Does Sezzle Premium Increase Spending Limit

Imagine scrolling through your favorite online boutique, a cart brimming with must-have items: that perfect summer dress, the artisan-crafted earrings you’ve been eyeing, and a cozy throw blanket for those chilly evenings. The total teeters on the edge of your budget, leaving you with that familiar pang of indecision. Enter Sezzle, promising to break down the cost into manageable installments. But then you wonder, "If I upgrade to Sezzle Premium, will my spending limit magically increase, unlocking even more shopping possibilities?"

This is the question swirling in the minds of many Sezzle users: Does Sezzle Premium actually translate to a higher spending limit? While Sezzle Premium offers a suite of enticing benefits, it's crucial to understand that it doesn't automatically guarantee a larger spending allowance. Instead, the relationship is more nuanced, tied to responsible usage, creditworthiness, and Sezzle's own risk assessment algorithms.

Understanding Sezzle's Core Offering

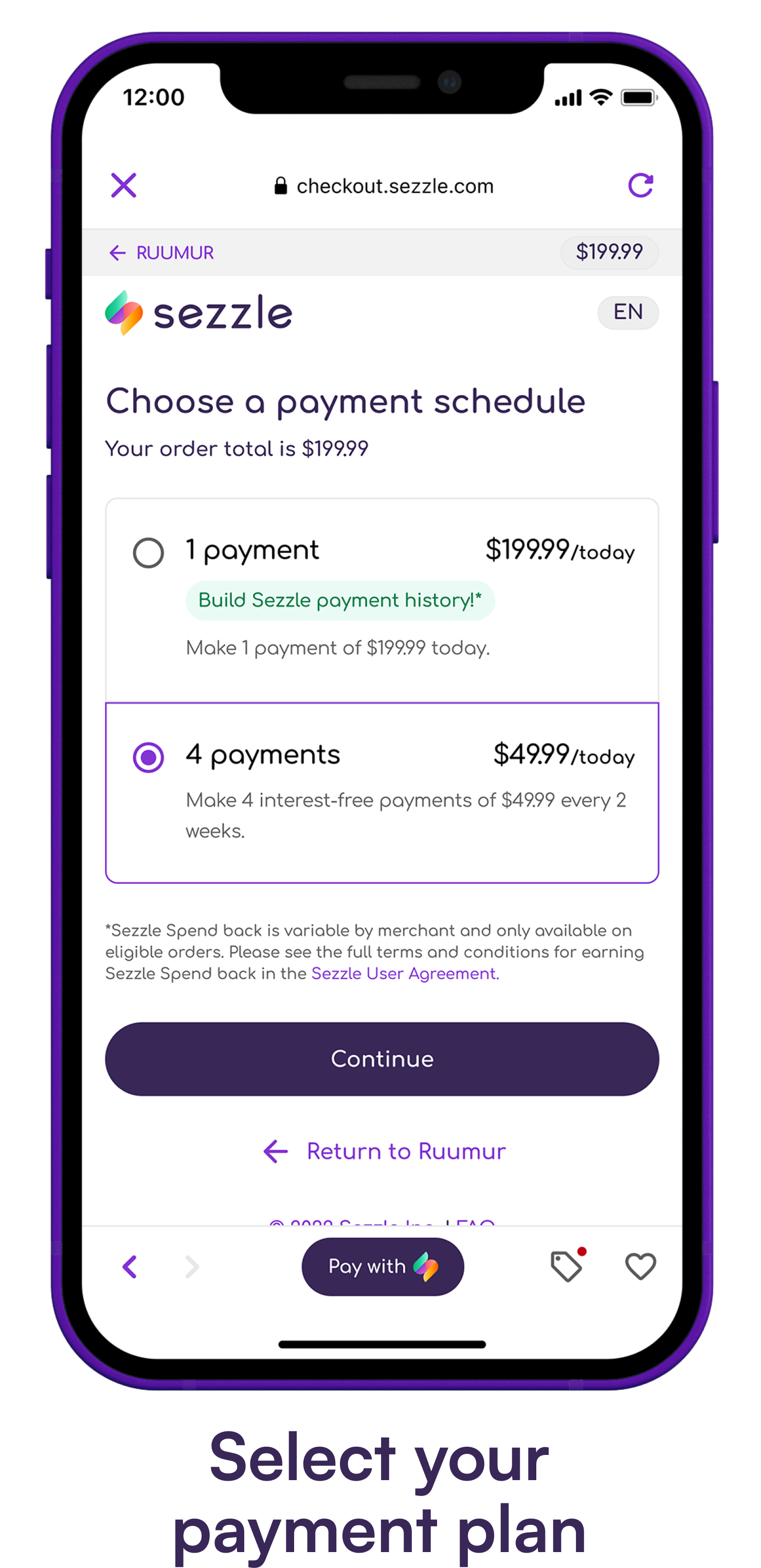

