Under The Allowance Method Of Accounting For Uncollectible Accounts

The allowance method of accounting for uncollectible accounts, a cornerstone of financial reporting, continues to be scrutinized and refined as businesses navigate increasingly complex economic landscapes. This method, designed to provide a more accurate representation of a company's financial health, directly impacts how businesses report their profits and assets.

This article delves into the intricacies of the allowance method, its significance, and its potential impact on businesses and stakeholders. Understanding this accounting practice is crucial for investors, creditors, and anyone involved in financial analysis.

Understanding the Allowance Method

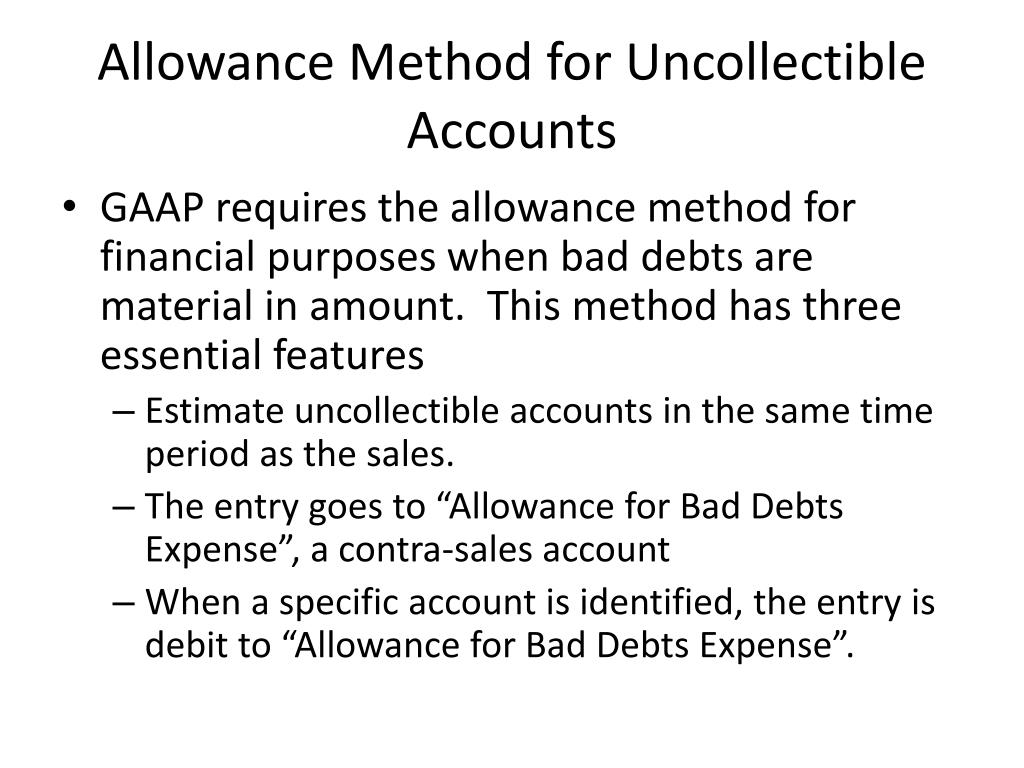

The allowance method is a generally accepted accounting principle (GAAP) used to estimate and account for bad debts, also known as uncollectible accounts. Instead of waiting until an account is deemed definitively uncollectible, companies using this method proactively estimate the amount of receivables that are unlikely to be recovered.

This estimation is based on historical data, industry trends, and current economic conditions. The allowance method contrasts with the direct write-off method, which only recognizes bad debt expense when an account is actually determined to be uncollectible.

The key difference lies in the timing of expense recognition. The allowance method adheres to the matching principle, recognizing the bad debt expense in the same period as the revenue it generated.

