Dsp Blackrock Natural Resources And New Energy Fund Growth

Imagine a world powered by the sun, wind turbines gracefully spinning, and electric vehicles silently gliding through city streets. This vision of a sustainable future is not just a dream; it’s becoming a reality, fueled by innovation and investment in natural resources and new energy. As the world increasingly focuses on combating climate change and securing energy independence, the financial landscape is shifting, creating opportunities for growth in sectors that champion sustainability.

The DSP BlackRock Natural Resources and New Energy Fund has emerged as a noteworthy player in this evolving landscape. This article delves into the fund's recent growth trajectory, exploring the factors contributing to its success and its significance within the broader context of sustainable investing. We'll examine how this fund is navigating the complexities of the natural resources and new energy sectors while delivering value to its investors.

A Closer Look at the Fund

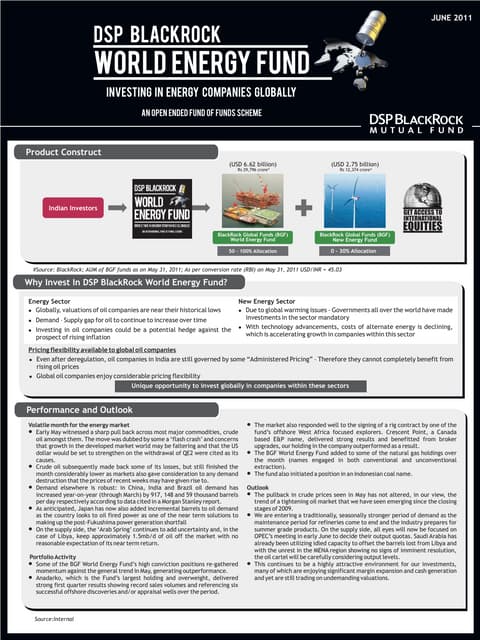

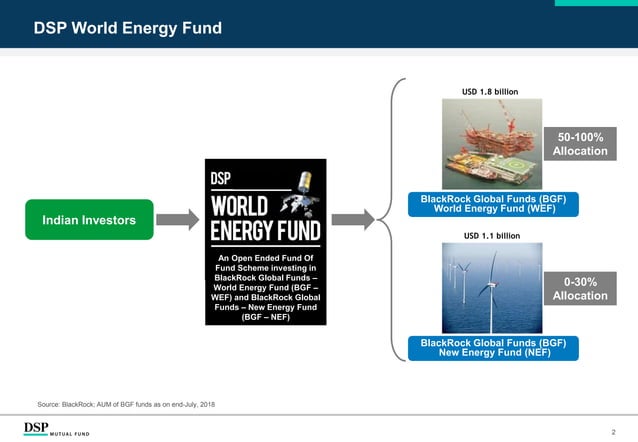

The DSP BlackRock Natural Resources and New Energy Fund is an investment vehicle focused on companies involved in the exploration, production, and processing of natural resources, as well as those driving innovation in renewable energy technologies. According to recent data from DSP Mutual Fund, the fund has demonstrated promising growth, attracting significant investor interest. This growth reflects a broader trend of increasing investment in environmental, social, and governance (ESG) focused funds.

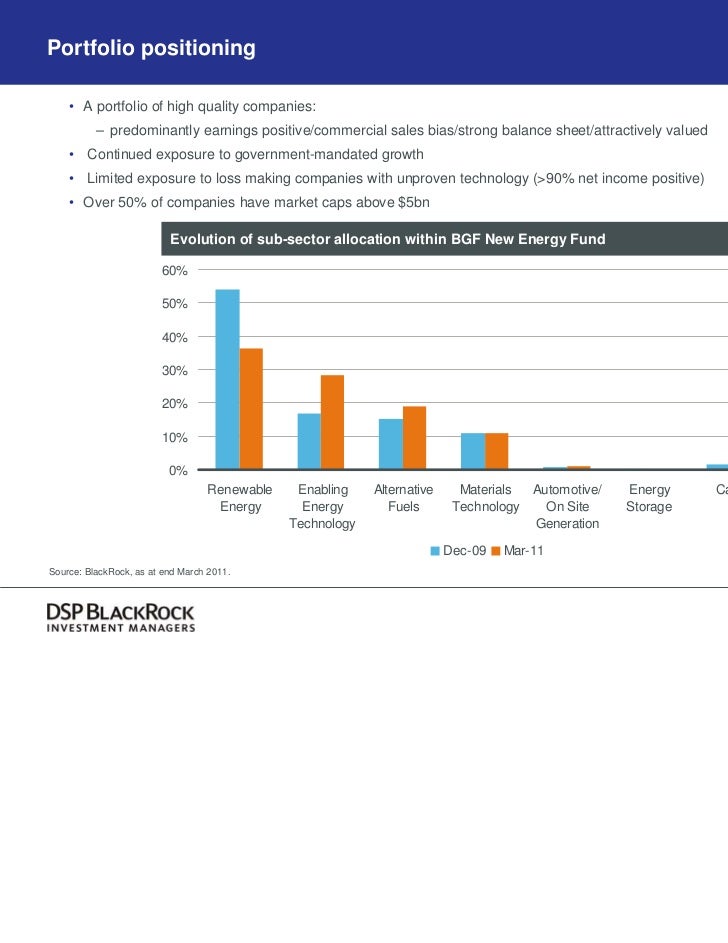

The fund's portfolio typically includes companies engaged in areas like solar energy, wind power, energy storage, sustainable agriculture, and responsible mining practices. By strategically allocating capital to these sectors, the fund aims to capitalize on the growing demand for sustainable solutions and contribute to a more environmentally conscious economy.