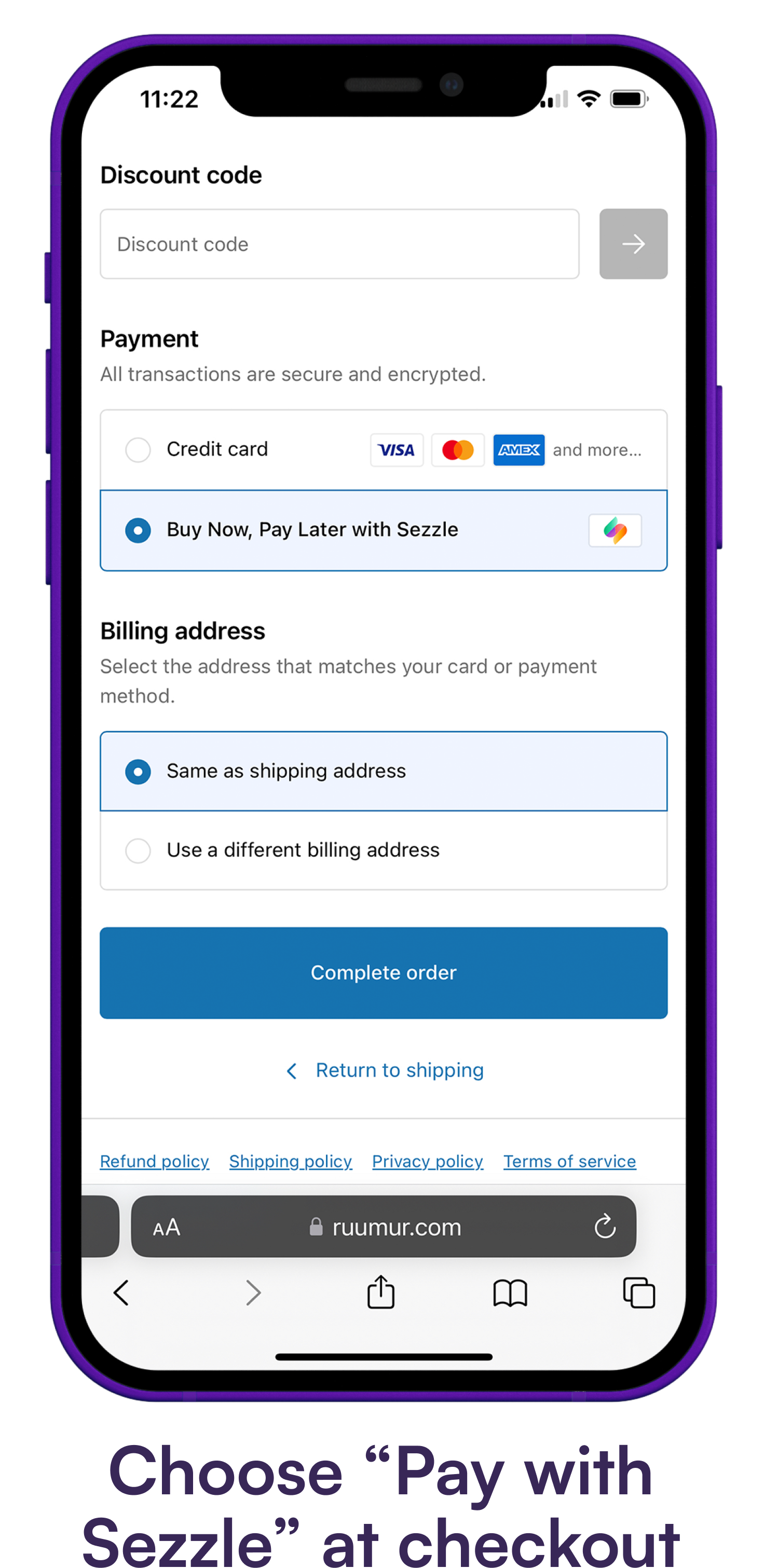

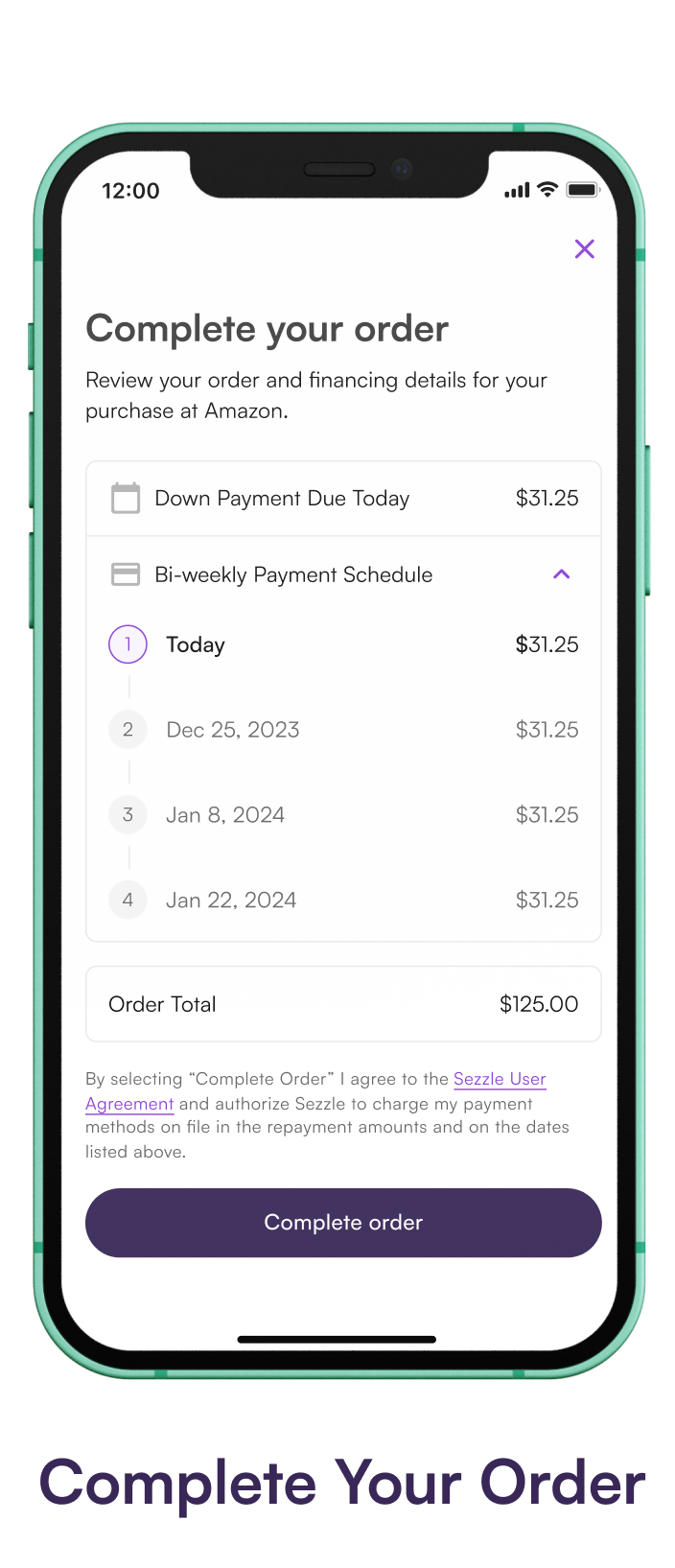

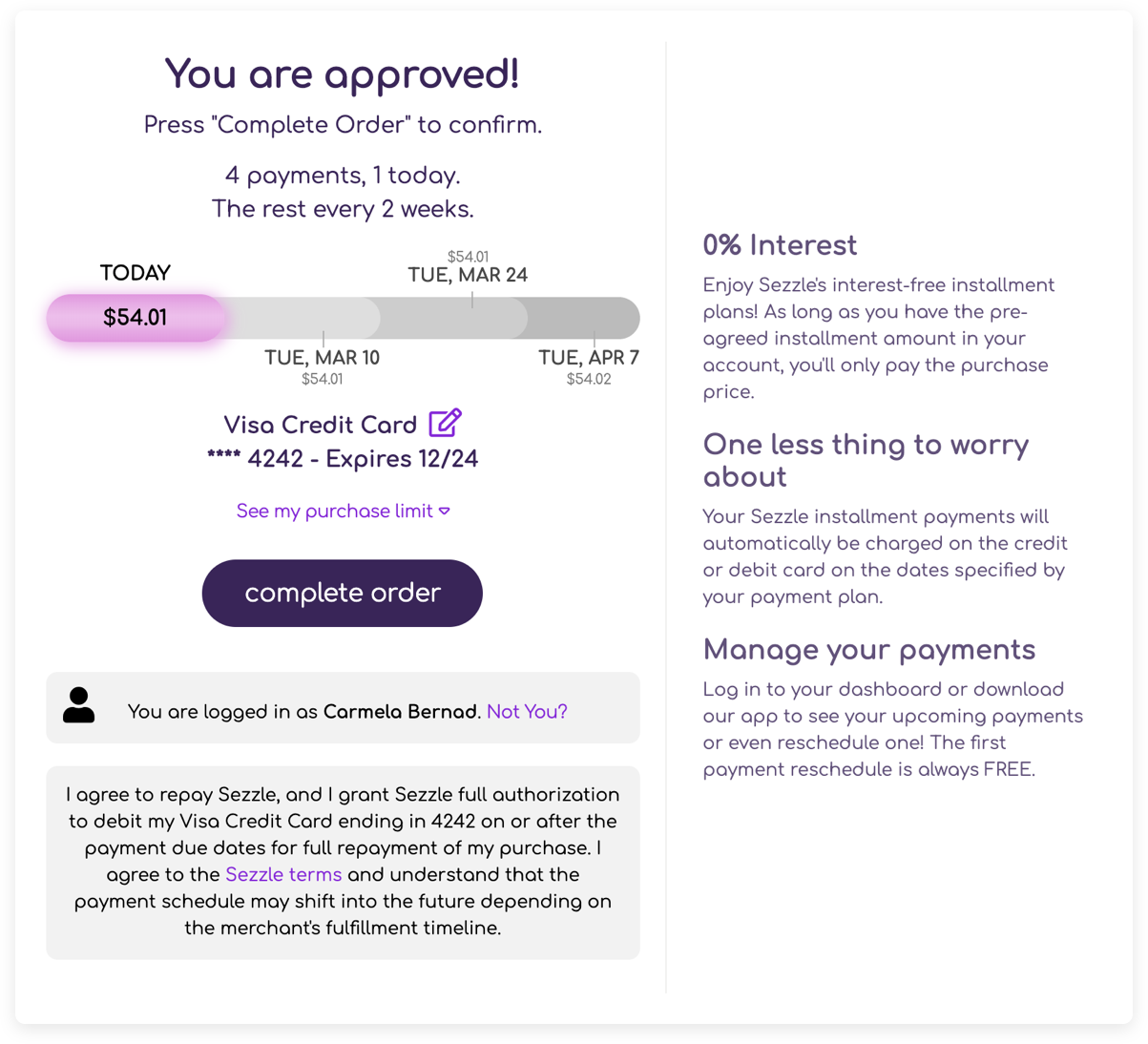

Before delving into Sezzle Premium, it’s essential to grasp the basics of the core Sezzle service. Sezzle is a buy now, pay later (BNPL) platform that allows users to split purchases into four interest-free installments, typically spread over six weeks. This provides an alternative to traditional credit cards, appealing especially to younger consumers and those seeking to avoid high interest rates.