Key Components of the Allowance Method

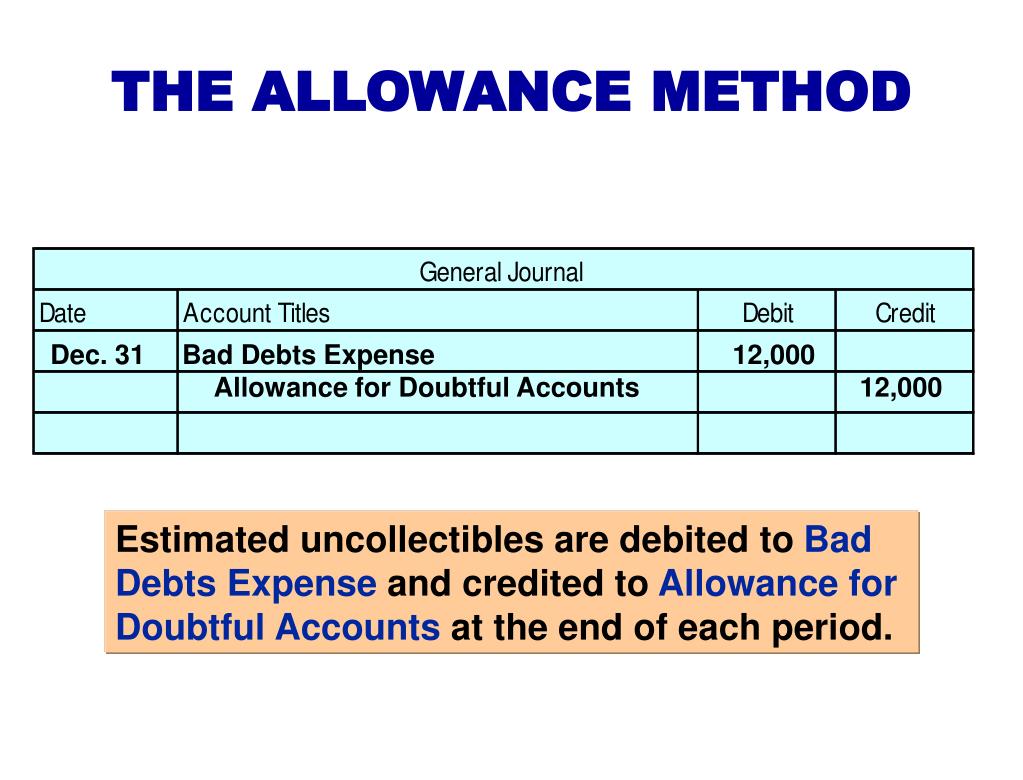

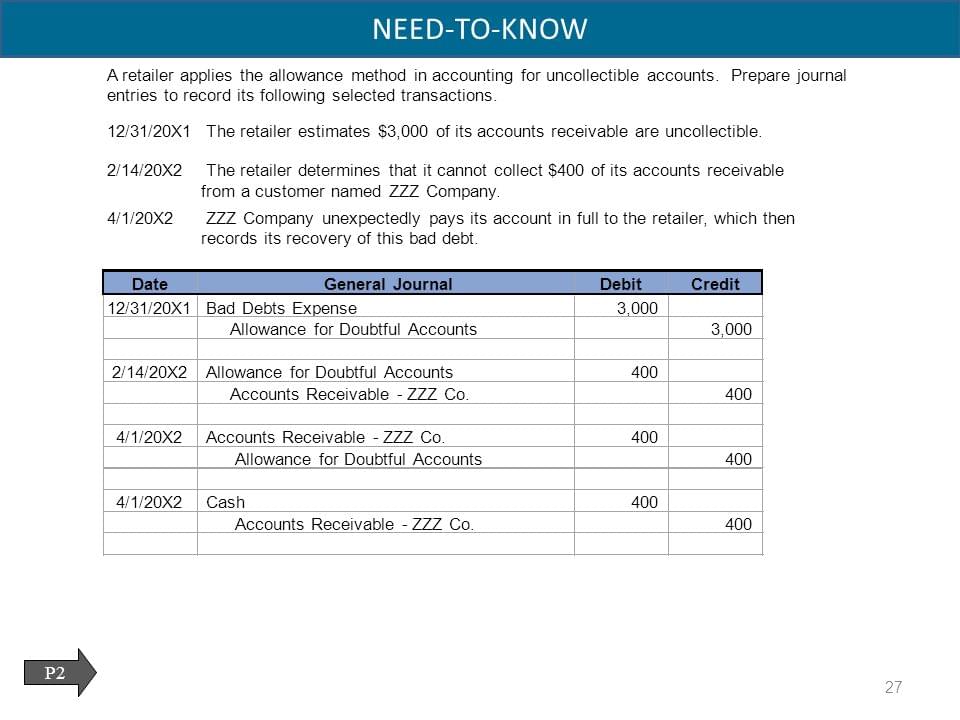