Key Drivers of Growth

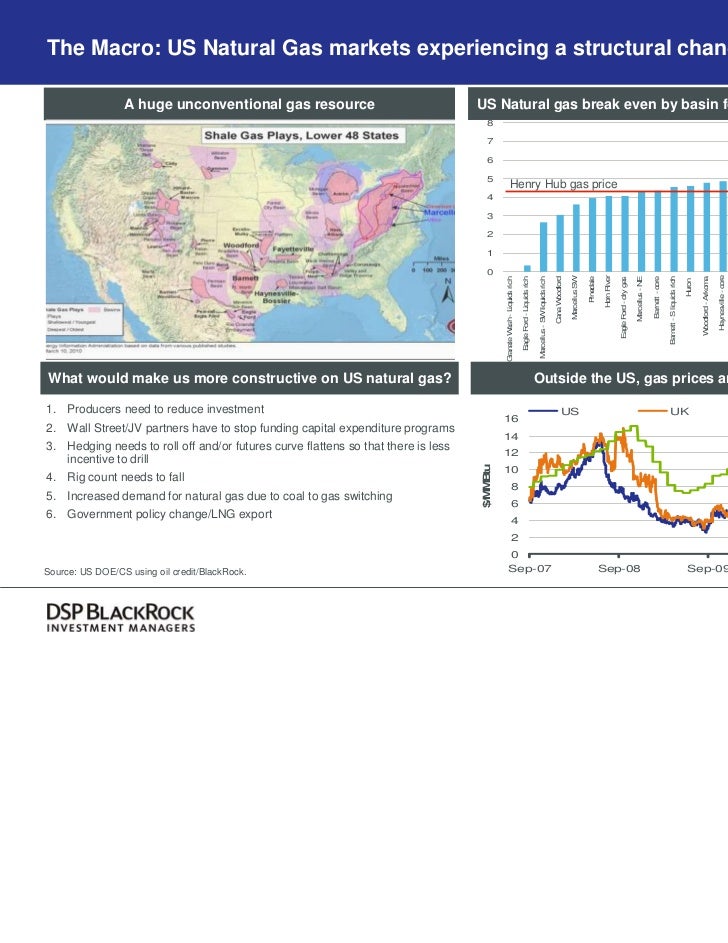

Several factors have contributed to the fund's positive performance. Firstly, growing awareness of climate change and the urgent need for sustainable energy solutions has spurred government initiatives and corporate commitments. These policies often incentivize renewable energy projects and create a favorable environment for companies operating in the sector.

Secondly, technological advancements have made renewable energy sources more efficient and cost-competitive with traditional fossil fuels. This has further accelerated the adoption of clean energy technologies and enhanced the attractiveness of investments in the sector.

Finally, the fund's experienced management team and well-defined investment strategy have played a crucial role in identifying promising investment opportunities and navigating market volatility. Their expertise in the natural resources and new energy sectors has allowed them to make informed investment decisions that align with the fund's long-term objectives.

Significance in the Investment Landscape

The DSP BlackRock Natural Resources and New Energy Fund plays a significant role in promoting sustainable investing in India and beyond. By directing capital towards companies that are committed to environmental responsibility and innovation, the fund encourages corporate behavior that benefits both investors and the planet.

Furthermore, the fund provides investors with an opportunity to align their financial goals with their values. Many individuals and institutions are increasingly seeking investments that not only generate returns but also contribute to a more sustainable future. Funds like DSP BlackRock Natural Resources and New Energy Fund cater to this growing demand.

"Sustainable investing is no longer a niche market; it's becoming mainstream," stated a recent report by the Global Sustainable Investment Alliance. "Investors are recognizing the long-term value of companies that prioritize environmental and social responsibility."

The fund's success also highlights the potential for growth in the renewable energy sector in India. With its vast renewable energy resources and growing energy demand, India is poised to become a global leader in clean energy. Funds like DSP BlackRock Natural Resources and New Energy Fund can play a critical role in facilitating this transition by channeling capital towards promising renewable energy projects.

Looking Ahead

The future of the DSP BlackRock Natural Resources and New Energy Fund appears promising, driven by the continued growth of the sustainable energy sector and increasing investor demand for ESG-focused investments. However, the fund also faces challenges, including market volatility and the evolving regulatory landscape.

Navigating these challenges will require a continued focus on rigorous research, disciplined investment strategies, and a commitment to sustainability. By staying true to its core values and adapting to changing market conditions, the DSP BlackRock Natural Resources and New Energy Fund can continue to deliver value to its investors while contributing to a more sustainable future for all.

As the world grapples with the urgent challenges of climate change and energy security, investments in natural resources and new energy will only become more critical. The DSP BlackRock Natural Resources and New Energy Fund's growth reflects a broader shift towards a more sustainable and responsible investment landscape, a landscape where financial returns and positive environmental impact go hand in hand.