This can provide peace of mind and help identify any potential errors on their credit report.

Rocket Mortgage and other lenders are generally transparent about their credit check policies. Reviewing their FAQs or contacting their customer service can help address any specific concerns you may have.

Looking Ahead: The Future of Credit Checks in Mortgage Lending

The mortgage industry is continually evolving, with technological advancements potentially shaping the future of credit checks. Alternative credit scoring models and data sources may become more prevalent, offering a more holistic view of a borrower's creditworthiness.

For now, understanding the difference between soft and hard credit inquiries and the timing of these checks is crucial for anyone navigating the mortgage application process with Rocket Mortgage or any other lender. Being informed empowers you to make smart financial decisions and protect your credit score.

As the industry changes, staying informed about best practices for managing your credit and shopping for a mortgage will remain paramount.