Sezzle makes money by charging merchants a small fee for each transaction. This differs significantly from credit card companies that often rely on interest charges and late fees from consumers.

The attractiveness of Sezzle lies in its accessibility and transparent repayment structure. Users know exactly when each installment is due, fostering a sense of control over their spending.

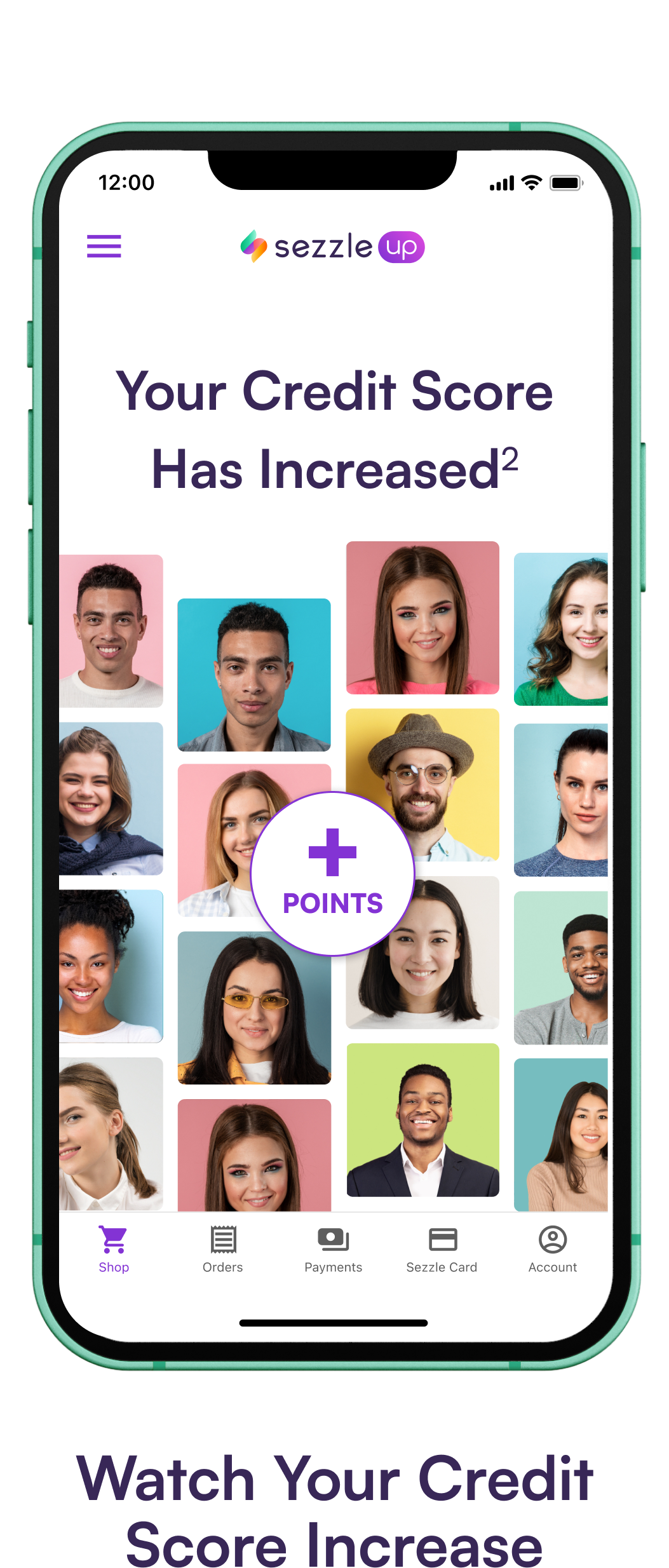

The Allure of Sezzle Premium

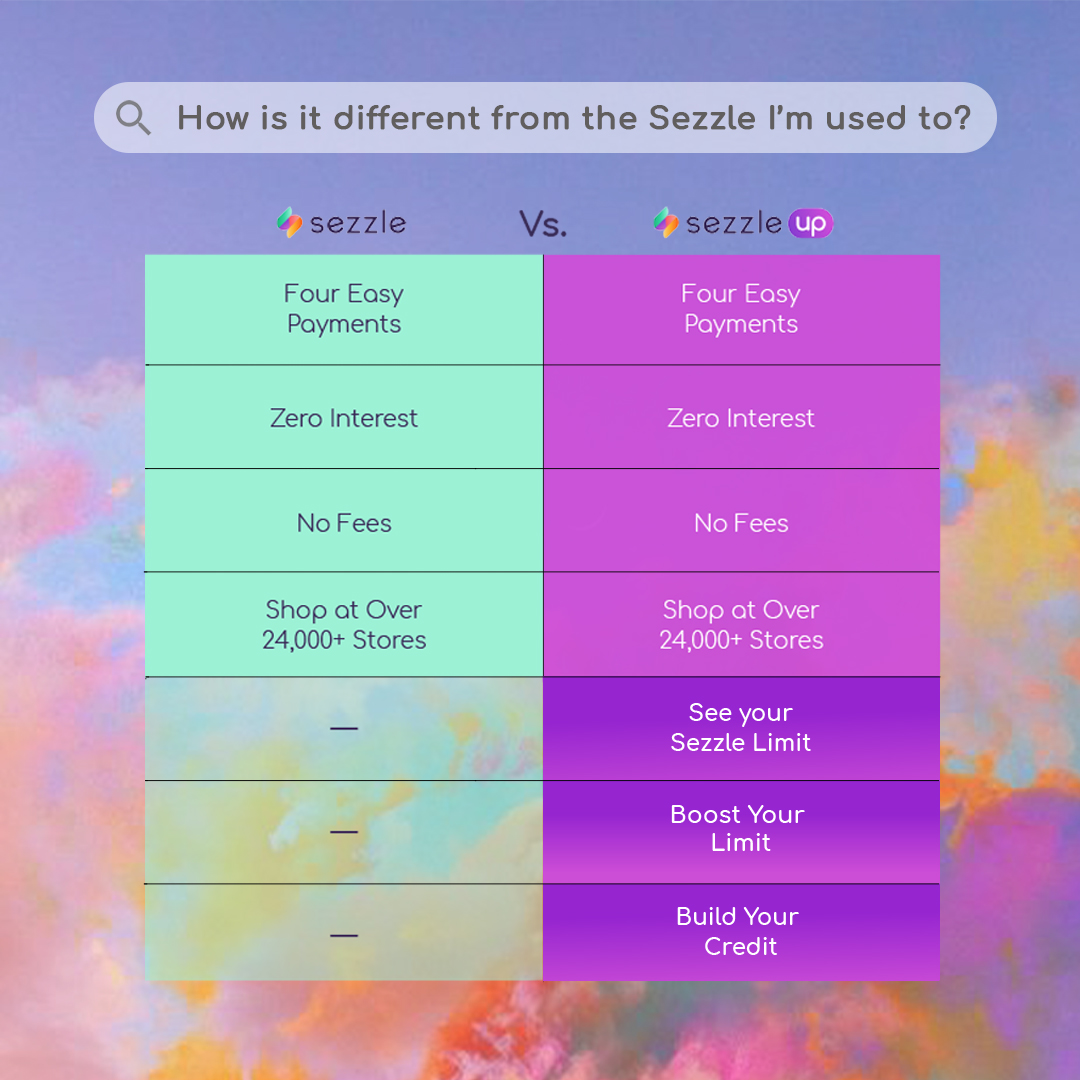

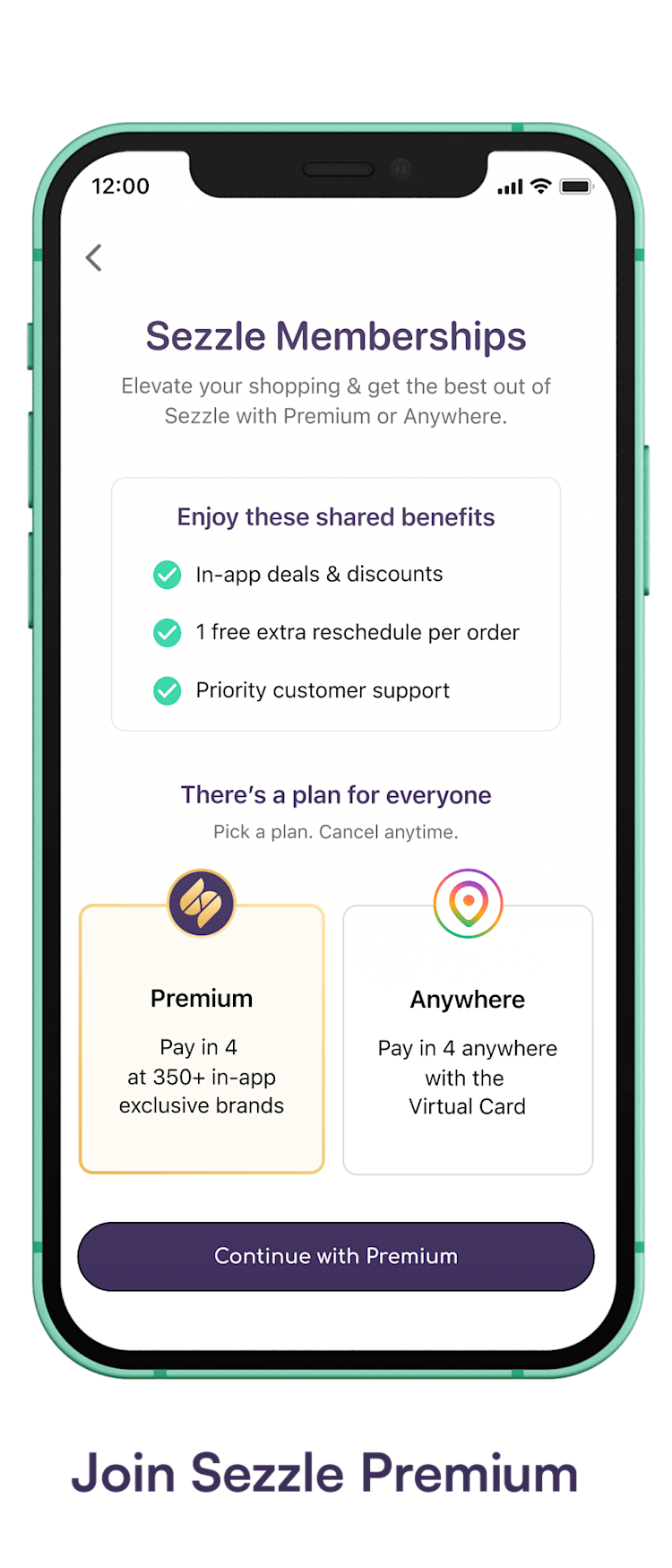

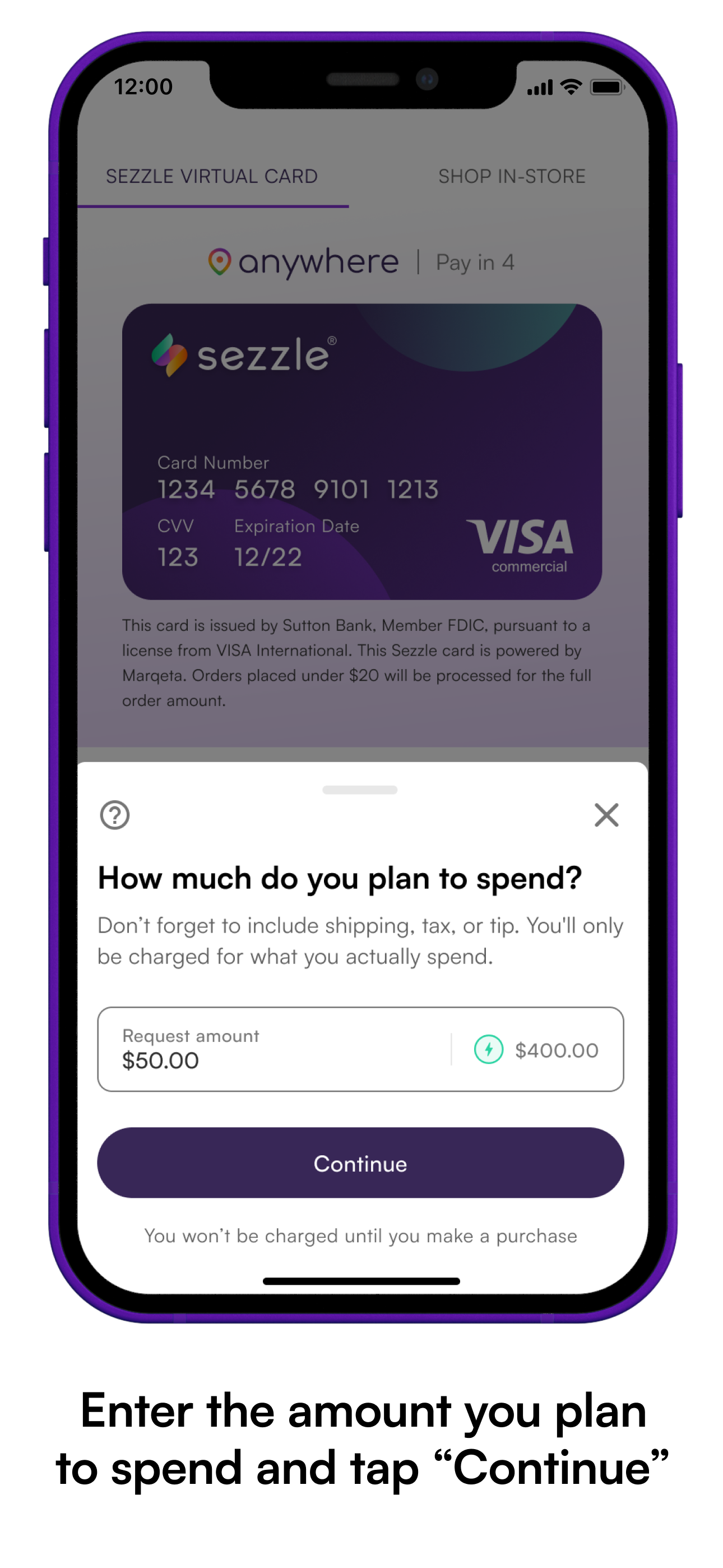

Sezzle Premium is a paid subscription service that builds upon the core BNPL offering. It introduces a range of perks designed to enhance the Sezzle experience.

Some of the common benefits include access to exclusive deals, early access to sales, and the ability to reschedule payments. Some plans may even offer higher spending limits for specific retailers.

The monthly fee for Sezzle Premium varies depending on the plan and any promotional offers available. Users should carefully weigh the cost against the perceived value of the benefits before subscribing.

The Nuances of Spending Limits

Sezzle determines spending limits on a case-by-case basis, factoring in various elements. These factors contribute to their assessment of a user's risk profile.

These include credit history, payment behavior, and the length of time a user has been with Sezzle. Regular, on-time payments demonstrate responsible usage and can positively influence the algorithm.

Additionally, factors such as income and outstanding debt may also play a role, though Sezzle often relies more heavily on internal data related to payment history within the platform.

Sezzle Premium and Spending Limits: A Closer Look

While Sezzle Premium doesn't guarantee a higher spending limit, it can certainly influence it indirectly. Consistent on-time payments while subscribed to Premium can signal responsible financial behavior to Sezzle's algorithm.

This, in turn, could lead to an increased spending limit over time. Think of it as building trust with Sezzle through your subscription and responsible repayment habits.

However, it's crucial to remember that even with Premium, late payments or missed installments will negatively impact your chances of getting a higher spending limit. Responsible usage remains paramount.