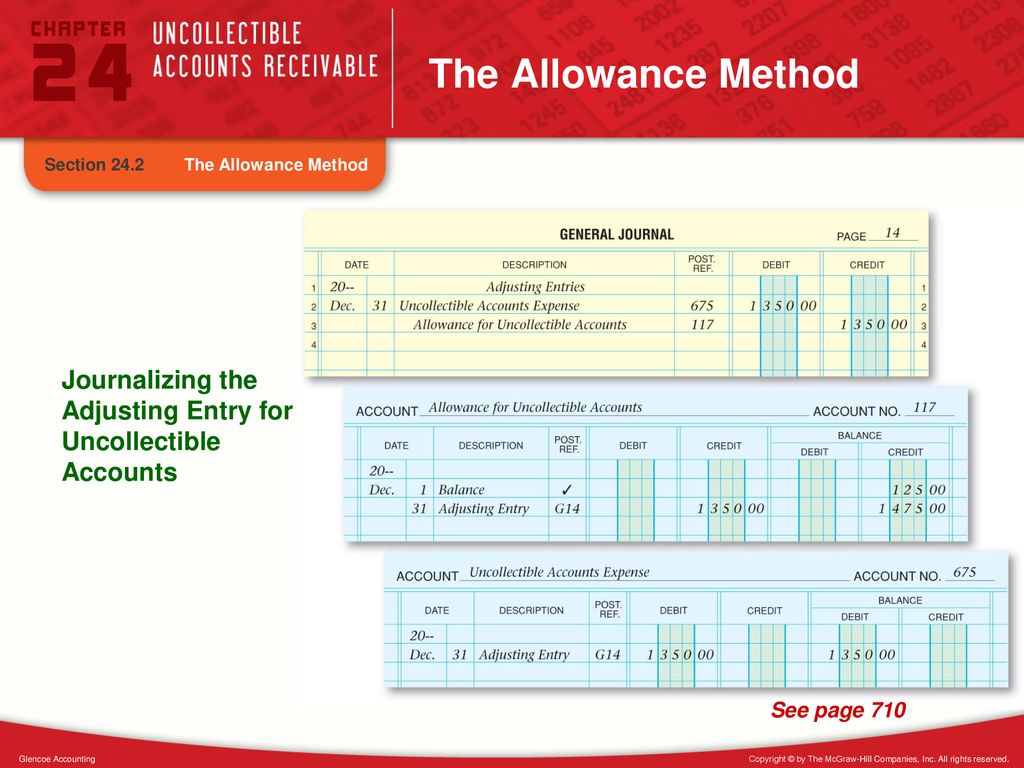

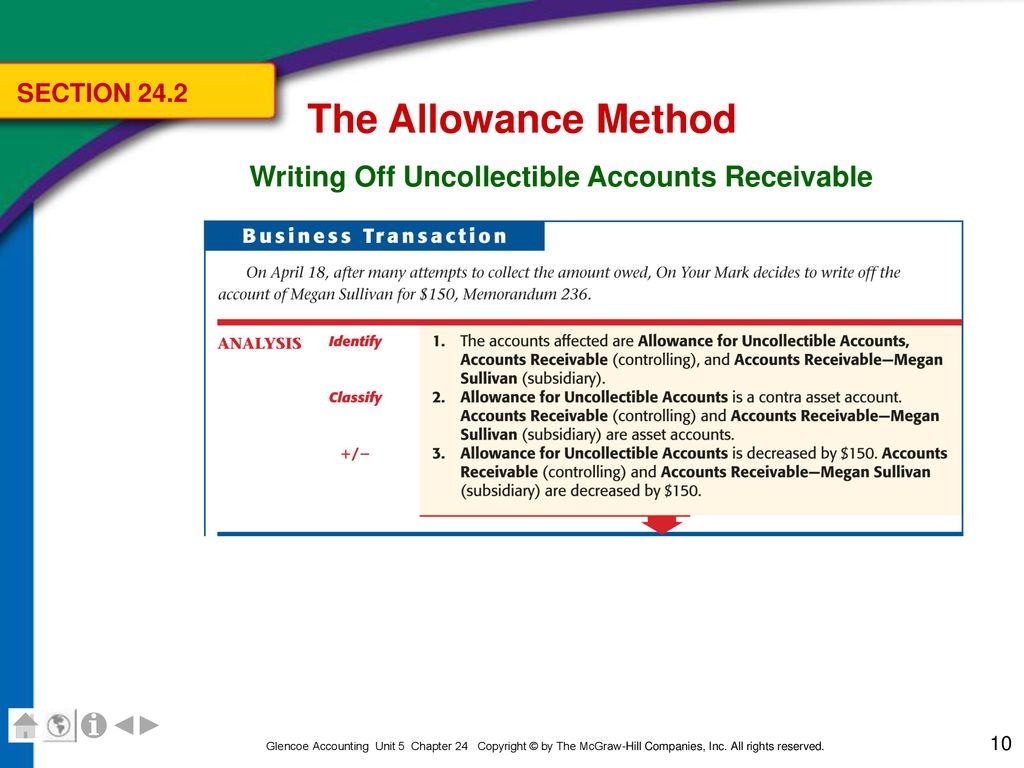

The allowance method involves several key components. These include the allowance for doubtful accounts, the bad debt expense, and the process of writing off uncollectible accounts.

