Does Wells Fargo Have Free Checking For Seniors

The aroma of freshly brewed coffee hung in the air at the local community center, where a group of seniors gathered, their laughter and chatter filling the room. A common topic of discussion, however, was far from lighthearted: managing finances on a fixed income. The question on many minds: "Does Wells Fargo, a bank with a significant presence in our community, offer free checking accounts for seniors?"

This question reflects a broader concern among older adults: the need for accessible and affordable banking options. This article delves into whether Wells Fargo provides free checking accounts tailored to seniors, examining the details of their account offerings and exploring alternative solutions for those seeking cost-effective banking.

Understanding the Need for Senior-Friendly Banking

Seniors often rely on fixed incomes, making them particularly vulnerable to the impact of fees associated with traditional checking accounts. These fees, ranging from monthly maintenance charges to overdraft penalties, can quickly erode their financial stability. Accessible and affordable banking options are, therefore, not just a convenience but a crucial necessity for this demographic.

Many banks have recognized this need, introducing specific account types designed to cater to the unique financial circumstances of older adults. These accounts often include features like waived monthly fees, discounted services, and access to financial education resources.

Wells Fargo's Checking Account Options: A Closer Look

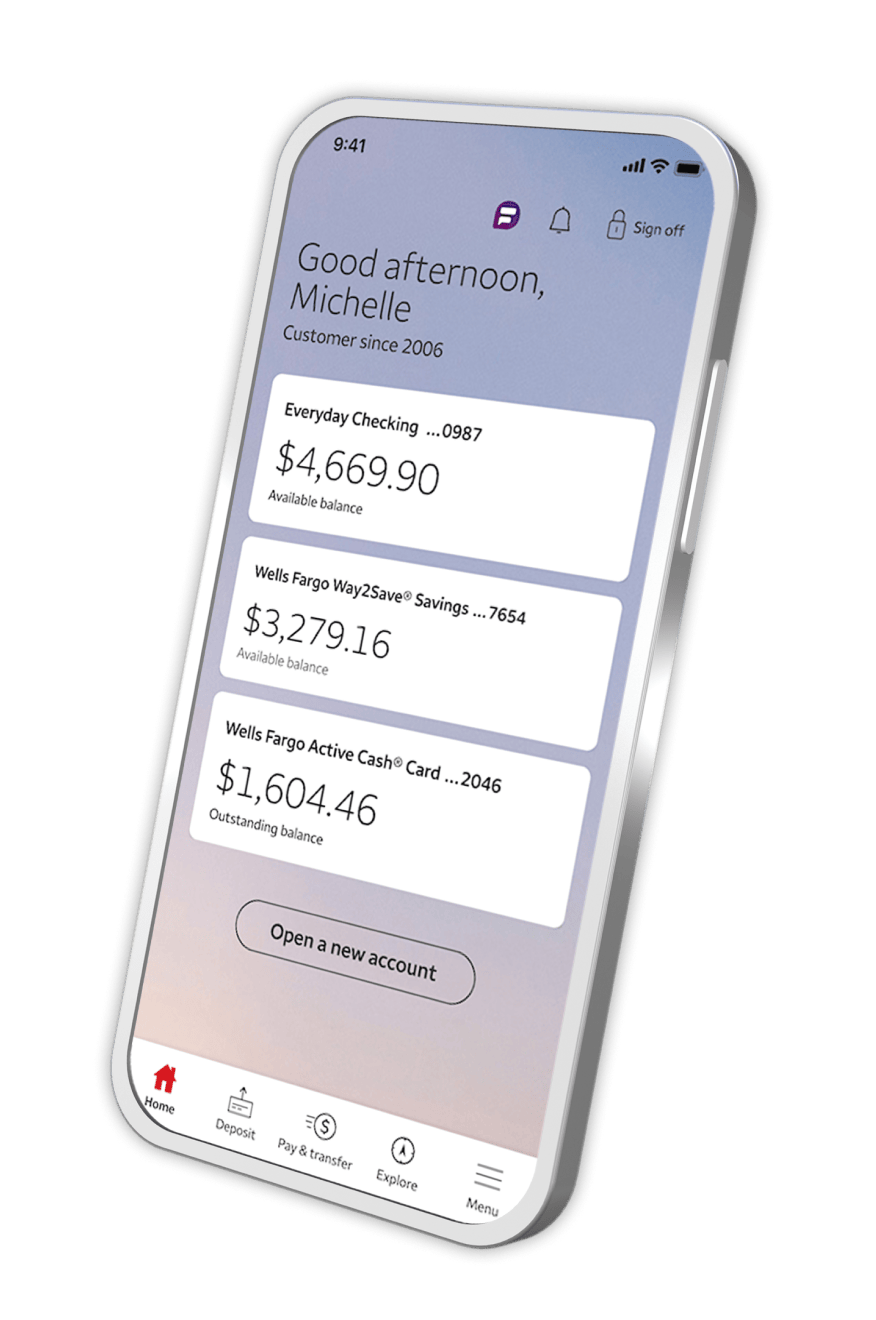

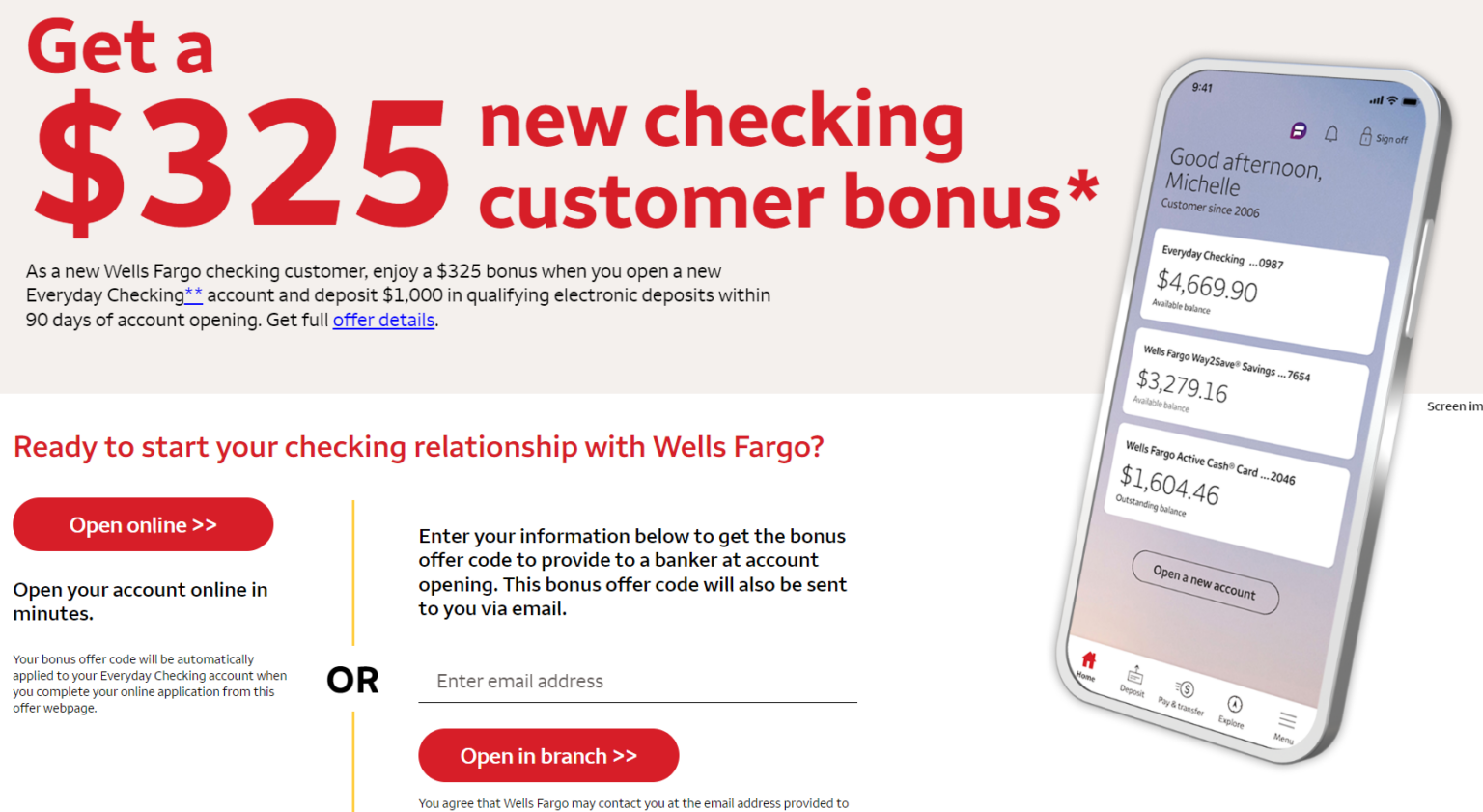

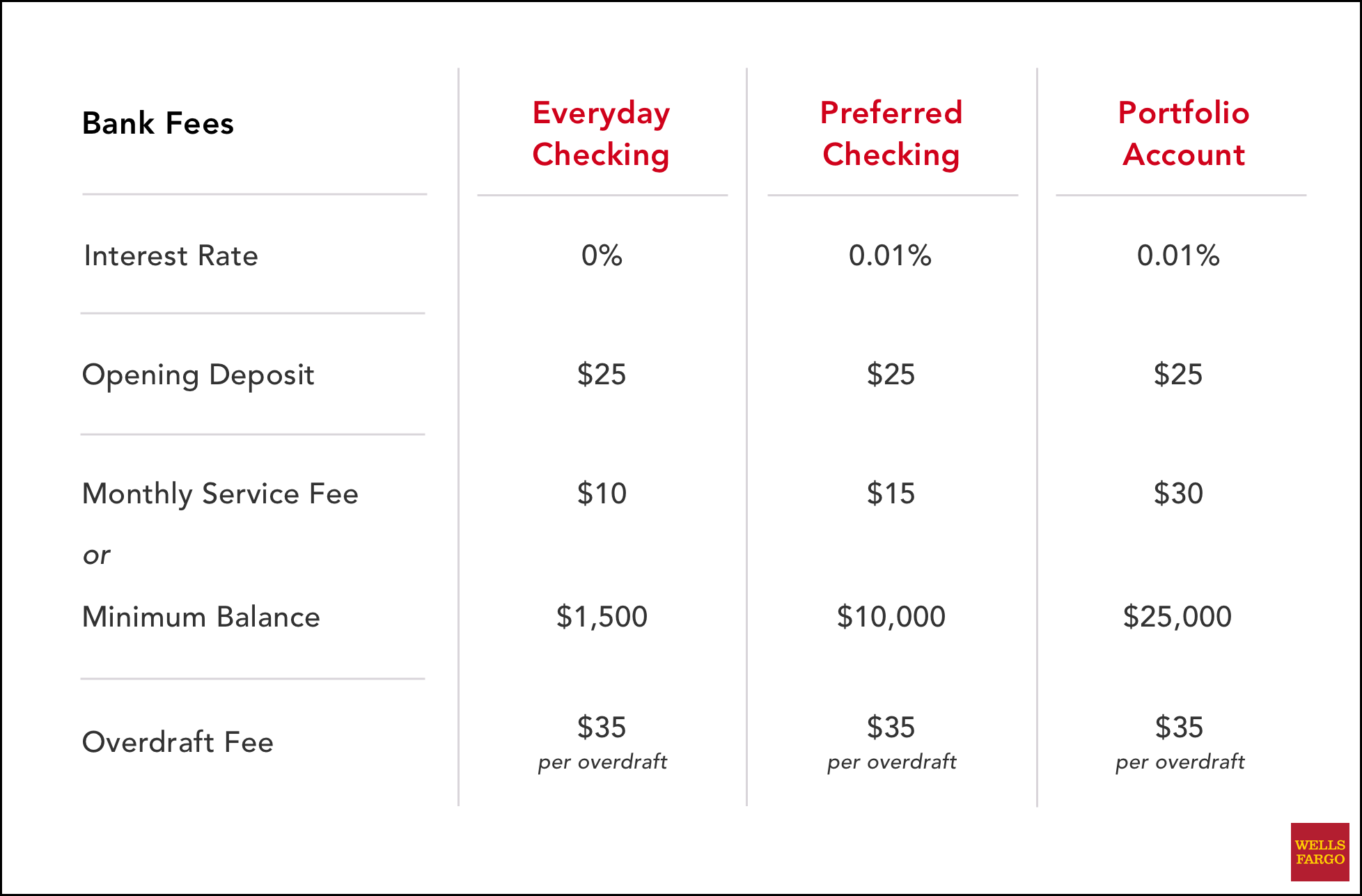

Wells Fargo offers a variety of checking account options, each with its own set of features and fees. As of recent updates, Wells Fargo did not explicitly advertise a "free checking account for seniors" but does offer various ways to waive the monthly service fees on some accounts.

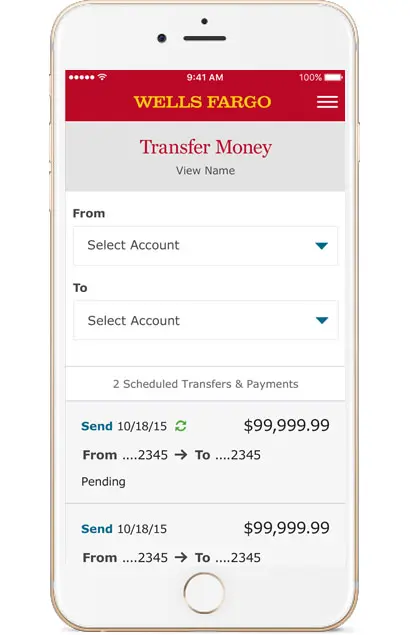

The Clear Access Banking account, designed to avoid overdraft fees, has a lower monthly fee compared to other options. For other accounts, the monthly service fees can often be waived by maintaining minimum daily balances, receiving direct deposits of a certain amount, or by linking the checking account to a qualifying savings account.

Exploring Alternatives to Traditional Checking

For seniors seeking truly free checking accounts, several alternative options exist beyond traditional brick-and-mortar banks. Online banks and credit unions often offer free checking accounts with no minimum balance requirements or monthly fees.

These institutions often pass on the cost savings of lower overhead to their customers through more favorable terms. Additionally, some community banks and credit unions provide specialized senior accounts with waived fees and personalized services.

The Importance of Financial Literacy and Informed Choices

Navigating the complexities of banking products and services can be challenging, especially for seniors. Empowering older adults with financial literacy is crucial to making informed decisions about their banking needs.

Organizations like the AARP and the National Council on Aging offer valuable resources and educational programs to help seniors understand their financial options and protect themselves from fraud and exploitation. It’s important to compare different account options and ask questions to understand all associated fees and terms.

Ultimately, while Wells Fargo may not offer a straightforward "free checking for seniors" account, exploring fee waiver options and considering alternative banking solutions can help seniors find accessible and affordable banking that suits their individual needs. Empowering older adults with information and promoting financial literacy will ensure they can manage their finances with confidence and security.