"Sezzle spending limits are determined by a number of factors, including the user's credit profile and payment history with Sezzle. While Sezzle Premium may offer certain benefits, it does not guarantee a higher spending limit," - Official Sezzle Statement.

Building a Positive Sezzle History

Regardless of whether you opt for Sezzle Premium, cultivating a positive payment history is the most effective way to potentially increase your spending limit. This means consistently paying your installments on time and avoiding late fees.

It also means not overextending yourself by making too many purchases at once. Start small, demonstrate responsible usage, and gradually build your credit with Sezzle.

Think of your Sezzle account as a digital credit line. The better you manage it, the more likely you are to see your spending limit increase over time.

Beyond Spending Limits: The True Value of Sezzle Premium

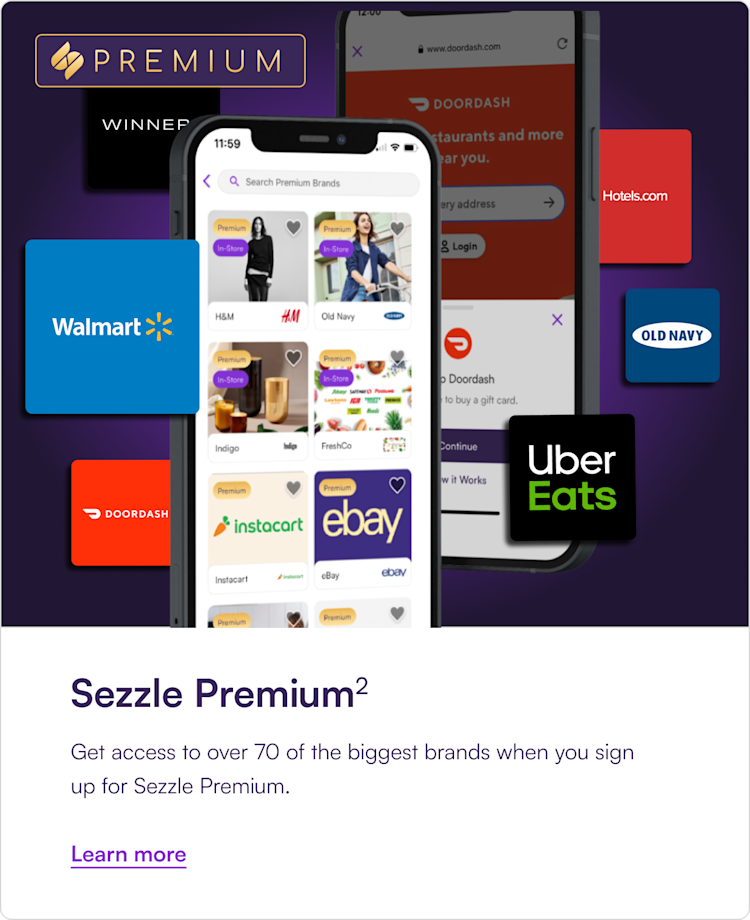

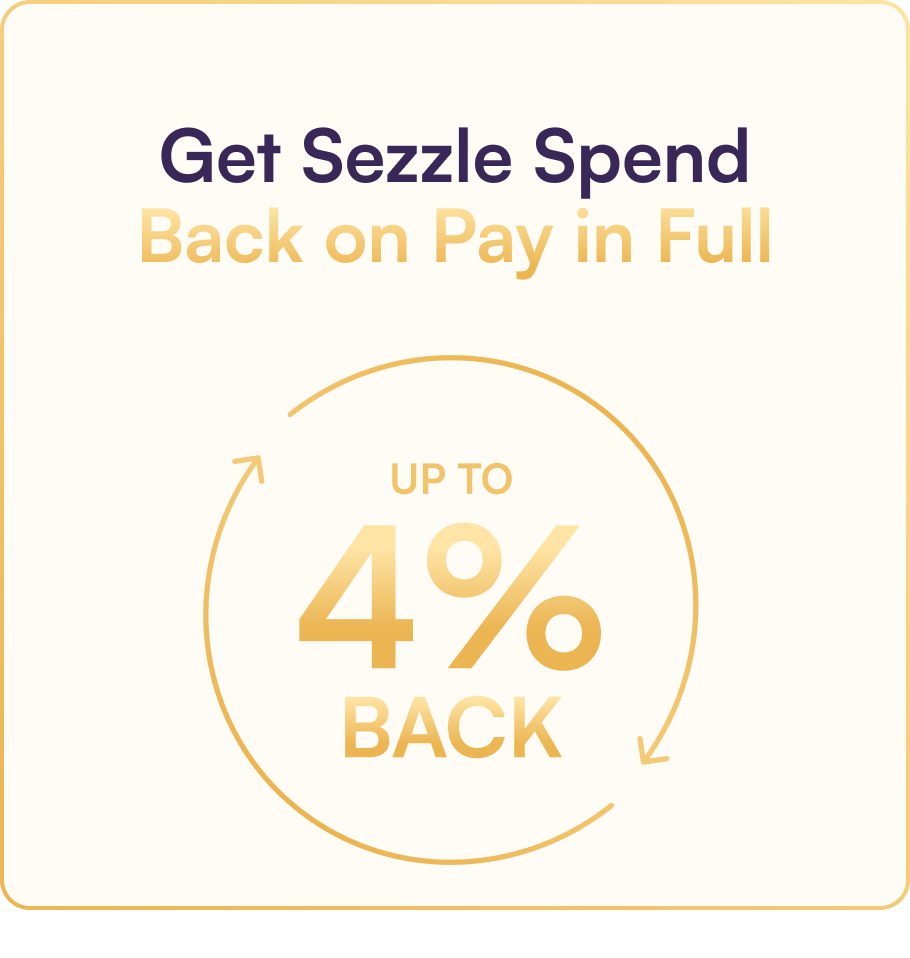

Focusing solely on whether Sezzle Premium increases spending limits misses the broader point of the subscription. The true value lies in the suite of additional perks and benefits it offers.