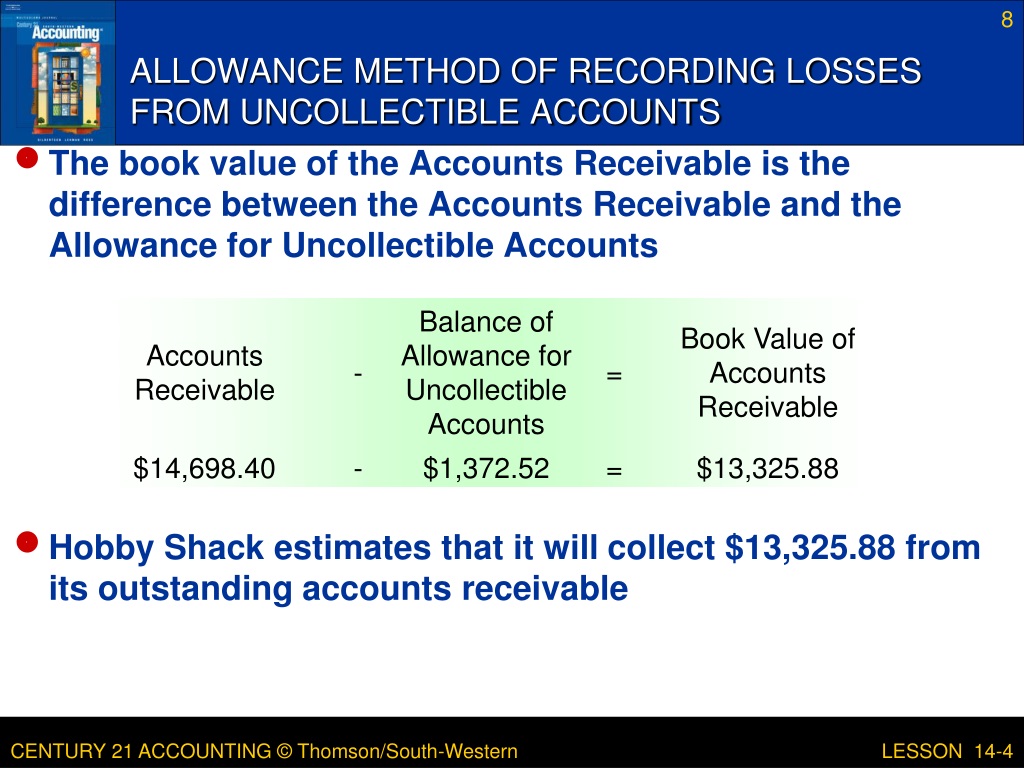

The allowance for doubtful accounts is a contra-asset account that reduces the carrying value of accounts receivable on the balance sheet. It represents the estimated amount of receivables that will not be collected.

Bad debt expense is the expense recognized on the income statement to reflect the estimated uncollectible accounts. This expense reduces a company's net income.

When an account is determined to be uncollectible, it is written off against the allowance for doubtful accounts. This write-off does not affect the income statement, as the expense has already been recognized.

Significance and Impact

The allowance method offers a more realistic view of a company's financial position. By estimating and accounting for uncollectible accounts, the method provides a more accurate representation of a company's assets and profitability.

This is especially important for companies with significant credit sales. Ignoring potential bad debts can lead to an overstatement of assets and an inflated net income.

The allowance method impacts various stakeholders. Investors can make more informed decisions based on a clearer picture of a company's financial health.

Creditors can assess the risk of lending to a company with greater accuracy. Company management gains access to more reliable data for strategic planning and decision-making.