These can include exclusive deals, early access to sales, and the flexibility to reschedule payments. These features can enhance the overall shopping experience and provide greater control over your finances.

Consider whether these benefits align with your shopping habits and financial needs. If you frequently shop at Sezzle-partnered merchants and value the added flexibility, Premium might be a worthwhile investment, regardless of its direct impact on your spending limit.

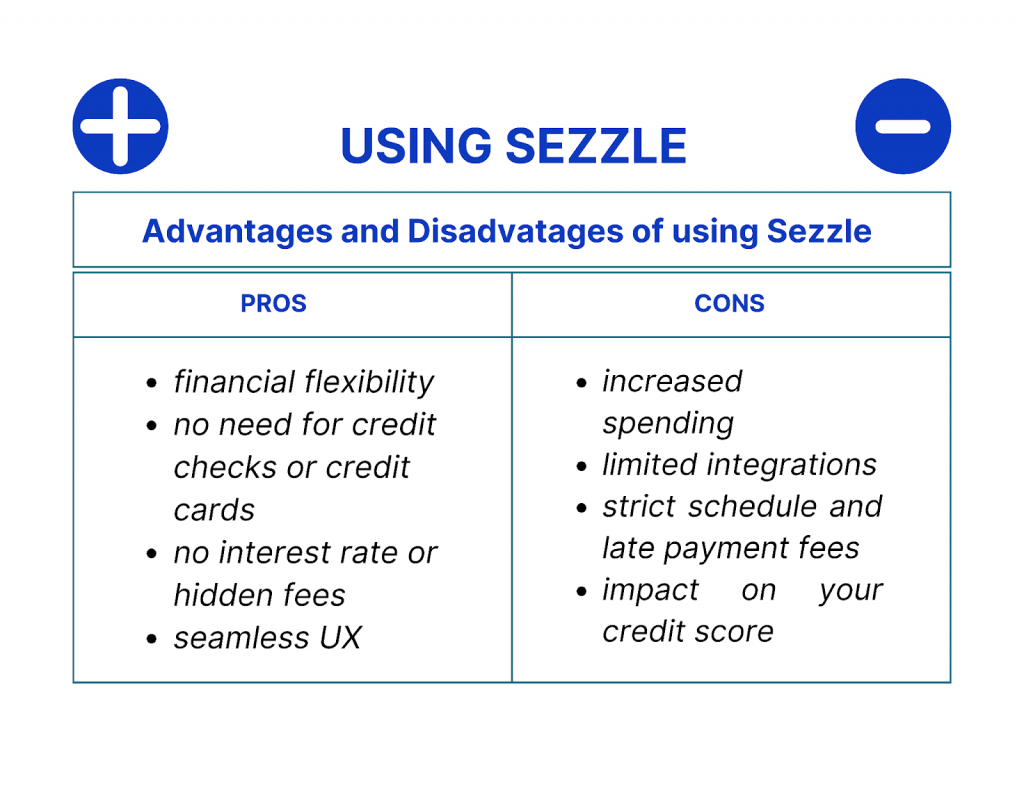

The Ethical Considerations of BNPL

It's also important to consider the ethical implications of BNPL services in general. While they offer convenience and flexibility, they can also encourage overspending if not used responsibly.

It is crucial to use BNPL services like Sezzle thoughtfully and avoid accumulating debt beyond your ability to repay. Treat it as a tool for budgeting and managing expenses, not as an excuse to overspend.

Be mindful of the terms and conditions, including any late fees or potential impact on your credit score. Responsible financial management is key to maximizing the benefits of BNPL while mitigating the risks.

Making an Informed Decision

Ultimately, the decision of whether to subscribe to Sezzle Premium depends on your individual circumstances and financial goals. Don't make the decision solely based on the hope of an increased spending limit.

Weigh the cost of the subscription against the value of the benefits it offers, and assess your own ability to use Sezzle responsibly. A well-informed choice is always the best choice.

By understanding the nuances of Sezzle Premium and prioritizing responsible financial habits, you can make the most of the platform while avoiding the pitfalls of overspending.

The Future of Buy Now, Pay Later

The BNPL landscape continues to evolve, with new players and innovative features emerging all the time. Regulations are also likely to tighten as consumer protection concerns grow.

It's essential to stay informed about the latest developments and choose BNPL providers that prioritize transparency and responsible lending practices. The future of BNPL depends on fostering a sustainable and ethical ecosystem.

As consumers become more educated about the benefits and risks of BNPL, they can make informed choices that empower them to manage their finances effectively and achieve their shopping goals responsibly.

So, does Sezzle Premium increase your spending limit? The answer is a nuanced “maybe, but don’t count on it.” Focus on responsible usage, building a positive payment history, and weighing the benefits of Premium against your individual needs. That way, you can confidently navigate the world of buy now, pay later and shop with peace of mind.