Methods for Estimating Uncollectible Accounts

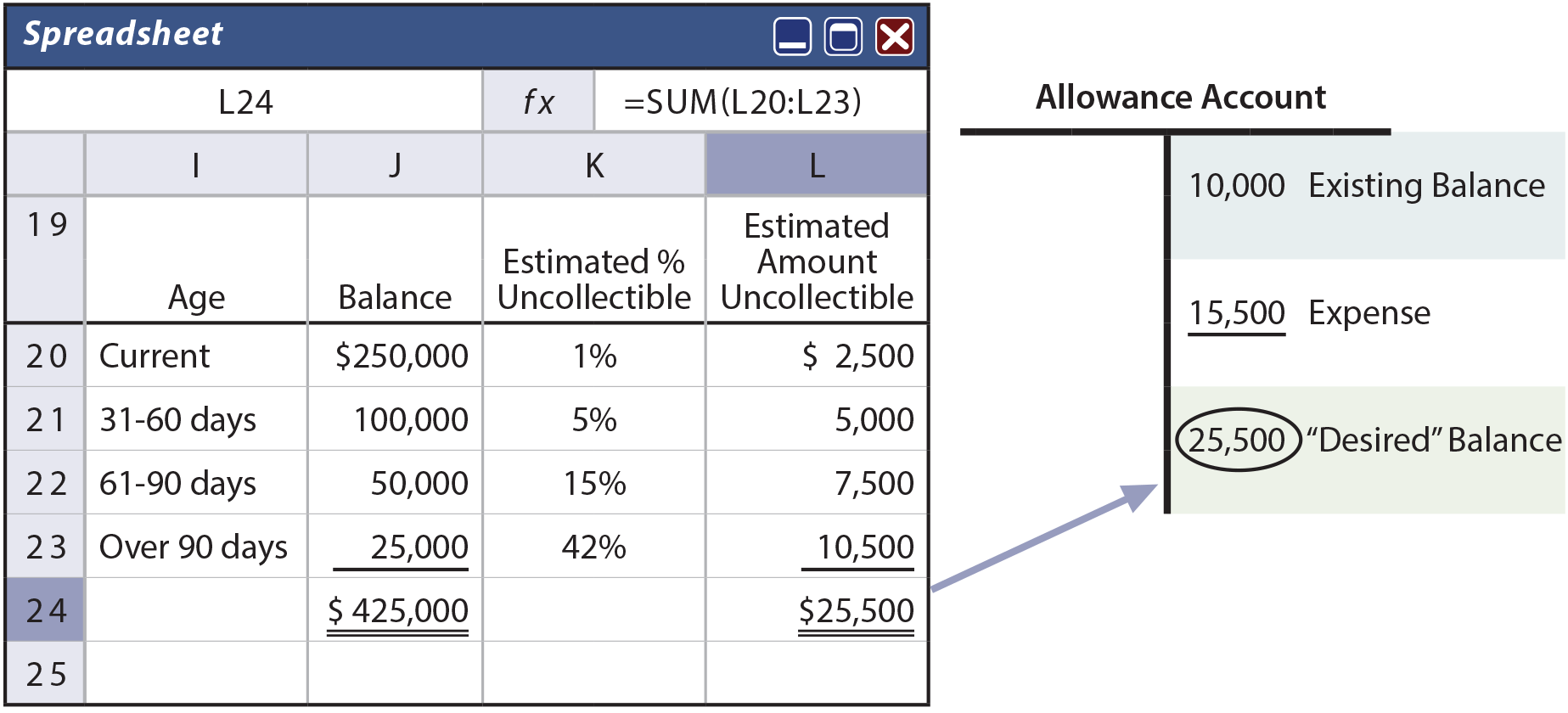

There are several methods for estimating uncollectible accounts under the allowance method. These methods typically fall into two broad categories: the percentage of sales method and the aging of accounts receivable method.

The percentage of sales method estimates bad debt expense as a percentage of total credit sales. This percentage is typically based on historical data and industry benchmarks.

The aging of accounts receivable method categorizes accounts receivable based on the length of time they have been outstanding. A higher percentage is applied to older receivables, as they are considered more likely to be uncollectible.

The choice of method depends on the specific circumstances of the company. The aging method is often considered more accurate as it takes into account the age of individual receivables.

Criticisms and Challenges

Despite its advantages, the allowance method is not without its criticisms and challenges. The estimation process involves subjectivity, and different companies may use different assumptions and methodologies.

This can lead to inconsistencies in financial reporting. Some argue that it provides companies with too much leeway to manipulate earnings.

Another challenge is the difficulty in accurately predicting future uncollectible accounts. Economic conditions and industry trends can change rapidly, making it difficult to rely solely on historical data.

This has led to calls for enhanced disclosure requirements and more rigorous auditing standards. Transparency is paramount to ensuring the credibility and reliability of financial reporting.

The Future of the Allowance Method

The allowance method is likely to remain a fundamental aspect of financial accounting. However, ongoing advancements in data analytics and artificial intelligence could potentially enhance the accuracy and efficiency of the estimation process.

Companies can now leverage data from various sources, including credit scores, payment histories, and social media activity, to better assess the creditworthiness of their customers. These developments could lead to more sophisticated and reliable models for estimating uncollectible accounts.

As the global economy continues to evolve, the allowance method will undoubtedly be subject to further scrutiny and refinement. The goal is to strike a balance between providing accurate financial information and minimizing the potential for manipulation.

The enduring significance of the allowance method underscores its importance in the broader context of financial reporting and economic stability. It serves as a critical mechanism for ensuring transparency, accountability, and sound financial management.

![Under The Allowance Method Of Accounting For Uncollectible Accounts Allowance Method Solved] Effective With The Current Year, Fateful](https://www.principlesofaccounting.com/wp-content/gallery/chapter-7/itobalance.png)